When it comes to understanding an audit opinion, it can sometimes feel like deciphering a foreign language. Essentially, an audit opinion provides a professional's evaluation of a company's financial statements, offering insights into their accuracy and compliance with accounting standards. Different types of opinions, from unmodified to adverse, convey varying levels of assurance about the financial health of a business. Curious about what each type means and how they can impact your organization? Keep reading to dive deeper into the world of audit opinions!

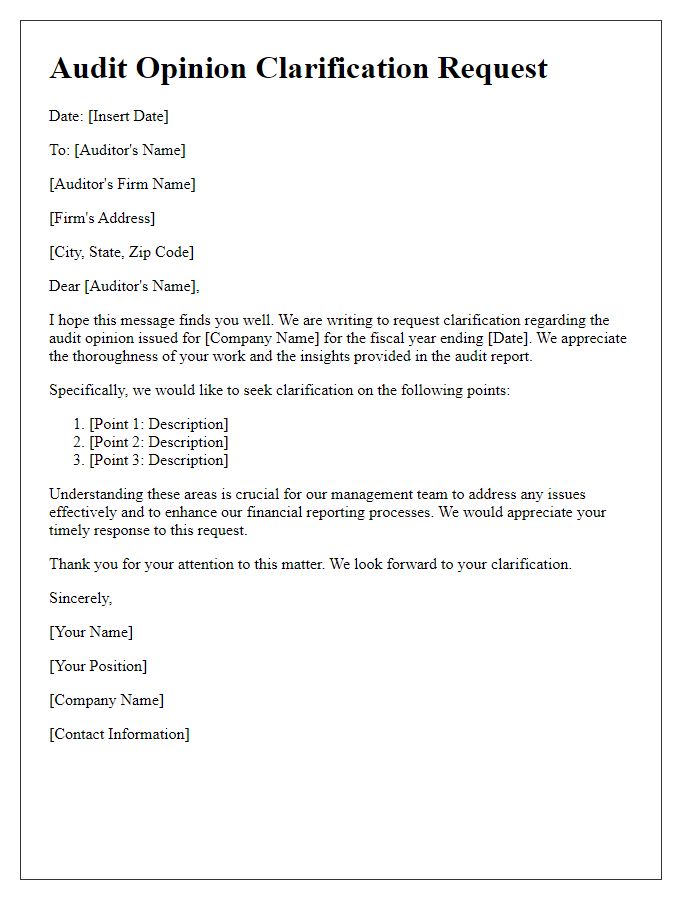

Scope of Audit

The scope of the audit encompasses a comprehensive examination of the financial statements of [Company Name], for the fiscal year ending [Date], in accordance with International Financial Reporting Standards (IFRS). This audit includes evaluations of internal controls, examination of evidence supporting the reported transactions, and assessments of compliance with relevant laws and regulations, particularly [specific laws or regulations]. Significant areas of focus involve the analysis of revenue recognition processes, inventory valuation techniques, and overall financial reporting accuracy. The auditor's responsibilities also extend to assessing the risks of material misstatement whether due to fraud or error, with consideration given to the operating environment of [Company Location]. The audit was conducted in accordance with [specific auditing standards], ensuring a fair and consistent approach to evaluating the overall financial health of the entity.

Responsibilities of Management

Management is responsible for the preparation of financial statements in accordance with applicable accounting standards, such as the International Financial Reporting Standards (IFRS). This responsibility includes designing, implementing, and maintaining an effective internal control system to ensure accuracy and reliability in financial reporting. Additionally, management must provide oversight in compliance with legal and regulatory requirements established by governing bodies, including the Financial Accounting Standards Board (FASB). It is also incumbent upon management to make assessments related to the entity's ability to continue as a going concern, particularly considering factors such as liquidity, solvency, and operational continuity during unexpected economic events or downturns. Regular communication with external auditors is essential to facilitate the audit process and to address any identified issues or irregularities in financial reporting practices, which may affect the overall audit opinion.

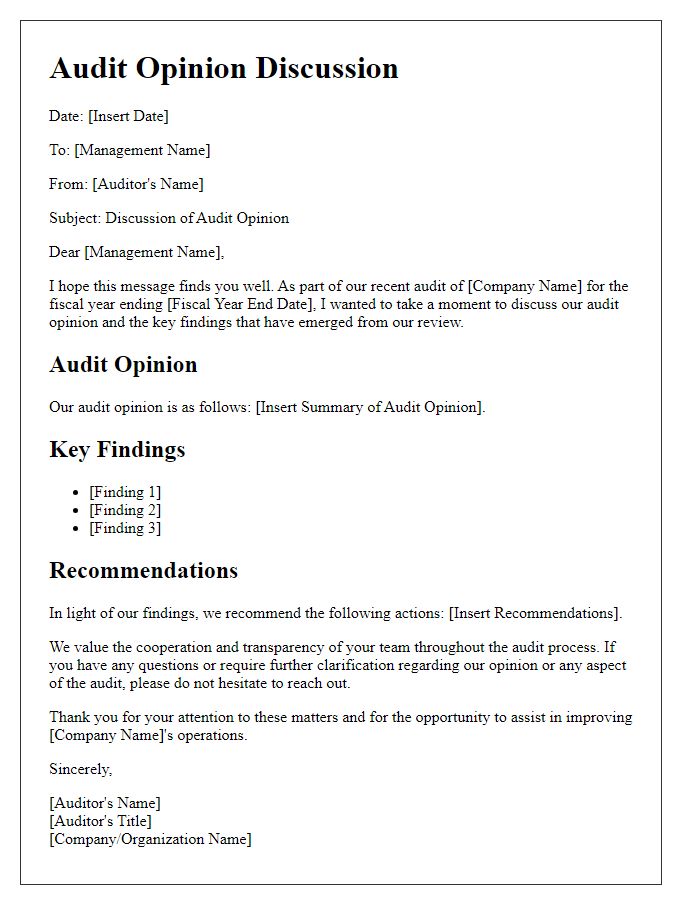

Auditor's Responsibility

The auditor's responsibility encompasses the obligation to conduct a comprehensive assessment of an organization's financial statements, ensuring adherence to accounting standards like Generally Accepted Accounting Principles (GAAP). This involves meticulous examination of records, verification of transactions, and evaluation of internal controls to ascertain the accuracy and completeness of financial reports for the fiscal year ending December 31, 2023. Auditors must use professional skepticism, relying on objective evidence and independent judgment. The objective lies in expressing an opinion on the fair presentation of the financial statements, ultimately instilling confidence among stakeholders such as investors, creditors, and regulatory bodies.

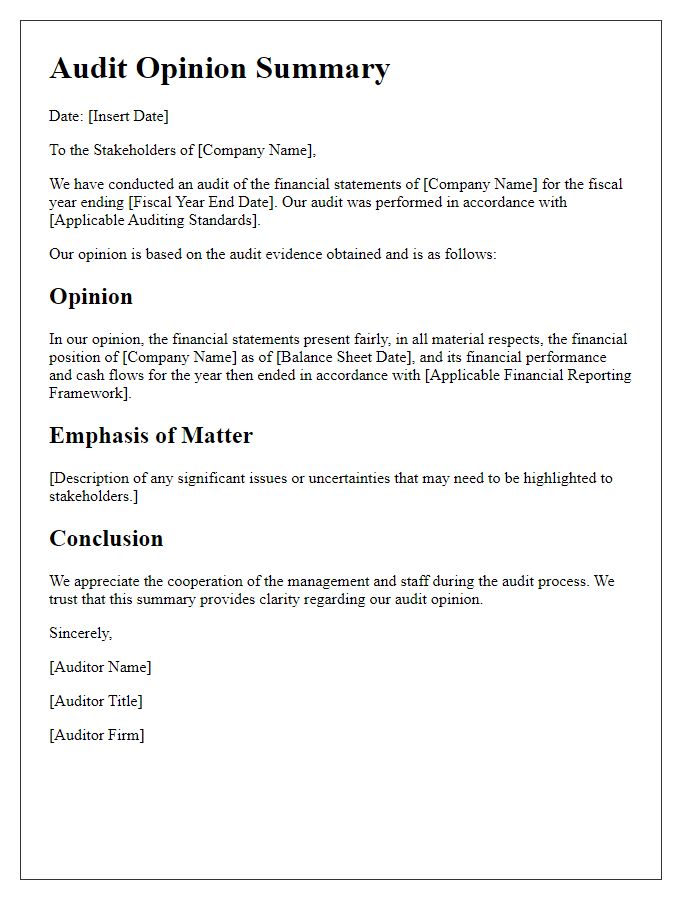

Basis for Opinion

An audit opinion is fundamentally influenced by the auditor's evaluation of the underlying financial records and practices of an organization, often expected to adhere to standards such as Generally Accepted Accounting Principles (GAAP). The basis for opinion section highlights the methodologies employed during the audit, encompassing substantive testing and analytical procedures performed across various transactions, accounts, and disclosures. Engagements typically focus on assessing the effectiveness of internal controls, including compliance with legislative mandates and regulations specific to the industry, such as the Sarbanes-Oxley Act for public companies in the United States. Key financial metrics, such as revenue recognition and expense reporting, are meticulously examined to ensure accuracy and transparency in financial statements. Ultimately, the auditor's report integrates findings on material misstatements and overall presentation, culminating in a professional opinion on whether the financial records give a true and fair view of the organization's financial health.

Conclusion of Opinion

In an audit opinion, the conclusion of opinion serves as a critical component summarizing the auditor's findings regarding the financial statements of an entity, such as a corporation or nonprofit organization. The conclusion clearly states whether the financial statements present a true and fair view of the entity's financial position in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). It is essential for the auditor to note any reservations or uncertainties regarding the financial statements, providing a basis for an unmodified opinion, qualified opinion, adverse opinion, or disclaimer of opinion. Clarity in this section is key, as stakeholders, including investors and regulatory bodies, rely on this conclusion to make informed decisions about the organization's financial health and compliance with relevant laws and regulations.

Comments