Are you prepping for an audit and unsure how to select the right samples? Choosing the right data can feel overwhelming, but it's essential for ensuring accuracy and compliance. In this article, we'll break down the key steps for effective audit sample selection, helping you navigate the process with ease. So, grab a cup of coffee and dive in â there's much more to discover!

Recipient Information

Recipient information for audit sample selection typically includes details such as the recipient's name, job title, company name, and address. For instance, an internal audit team may need to contact a department head to obtain relevant documents. The recipient's name (e.g., John Smith), job title (Finance Manager), company name (XYZ Corporation), and address (123 Main St, Suite 456, Cityville, State, Zip Code) should be clearly stated. This ensures that the audit team accurately reaches the appropriate personnel responsible for the information needed for compliance checks or risk assessments. Properly documenting this information streamlines communication and enhances the efficiency of the audit process.

Audit Objectives

Audit objectives define the purpose and intended outcomes of the audit process, ensuring compliance with regulatory standards and internal policies. Selecting a sample involves identifying specific criteria during the audit process, which may include transactions exceeding $10,000 or those conducted within the last fiscal year. The goal is to analyze data from critical areas such as revenue recognition, financial reporting, and operational efficiency. In large organizations, like Fortune 500 companies, sample sizes can represent a mere 5% of total transactions, yet still provide valuable insights. Auditors typically utilize statistical methods such as random sampling or stratified sampling techniques to enhance accuracy and reliability in findings. The effectiveness of the audit hinges on carefully defined objectives that align with the overall risk assessment strategy to ensure that audit conclusions support confident decision-making.

Sample Criteria

In audit procedures, sample selection is critical to ensure the reliability and accuracy of financial statements. For instance, when assessing accounts receivable, auditors may implement a criteria-based sampling method, such as Random Sampling, where a specified number of entries (e.g., 50 of 1,000 total transactions) are chosen without bias. Statistical Sampling techniques, such as Monetary Unit Sampling, utilize the dollar value of transactions to prioritize larger amounts, enhancing the focus on significant areas of concern. In the context of Inventory Verification, auditors might opt for Stratified Sampling, categorizing items into groups based on characteristics, like value or type, ensuring that high-value items (over $1,000) receive particular scrutiny. Additionally, compliance with regulations from governing bodies (like the PCAOB) mandates that auditors follow established guidelines to maintain integrity in their selection process. Proper documentation of the sampling parameters and findings enhances the overall audit quality and supports financial statement assertions.

Selection Methodology

The selection methodology for audit sample includes various approaches to ensure a representative sampling of the financial data. Random sampling techniques, such as using statistical software like R or SPSS, may be utilized to maintain objectivity and minimize bias. Stratified sampling can also be applied, where the population is divided into subgroups (strata) based on key characteristics such as transaction size or type, ensuring each subgroup is adequately represented. Additionally, monetary unit sampling (MUS) focuses on larger value transactions to maximize audit effectiveness, while non-statistical methods provide judgment-based selection for specific risk areas identified during preliminary assessments. Each methodology is designed to achieve a confident level of assurance regarding the financial statements of the organization, while adhering to the auditing standards set forth by professional bodies like the International Auditing and Assurance Standards Board (IAASB).

Response Deadline

The audit sample selection process involves determining a representative subset of items or data points from a larger dataset to evaluate the accuracy and reliability of financial statements or operational processes. Auditors typically utilize statistical methods or judgmental sampling techniques to ensure the selected sample reflects the overall population effectively. For the current audit period, which spans January 1, 2023, to December 31, 2023, the response deadline for submitted documentation and records to support sample selection is set for November 15, 2023. This allows auditors ample time to analyze the provided materials, conduct necessary fieldwork, and compile findings into the final audit report due by December 31, 2023. Proper compliance with the established deadline is crucial for maintaining the audit timeline and ensuring thorough examination.

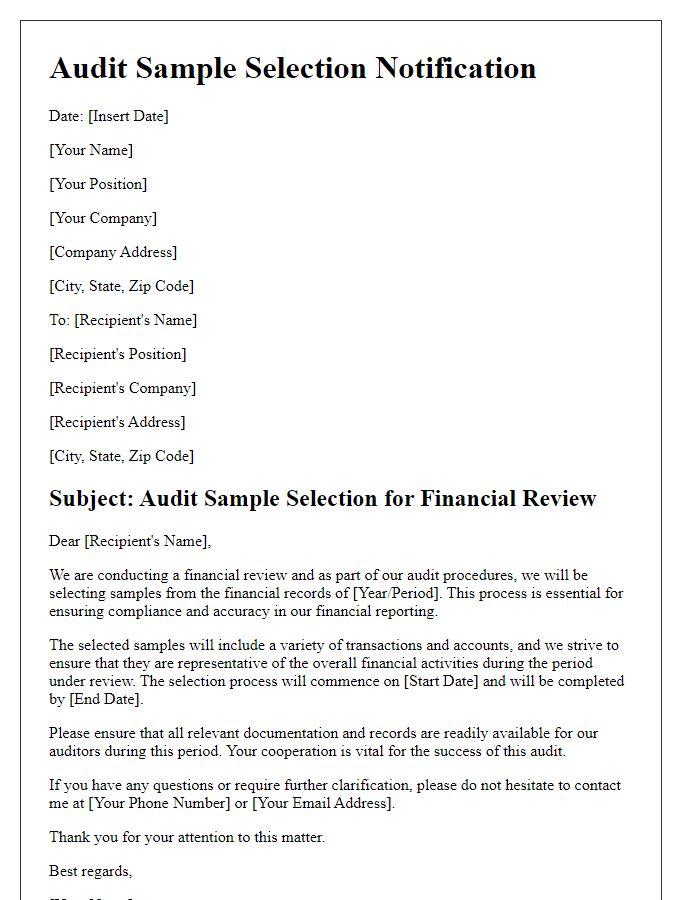

Letter Template For Audit Sample Selection Samples

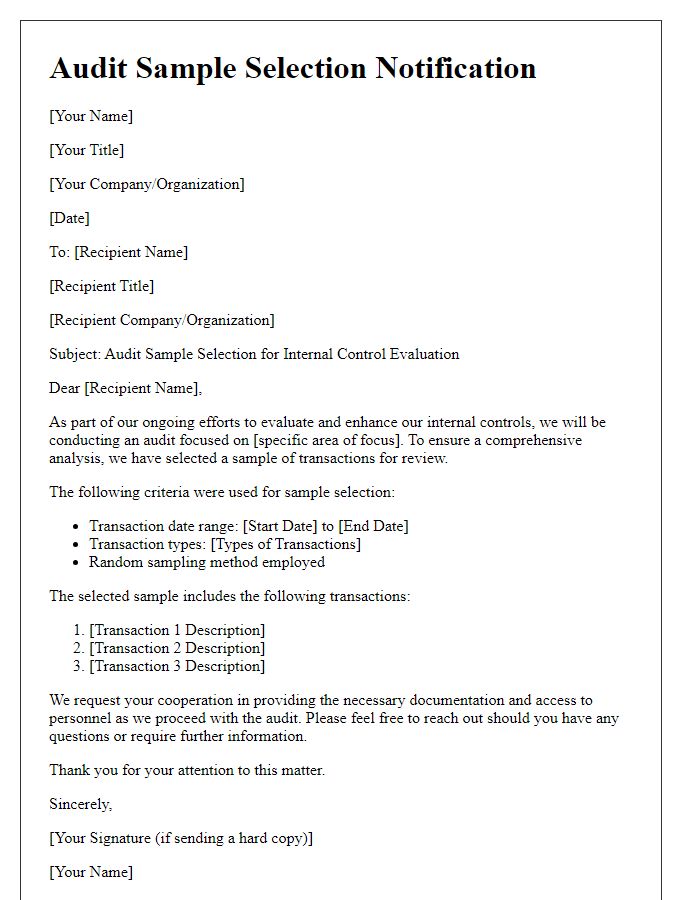

Letter template of audit sample selection for internal control evaluation

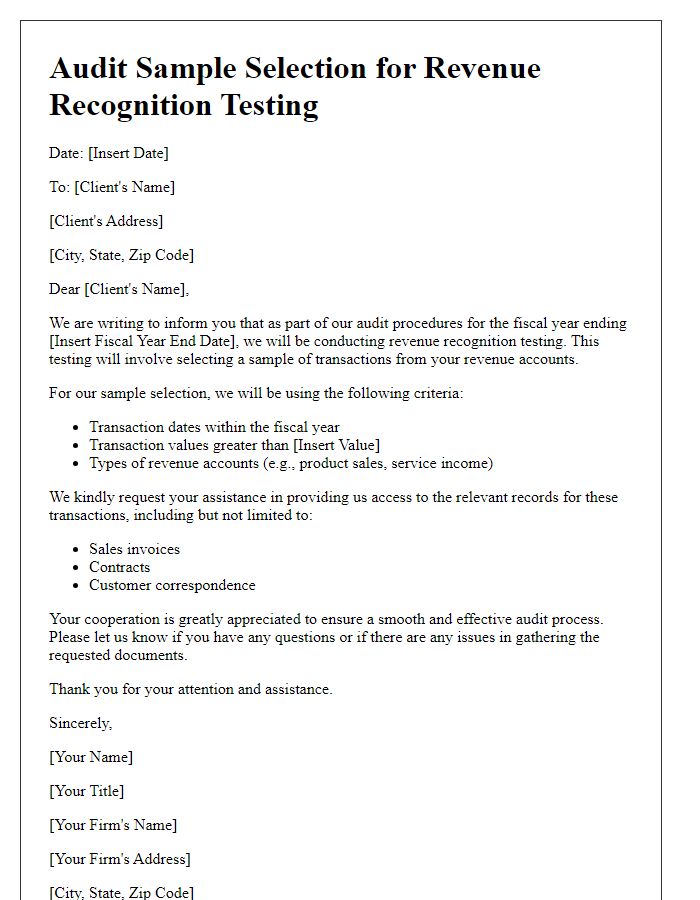

Letter template of audit sample selection for revenue recognition testing

Comments