Preparation for an audit can feel daunting, but it doesn't have to be! By implementing a simple checklist, you can streamline the process and ensure you cover all essential aspects, from financial documents to compliance requirements. Audit readiness not only demonstrates your commitment to transparency but also helps identify potential areas for improvement within your organization. Interested in crafting your own audit preparation checklist? Read on for all the essential tips and templates to get you started!

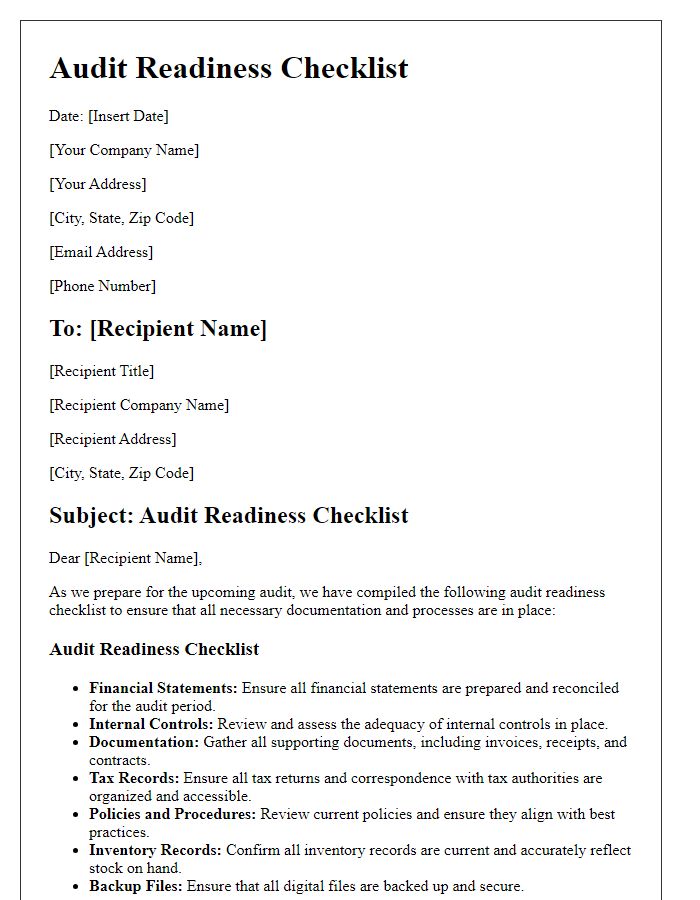

Recipient Information

The audit preparation checklist is crucial for ensuring a smooth audit process. It typically includes essential elements such as the company's name, which refers to the legal entity being audited, and contact information including phone numbers and email addresses for the primary contact person. Additionally, the checklist highlights the audit start date, which indicates when the auditing firm will commence their review, and the deadlines for required documents. The recipient's address, including city, state, and zip code, plays a vital role in confirming the audit's location. Special notes regarding relevant regulatory bodies, such as the IRS for tax audits or the SEC for public companies, may also be included to highlight compliance requirements. Providing accurate recipient information facilitates effective communication and ensures all stakeholders are aligned throughout the audit process.

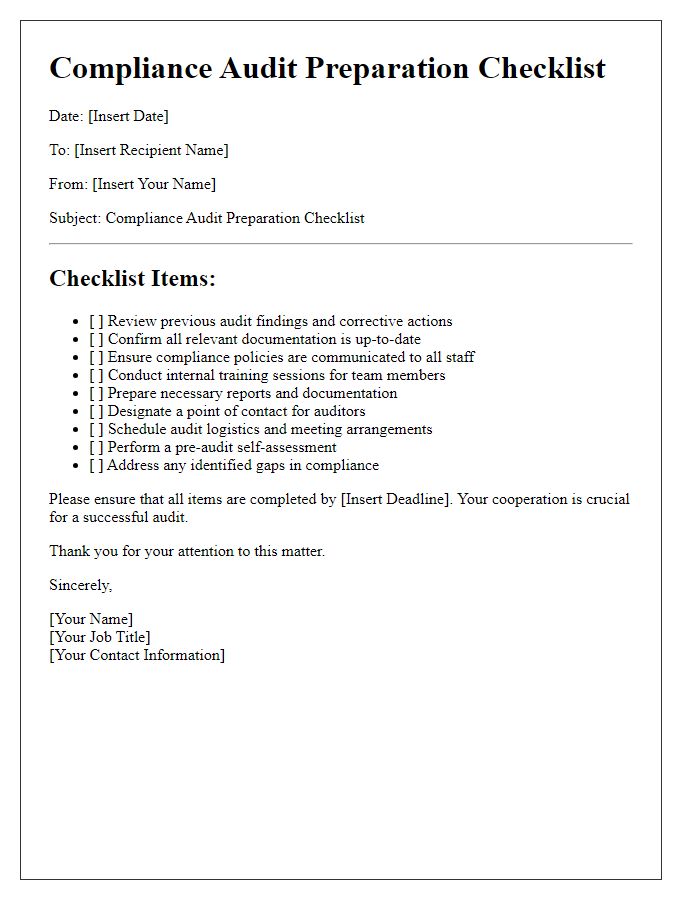

Audit Scope and Objectives

The audit scope and objectives outline the parameters and intentions of the audit process, such as financial audits of corporate entities like Fortune 500 companies. Key objectives often include compliance with regulations set by governing bodies like the Securities and Exchange Commission (SEC) and assessing the accuracy of financial reporting of assets, liabilities, and equity. Determining the risk factors associated with internal controls is crucial, with specific focus on areas like revenue recognition and expense tracking which can significantly impact financial statements. Proper documentation and an understanding of the organization's operational processes are vital to ensure a thorough evaluation of adherence to Generally Accepted Accounting Principles (GAAP). This comprehensive strategic approach enhances the credibility and reliability of financial information presented to stakeholders and investors.

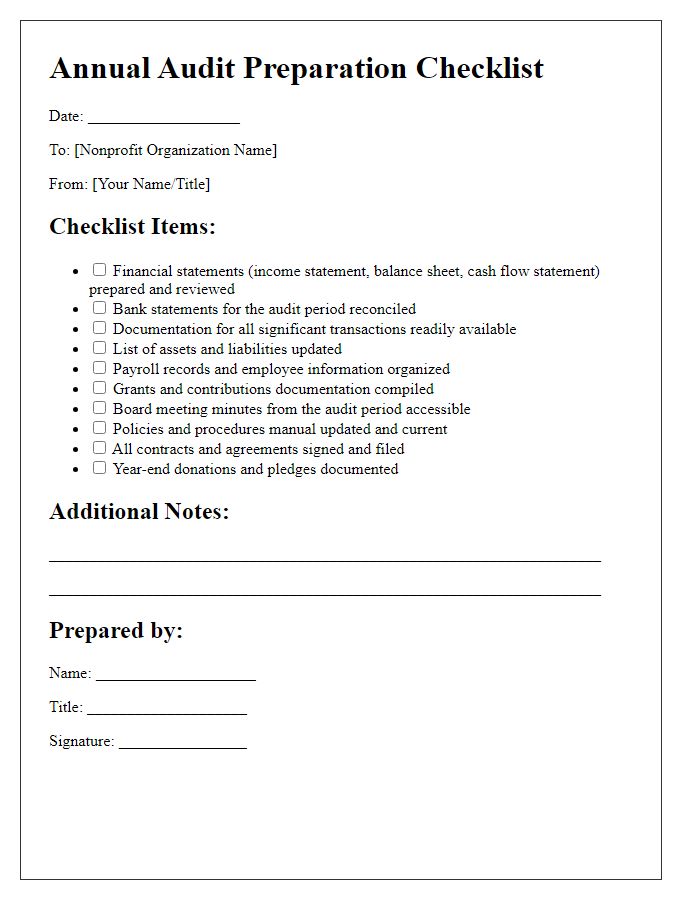

Required Documentation List

An effective audit preparation checklist necessitates comprehensive documentation to ensure a smooth and efficient review process. Key elements of this list include financial statements (such as balance sheets and income statements from the fiscal year ended, typically December 31, 2022), bank reconciliations (detailing bank transactions for each account, ideally as of the last day of the fiscal year), accounts receivable aging reports (showing outstanding customer invoices, categorized by time past due), and accounts payable aging reports (illustrating outstanding debts to suppliers). Furthermore, inventory records (providing counts and valuation methods employed, such as FIFO or LIFO) must be included, alongside documentation of significant contracts (such as leases or service agreements, especially those entered into or amended in 2022). Tax returns (including federal and state filings) and minutes from board meetings (especially those related to financial decision-making) should also be compiled. Establishing this thorough Required Documentation List promotes adherence to regulatory standards, enhances accountability, and streamlines the auditing process.

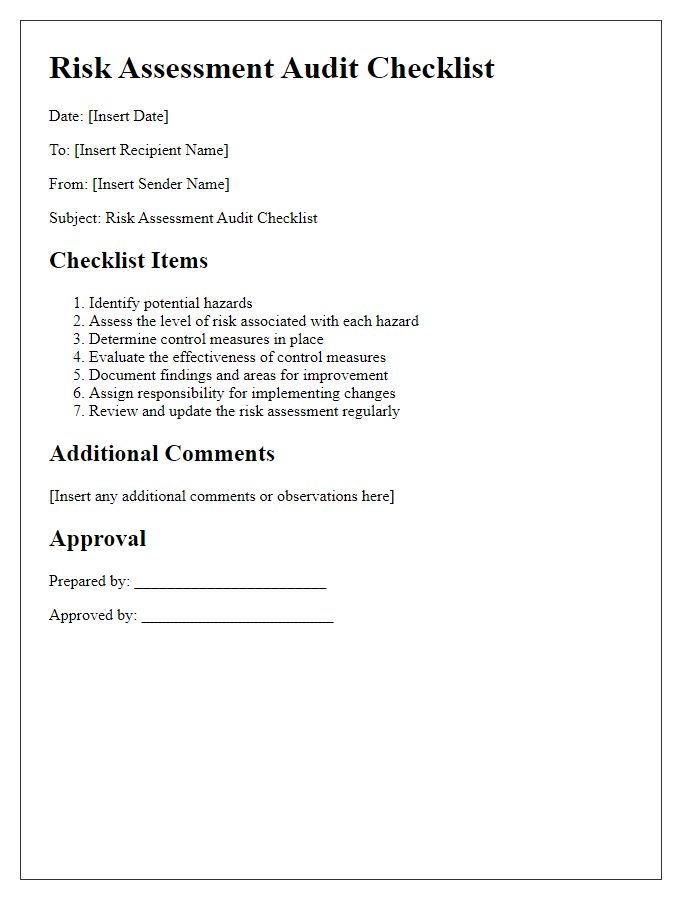

Key Deadlines and Timeline

Effective audit preparation requires a clear understanding of key deadlines and a well-structured timeline. Essential events include the submission of financial statements (typically by the end of the fiscal quarter, such as March 31 for Q1), the completion of preliminary audit procedures, which often occurs four to six weeks prior to the final audit date, and the review of internal controls (scheduled approximately two weeks before fieldwork). Additionally, stakeholders must be aware of audit confirmation requests that should be sent out at least three weeks ahead of the audit to allow ample time for responses. Access to necessary documentation, including accounting records and previous audit reports, usually needs to be granted a minimum of one week prior to the audit kickoff meeting, which typically takes place on the first day of the audit fieldwork.

Contact Details for Queries

In preparation for the upcoming financial audit, it is essential to establish a clear channel for queries that may arise during the process. The primary contact for any inquiries related to the audit will be the Chief Financial Officer (CFO), whose office can be reached at the company headquarters located at 1234 Financial Way, Suite 100, New York City, NY 10001. The CFO's assistant will assist in coordinating responses and can be contacted directly via email at cfo_assistant@company.com or by phone at (555) 123-4567. Additionally, the Internal Audit Manager, stationed at the same location, will address technical questions and can be reached at audit_manager@company.com or via phone at (555) 987-6543. Establishing these contact points will facilitate efficient communication and resolution of any issues during the audit period.

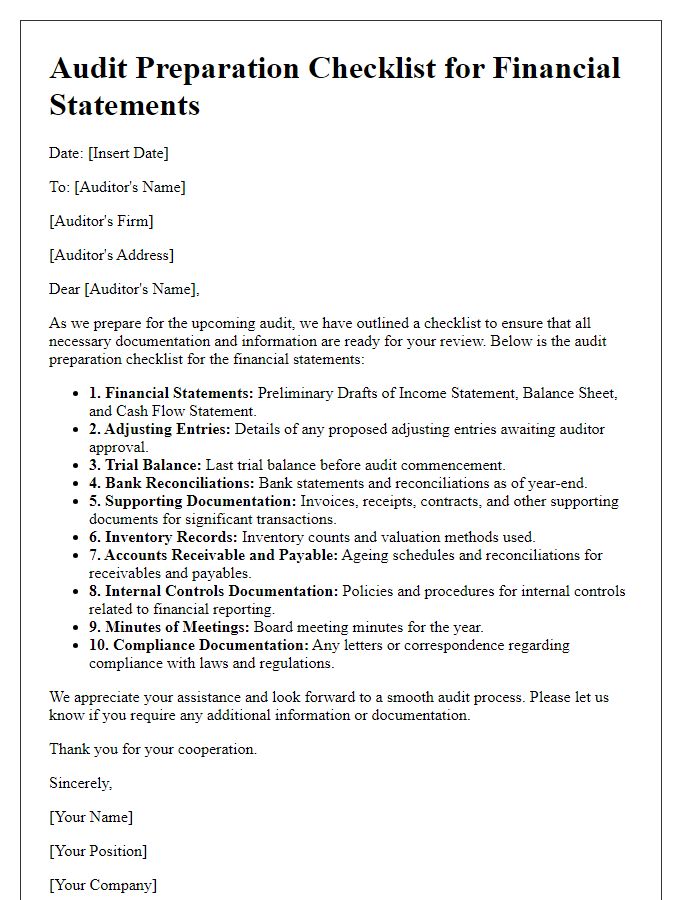

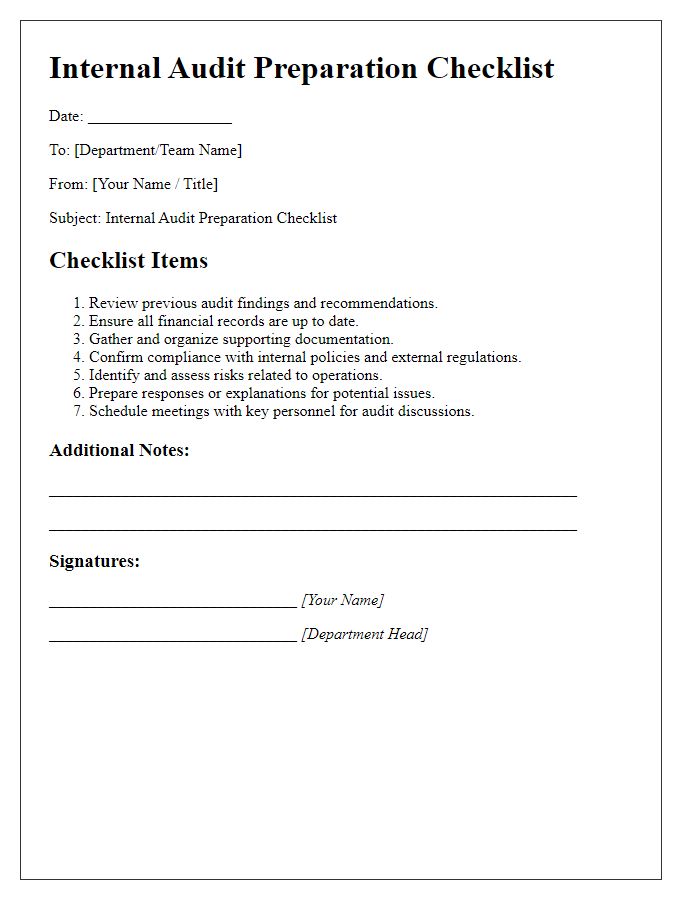

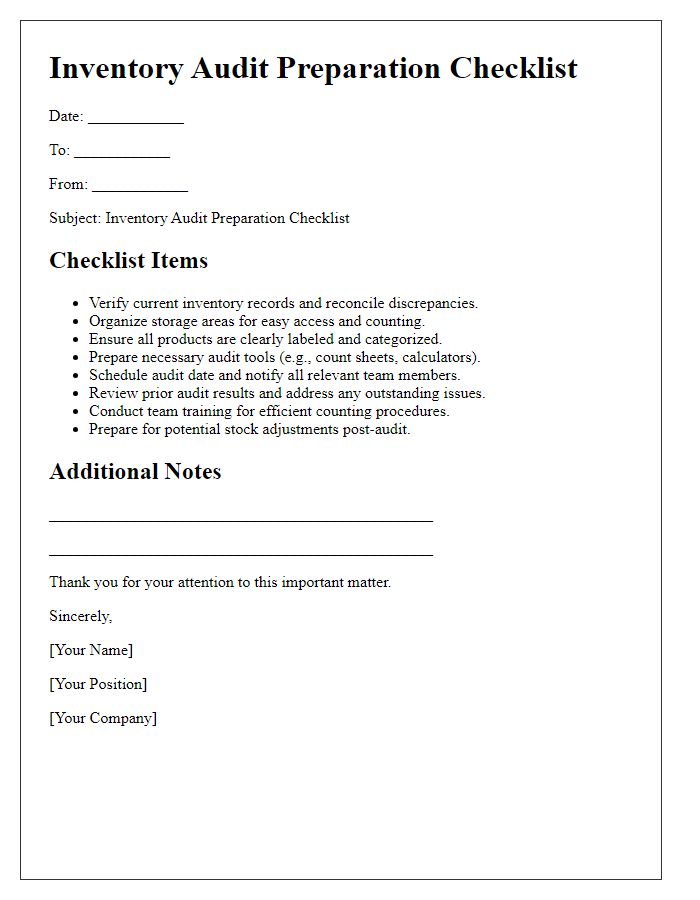

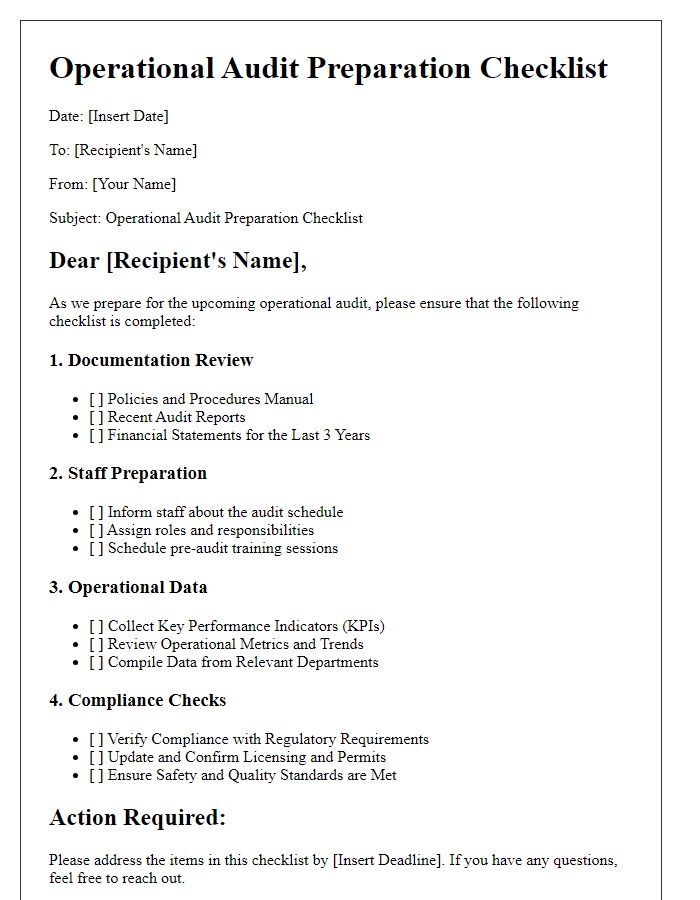

Letter Template For Audit Preparation Checklist Samples

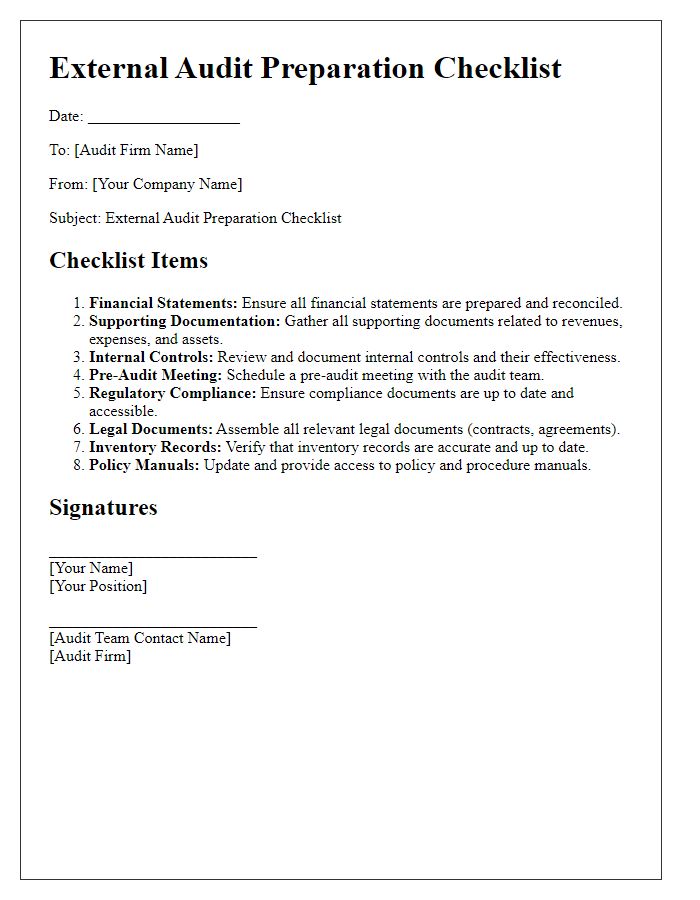

Letter template of External Audit Preparation Checklist for Corporations

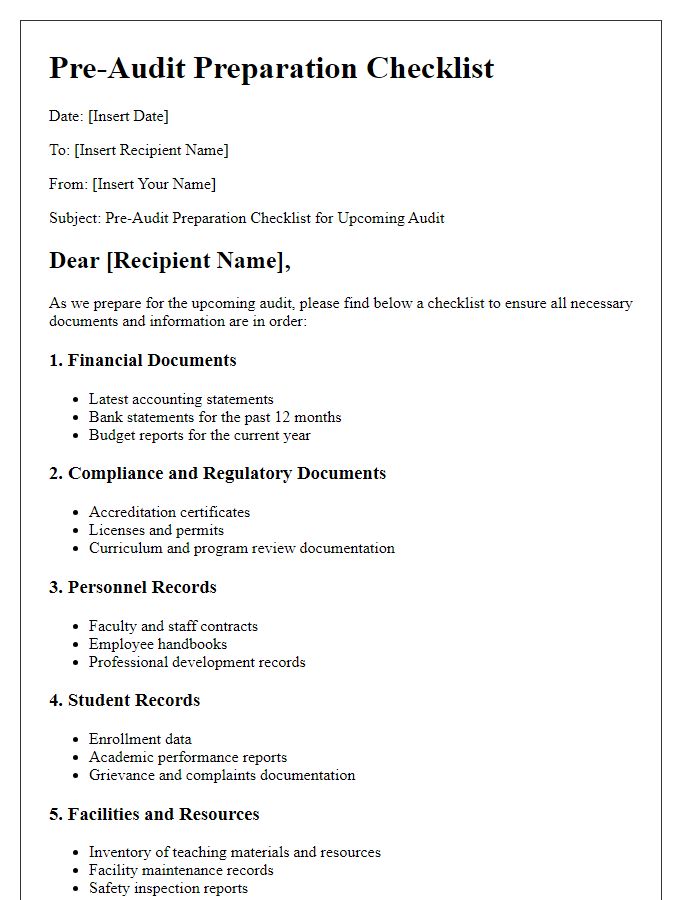

Letter template of Pre-Audit Preparation Checklist for Educational Institutions

Comments