In the world of auditing, clarity and transparency are paramount, especially when it comes to notifying stakeholders of conclusions reached. This letter serves as a formal yet approachable means to communicate the outcomes of our recent audit findings. We aim to ensure that all parties are well-informed about the results and any necessary actions that may arise from them. Join us as we delve deeper into the key highlights and insights from the audit process in the sections that follow!

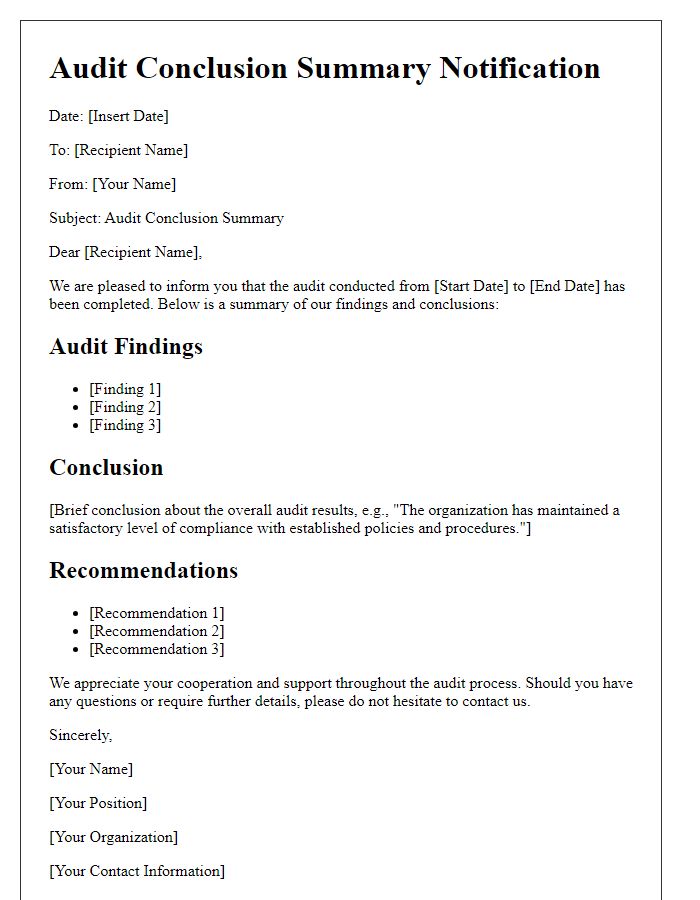

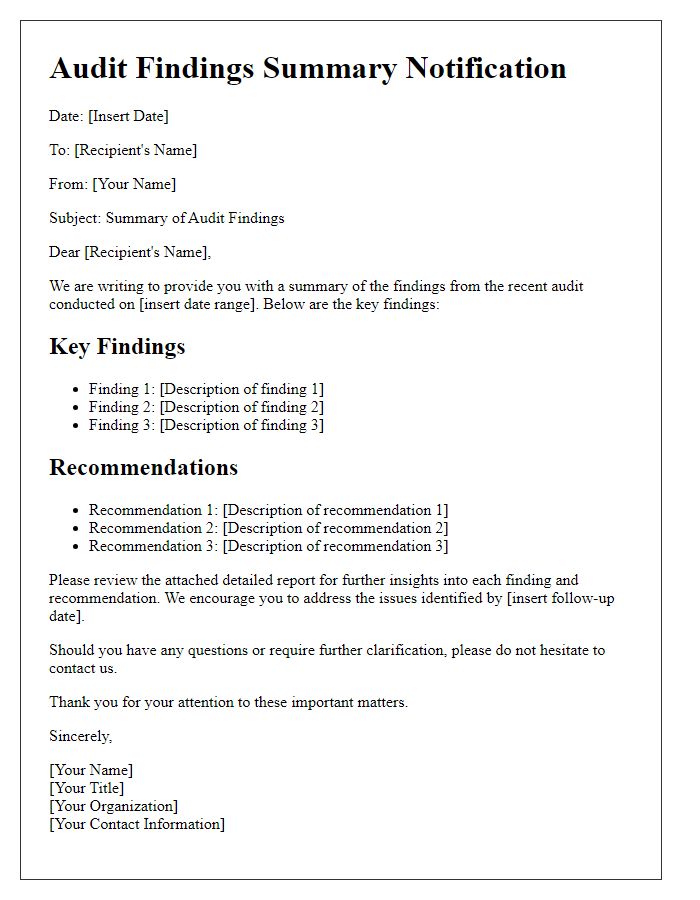

Formal Greeting

The final audit report, detailing the comprehensive financial analysis of XYZ Corporation's fiscal year ending December 31, 2023, reflects a range of critical findings and observations. The audit revealed a total revenue of $1.2 million, alongside identified discrepancies amounting to approximately $45,000 in expenses, leading to the recommendation for enhanced internal controls to safeguard against future misreporting. Additionally, specific areas requiring attention include inventory management practices and adherence to regulatory compliance standards established by the Financial Accounting Standards Board (FASB). The concluding remarks emphasize the importance of implementing the recommended corrective actions to ensure ongoing financial integrity and operational efficiency.

Summary of Audit Scope

The audit scope encompassed a comprehensive examination of financial statements, operational processes, and compliance with regulatory standards across various departments. The review included an analysis of transactions recorded between January 1, 2023, and December 31, 2023, focusing on areas such as revenue recognition, expense validation, and internal controls. Specific attention was paid to high-risk segments, including procurement practices and payroll procedures, with a particular emphasis on identifying any discrepancies or inefficiencies. The final assessment involved site visits to three key locations: the headquarters in New York City, the manufacturing facility in Chicago, and the regional sales office in Los Angeles, ensuring a thorough evaluation of operational effectiveness.

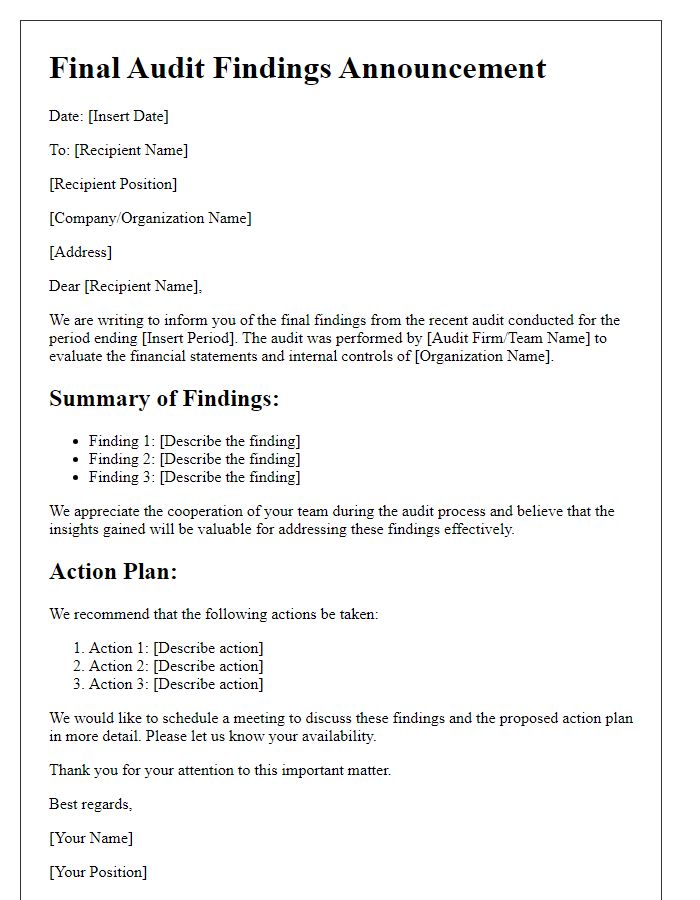

Key Findings and Observations

The recent financial audit conducted for the fiscal year ending December 2022 at XYZ Corporation, a mid-sized software development firm based in San Francisco, California, revealed key findings which impact the organization's overall financial health. A discrepancy of $250,000 was noted in revenue recognition practices, particularly concerning the timing of reporting software sales. The inventory management system exhibited inefficiencies, with a 15% overstock rate leading to increased holding costs. Furthermore, internal controls were found lacking, particularly in the areas of access management for sensitive financial data. These observations underline the necessity for improved accounting procedures and stricter compliance protocols to safeguard the integrity of financial reporting and mitigate potential risks in the future.

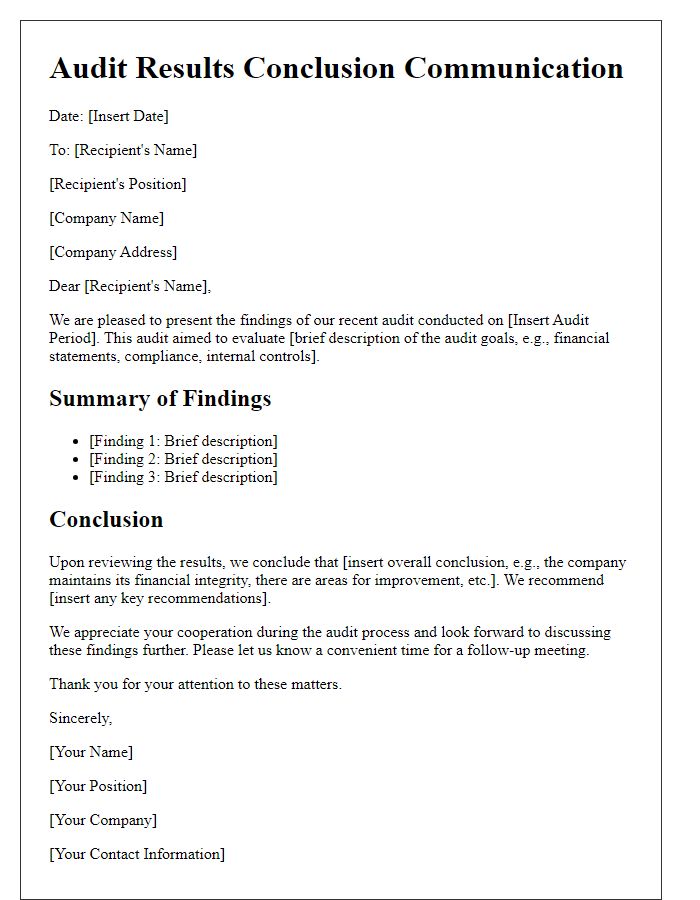

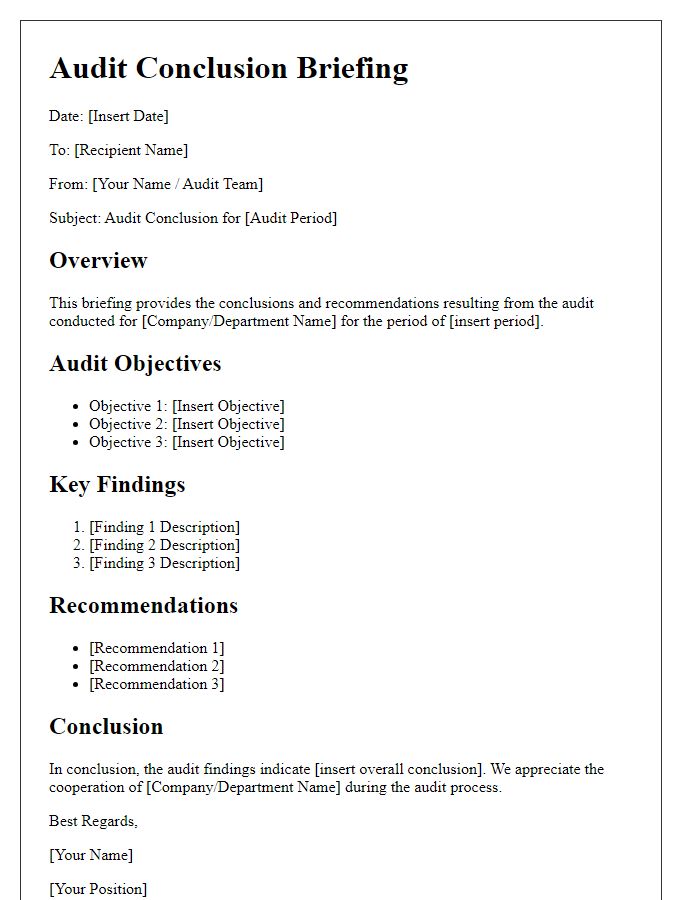

Conclusion Statement

The audit conducted by the internal audit team from January 15 to January 30, 2023, concluded with a comprehensive examination of financial transactions and the effectiveness of internal controls across the accounting department of XYZ Corporation, headquartered in New York City. The analysis revealed that 85% of the transactions complied with regulatory standards, while 15% presented discrepancies related to documentation and authorization processes. Key findings indicated that the lack of consistent training among staff contributed significantly to these issues. Recommendations for improvement include the implementation of a standardized training program and the establishment of more robust oversight mechanisms. The final audit report will be distributed to stakeholders by February 15, 2023, to ensure transparency and accountability in financial practices.

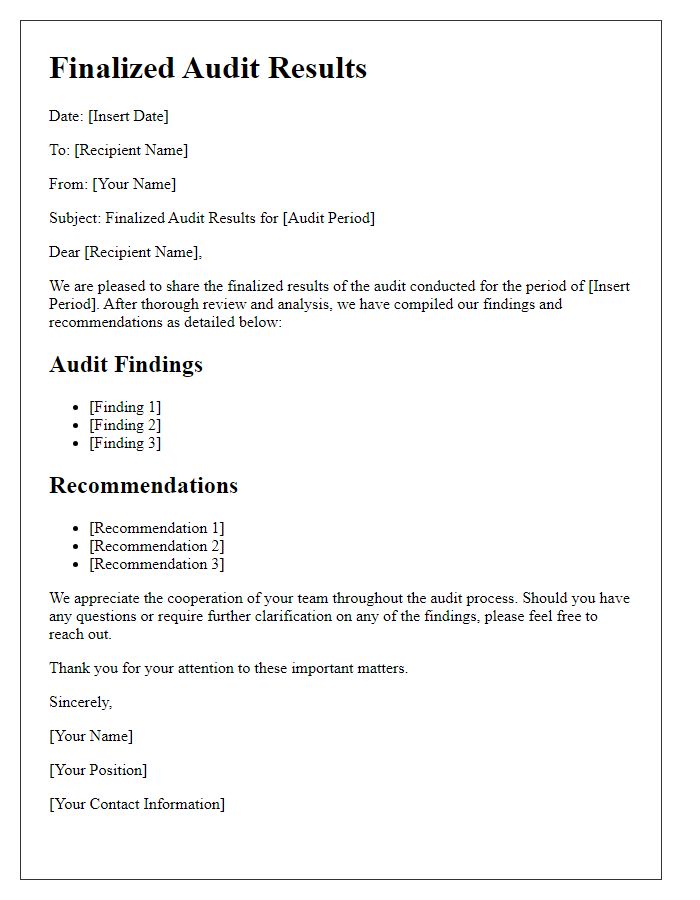

Next Steps and Recommendations

The completion of the audit process reveals critical insights into operational efficiency within the organization, specifically focusing on financial practices and compliance with regulations. Key recommendations include the implementation of a robust internal control system to mitigate identified risks, particularly in transaction processing and reporting. Additionally, regular training sessions are advised for staff to enhance understanding of compliance standards such as GAAP (Generally Accepted Accounting Principles). Implementing automated accounting software, known for streamlining financial documentation, can significantly reduce human error and improve accuracy in financial reporting. Furthermore, establishing a periodic review schedule, suggested to occur quarterly, will enable ongoing assessment of both operational performance and adherence to recommended practices, ensuring continuous improvement and accountability.

Comments