Hey there! Have you ever wondered how a customer account audit can streamline your business processes and enhance your client relationships? It's essential for identifying discrepancies and ensuring accurate records, which ultimately leads to improved customer satisfaction. In this article, we'll explore the key steps and benefits of conducting a thorough audit of your accounts. So, grab a cup of coffee, sit back, and let's dive into the details together!

Personalization

A customer account audit is crucial in assessing user engagement on platforms like Shopify, Salesforce, or HubSpot. This process involves reviewing transaction history, including dates (e.g., last purchase on January 15, 2023), account activity logs, and user preferences to enhance personalization. Key metrics such as average order value ($150) and customer lifetime value ($1,200) help identify loyalty trends and potential upselling opportunities. Additionally, demographic data, like age range (25-34 years) or location (New York City), aids in creating tailored marketing campaigns, improving customer retention, and optimizing product recommendations for enhanced satisfaction.

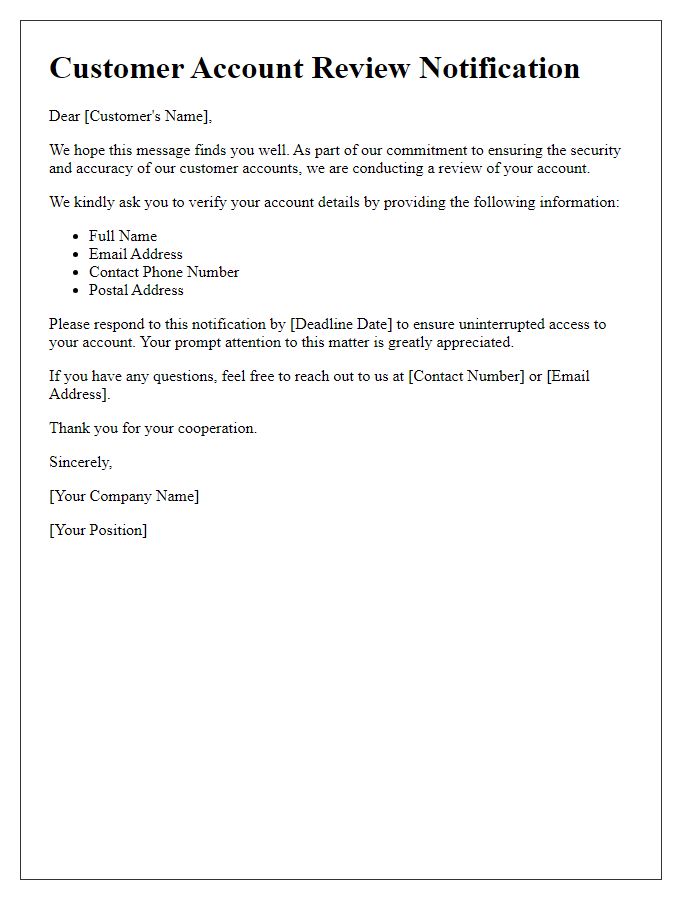

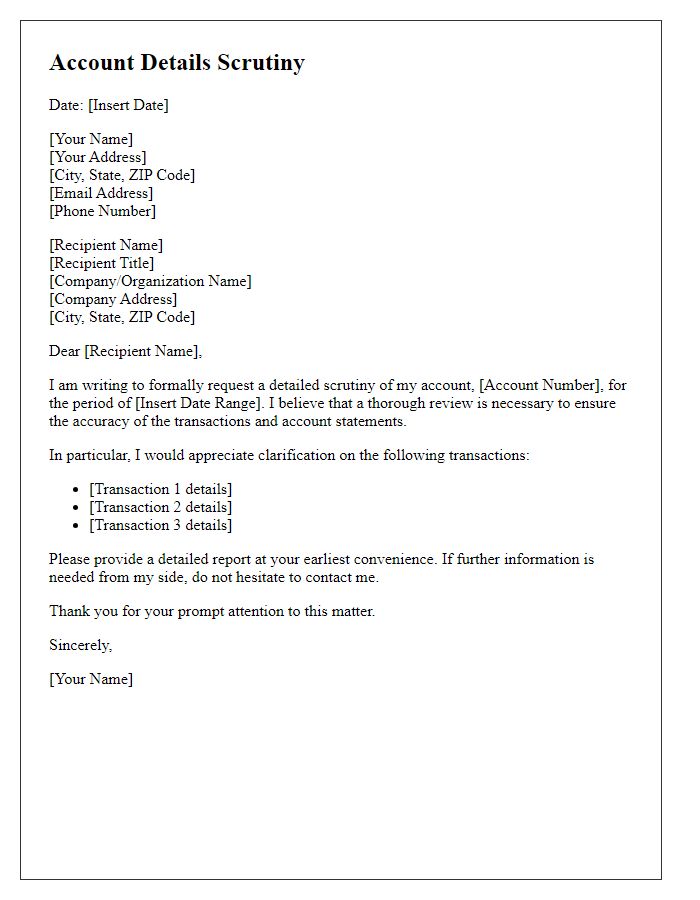

Clear Subject Line

Customer account audits are essential for ensuring compliance and accuracy in financial records. An email with a clear subject line, such as "Urgent: Customer Account Audit Notification," will help in capturing immediate attention. During the audit process, customers must provide crucial information related to transactions, account balances, and personal identification details. Important deadlines, often set within a 30-day response window, should be highlighted to facilitate timely cooperation. Moreover, specific guidelines on document submission, such as digital formats or required verification processes, enhance clarity. This structured approach fosters transparency and strengthens the relationship between businesses and their customers throughout the auditing process.

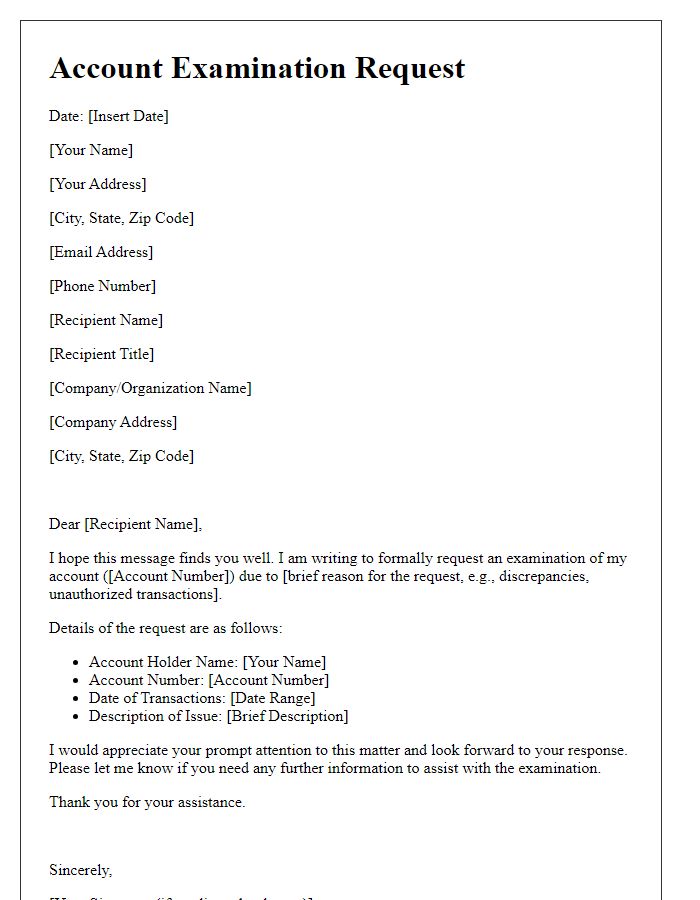

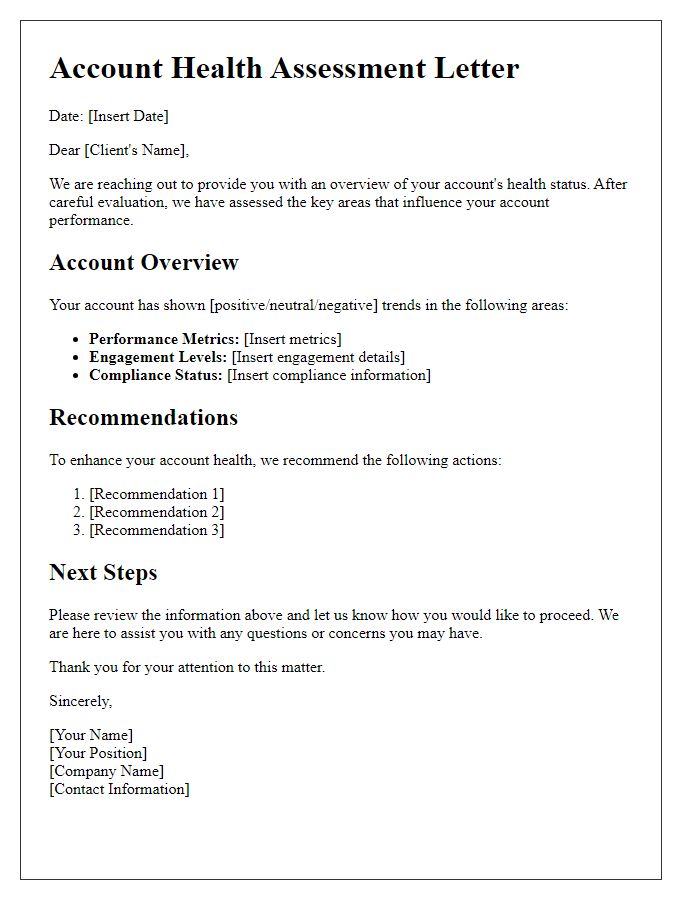

Structured Information

Customer account audits serve as a crucial mechanism for ensuring compliance, accuracy, and integrity within the financial records of companies. An audit typically involves a comprehensive review of account transactions, account balances, and adherence to regulatory requirements, such as the Generally Accepted Accounting Principles (GAAP). Account audits often occur annually, with firms like Deloitte and PwC frequently performing these evaluations on corporate clients. Validation processes may include verifying customer identity and cross-referencing transaction history with external data sources, such as credit reports. Auditors meticulously check for discrepancies, such as unusual large transactions or missing documentation, which could indicate fraud or accounting errors. By employing structured methodologies and advanced software tools, organizations enhance the robustness of their auditing process, ensuring continued trust and reliability in customer accounts.

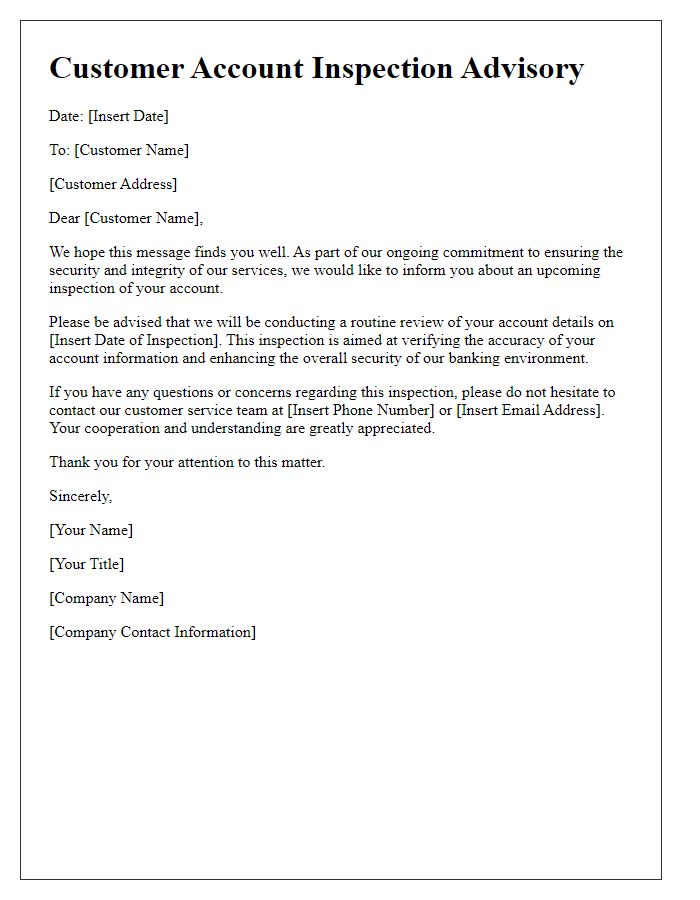

Contact Details

When conducting a customer account audit, accurate and comprehensive contact details play a crucial role. Essential information includes the customer's full name, which serves as the primary identifier for account verification. The customer's mailing address should include street number, city, state, and ZIP code, ensuring accurate correspondence. A reliable phone number, preferably a mobile number, allows for immediate communication in case of discrepancies or follow-up inquiries. Additionally, an email address is vital for sending digital communications and important account updates, and should be verified for accuracy. Lastly, recording any preferred contact methods indicates the customer's communication preferences, improving overall customer service efficiency.

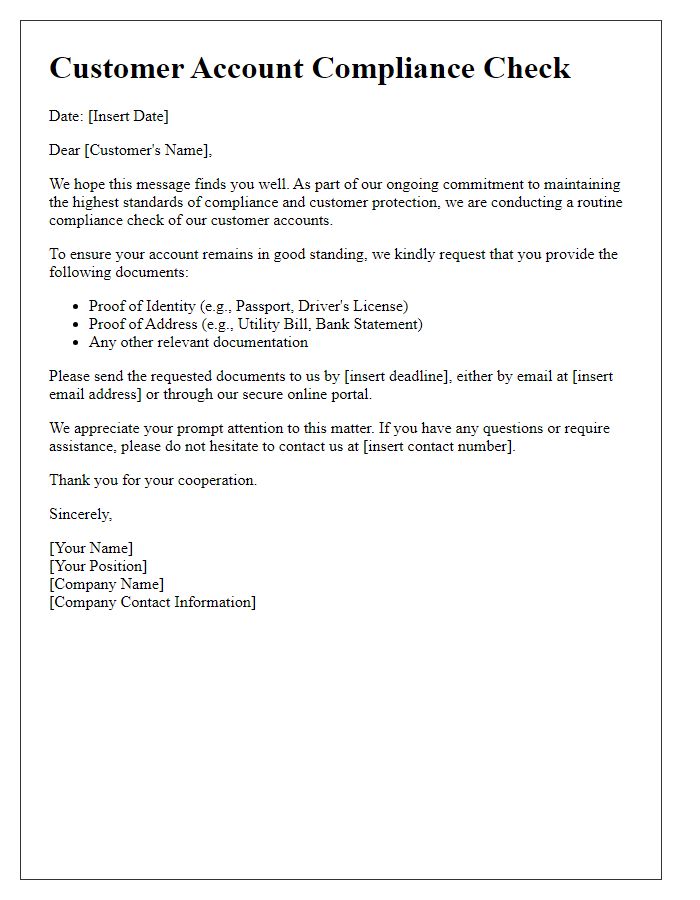

Confidentiality Assurance

A customer account audit involves a comprehensive evaluation of an individual's account information to ensure compliance and accuracy. This process typically includes examining personal data, account transactions, and security protocols implemented by the financial institution, such as Bank of America or Wells Fargo. Confidentiality is paramount during this audit, as sensitive information may include Social Security numbers, account balances, and transaction histories. To maintain privacy, measures such as encryption (standards like AES-256) and access controls are utilized, preventing unauthorized access to customer data. Regulatory frameworks, including the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), mandate strict adherence to confidentiality and data protection practices throughout the auditing process.

Comments