When it comes to maintaining transparency and accountability within an organization, having a solid audit trail is essential. A well-crafted letter can serve as a formal template for documenting all the intricate details involved in the audit process. Whether you're outlining procedures, highlighting findings, or detailing recommendations, a clear and organized letter ensures that everyone is on the same page. Curious to learn more about creating effective audit trail documentation? Let's dive in!

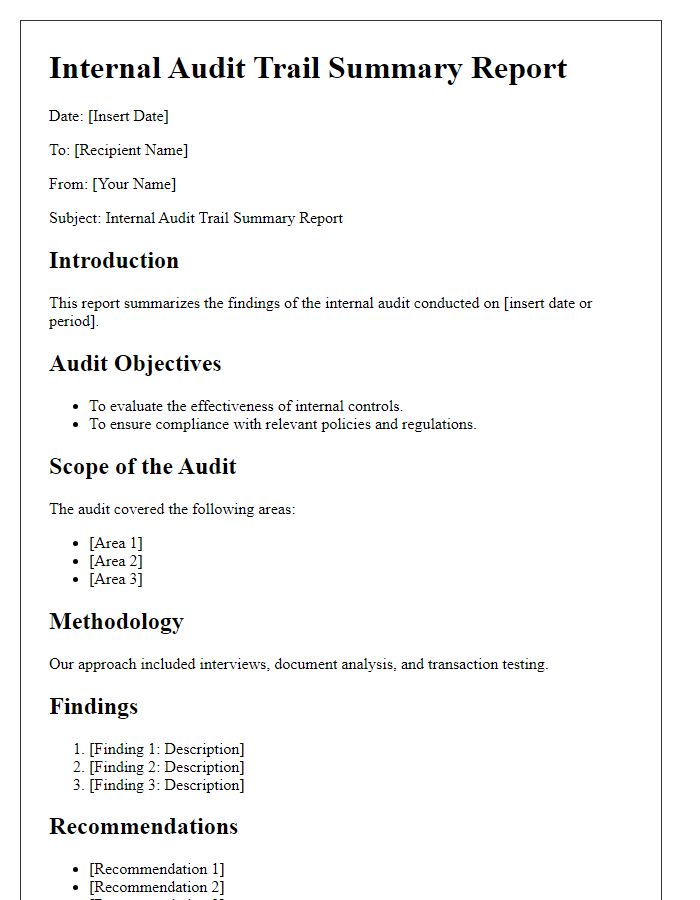

Purpose and Scope of Audit

The purpose of an audit is to assess the accuracy, reliability, and conformity of financial statements and operational processes to established standards. Audits often focus on identifying discrepancies and ensuring compliance with regulations such as the Sarbanes-Oxley Act (2002) or International Financial Reporting Standards (IFRS). The audit scope includes examining fiscal records, internal controls, and operational procedures within specific timeframes--typically financial years or quarterly periods. Relevant entities, such as the audit committee of a corporation or external auditors, engage in detailed evaluations, ensuring documentation supports financial report assertions. Locations like corporate offices or data warehouses are often scrutinized for comprehensive insights on operational efficacy and risk management. Background events leading up to the audit, including previous audit findings or external regulatory changes, shape the assessment's focus and objectives.

Audit Trail Protocol and Standards

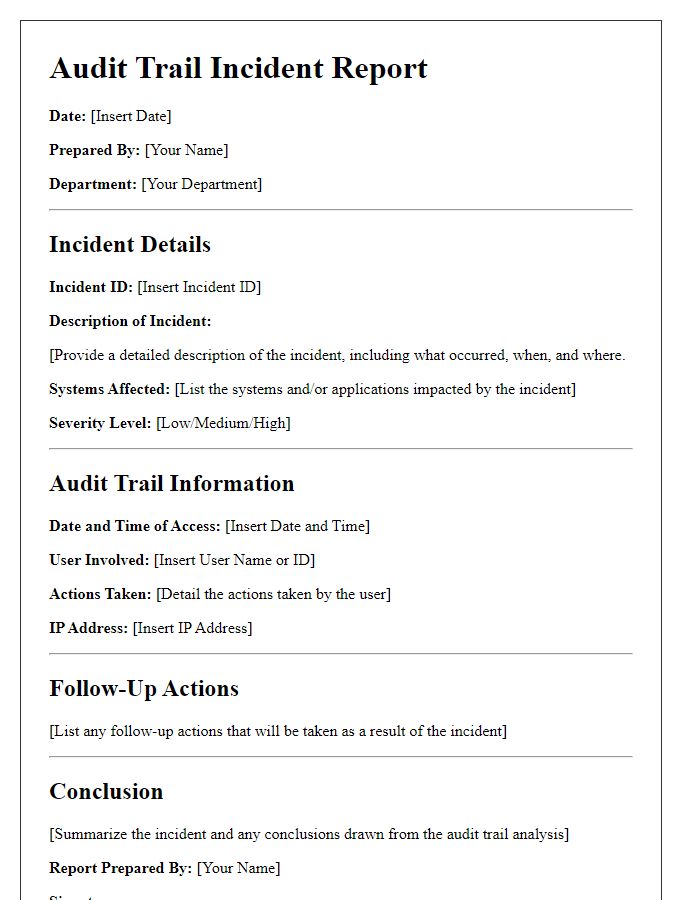

The Audit Trail Protocol ensures comprehensive documentation of transactions and system activities within corporate environments, facilitating accountability and compliance. This protocol involves capturing essential data points such as timestamps (date and time of each action), user identification (unique user ID linked to individual actions), and relevant activity details (specific actions taken) across various systems, including financial systems and customer relationship management (CRM) software. Regular audits (typically quarterly) are essential to validate the integrity of the audit trail information, enabling identification of unauthorized access or anomalies. Compliance with standards, such as the International Organization for Standardization (ISO) 27001, fortifies data security measures and promotes best practices in data management. Organizations must also provide employee training on these protocols to reinforce adherence and understanding of their importance in maintaining operational transparency.

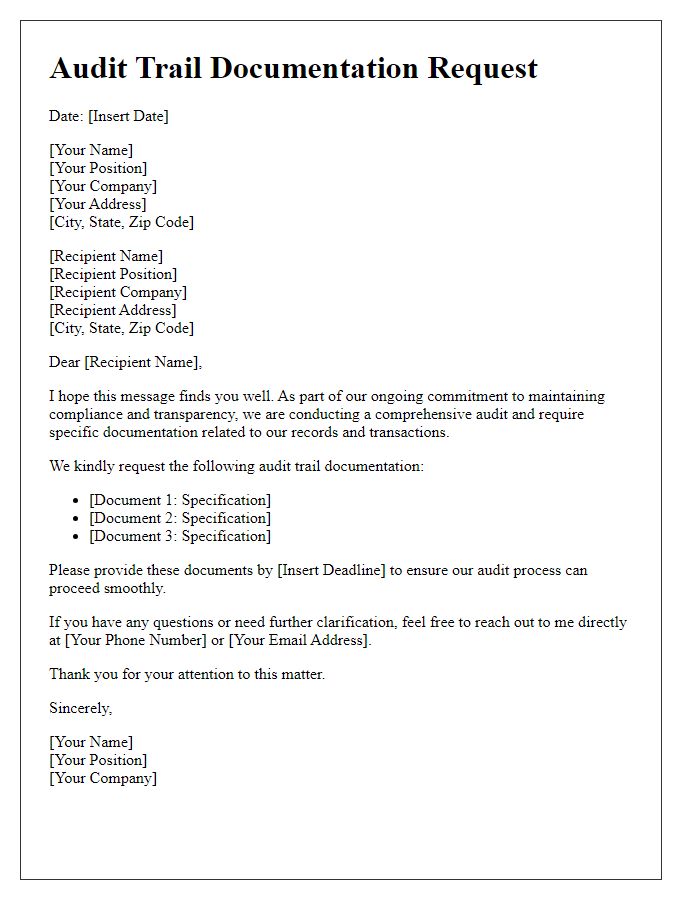

Documentation and Record-Keeping Procedures

Effective documentation and record-keeping procedures play a crucial role in maintaining accurate audit trails for financial transactions and compliance practices. Each transaction should be supported by source documents, such as invoices (detailed accounts of goods or services rendered), receipts (proofs of payment), and contracts (legally binding agreements between parties). Maintaining organized digital or physical files in a secure location is essential for protecting sensitive information (such as customer data and corporate financials). Regular audits, like quarterly internal audits (scheduled reviews to check compliance), ensure that records align with regulatory requirements set forth by governing bodies (such as the Securities and Exchange Commission). Moreover, a structured approach involving systematic backups and version control helps preserve historical data, establishing an undeniable trail that facilitates transparency and accountability during external audits or investigations.

Access Controls and Security Measures

Access controls and security measures are critical elements in maintaining the integrity of sensitive information systems, particularly in financial institutions like banks and credit unions. Organizations implement robust access control mechanisms, such as role-based access controls (RBAC), which define user permissions based on their job responsibilities, ensuring that only authorized personnel can access specific data. Security measures include multi-factor authentication (MFA), which significantly enhances user verification processes by requiring two or more forms of identification, such as mobile device codes or biometric verifications. Audit trails, documenting all access attempts--successful or failed--provide a comprehensive log for compliance audits, allowing organizations to identify potential security breaches or unauthorized access incidents. Additionally, regular reviews of access rights, conducted at least quarterly, align with industry standards from frameworks such as NIST (National Institute of Standards and Technology) or GDPR (General Data Protection Regulation), enhancing overall data protection posture. Technologies like SIEM (Security Information and Event Management) systems play a vital role in real-time monitoring of logs, facilitating rapid response to any detected anomalies or threats.

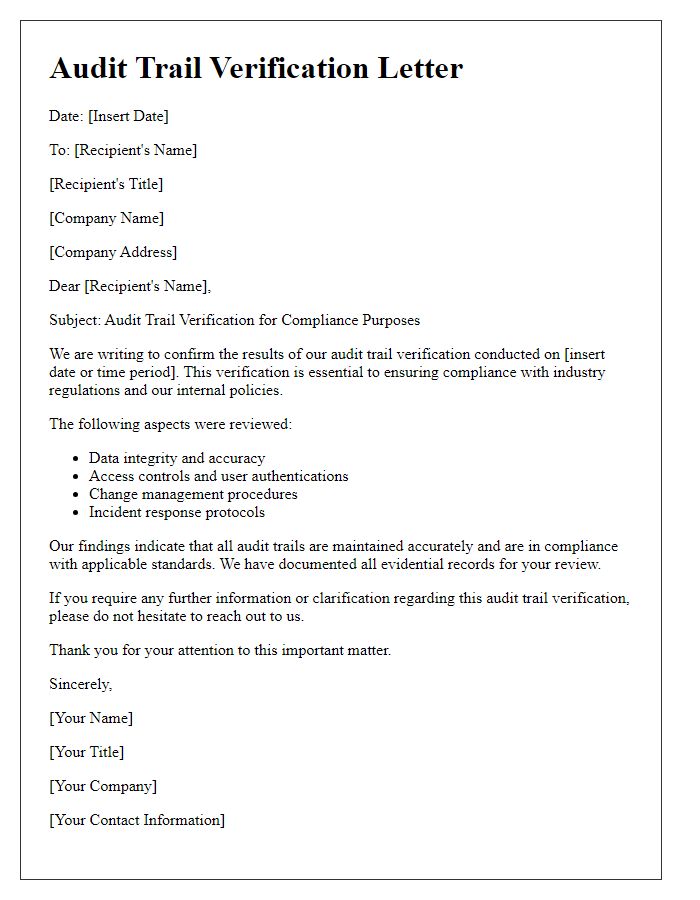

Review and Approval Process

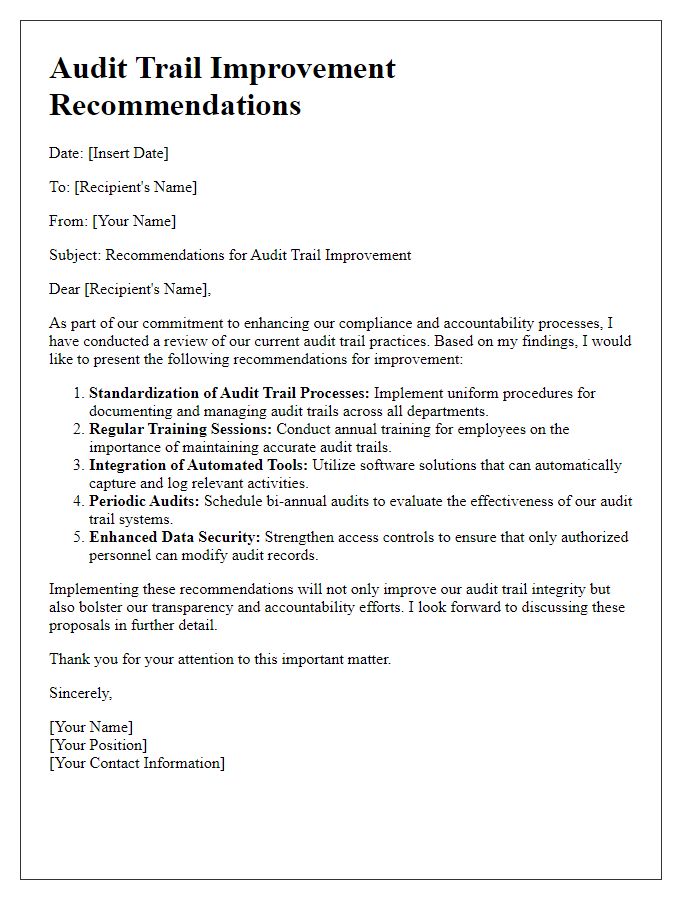

Audit trail documentation serves as a comprehensive record of actions, approvals, and changes within a specific process. It ensures accountability and transparency, particularly in regulatory environments. Each document typically includes timestamps (exact date and time), identifying users (including names and roles), and detailed descriptions of actions taken during the review process. For instance, a financial audit may require signatures from auditors (certified professionals responsible for verifying accuracy) and approvals from management (executives overseeing compliance) to validate the integrity of the financial statements. This meticulous documentation aids in tracing revisions (changes or updates made), enhances communication (between teams or departments), and supports investigations (if discrepancies arise) by providing a clear history of interactions and decisions made throughout the audit cycle.

Comments