Are you feeling anxious about an upcoming tax audit? You're not alone â many people find themselves in a similar situation and often wonder what to expect. In this article, we'll break down the key components of a tax audit notification letter and provide a helpful template to guide you through this process. So, if you're ready to ease your worries and get informed, keep reading for valuable insights!

Subject Line: Tax Audit Notification

Tax audit notifications inform individuals or businesses about the examination by tax authorities, such as the Internal Revenue Service (IRS) in the United States. Affected parties usually receive notifications via mail, alerting them to an upcoming review of their tax returns from the previous year, such as 2022. Audits may arise from discrepancies in reported income, unusually high deductions, or random selection processes within a sampling method used by tax agencies. Subjects of audits are advised to gather relevant documents, including W-2 forms, 1099 statements, and receipts for deductible expenses, as the review process can delve deeply into financial records and supporting documentation. Compliance and timely response to audit notifications are crucial for avoiding penalties and facilitating more convenient resolutions.

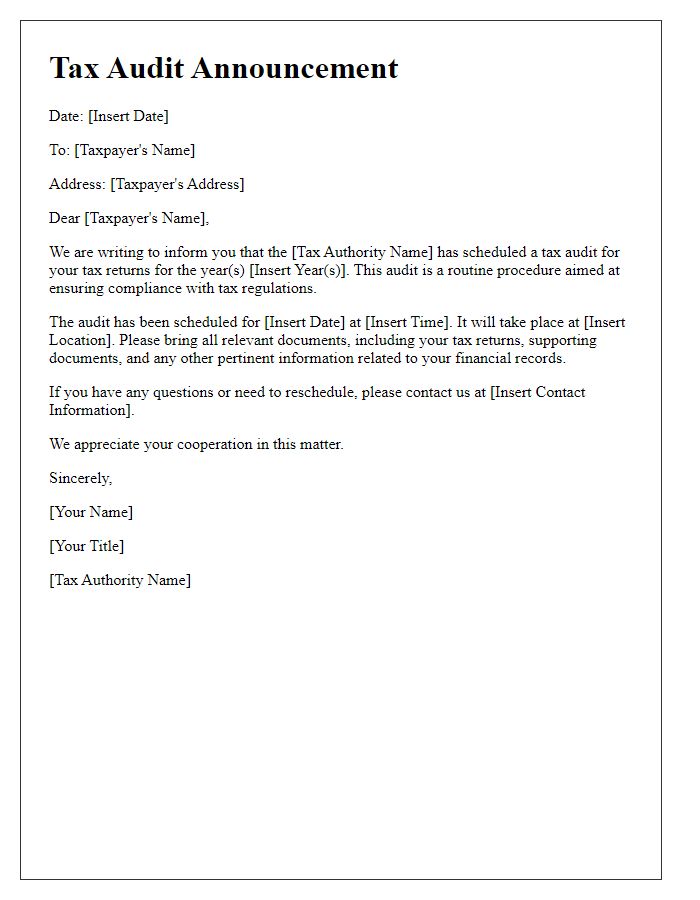

Salutation and Taxpayer Identification

The tax audit notification informs taxpayers about an upcoming review of their financial records and compliance with tax regulations. Each notification clearly states the name of the taxpayer along with their unique Taxpayer Identification Number (TIN) for accurate identification within the tax system. This process typically includes specific details such as the audit's scheduled date, the period under review, and the method of contact for further inquiries regarding the audit. It is crucial for taxpayers to keep their financial documents ready for the audit to demonstrate compliance with local and federal tax laws.

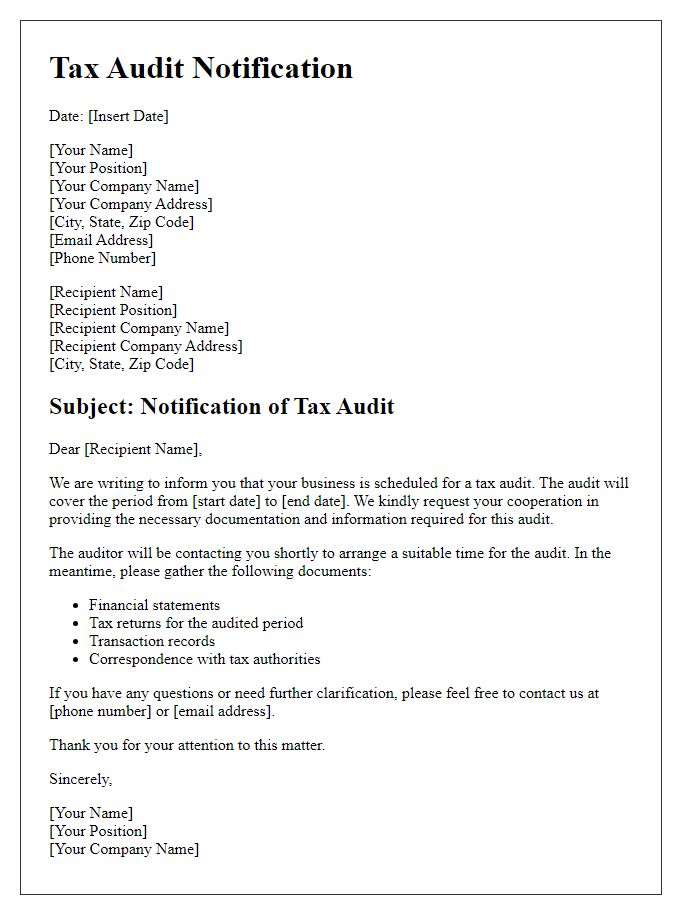

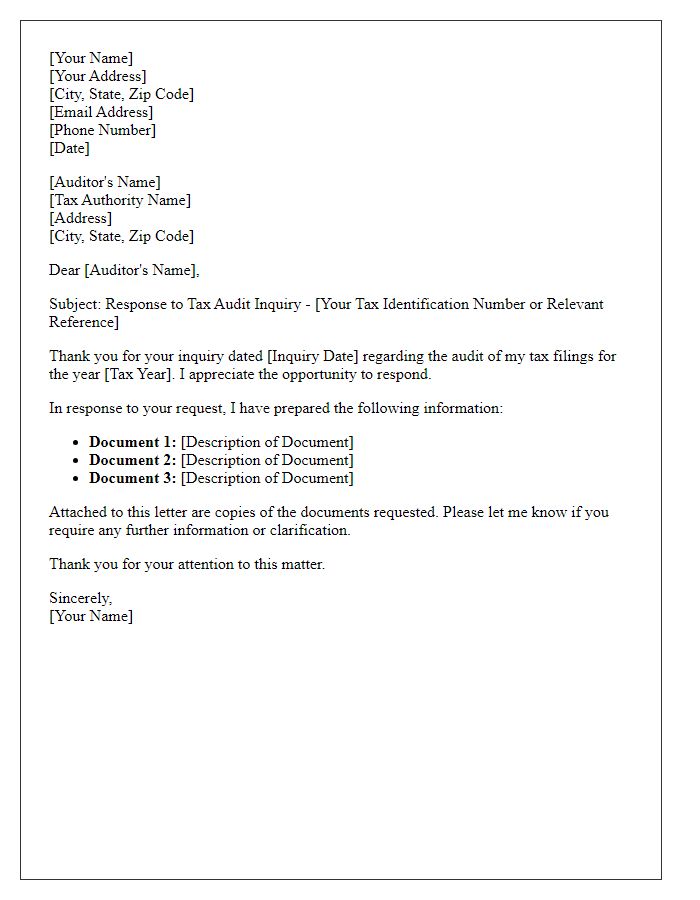

Audit Purpose and Scope

The tax audit notification informs taxpayers regarding the review of financial documents and records by the Internal Revenue Service (IRS) or relevant tax authority. This process evaluates compliance with tax laws and regulations, focusing on the accuracy and completeness of reported income, deductions, and credits. The purpose of the audit encompasses determining the taxpayer's adherence to current tax legislation, including the scrutiny of Form 1040 (individual income tax return) or Form 1120 (corporate tax return), and uncovering discrepancies or irregularities. The scope of the audit may cover various tax years, often limited to a three-year period, but can extend to six years for substantial underreporting. Key areas of examination might include source of income, eligibility for deductions, and overall tax liability calculation, which can influence future tax obligations and potential penalties.

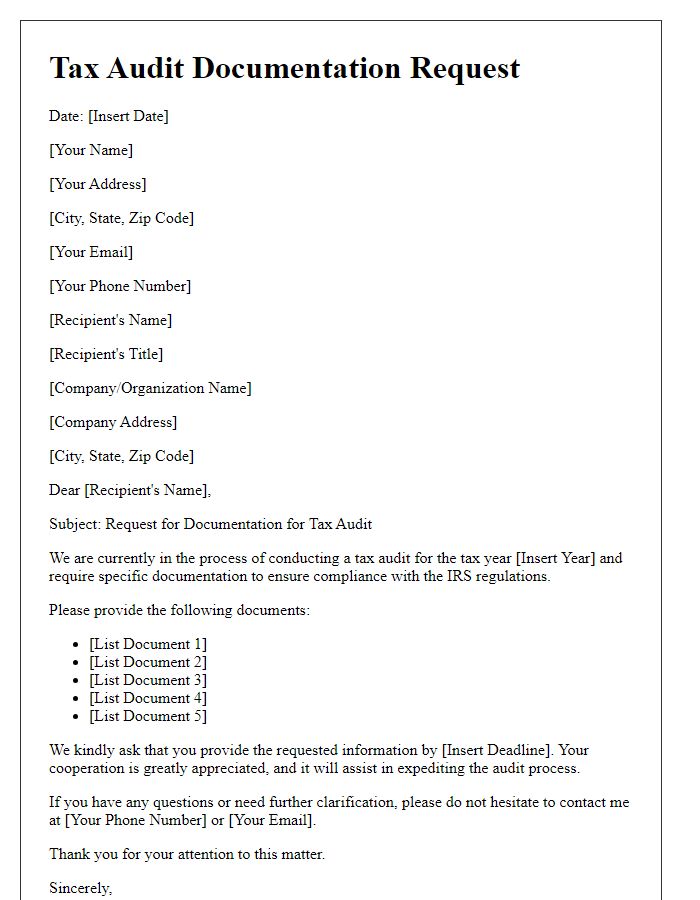

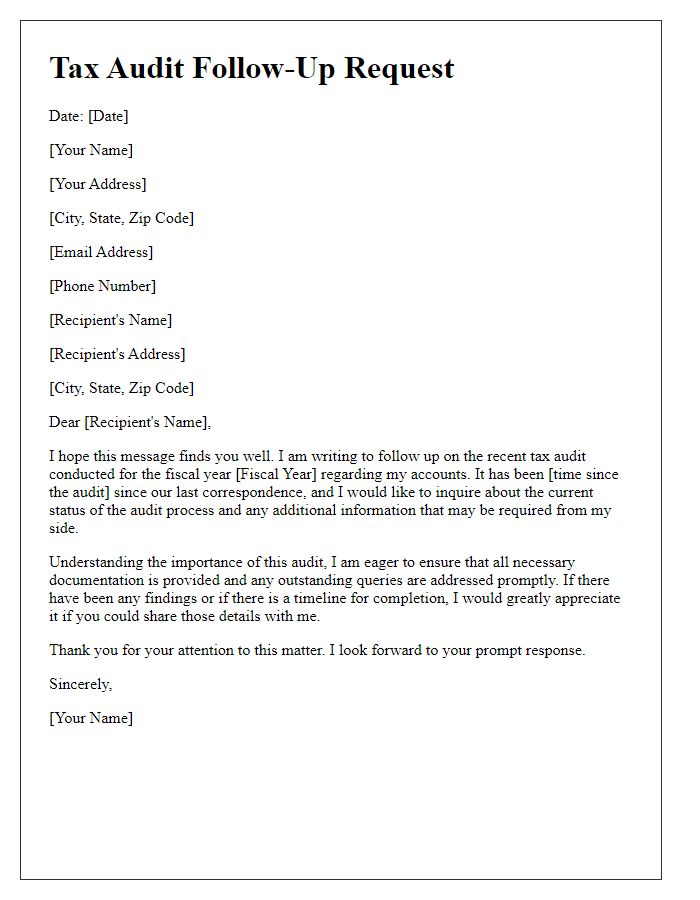

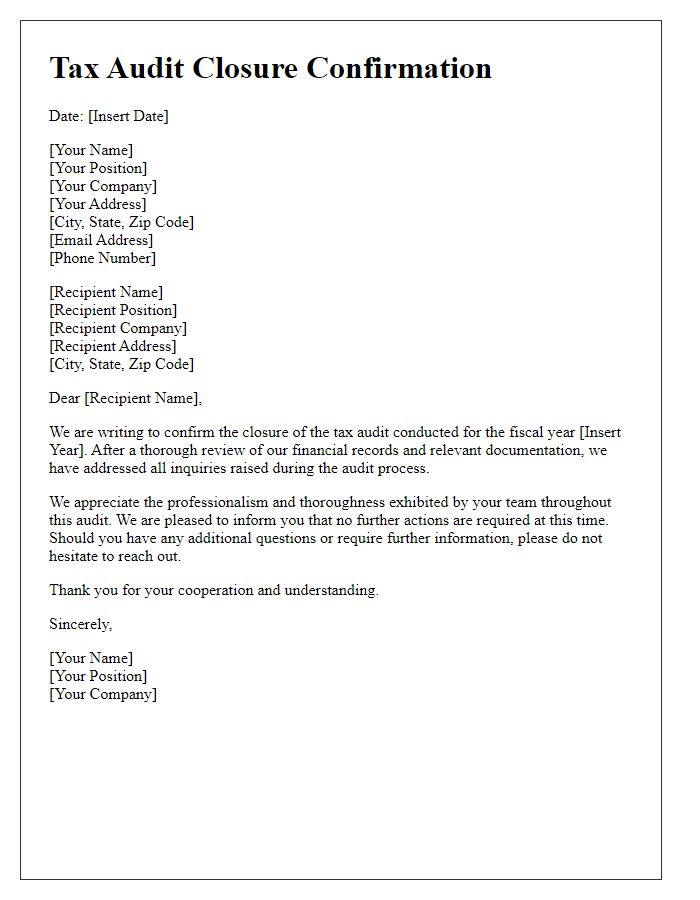

Required Documentation and Deadlines

The tax audit notification requires specific documentation to ensure a thorough review by the Internal Revenue Service (IRS). Taxpayers must supply financial statements from the previous fiscal year, including income statements and balance sheets, along with detailed records of expenses, receipts, and invoices. Documentation should cover pertinent periods such as January 1, 2022, to December 31, 2022. Additionally, any correspondence related to prior audits or disputes must be included. Deadlines for submitting requested documents typically fall within 30 days from the date of the notification letter, ensuring compliance with regulations. Failure to provide required materials may lead to further inquiries or penalties. The audit location may vary, commonly taking place at the taxpayer's home office or IRS facility, which necessitates careful organization and accessibility of the documentation.

Contact Information and Support Resources

Tax audit notifications often include crucial contact information and support resources for taxpayers. The notice typically includes the IRS (Internal Revenue Service) phone number, enabling taxpayers to directly seek assistance regarding their audit. It may also provide a dedicated website link leading to FAQ sections, tax guidelines, and forms pertinent to the audit process, ensuring easy access to essential information. Local tax offices addresses are frequently cited, allowing taxpayers to engage with professionals in person for personalized support. Furthermore, resources such as taxpayer advocate services, operating at the IRS and offering free assistance, become vital for navigating the audit landscape efficiently. Detailed instructions on appeal processes can also be provided, emphasizing taxpayer rights throughout the audit journey.

Comments