Are you part of an audit committee looking to streamline your feedback process? Crafting a clear and concise letter template can enhance communication and ensure all concerns are addressed. By setting a standard format, you can facilitate productive discussions and foster a collaborative environment. Ready to dive in and explore the essential elements of an effective audit committee feedback letter?

Clarity of Financial Reporting

Clear financial reporting is essential for stakeholders in organizations like public companies, allowing transparency regarding fiscal health. Accurately prepared statements, such as income statements and balance sheets, must adhere to generally accepted accounting principles (GAAP) to ensure consistency across reporting periods. Inaccuracies or vagueness can lead to misinterpretations, potentially misguiding investors, analysts, and regulatory bodies, such as the Securities and Exchange Commission (SEC). Furthermore, the clarity of disclosures regarding accounting policies and significant estimates significantly influences the reliability of financial information. Stakeholders often rely on key metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to gauge operational performance. Therefore, effective communication of financial data not only enhances decision-making processes but also fosters trust and confidence in financial markets.

Risk Management Evaluation

The audit committee feedback on risk management evaluation signifies a crucial assessment of organizational vulnerabilities. In the context of corporate governance, effective risk management frameworks must align with regulatory standards set forth by entities such as the Securities and Exchange Commission (SEC) and the International Organization for Standardization (ISO). Key components involve identifying potential risks, including financial discrepancies and operational inefficiencies, with quantitative measures like the risk impact score and likelihood percentage, typically assessed annually. The evaluation process encompasses a thorough review of risk mitigation strategies, internal controls, and compliance adherence, ensuring that the organization fortifies its operational resilience. Incorporating industry benchmarks allows for comparative analysis, highlighting areas for improvement within sectors, such as finance or healthcare, that are often subject to stringent oversight. Regular updates to risk assessments contribute to a dynamic risk management approach, fostering a culture of proactive risk awareness throughout the organization.

Compliance and Regulatory Adherence

The audit committee's feedback on compliance and regulatory adherence emphasizes the importance of strict adherence to laws and regulations within the organization. Key compliance frameworks, such as the Sarbanes-Oxley Act of 2002, mandate accurate financial reporting and robust internal controls to prevent fraud. Regulatory adherence is critical in industries like healthcare, finance, and manufacturing, where specific standards, including HIPAA for patient information privacy or the Dodd-Frank Act for financial transparency, must be strictly followed. Regular audits, both internal and external, enhance accountability and transparency, identifying any potential lapses in compliance. The audit committee should actively promote a culture of compliance, providing necessary training and resources to employees to minimize risks and ensure adherence to regulatory requirements efficiently.

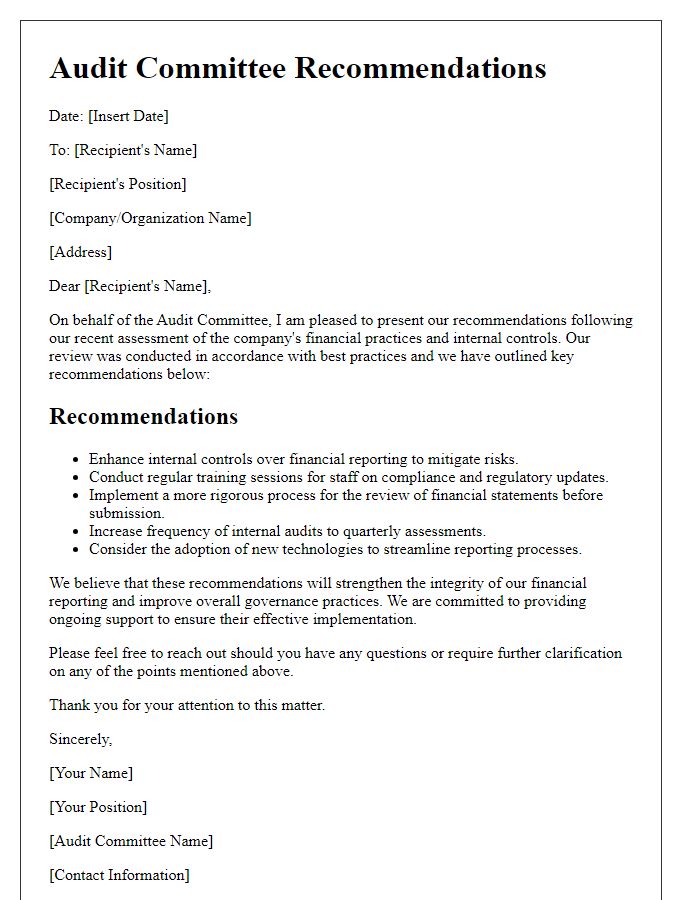

Audit Findings and Recommendations

The audit committee received findings regarding internal controls and financial reporting practices within Company XYZ. Significant discrepancies identified during the audit period from January to June 2023, including a 15% variance in inventory valuation and a 20% increase in overdue receivables, suggest potential lapses in oversight. Recommendations emphasize enhancing personnel training, particularly in financial reconciliation processes, implementing a robust software solution for real-time analytics, and conducting quarterly reviews of financial documentation. Addressing these issues promptly can mitigate risks, improve compliance with GAAP (Generally Accepted Accounting Principles), and enhance stakeholder confidence in financial integrity.

Internal Control Effectiveness

The effectiveness of internal controls within an organization significantly impacts financial reporting and operational efficiency. A robust internal control system, comprising components such as the control environment, risk assessment, control activities, information and communication, and monitoring activities, is essential for safeguarding assets and ensuring compliance with applicable laws and regulations. The feedback from the audit committee, particularly regarding internal audit findings during the fiscal year (2023), highlights areas for improvement and strengthens the organization's governance framework. Key performance indicators (KPIs), defined by specific metrics, further illustrate the effectiveness of these controls. Regular evaluations, including compliance audits and risk assessments, are crucial for adapting to evolving regulations and financial landscapes, ultimately reducing the risk of fraud and financial misstatements.

Comments