Are you looking for a straightforward way to approach your loan repayment? Writing a loan repayment agreement can help you clarify the terms and ensure both parties are on the same page. By formalizing your repayment plan in a letter, you not only protect yourself legally but also build trust with the lender. Dive in to discover how to create the perfect template that suits your needs!

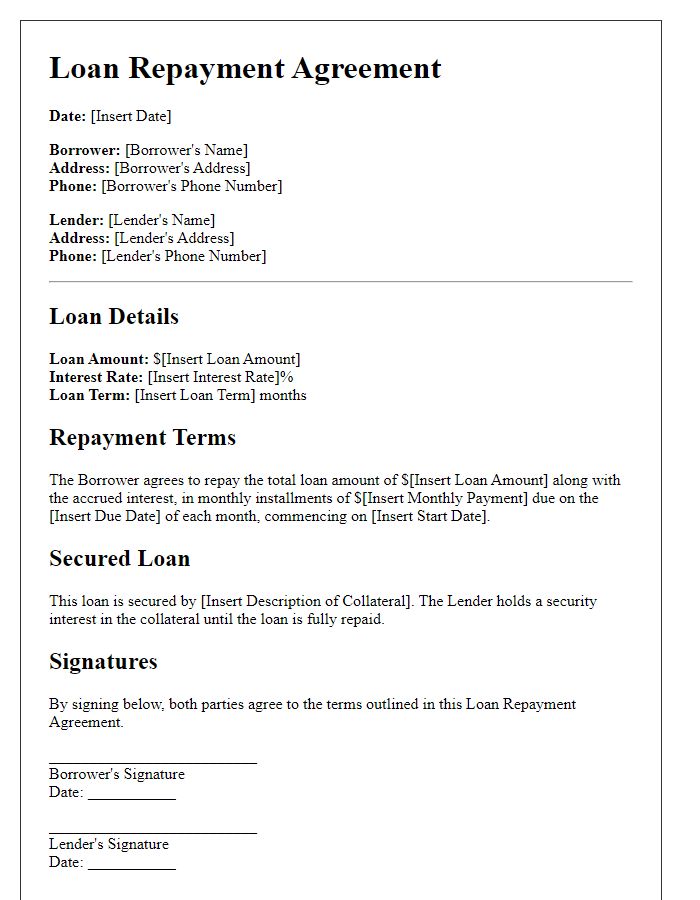

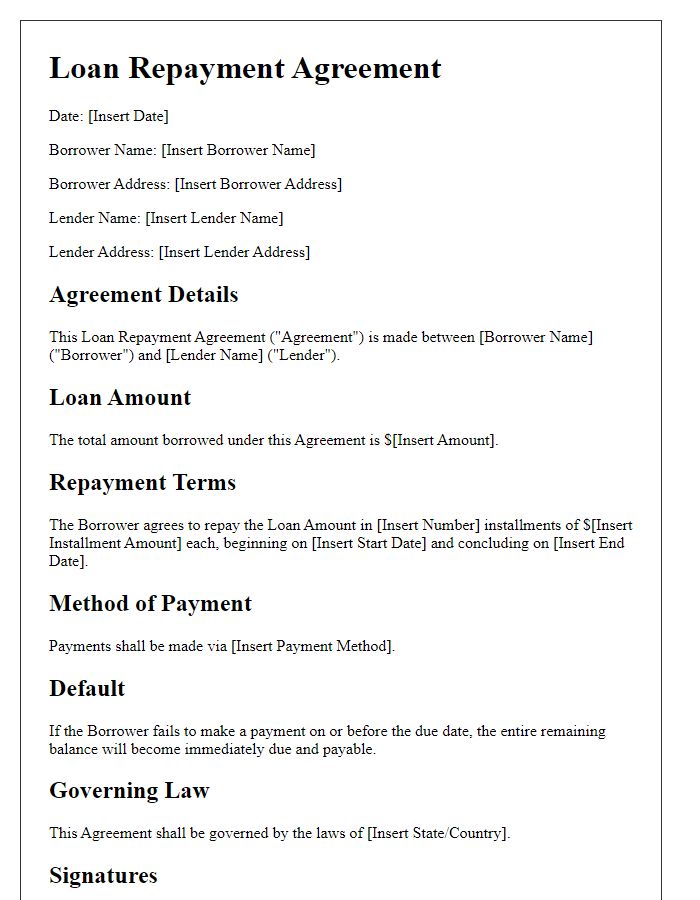

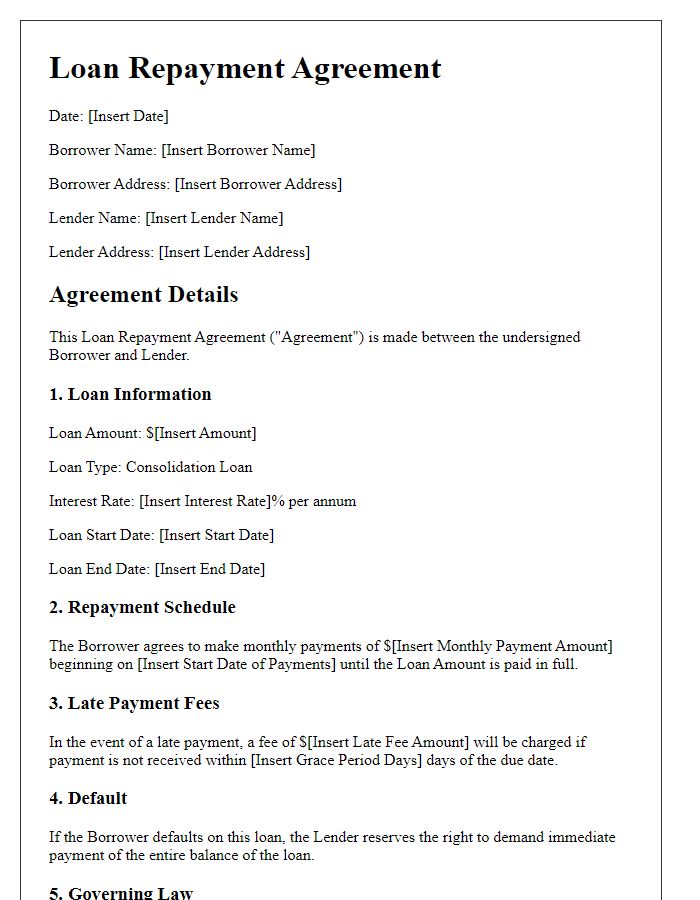

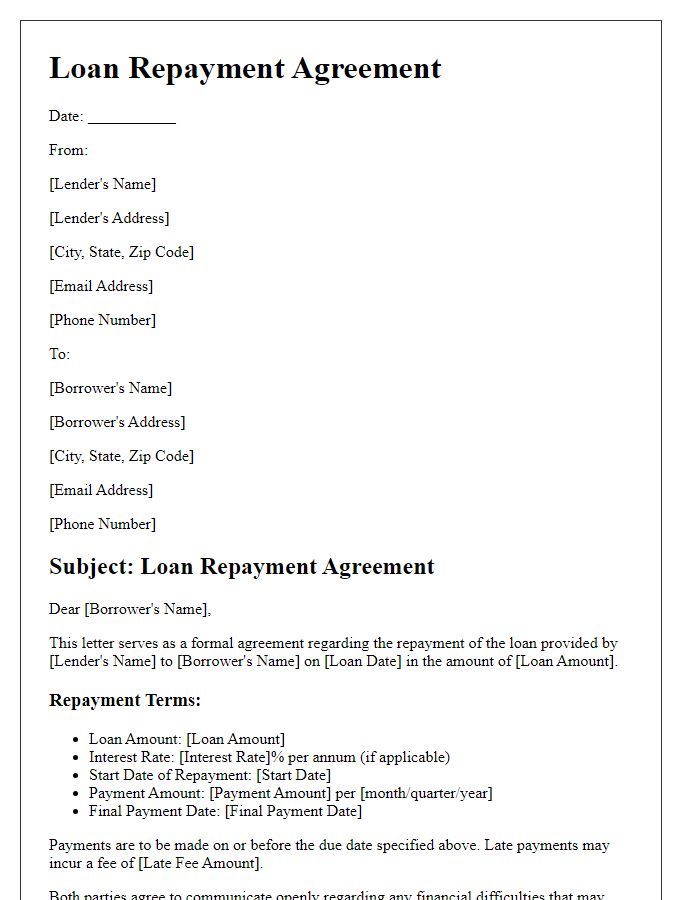

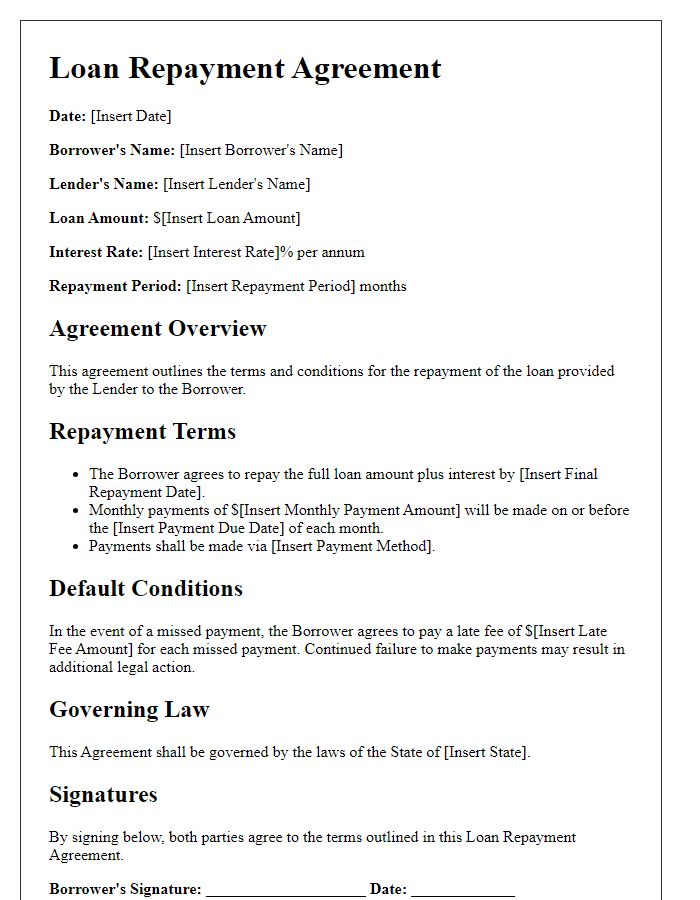

Parties Involved

A loan repayment agreement, particularly in real estate transactions like mortgages or personal loans, typically includes key parties: the borrower, an individual or entity receiving funds with the commitment to repay, and the lender, often a financial institution or private creditor providing the capital. Essential terms include the loan amount, interest rate (often expressed as an annual percentage rate or APR), repayment schedule (monthly installments over a specified period, such as 15 or 30 years), and consequences of default, including late fees or legal actions. The agreement should also reference the governing law, which outlines jurisdictional regulations where the transaction occurs, such as the state of California or New York. Additional provisions may cover collateral requirements, defining the asset that secures the loan, often a tangible property.

Loan Amount and Repayment Terms

A loan repayment agreement outlines the financial terms of a loan, including the principal amount borrowed. For instance, a loan amount of $10,000 at an annual interest rate of 5% for a duration of 36 months is commonly structured with monthly payments of approximately $299. While drafting such agreements, it is essential to specify the repayment terms clearly. Include payment due dates, methods of payment (such as bank transfer or check), and any penalties for late payments. Furthermore, consider outlining the total repayment amount, which in this example would be around $10,764, covering interest accrued over the repayment period. This clarity ensures transparency and helps in managing financial expectations between the lender and borrower.

Interest Rate and Fees

A loan repayment agreement typically includes essential details such as interest rates, fees, and terms applicable to the loan. The interest rate (for example, 5% annually) determines the cost of borrowing money and is usually expressed as an annual percentage rate (APR). Fees may consist of origination fees, late payment penalties, or prepayment penalties, each impacting the overall financial burden. Clear stipulations regarding the time frame for repayments, typically outlined as monthly installments over a designated period (such as 12, 24, or 36 months), ensure both parties understand their obligations. Furthermore, documenting the consequences of default or missed payments safeguards the lender's interests while providing the borrower with transparency in their responsibilities.

Default and Late Payment Provisions

Loan repayment agreements often include default and late payment provisions to ensure clarity between the lender and the borrower. Default provisions typically outline circumstances that may lead to a loan being considered in default, such as missed payments exceeding 30 days or failure to comply with other terms of the agreement. Late payment provisions often specify the consequences of delayed payments, including a potential late fee (often a percentage of the missed payment) and how interest may accrue on the outstanding balance. Additionally, these provisions may detail the lender's rights, such as the ability to accelerate the loan (demand immediate full repayment) or initiate collection proceedings if the borrower fails to remedy the default within a stipulated time frame (often 30 days from the notification of default). It's essential for both parties to understand these terms clearly to avoid future disputes and ensure mutual compliance.

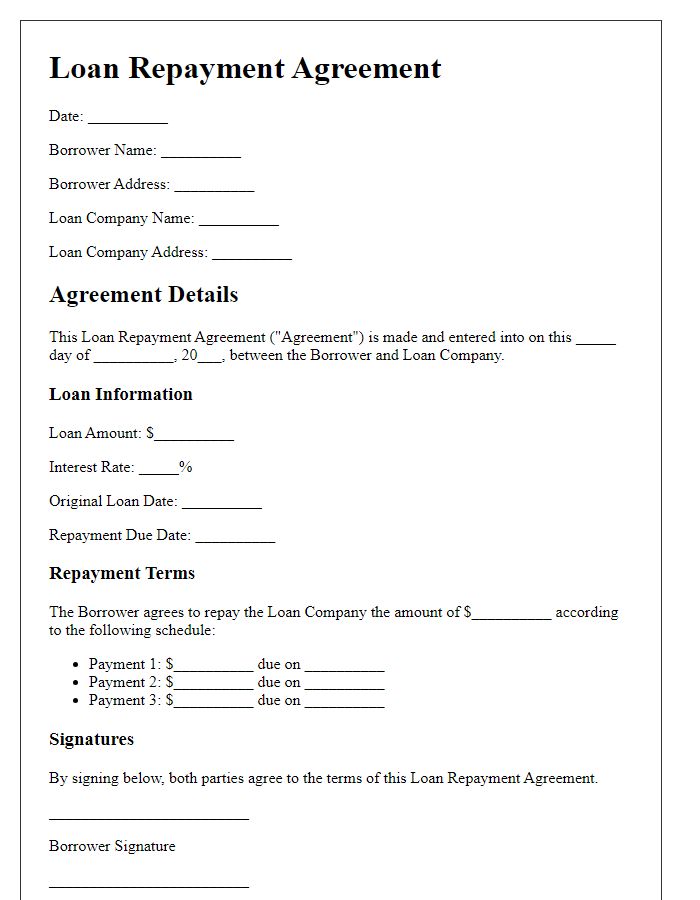

Signatures and Date

A loan repayment agreement formalizes the terms of repayment between a borrower and a lender. Essential components include signatures of all parties involved, indicating their acceptance of the terms outlined in the agreement. The date of signing is crucial, establishing the timeline for the commencement of repayment obligations. Specific details such as the loan amount (denominated in currency), interest rate (percentage), payment schedule (monthly, quarterly), and consequences of default may also be included, enhancing clarity and enforceability. Proper documentation of signatures and date ensures legal validity and accountability for both parties.

Comments