Are you feeling overwhelmed by the need to initiate a liquidation process? It's a challenging but necessary step for some businesses, and understanding how to approach it can make a significant difference. In this article, we'll walk you through the essential steps to get started, shedding light on the paperwork and processes involved. So, let's dive in and explore how to navigate this important journey together!

Clear identification and contact details

Initiating the liquidation process for a company involves a clear and concise identification of the business entity along with relevant contact details. The document should specify the business's legal name, registered address, and company registration number for precise identification. Additionally, include the contact person's name, phone number, and email address to facilitate communication during the liquidation process. These details are crucial in ensuring that all stakeholders, such as creditors and regulatory bodies, can reach out effectively and maintain transparency throughout the proceedings. Proper documentation and clarity in these areas can streamline the entire liquidation process.

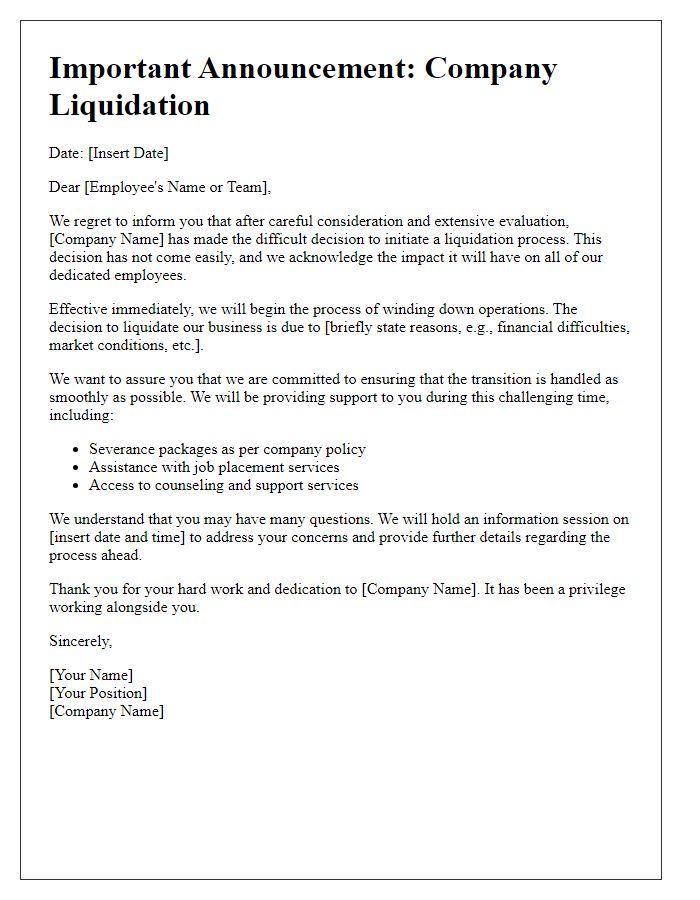

Formal announcement of liquidation

The initiation of the liquidation process signifies a significant transition for the company, particularly affecting employees, stakeholders, and creditors. This formal announcement will detail the necessary steps outlined under relevant laws and regulations, such as the Insolvency Act of 1986 in the UK or Chapter 7 of the Bankruptcy Code in the United States. Key aspects of the process include the appointment of a licensed insolvency practitioner, responsible for overseeing the asset distribution. Stakeholders, including shareholders and creditors, will be informed of timelines and meetings, such as the creditors' meeting typically held within 14 days of liquidation commencement. Transparency during this process is crucial, as it ensures that all parties understand their rights and obligations regarding outstanding debts and claims against the company.

Detailed explanation of reasons for liquidation

A letter template for initiating the liquidation process serves as a formal document outlining the circumstances leading to the necessity for dissolving a business entity. Key reasons for liquidation often include sustained financial losses, inability to meet obligations, or changes in market conditions that render continued operations untenable. This document must also communicate the decision to liquidate assets, repay creditors, and address stakeholder interests. The clarity of this template ensures all parties understand the rationale behind the liquidation, including potential impacts on employees, vendors, and shareholders, while adhering to legal and regulatory requirements governing corporate dissolution.

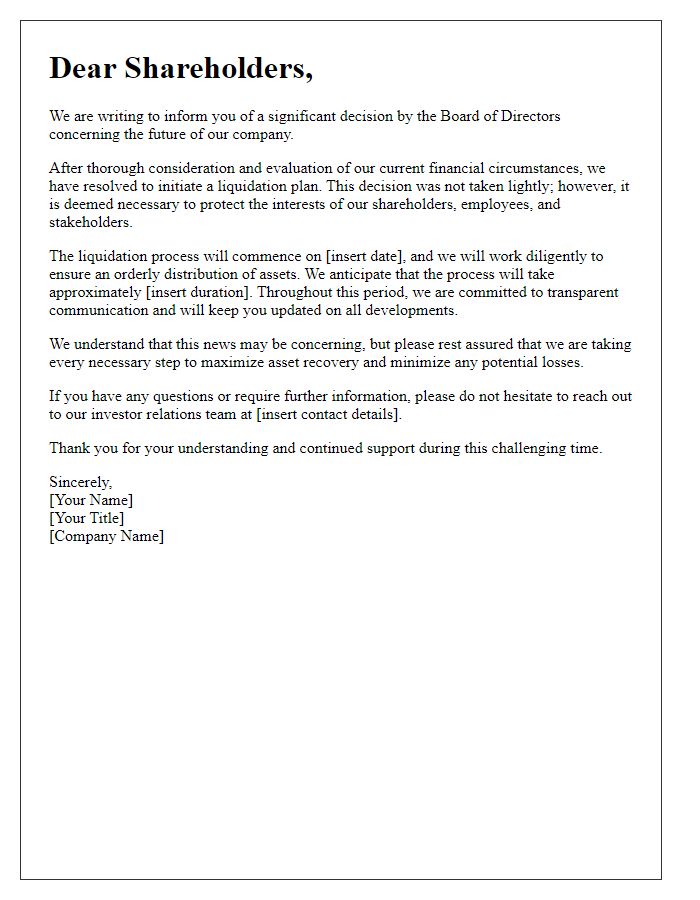

Outline of stakeholder rights and responsibilities

Liquidation processes involve complex interactions among stakeholders such as creditors, shareholders, employees, and liquidators. Creditors hold the right to claim unpaid debts while also being responsible for submitting accurate claims promptly. Shareholders possess rights to the company's remaining assets after debt settlements but must understand their liability in case of insolvency. Employees have the right to receive unpaid wages and severance but must comply with any employment contract obligations. Liquidators assume the vital responsibility of managing the asset liquidation, ensuring equitable distribution among creditors, and filing necessary reports. Understanding each role within this process is crucial for a transparent and efficient liquidation.

Timelines and next steps

The initiation of the liquidation process marks a critical phase for a company, such as Tech Innovations LLC, which may be undergoing significant changes due to financial difficulties or strategic realignments. Following the formal decision to liquidate, key timelines will dictate the course of action. The first step involves the Board of Directors' meeting scheduled for December 1, 2023, where a resolution will be passed to initiate the liquidation. Subsequently, a notice to creditors will be distributed by December 5, outlining the claims process and deadlines. Creditors must submit their claims by January 15, 2024, allowing for an orderly evaluation of financial obligations. An appointed liquidator will then conduct an inventory assessment of all assets within the first two weeks of January, including tangible assets such as property and equipment valued at approximately $500,000, alongside intangible assets like intellectual property. The liquidation process will culminate in the final distribution of proceeds to creditors by February 28, 2024, providing closure for stakeholders involved.

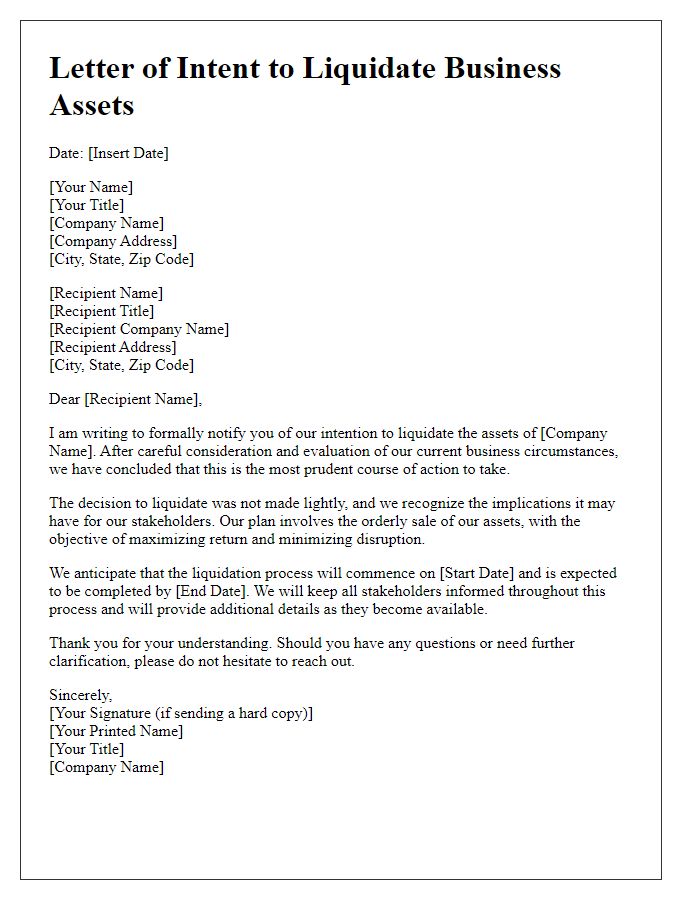

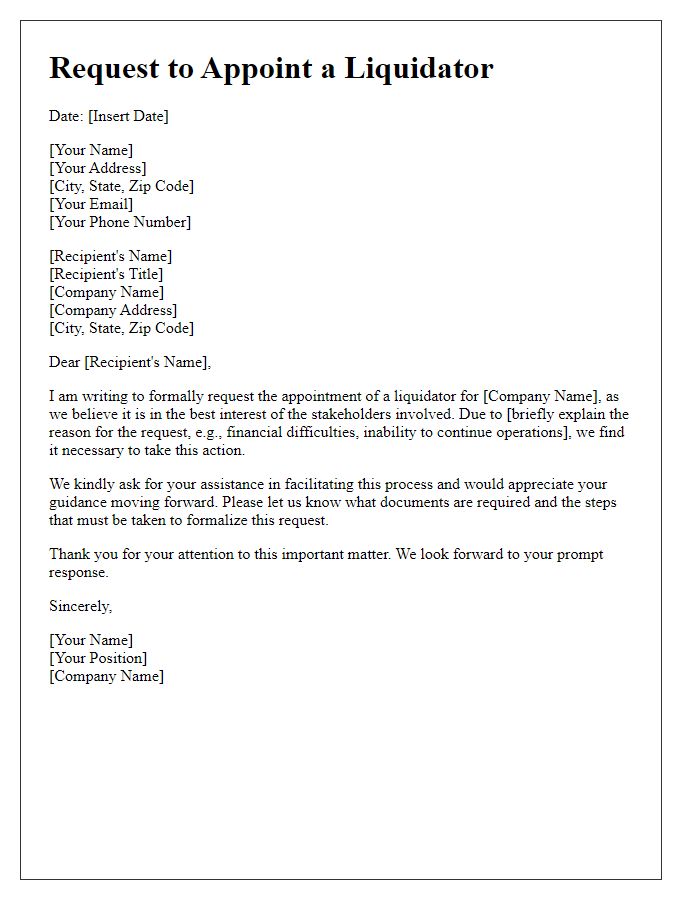

Letter Template For Liquidation Process Initiation Samples

Letter template of creditor meeting invitation for liquidation discussion

Comments