Navigating the complexities of tax penalties can be daunting, but you're not alone in this journey! Understanding how to effectively resolve these issues is crucial for your financial health. We've compiled a comprehensive guide that breaks down the steps you need to take, ensuring you have all the tools at your disposal to mitigate any stress. Dive in to discover actionable strategies and expert insights that can pave the way for your successful tax penalty resolution!

Professional Greeting and Client Identification

In the complex landscape of tax compliance, clients often face daunting challenges, such as navigating tax penalties imposed by the Internal Revenue Service (IRS). Tax penalties can arise from various situations including late filings, underpayment of taxes, or inaccuracies in reported income. For instance, failure to pay taxes on time can lead to a penalty of 0.5% per month on the unpaid balance, while the accuracy-related penalty can punish underreporting by as much as 20% of the unpaid tax. The resolution of these penalties typically involves comprehensive analysis of the client's financial situation, negotiation with the IRS, and potential filing for abatement to reduce or eliminate fines. Understanding relevant details such as the client's prior compliance history and reasons for penalties forms the basis of an effective strategy to mitigate financial repercussions.

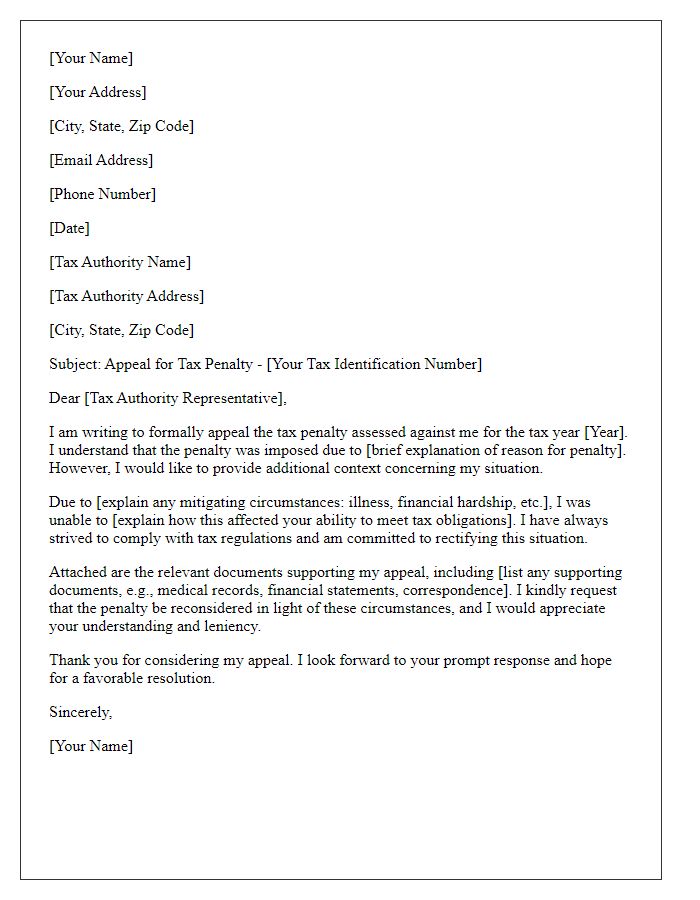

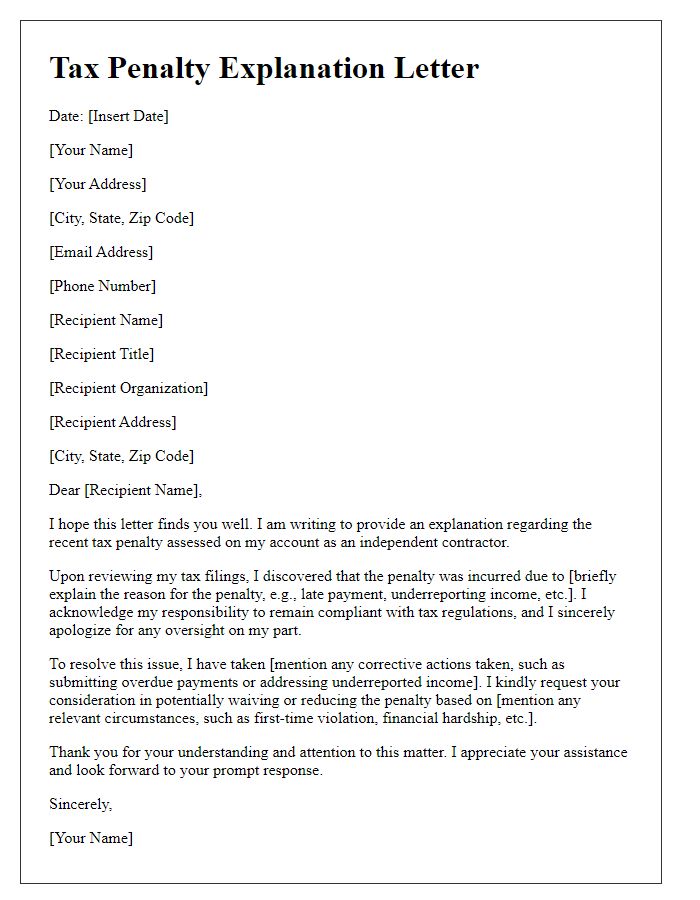

Explanation of Tax Penalty Issue

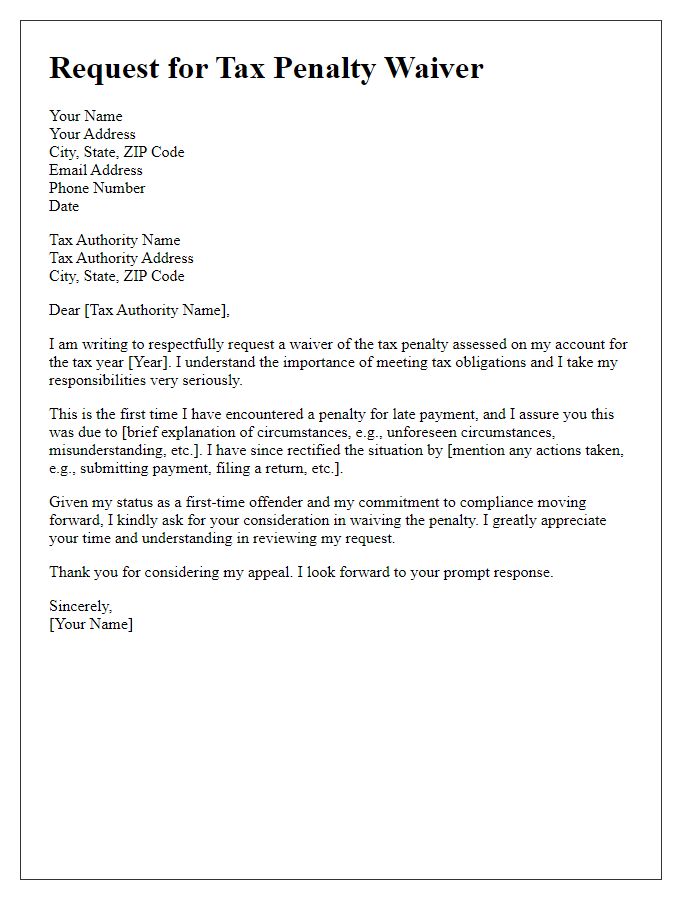

Tax penalties often arise from underreported income, late filings, or failure to meet tax obligations. For instance, the Internal Revenue Service (IRS) may impose a penalty of 5% per month on unpaid taxes, culminating in a maximum of 25% of the owed amount. A common scenario involves a client whose 2022 tax return was submitted past the April 15 deadline due to unforeseen circumstances, such as medical emergencies or employment changes. This delay can result in significant financial consequences, including interest accumulation on unpaid taxes. Locations like California or Texas have varying state tax regulations that can further complicate the resolution process. Engaging a tax professional can lead to potential abatement of penalties through reasonable cause arguments, based on supporting documentation and prior compliance history. Clients must be aware of their rights, including the ability to appeal, and the importance of proactive communication with tax authorities to mitigate penalties.

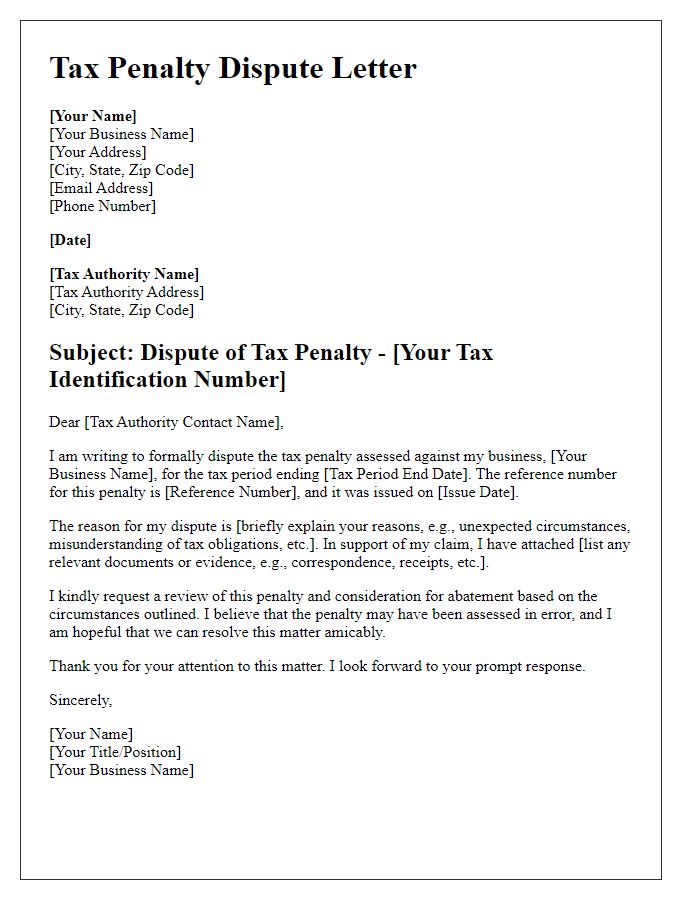

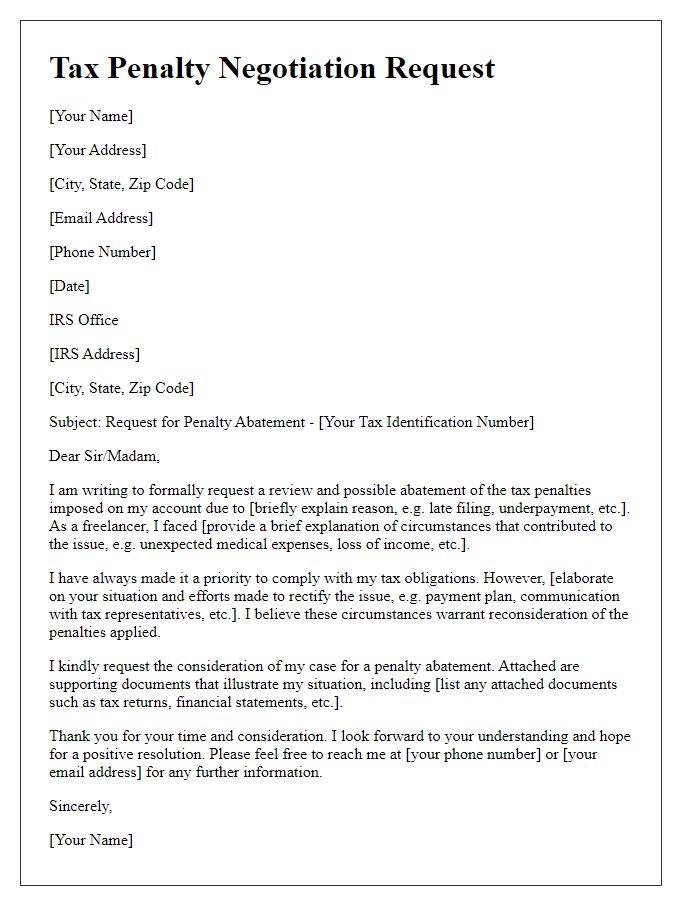

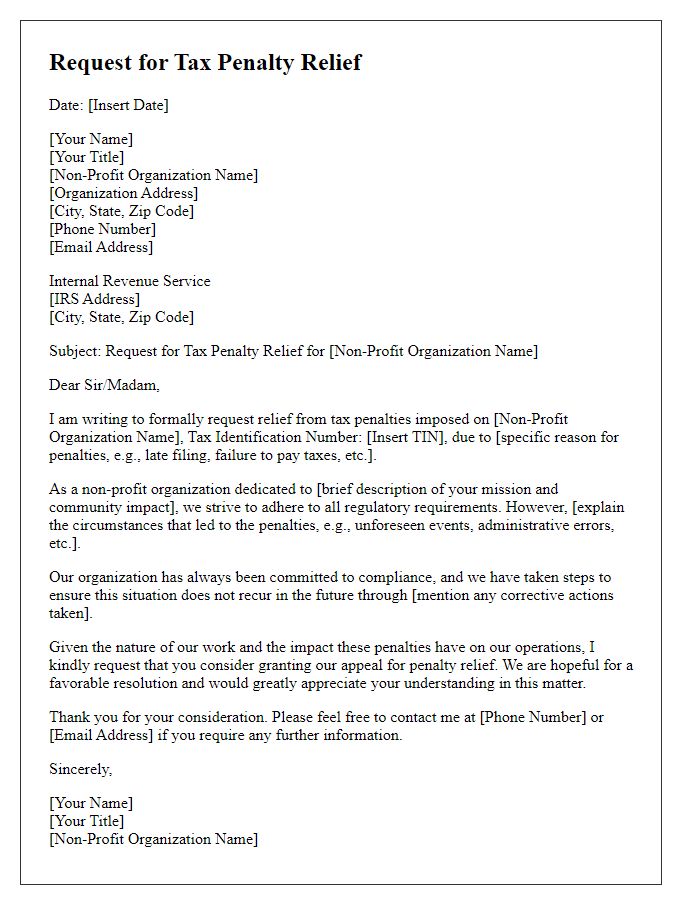

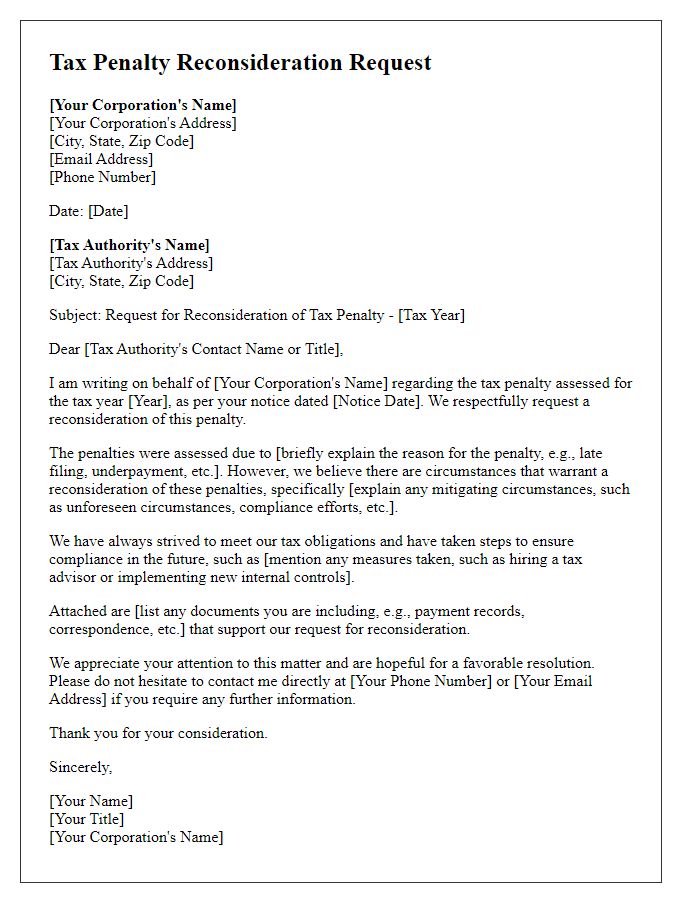

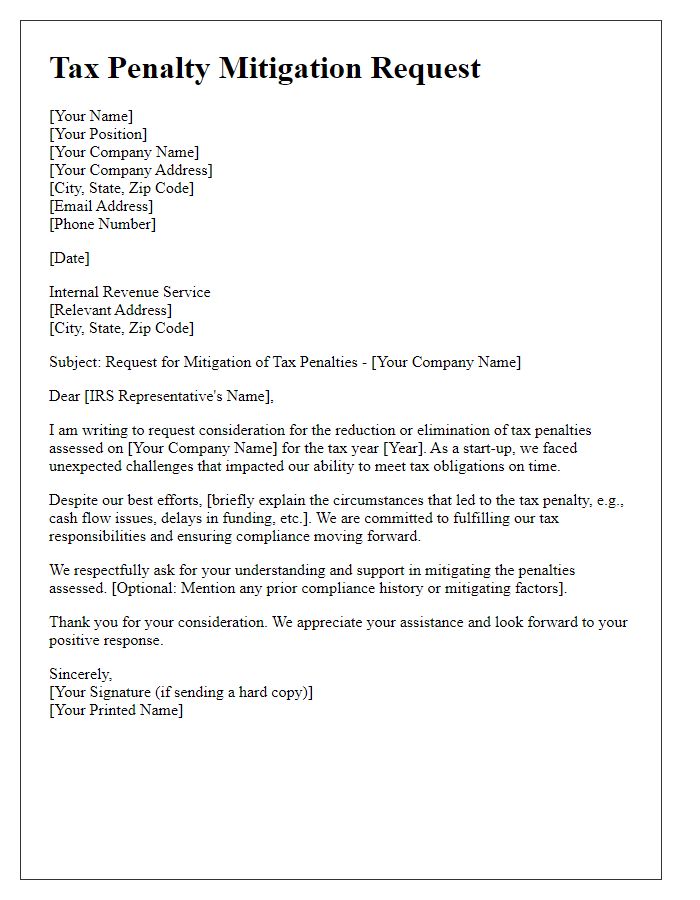

Resolution Strategy and Proposed Actions

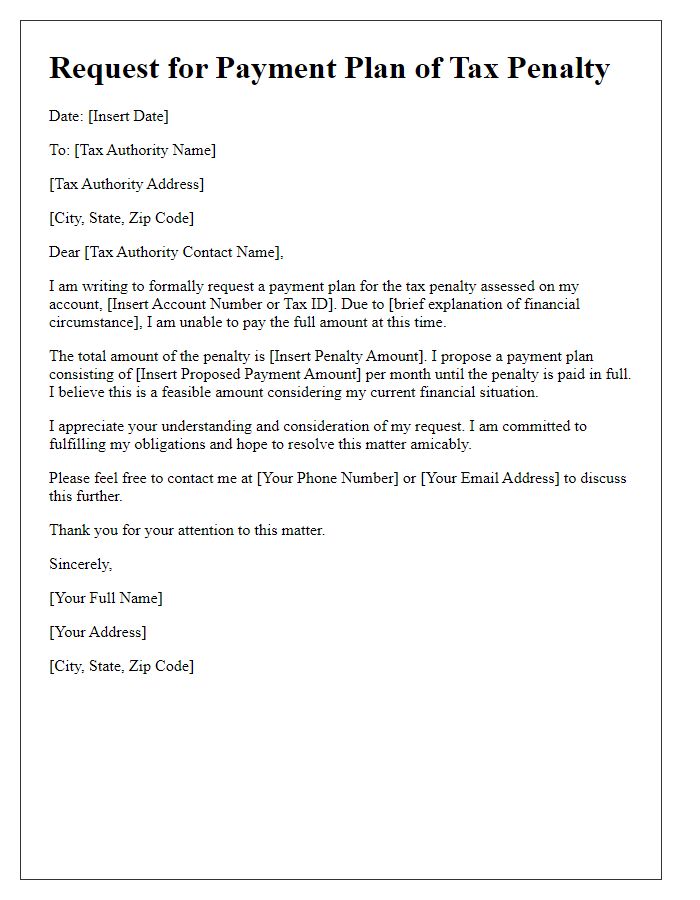

Tax penalties can impose significant financial burdens on businesses, particularly in cases involving penalties from the Internal Revenue Service (IRS) due to late filings or incorrect submissions. Penalty relief programs, such as the First-Time Penalty Abatement program, can potentially reduce or eliminate penalties for eligible taxpayers. Active communication with the IRS is essential, requiring the submission of detailed documentation and a formal request for reconsideration. Offering an explanation that includes reasonable cause or demonstrated compliance history can strengthen a case for relief. Engaging a tax professional with expertise in penalty negotiations can facilitate this process, optimizing the likelihood of a favorable outcome and minimizing financial repercussions for the client.

Assurance of Client Support and Follow-up

Tax penalties can significantly impact financial stability and cause stress. Engaging with the Internal Revenue Service (IRS) for resolution requires a strategic approach. Demonstrating unwavering client support throughout the resolution process is crucial. This includes assessing the specific nature of the penalty, which could range from late filing penalties (up to 25% of unpaid taxes) to failure-to-pay penalties (0.5% per month). Identifying opportunities for abatement, such as reasonable cause or first-time penalty abatement, can provide relief. Establishing clear communication channels ensures clients remain informed, fostering trust. Follow-up procedures post-resolution are essential to monitor compliance and prevent future penalties, enhancing overall financial wellbeing. Undertaking thorough documentation and proactive engagement with the IRS can reinforce the client's standing, ultimately leading to a more favorable outcome in these complex situations.

Contact Information and Closing Statement

Resolving tax penalties is crucial for individuals and businesses seeking financial stability, particularly when dealing with authorities like the Internal Revenue Service (IRS) in the United States. Timely communication through official channels can provide clarity on assessment errors or compliance discrepancies dating back to years such as 2019 and 2020. A comprehensive response should include accurate contact information, ensuring that the IRS or relevant tax agency can promptly reach the taxpayer. Additionally, a closing statement should emphasize collaboration and resolution, highlighting available options like an Offer in Compromise or installment agreements while expressing a willingness to cooperate in rectifying the situation efficiently.

Letter Template For Client Tax Penalty Resolution Samples

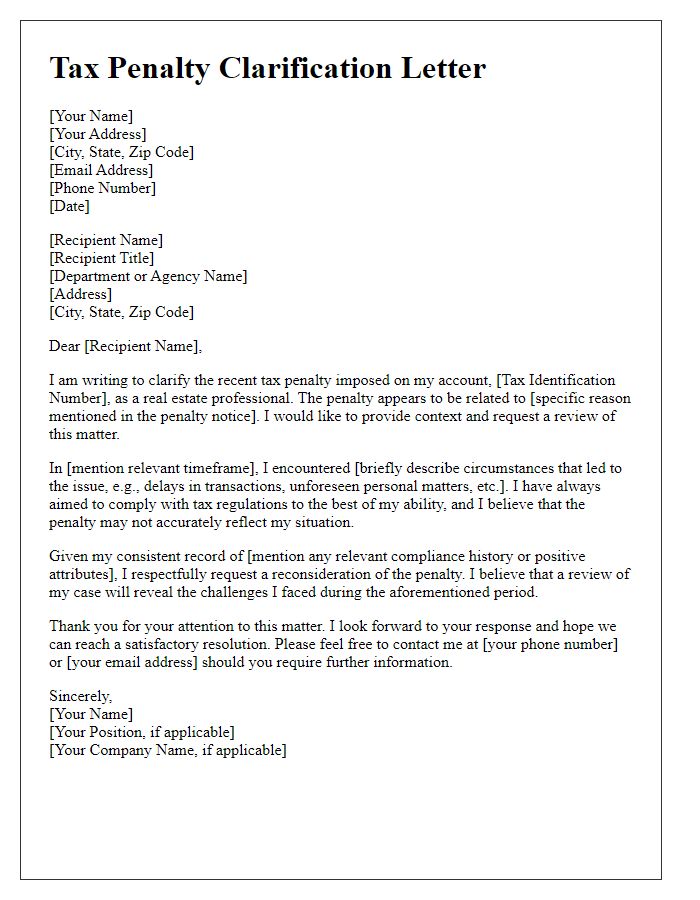

Letter template of tax penalty clarification for real estate professionals.

Comments