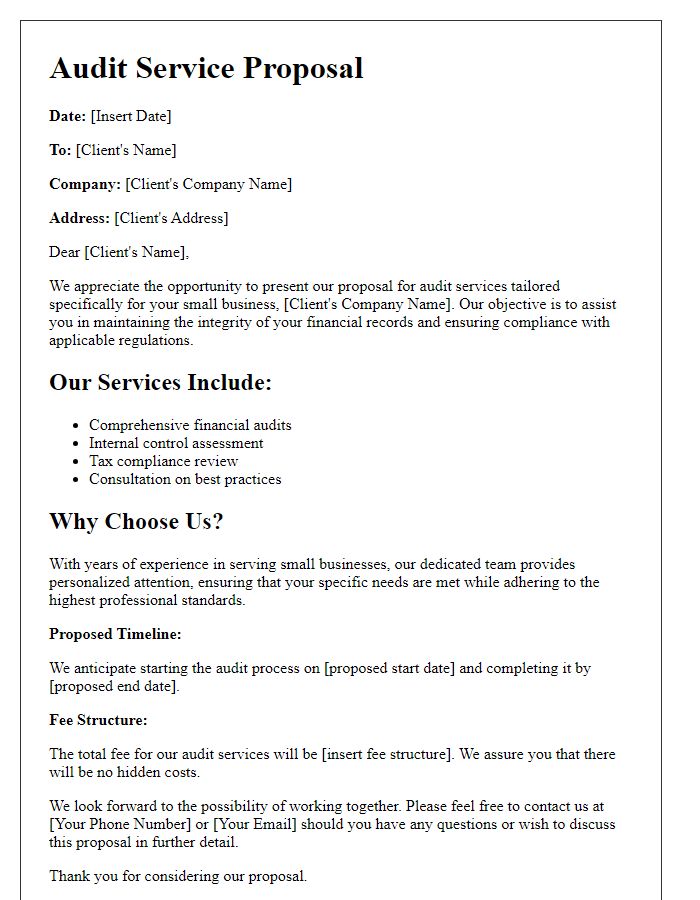

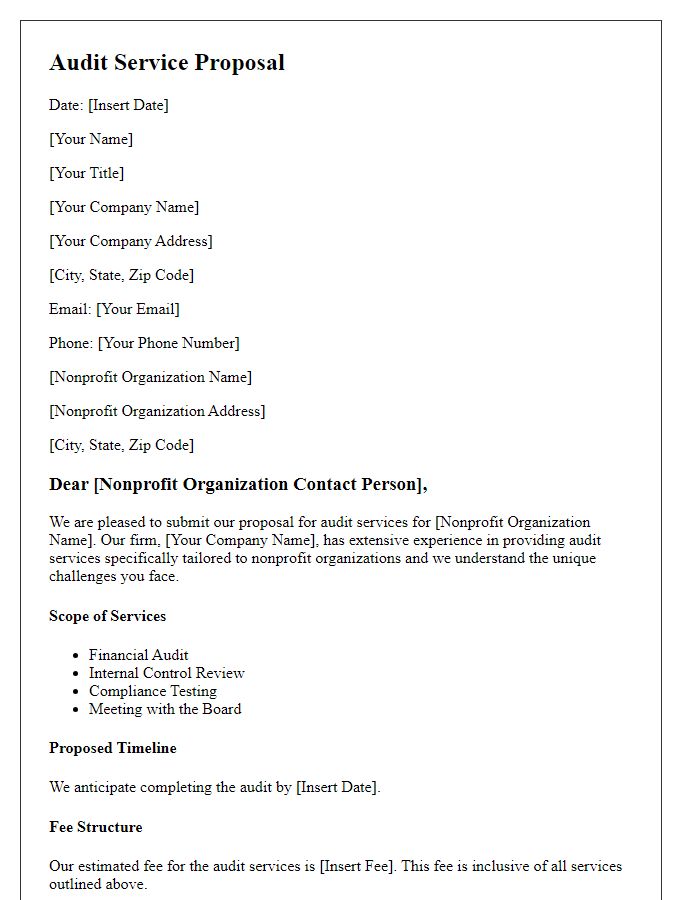

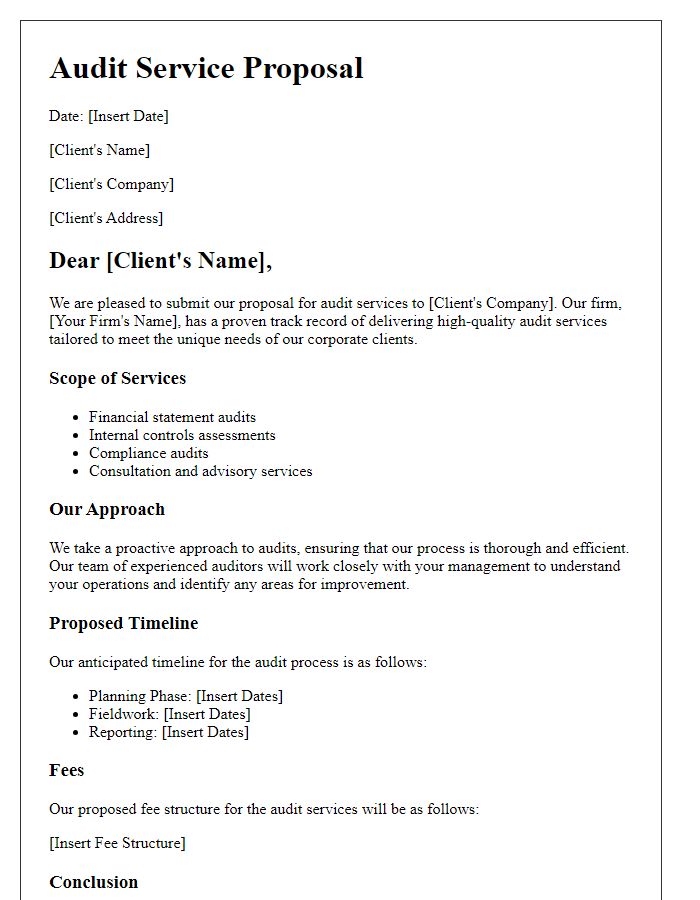

Are you looking for a professional audit service proposal that can effectively communicate your value to potential clients? Crafting a compelling letter is essential to highlight your expertise and the benefits of your services. In this article, we'll explore key elements to include in your proposal letter, ensuring it stands out in a competitive market. So, if you're ready to elevate your audit service offerings and engage your clients more effectively, keep reading!

Executive Summary

An executive summary outlines the key components of an audit service proposal, summarizing the objectives, benefits, and methodologies. This document serves as a starting point for evaluating the scope of the audit, emphasizing compliance with relevant standards such as Generally Accepted Auditing Standards (GAAS). Detailed analysis includes identifying potential risks, ensuring transparency, and enhancing financial integrity. The proposal may highlight timelines for the audit process, expected deliverables, comparative pricing models, and robust communication strategies tailored to client needs. Additionally, the inclusion of case studies from previous clients exemplifies proven success and strengthens trust in the recommended audit solutions.

Scope of Services

The audit service proposal outlines a comprehensive Scope of Services tailored for financial institutions like banks and credit unions. This includes an in-depth financial statement audit, ensuring compliance with regulations such as the Sarbanes-Oxley Act (SOX) and local laws. The assessment will involve an analysis of internal controls, focusing on the effectiveness of protocols designed to safeguard assets and ensure accurate financial reporting. Additionally, risk management evaluations will be conducted, particularly on market and credit risk assessments, identifying operational weaknesses that could impact financial stability. Regular reporting throughout the audit process will promote transparency, highlighting areas of improvement to mitigate potential risks. The engagement will culminate in a detailed audit report, typically provided within 90 days of the audit's conclusion, outlining findings and recommendations for enhanced operational efficiency and regulatory compliance.

Methodology and Approach

The methodology and approach for an audit service proposal typically include a systematic and structured process to ensure thorough examination and evaluation of financial records, compliance with regulations, and operational efficiency. Initial assessment begins with a risk analysis, identifying areas of concern related to financial integrity, governance, and internal controls. Fieldwork involves collecting evidence through interviews, document reviews, and on-site observations at the client's premises. This data analysis employs methods such as sampling techniques or analytical reviews to uncover discrepancies or inefficiencies. Following fieldwork, findings are compiled into a comprehensive audit report, highlighting critical issues, recommendations, and best practices for improvement. Regular communication with stakeholders throughout the audit process ensures transparency and addresses any emerging concerns. Finally, the delivery of the final report provides measurable insights into the organization's financial health and adherence to standards, paving the way for strategic improvements and enhanced compliance.

Team Qualifications

The audit service proposal highlights the qualifications of the dedicated audit team, consisting of certified professionals with extensive experience in financial analysis and regulatory compliance. The team includes Certified Public Accountants (CPAs) and Chartered Accountants (CAs), each with over 10 years of experience in conducting audits across various industries, including telecommunications, healthcare, and manufacturing. Notable accomplishments include the successful completion of audits for Fortune 500 companies and compliance with rigorous standards set by the International Financial Reporting Standards (IFRS). In addition, team members possess specialized knowledge in forensic accounting and risk management, having participated in high-profile investigations of financial mismanagement. Regular training sessions ensure that all team members are updated with the latest auditing techniques and technologies, enhancing the quality and efficiency of audit processes.

Pricing and Terms

Pricing structures for audit services typically reflect various factors including complexity, time commitment, and specific client needs. Service fees may range from $100 to $300 per hour depending on auditor experience and qualifications, with comprehensive audits potentially costing from $5,000 to $25,000 based on the size and intricacies of the client's financial operations. Additionally, terms often include upfront retainer fees, which can account for 20% to 50% of the total projected costs. Payment schedules may stipulate 30 days post-invoice issuance for standard arrangements, while some contracts might implement milestone payments based on progress. Clear communication about scope, deliverables, and timelines further ensures mutual understanding and satisfaction throughout the auditing process.

Comments