In today's fast-paced financial landscape, understanding the intricacies of due diligence is more crucial than ever. Whether you're a buyer looking to acquire a new asset or a seller preparing for a transaction, having the right financial advisory guidance can make all the difference. This letter template serves as a comprehensive framework to ensure that your financial due diligence is thorough, strategic, and tailored to your specific needs. Ready to take the next step in your financial journey? Dive into the complete article to learn more!

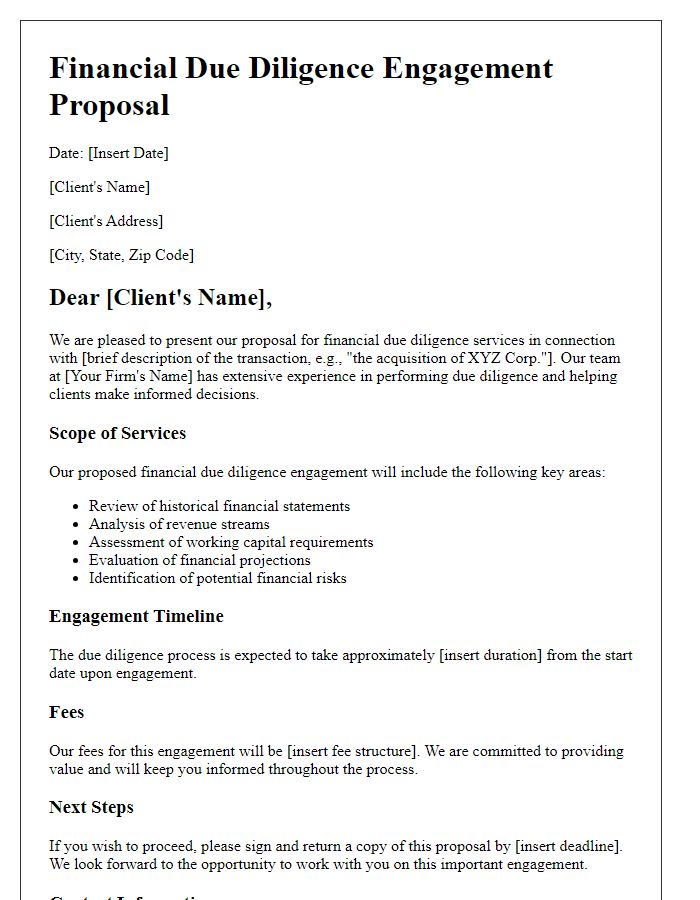

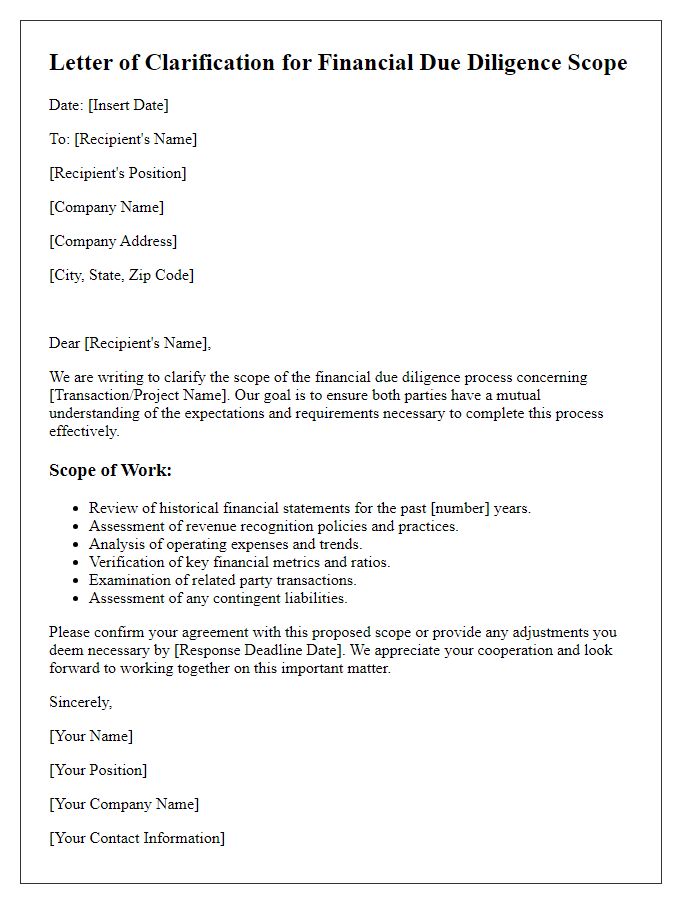

Introduction and Scope of Services

The financial due diligence advisory services encompass a comprehensive assessment of a company's financial health, providing critical insights for potential investors or stakeholders. This process typically includes a detailed analysis of financial statements, such as income statements, balance sheets, and cash flow statements, identifying key performance metrics and trends. Additionally, expert reviews of accounting policies, compliance with regulatory requirements, and evaluation of internal controls are integral components of the service. The scope extends to examining tax obligations, liabilities, and potential risks associated with the business, ensuring informed decision-making. By offering a thorough understanding of the target company's financial landscape, these services ultimately facilitate successful transactions in dynamic markets.

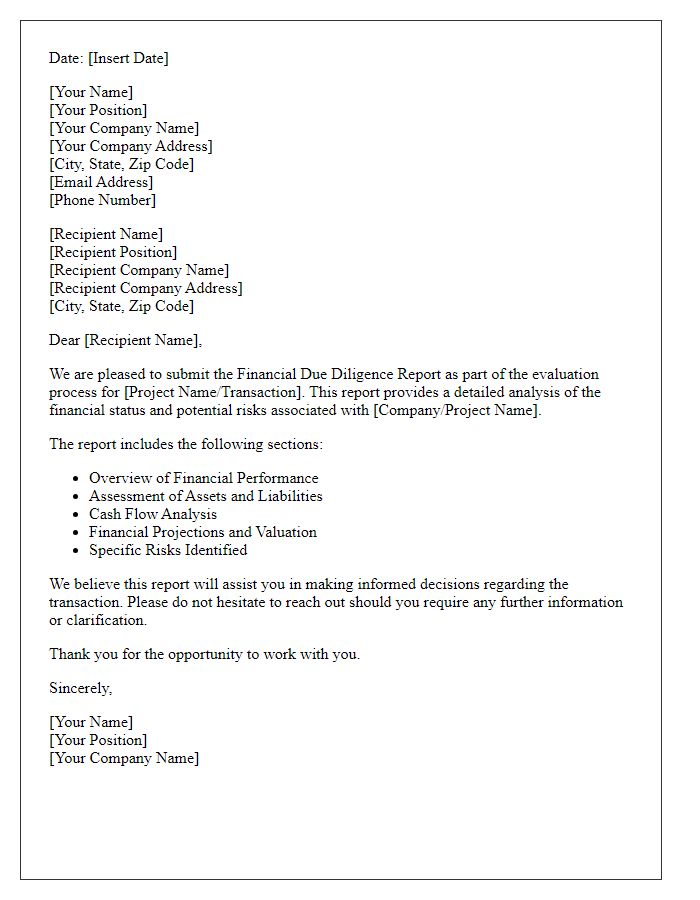

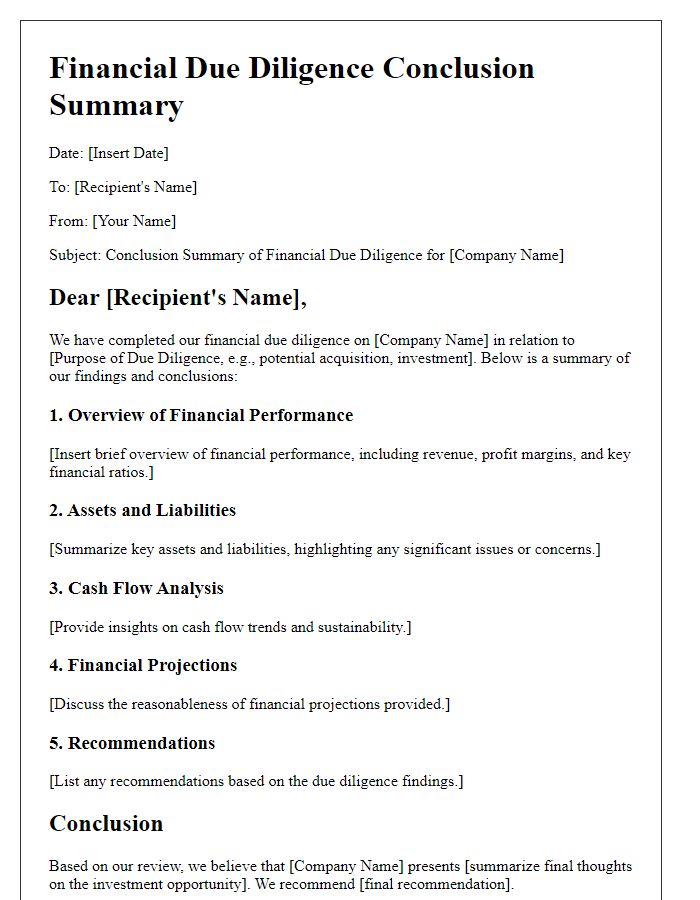

Executive Summary and Key Findings

The financial due diligence advisory process examines the fiscal health of target companies before mergers or acquisitions. This review often includes evaluating key financial statements, such as balance sheets, income statements, and cash flow statements, to uncover potential risks. Significant findings might highlight discrepancies in asset valuations, such as overstated revenue figures by 15% or understated liabilities totaling $3 million. Additionally, the analysis may reveal opportunities for cost savings or revenue enhancements that could improve profitability margins by 10%. Essential ratios, including the current ratio (1.5) and debt-to-equity ratio (0.8), can provide insights into liquidity and financial leverage, critical for strategic decision-making. Ultimately, this comprehensive due diligence ensures stakeholders are equipped with substantial information regarding the target company's financial viability and sustainability in a competitive market.

Detailed Analysis and Methodology

Financial due diligence encompasses a comprehensive analysis of an entity's fiscal health, encompassing its assets, liabilities, revenue streams, and operational efficiency. The tailored methodology begins with an extensive review of financial statements, including balance sheets and income statements, tracing patterns in historical financial performance over the past five fiscal years. Key ratios, such as the current ratio (typically above 1.5 for liquidity), leverage ratio (ideally under 2), and profit margins (benchmarking industry averages of 10-20%), will underpin the assessment. Following the quantitative evaluation, qualitative factors such as management competency, market positioning, and regulatory compliance are examined within the context of the industry, specifically focusing on sectors experiencing rapid disruption, like technology or healthcare. In conclusion, by integrating data analytics with industry benchmarks and risk assessments, a holistic understanding of the financial sustainability and potential synergies in mergers or acquisitions is established.

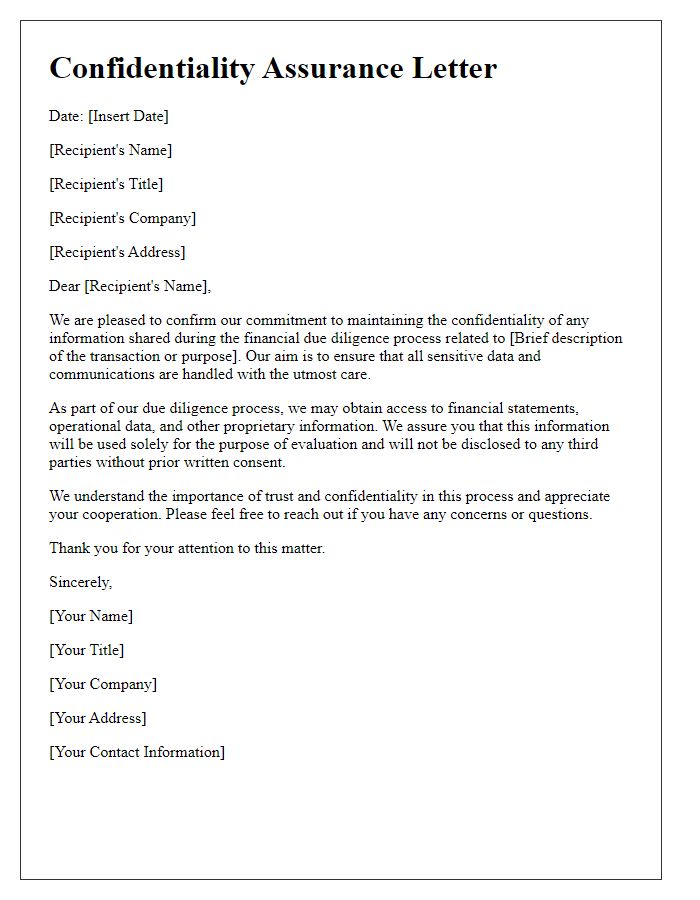

Confidentiality and Legal Compliance

Confidentiality in financial due diligence is paramount for maintaining trust between parties involved in a transaction. Appropriate measures must be implemented to protect sensitive data, such as financial statements and proprietary business models, from unauthorized access. Legal compliance refers to adherence to laws and regulations governing financial disclosures, including the Sarbanes-Oxley Act and the General Data Protection Regulation (GDPR) in Europe. Failure to comply with these legal standards can result in severe penalties, including fines or legal action. Conducting thorough due diligence not only ensures financial accuracy but also safeguards against fraud, enhancing the integrity of the potential business transaction, particularly in high-stakes environments such as mergers and acquisitions or investment assessments.

Contact Information and Next Steps

In financial due diligence advisory, comprehensive contact information is essential for effective communication. Key individuals may include stakeholders, investment bankers, or financial analysts located across various geographical areas or time zones. For example, the lead advisor's name, title, phone number, and email address should be clearly documented for quick accessibility. Following initial discussions, it is crucial to outline next steps in the due diligence process. This may involve scheduling meetings, compiling financial documents, and establishing timelines for deliverables, such as reports or presentations that need to be reviewed by stakeholders. Detailed deadlines and checkpoints can ensure that critical information flows seamlessly among all parties involved, promoting transparency and efficiency throughout the advisory engagement.

Comments