When it comes to submitting your tax documents, crafting the right letter can make all the difference. A well-structured letter not only conveys professionalism but also sets the tone for clear communication with tax authorities or your accountant. It's essential to include all relevant details, such as your name, identification numbers, and the specifics of the documents being submitted, to ensure a smooth process. If you want to learn more about how to create an effective tax document submission letter, keep reading!

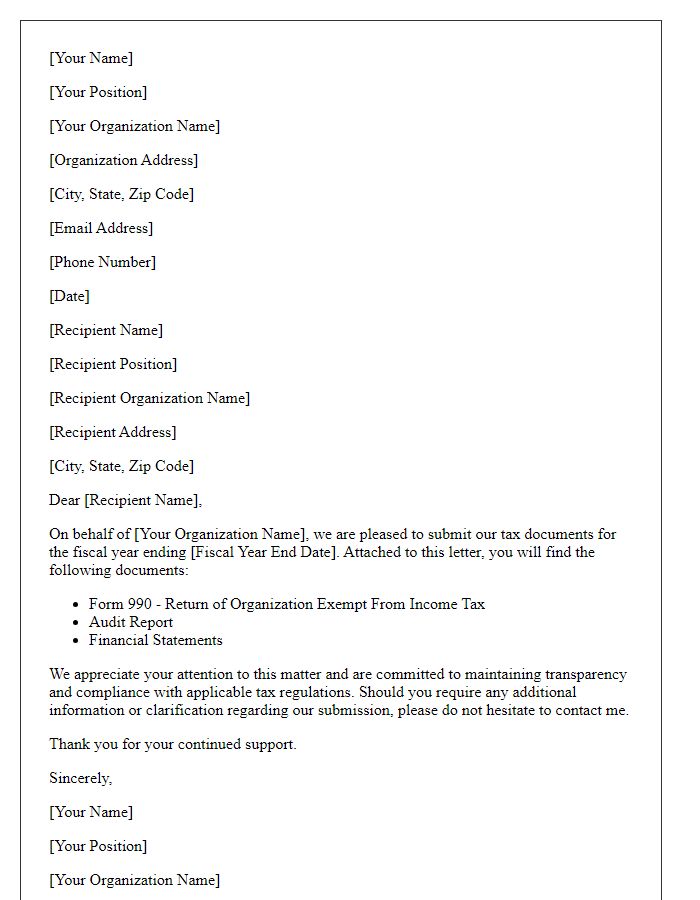

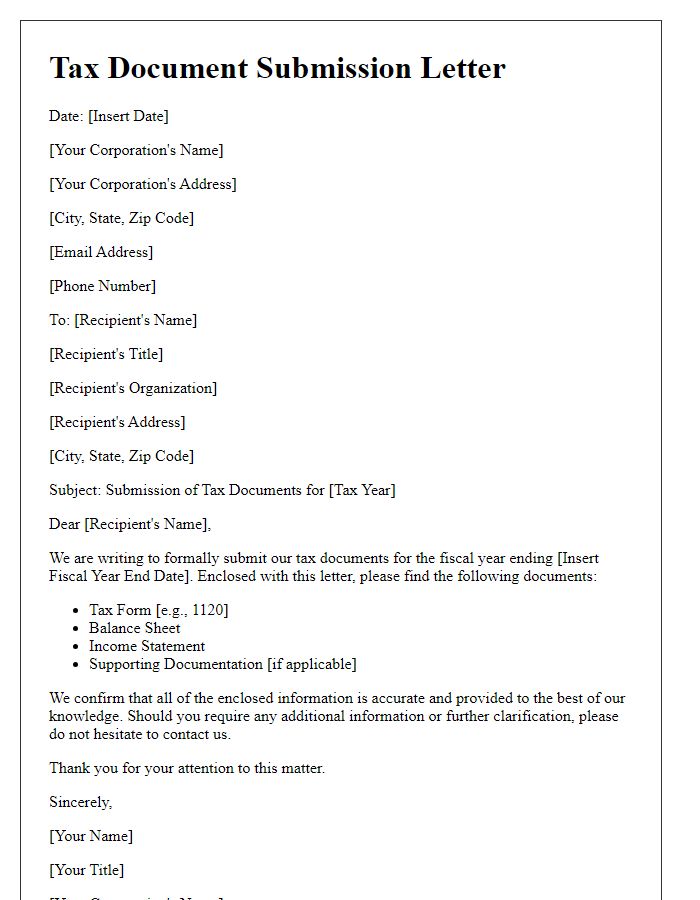

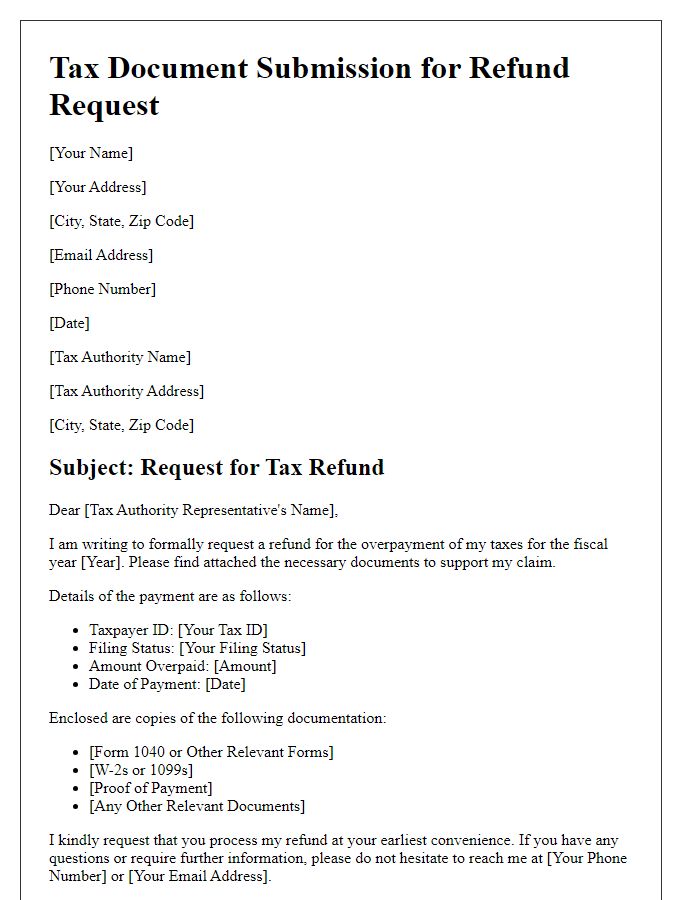

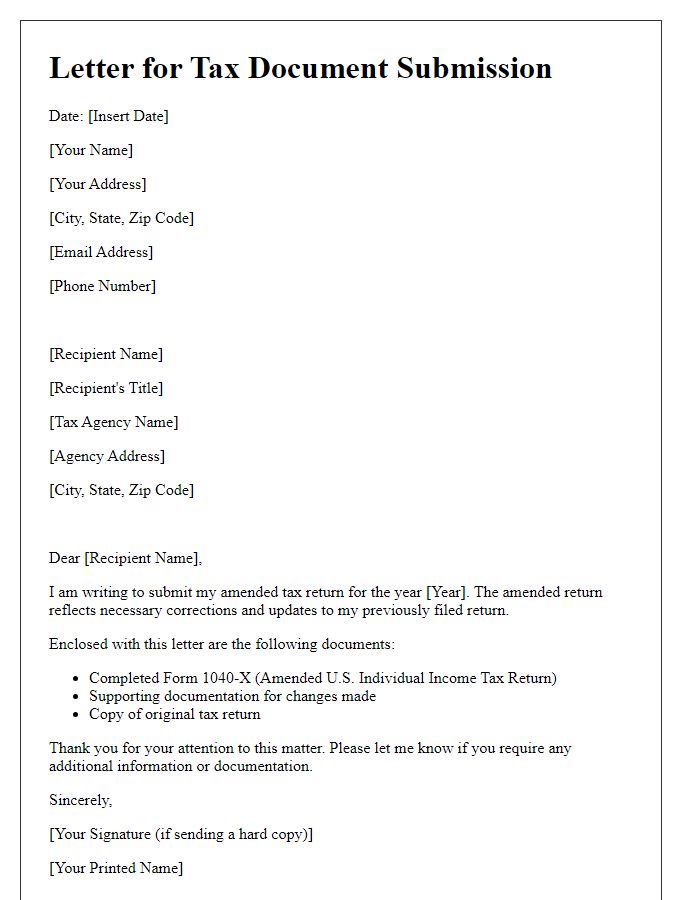

Recipient's address and contact information

When submitting a tax document, ensure to include the recipient's address for proper delivery. The address should specify the recipient's name (such as "Internal Revenue Service"), followed by the street number and name (e.g., "5000 Ellin Road"), including any unit or suite number if applicable. Next, include the city name (e.g., "Washington"), state abbreviation (e.g., "DC"), and the zip code (e.g., "20580"). Additionally, provide the recipient's contact information, such as a phone number (for instance, "(202) 555-0199") and email address (e.g., "contact@irs.gov"). This clear presentation ensures efficient processing and communication regarding the submitted tax materials.

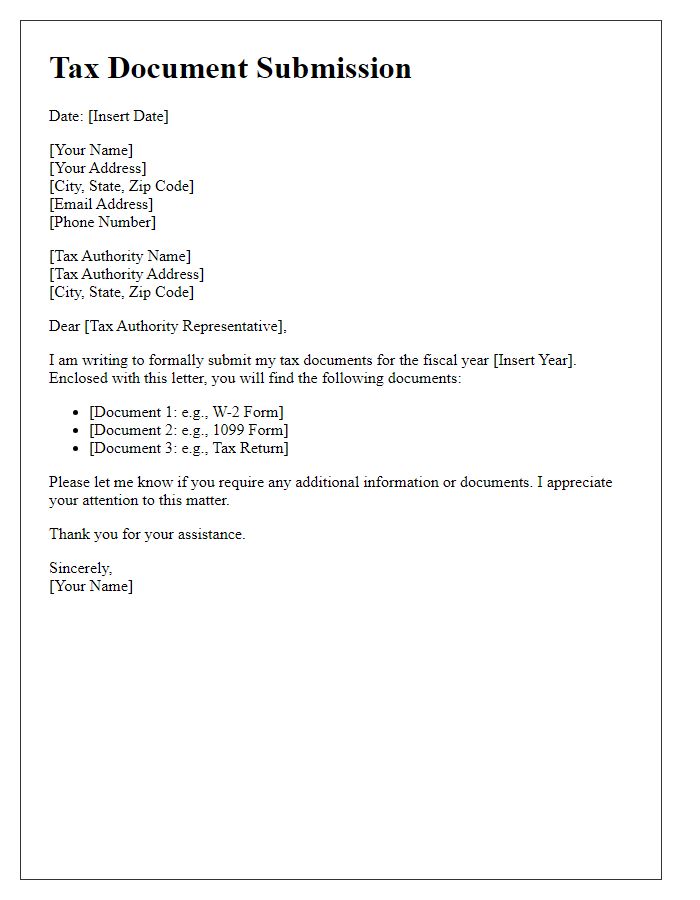

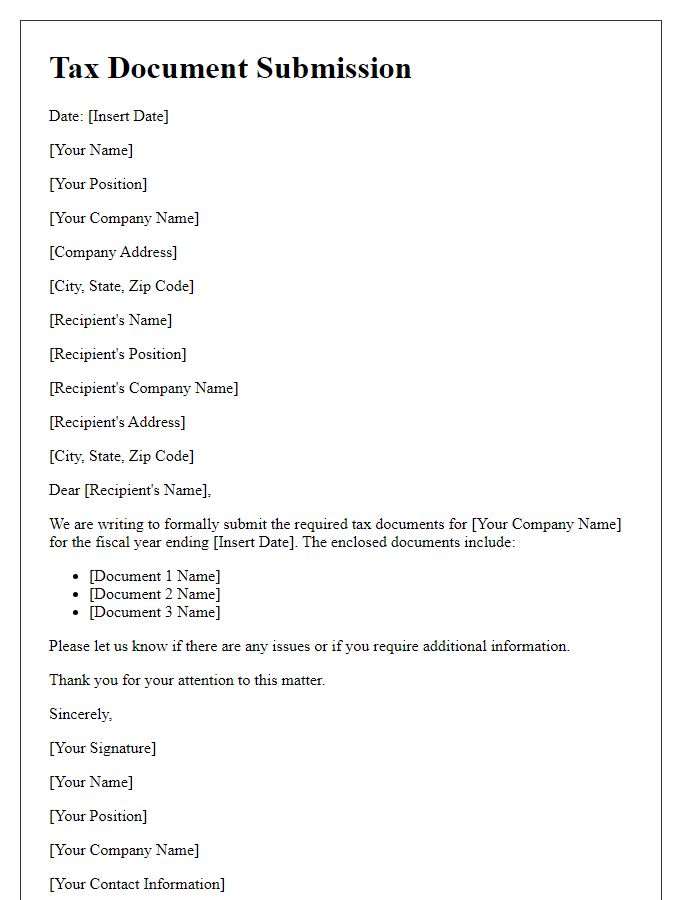

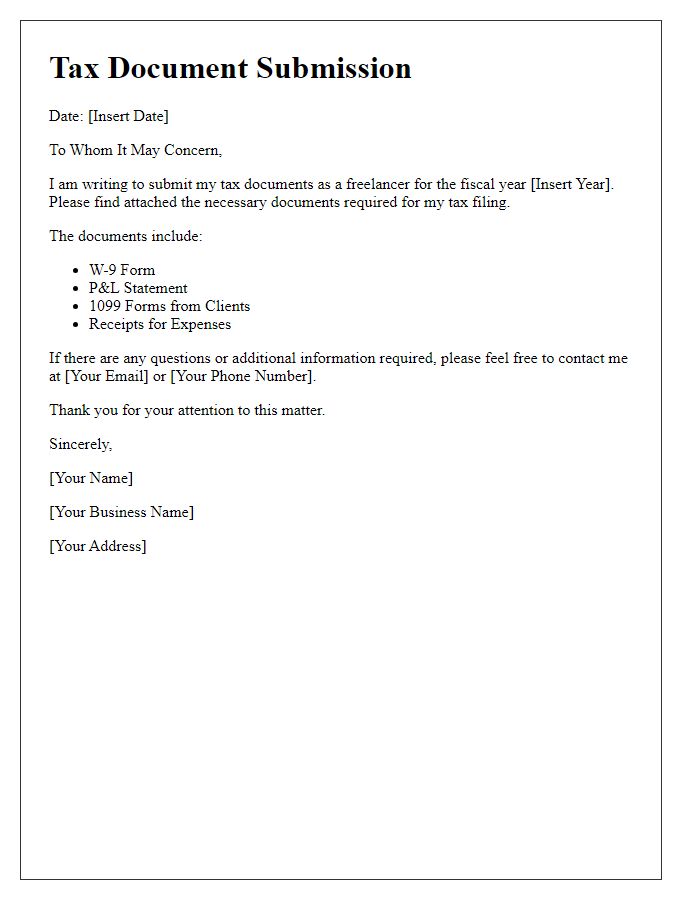

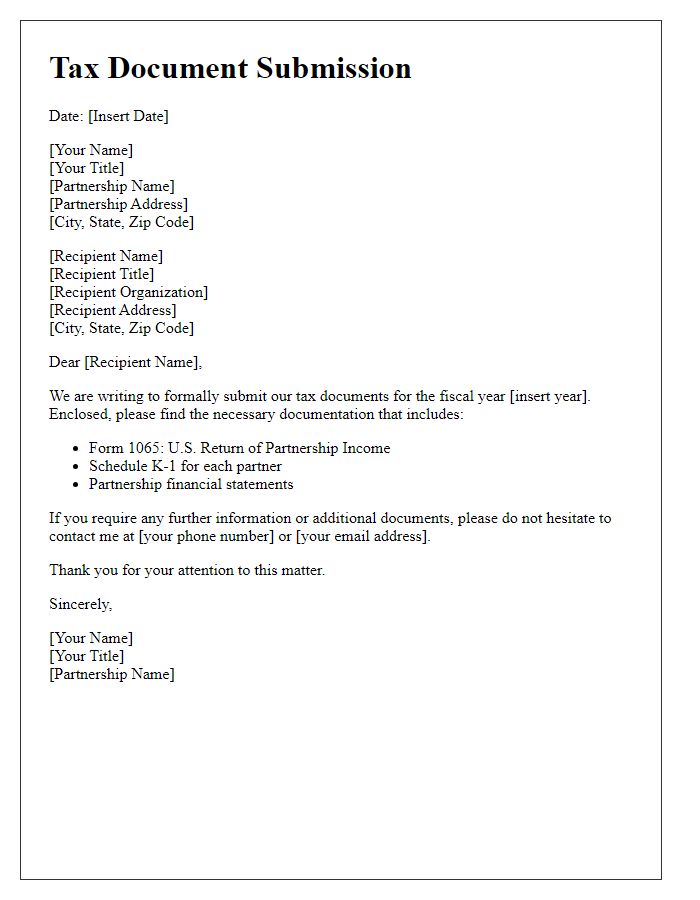

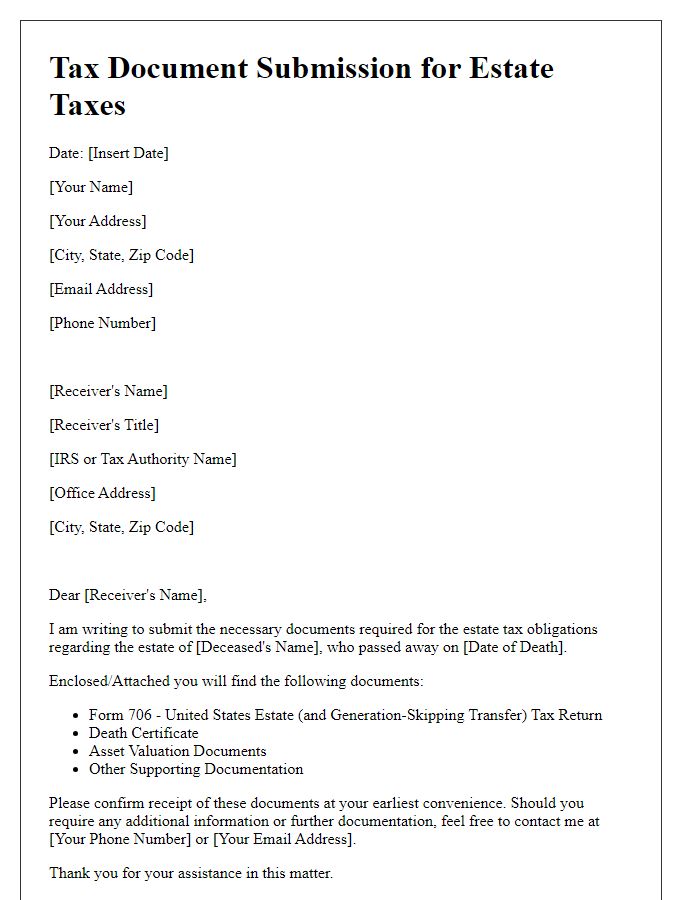

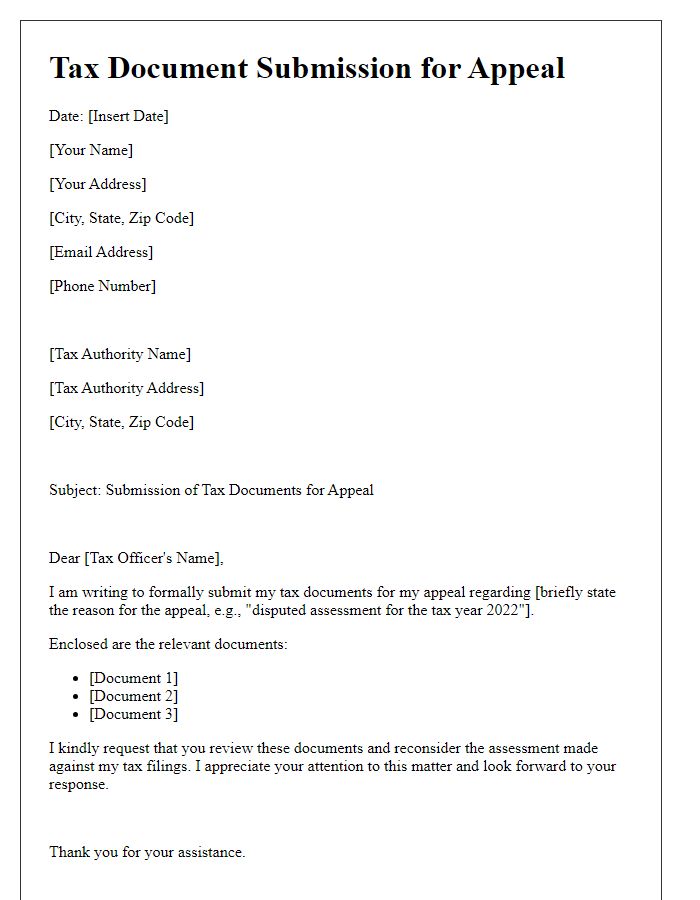

Sender's address and contact details

The submission of tax documents requires precise attention to detail, particularly in the context of sender identification. Accurate sender's address information, including street name, building number, city, state, and zip code, ensures that tax authorities, such as the Internal Revenue Service (IRS) in the United States, can process returns efficiently. Additionally, contact details, which may include a phone number and email address, enable swift communication regarding any queries or required follow-ups. Providing comprehensive information mitigates delays in processing and helps in maintaining a clear line of correspondence, essential for compliance with tax regulations.

Subject line indicating the purpose

Tax document submission for fiscal year 2023 requires meticulous organization and clarity. Complete paperwork includes W-2 forms detailing annual wages, 1099 forms encapsulating freelance income, and 1040 forms summarizing overall tax liabilities. Ensure that all supporting documents, such as bank statements showcasing deductible expenses and receipts for significant purchases, are included to substantiate claims. Deadline for submission aligns with April 15, 2024, necessitating timely preparation to avoid penalties. Additionally, online submission through platforms like IRS e-file may expedite processing and enhance tracking efficiency for submitted documents.

Detailed list of enclosed documents

When submitting tax documents, a detailed list of enclosed documents is crucial for proper organization and processing. Key items typically include Form 1040 (U.S. Individual Income Tax Return, commonly used for personal income), W-2 forms from employers (reporting annual wages, usually issued by January 31), 1099 forms (reporting miscellaneous income, such as freelance earnings), and receipts for deductible expenses (such as healthcare costs exceeding 7.5% of adjusted gross income). Additional documents may consist of brokerage statements (detailing capital gains and losses), Schedule C (reporting income or loss from self-employment), and any pertinent schedules that support credits or deductions claimed, like the Child Tax Credit. Providing a comprehensive index helps ensure that all necessary documentation accompanies the submission for accurate tax assessment.

Formal closing and signature block

Formal closing phrases, such as "Sincerely" or "Best regards," serve as respectful sign-offs in professional correspondence. The signature block typically includes the sender's full name, title, and contact information, including phone number and email address. For example, a signature block might show: John Smith Tax Consultant Phone: (123) 456-7890 Email: john.smith@email.com This structure ensures clarity and professionalism in tax document submissions, which are essential for compliance with regulations.

Comments