Are you finding it challenging to keep track of your receivable accounts? It's crucial for businesses to maintain clear and accurate financial records, and conducting a reconciliation of these accounts can simplify the process significantly. In this article, we'll explore effective letter templates designed to streamline your receivable accounts reconciliation, ensuring you have the right tools at your fingertips. So, grab a cup of coffee, and let's dive into how you can enhance your financial management skills!

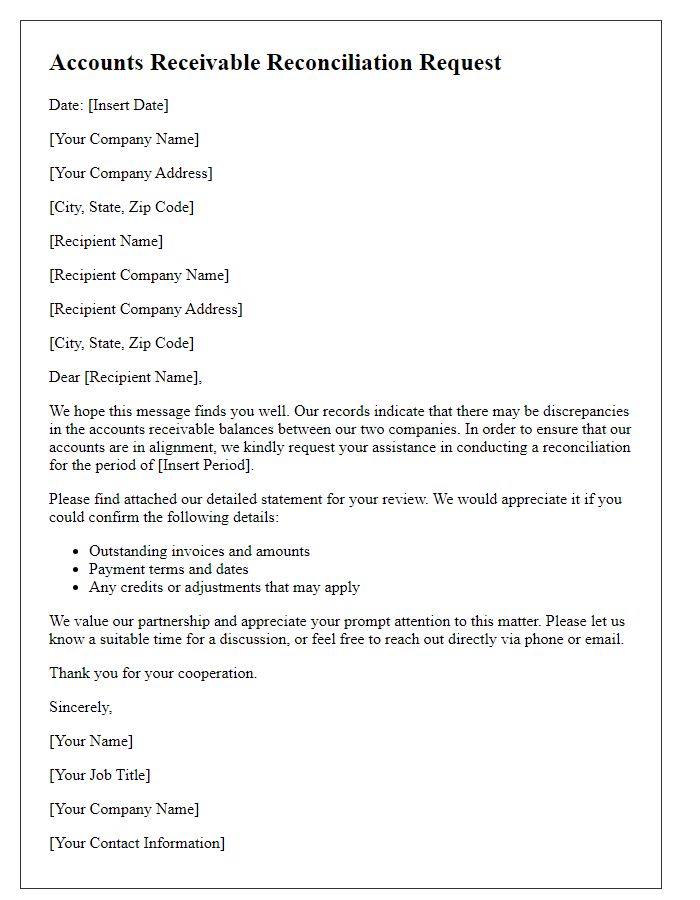

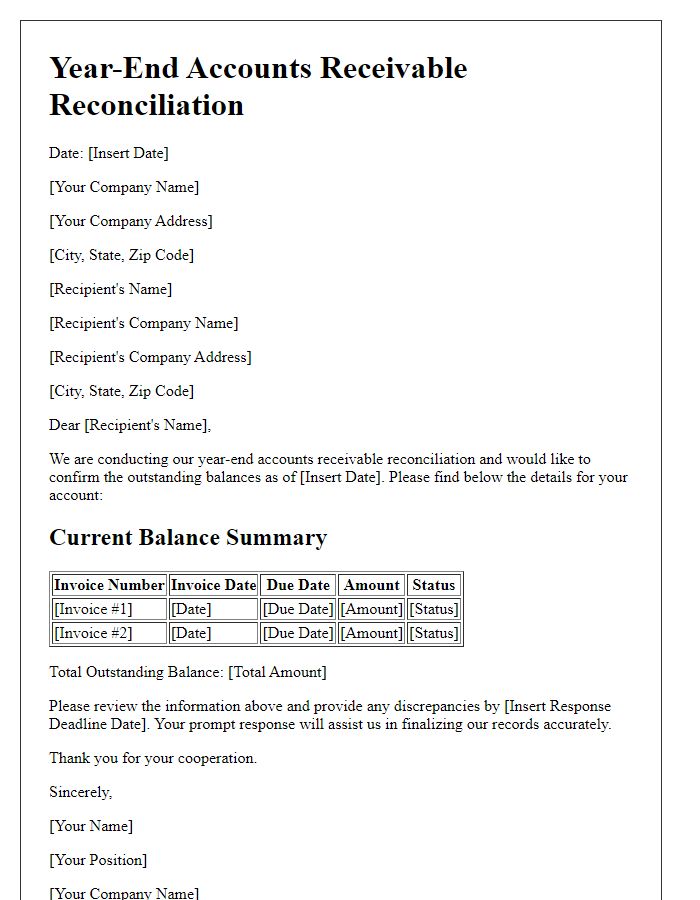

Contact Information: Address and Contact Details

Accounts receivable reconciliation involves verifying financial records to ensure that the amounts owed by customers match the records of sales transactions. This process requires detailed contact information, including business addresses and phone numbers, to facilitate communication between accounting departments. Accurate address listings (including street address, city, state, and zip code) are essential for ensuring proper billing procedures. Detailed contact numbers (both landline and mobile) enhance the efficiency of discussions surrounding any discrepancies. Consistent record-keeping of these elements supports smoother financial operations and fosters clearer communication regarding outstanding invoices, payment terms, and customer relationships.

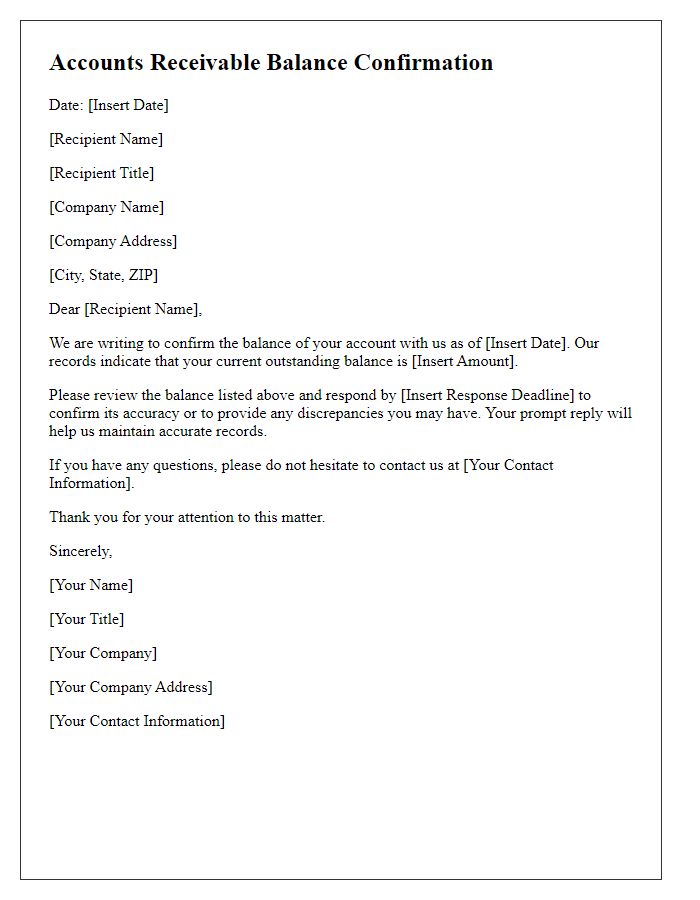

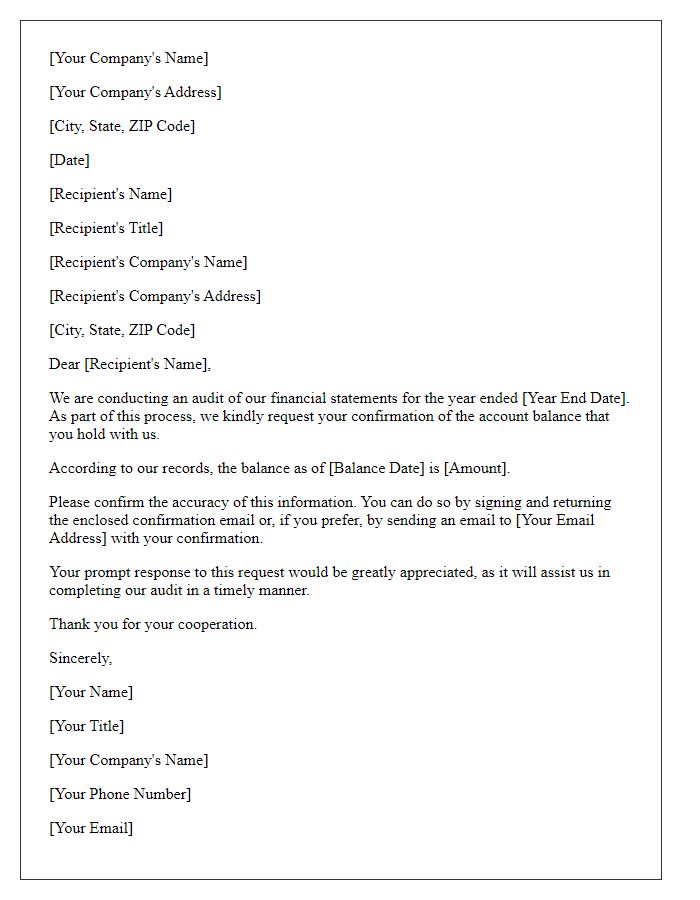

Statement of Purpose: Clear Intent for Reconciliation

The reconciliation process for accounts receivable is essential for maintaining accurate financial records, particularly within businesses operating in dynamic markets. This entails reviewing outstanding invoices that are due from customers, typically recorded on the balance sheet under current assets. Companies, like ABC Corporation, often conduct reconciliations on a monthly basis to ensure that financial statements accurately reflect the expected cash flows from sales made on credit. Key figures, such as the total accounts receivable balance (for instance, $150,000 as of September 2023) and the aging report (classifying outstanding invoices by 30, 60, and 90 days), provide a comprehensive snapshot of collectible amounts. Identifying discrepancies, such as unresolved customer payments or billing errors, aids in mitigating financial risk and enhances cash management practices. Detailed documentation, including invoices, payment confirmations, and credit memos, plays a crucial role in substantiating the reconciliation process, thus fostering transparent communication with stakeholders.

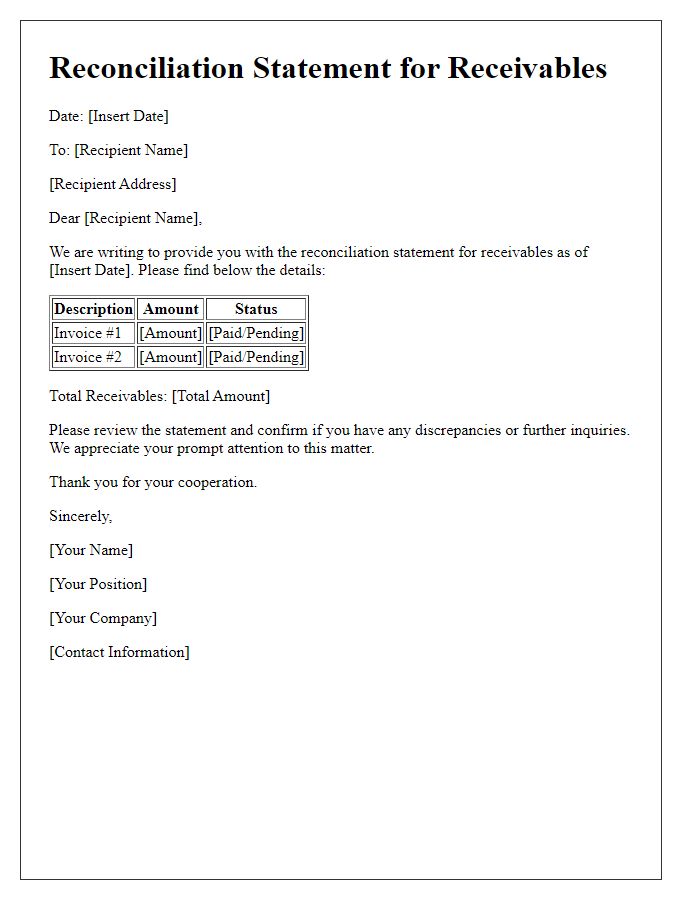

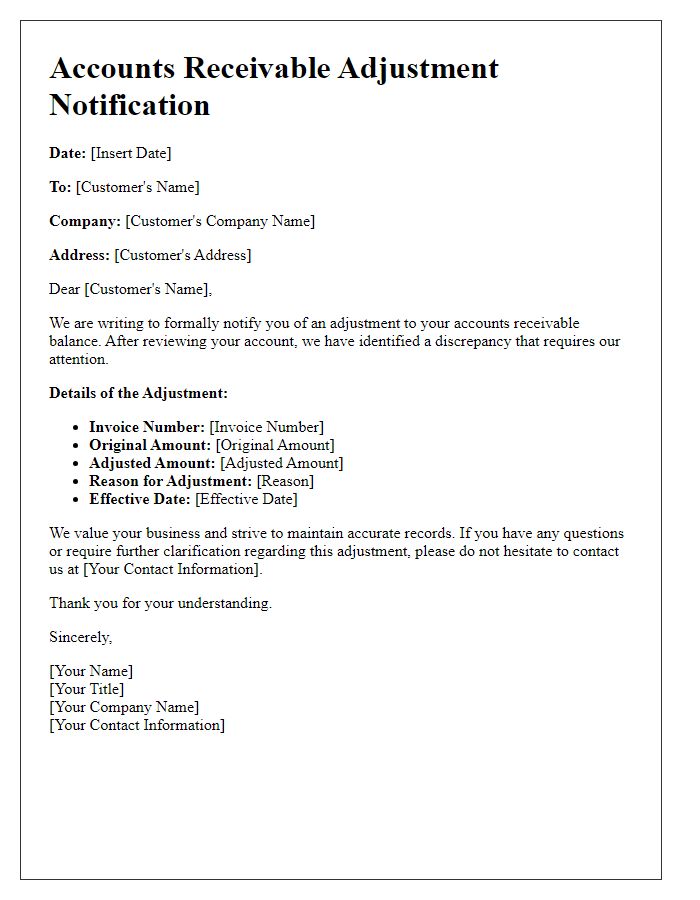

Account Details: Account Numbers and Associated Information

Accounts receivable reconciliation is essential for maintaining accurate financial records. Specific account details include account numbers, names, and outstanding balances for customers. For example, account number 12345, associated with XYZ Corporation, shows a balance of $25,000, reflecting recent transactions and payment history. Likewise, account number 67890, linked to ABC Industries, has an outstanding amount of $15,750, indicating delayed payments. Analyzing these details highlights discrepancies between recorded and actual amounts, underscoring the significance of regular audits and confirmations. Timely reconciliation ensures financial statements accurately reflect the company's financial position, facilitating effective cash flow management.

Outstanding Invoices: List of Unpaid Invoices

Outstanding invoices represent crucial accounts receivable, affecting cash flow and business operations. These unpaid invoices, often detailed in financial statements, can include various amounts ranging from hundreds to thousands of dollars. Companies like XYZ Corp. may face challenges in reconciling their books when several invoices remain unresolved for over 30 days, leading to potential disputes or deteriorating client relationships. The reconciliation process typically involves reviewing the accounts for discrepancies, categorizing outstanding amounts, and identifying the specific clients involved. Documentation, such as the invoice numbers, issue dates, and services rendered, is essential for clarity and accuracy in this financial audit process. Regular follow-ups on overdue accounts help maintain healthy cash flow and ensure timely payments.

Reconciliation Request: Action Items and Response Deadline

Accounts reconciliation is a critical process for financial accuracy, especially in businesses with numerous transactions. A reconciliation request typically pertains to the verification of accounts receivable balances, ensuring alignment between company records and client payment histories. Specific action items may include the review of unpaid invoices, confirmation of payment terms, and identification of discrepancies in transaction records. A response deadline, usually set within 14 days of the request, fosters timely communication and resolution, ensuring that both accounting teams have ample time to submit necessary documentation, such as bank statements and remittance advice. The collaboration aids in maintaining accurate financial reporting and enhances cash flow management.

Comments