If you've found yourself navigating the complex world of deferred revenue adjustments, you're definitely not alone. Many businesses encounter challenges when it comes to accurately reflecting these figures on their financial statements. Understanding how to manage deferred revenue can not only streamline your accounting processes but also enhance your financial reporting. Curious to learn about effective strategies for adjusting your deferred revenue accounts? Let's dive in!

Clear subject line

Deferred revenue adjustments play a crucial role in accounting as they reflect unearned income that a business has received for goods or services yet to be delivered. Businesses often utilize this account when customers pay upfront, impacting the financial statements by recognizing revenue only when the corresponding service is rendered or the product delivered. For instance, subscription-based services, such as online streaming platforms (like Netflix), often record a significant amount of deferred revenue as subscriptions are paid in advance. Regulatory standards, including the Generally Accepted Accounting Principles (GAAP), stipulate clear guidelines on recognizing this revenue to ensure financial reporting accuracy and integrity. Timely adjustments and accurate records of deferred revenue can help companies maintain reliable financial health assessments and investor trust.

Accurate recipient details

Deferred revenue accounts, commonly known as unearned revenue, represent funds received by a business for goods or services not yet delivered, affecting accounting practices in various industries such as software (SaaS) or subscription services. Accurate recipient details, including the business name, address, and contact information, are vital for ensuring proper record-keeping and compliance with revenue recognition standards set forth by the Financial Accounting Standards Board (FASB). Each adjustment made to a deferred revenue account must also reflect specific amounts, dates, and contract terms related to the service or product offered to maintain transparency and facilitate audits. Additionally, documentation for adjustments should include both original transaction entries and modified account details, ensuring clear tracking of revenue as it is recognized over time.

Concise explanation of deferred revenue adjustment

Deferred revenue is a liability account representing payments received by a company for goods or services not yet delivered or performed. This account reflects future obligations to provide products or services, such as subscriptions or prepaid contracts. Adjustments to deferred revenue occur when a company recognizes revenue as it fulfills its obligations over time, transitioning the amount from the liability account to revenue on the income statement. Accounting standards typically dictate the timing for these adjustments, ensuring that revenue is recorded in the period it is earned, enhancing financial accuracy and compliance with recognized principles such as GAAP or IFRS.

Essential financial data

Deferred revenue refers to payments received for goods or services that have not yet been delivered or rendered, creating a liability on the balance sheet. Accurate financial data tracking is crucial for businesses, especially in industries like software as a service (SaaS) or subscription-based models, where customers frequently prepay for extended service periods, typically ranging from one month to several years. The accounting standard ASC 606 mandates that firms recognize this revenue as it is earned over time. An adjustment in deferred revenue accounts must be meticulously documented, including specifics such as the original contract date, payment amount (for example, a $1,200 annual subscription), duration of the service period, and the rate of revenue recognition (for instance, monthly, leading to a recognized revenue of $100 per month). Proper management of deferred revenue ensures compliance with revenue recognition principles and provides transparency in financial reporting.

Contact information for follow-up

Deferred revenue accounts, representing advance payments for goods or services not yet delivered, require careful adjustment to reflect accurate financial reporting. Accurate documentation of transactions (typically including amounts received prior to the delivery of services) ensures compliance with accounting standards such as ASC 606. A systematic approach involves analyzing income recognition timelines (for example, quarterly or annually) and confirming relevant invoices and agreements. Follow-up contact information should clearly outline designated representatives, such as a finance manager or an accounting specialist, providing their names, telephone numbers, and email addresses to facilitate communication regarding any discrepancies or required adjustments in future periods.

Letter Template For Deferred Revenue Account Adjustment Samples

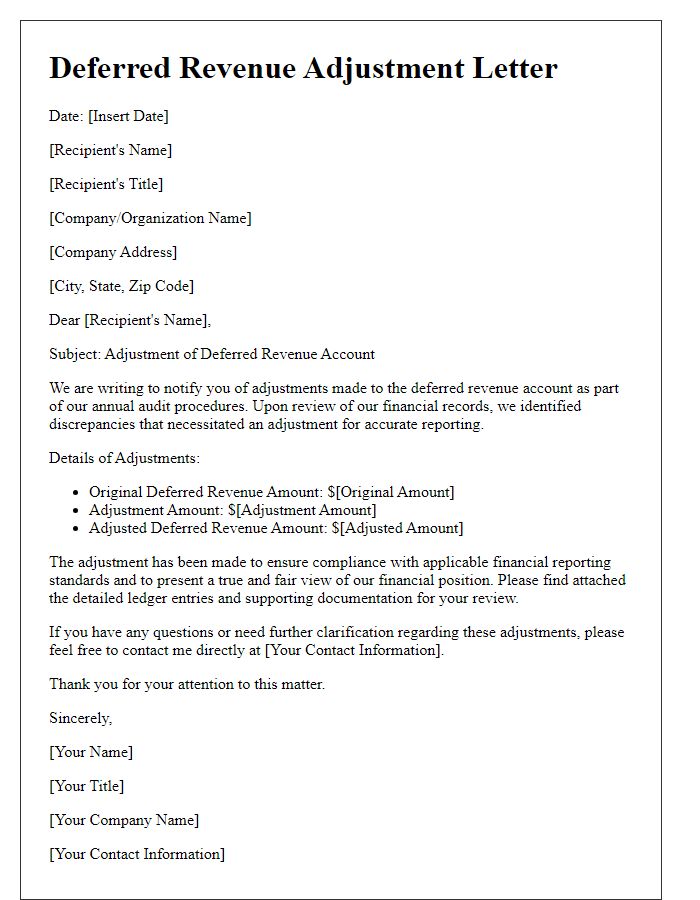

Letter template of deferred revenue account adjustment for auditing purposes.

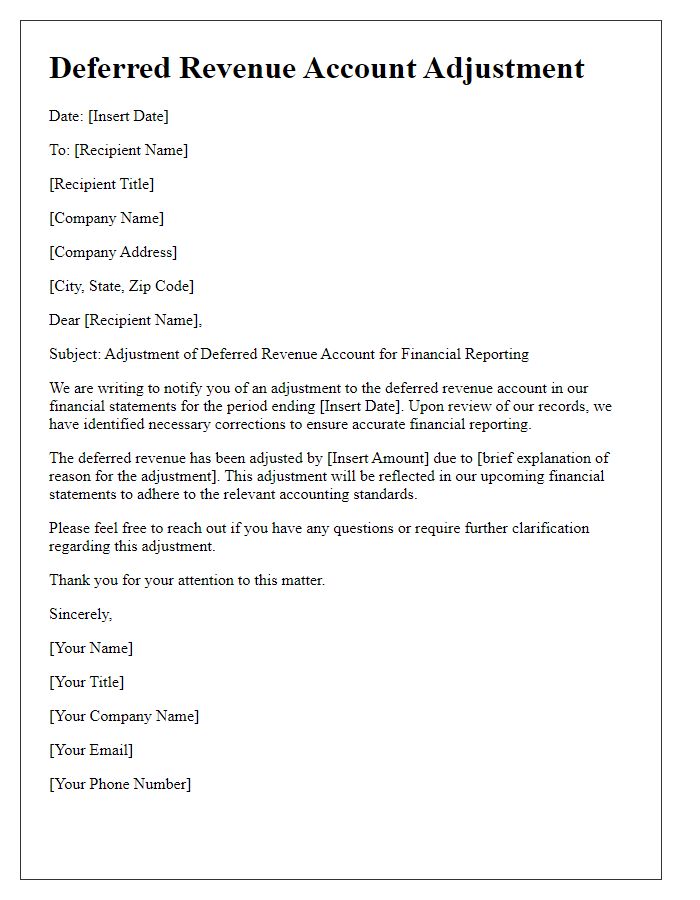

Letter template of deferred revenue account adjustment for financial reporting.

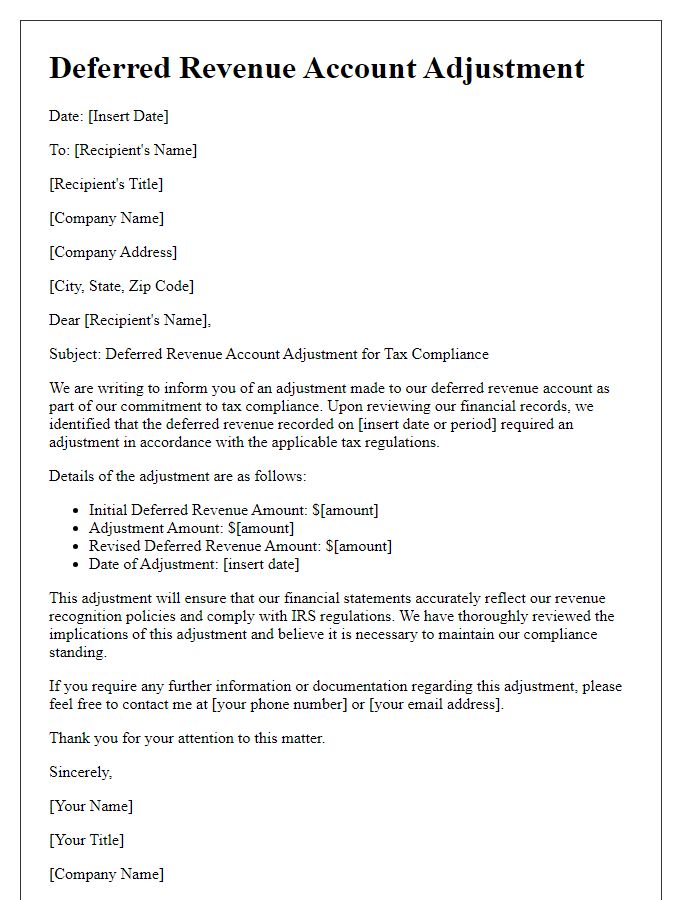

Letter template of deferred revenue account adjustment for tax compliance.

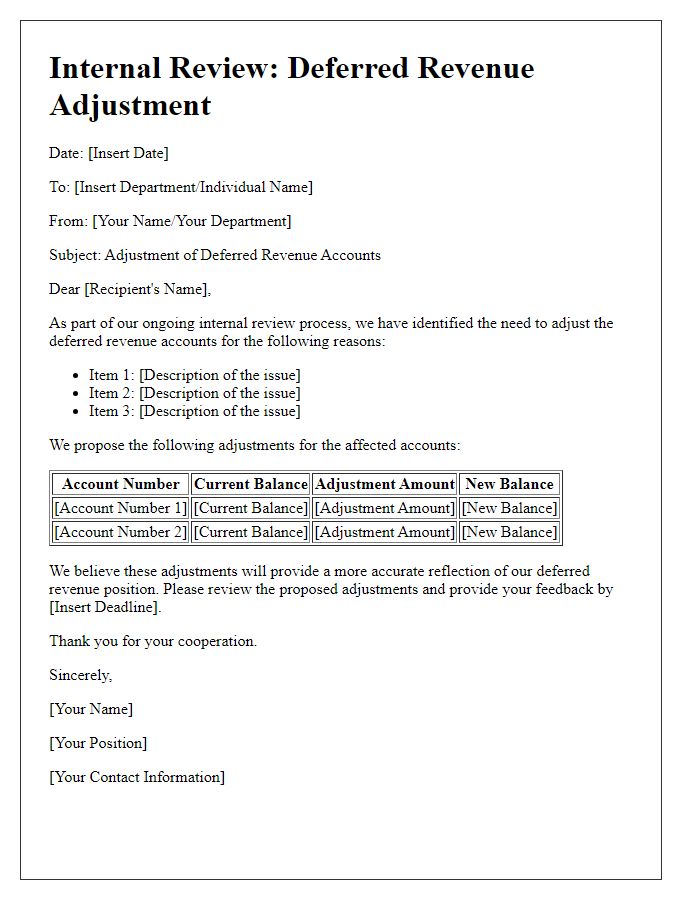

Letter template of deferred revenue account adjustment for internal reviews.

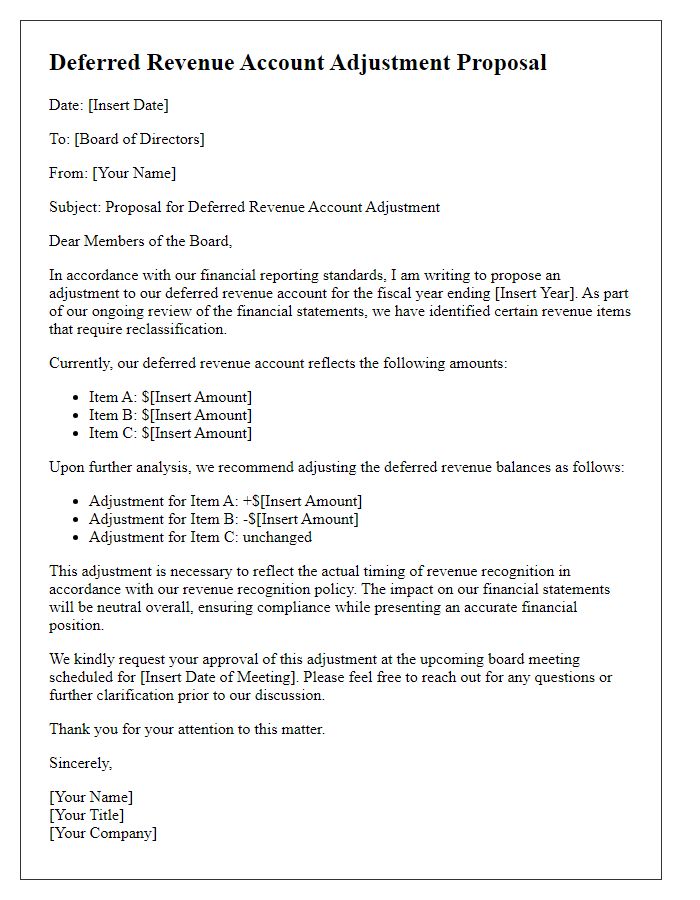

Letter template of deferred revenue account adjustment for board approval.

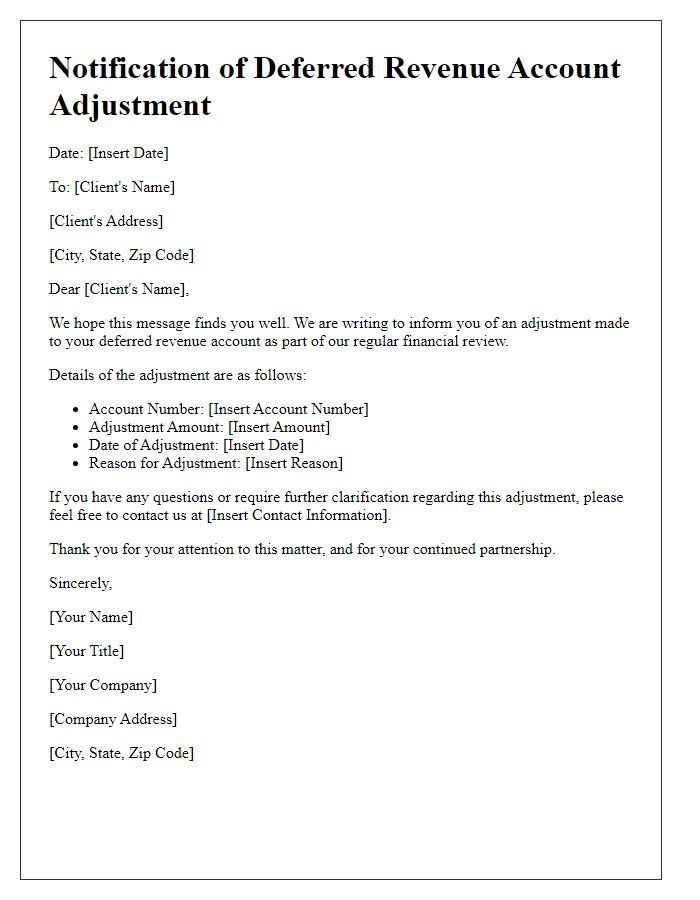

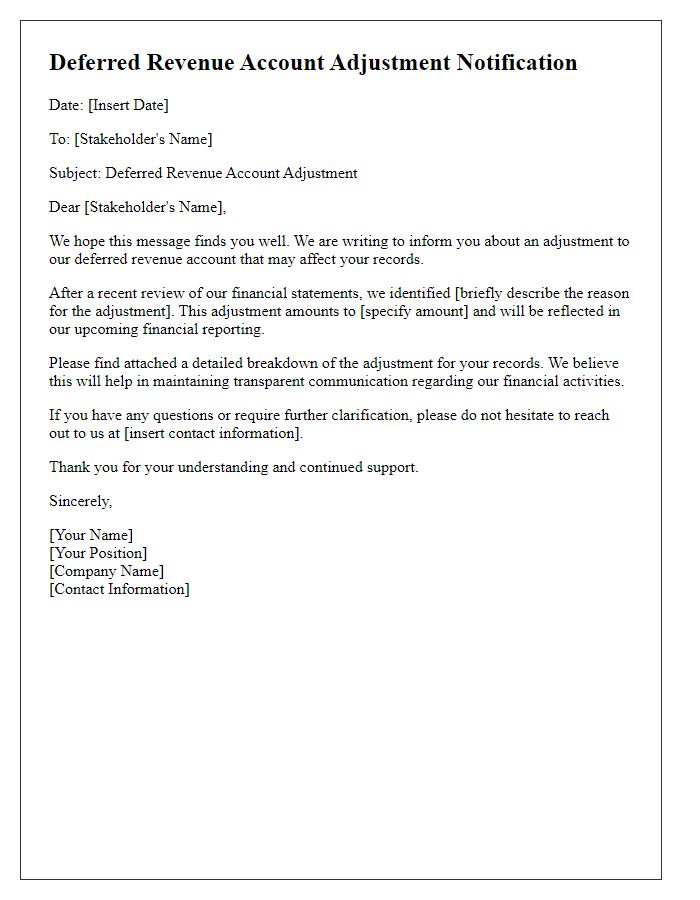

Letter template of deferred revenue account adjustment for client notification.

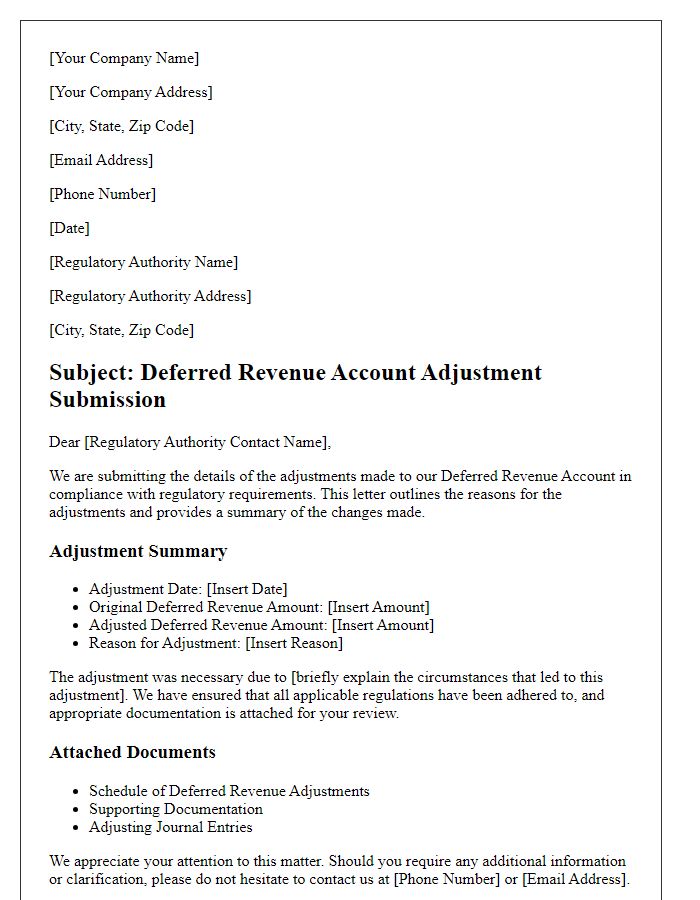

Letter template of deferred revenue account adjustment for regulatory submission.

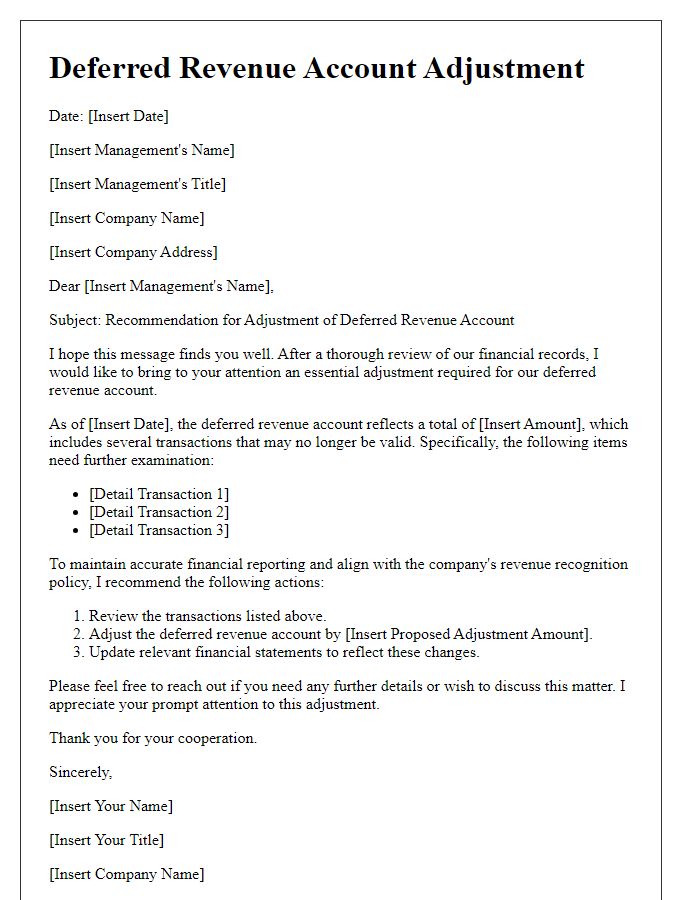

Letter template of deferred revenue account adjustment for management action.

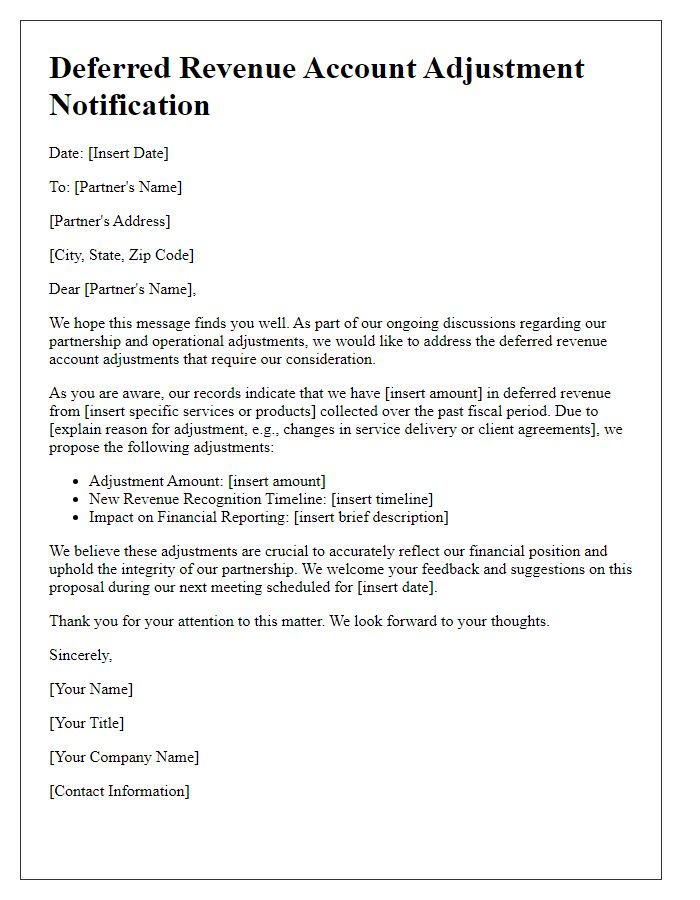

Letter template of deferred revenue account adjustment for partnership discussions.

Comments