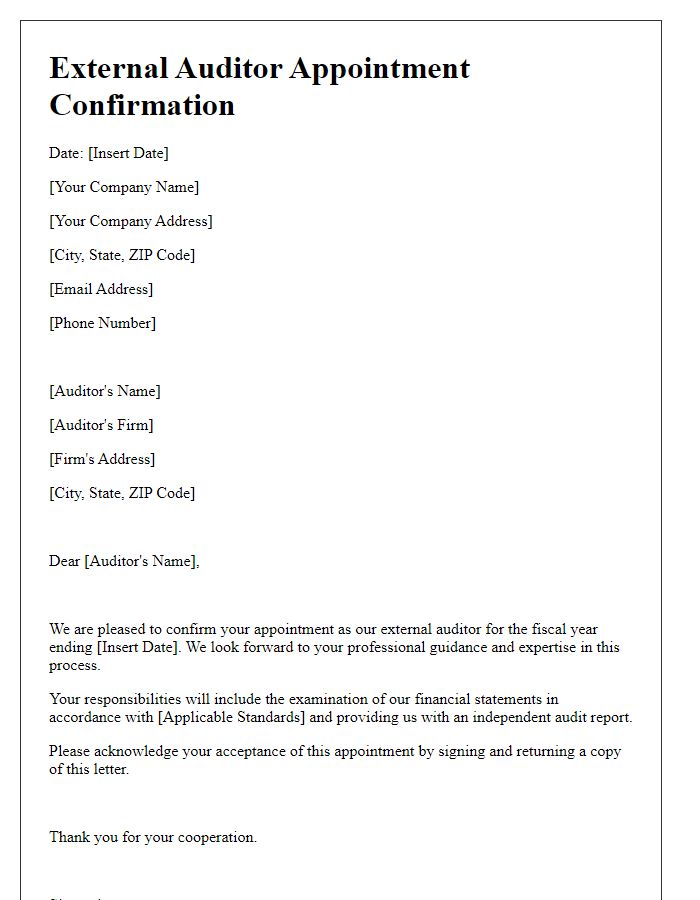

Are you looking to streamline your external auditor engagement process? Crafting the right letter can set the tone for a successful partnership and ensure that all parties are on the same page. From outlining the scope of the audit to clarifying deadlines and responsibilities, a well-structured letter is essential in fostering clear communication. Join us as we explore effective templates and tips that will help you engage with your external auditors seamlessly!

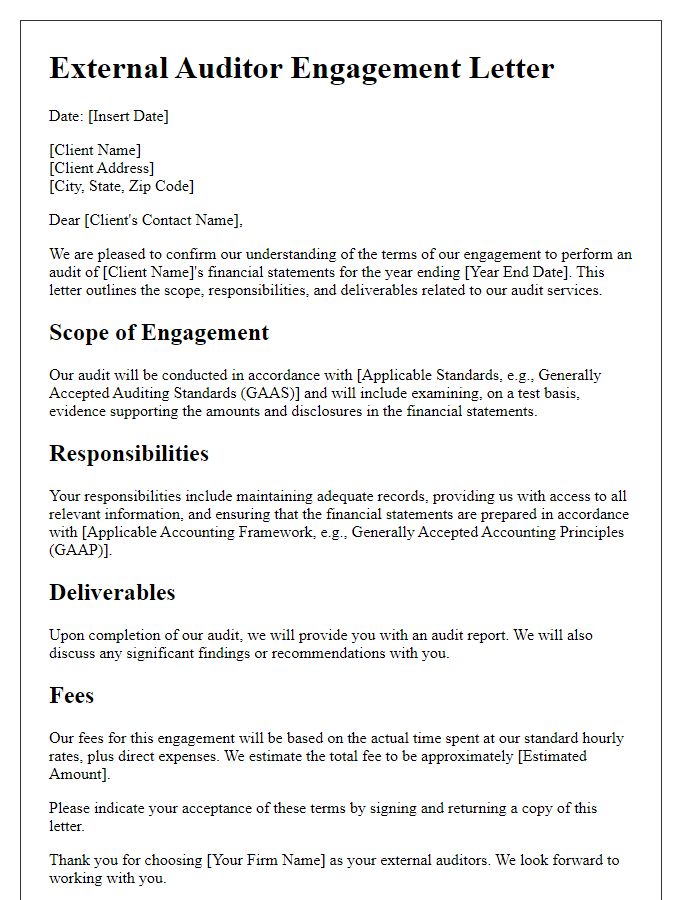

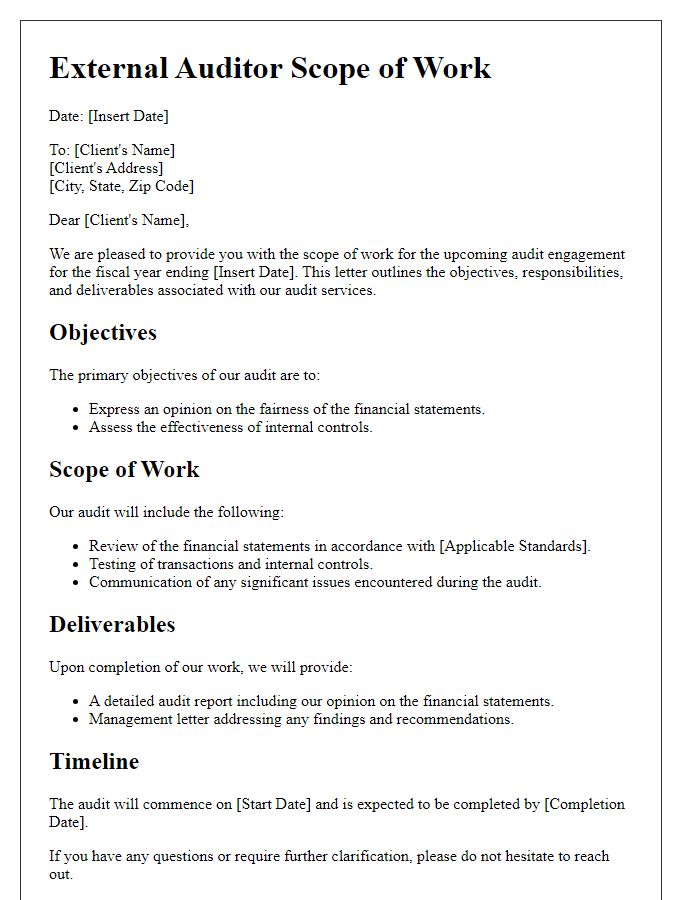

Scope of Audit

The scope of the audit encompasses a comprehensive examination of the organization's financial statements for the fiscal year ending December 31, 2023. The external auditors will assess the accuracy and fairness of the financial reports in compliance with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Key areas of focus will include revenue recognition procedures, inventory valuation practices, and evaluation of accounts receivable and payable balances. The audit will also involve an analysis of internal controls over financial reporting to identify areas of risk and potential fraud. Alongside the financials, the auditors will review compliance with applicable laws and regulations, including tax obligations pertinent to the local jurisdiction. The engagement is set to begin in early January 2024 and aims to conclude by mid-March 2024, culminating in a detailed audit report delivered to the Board of Directors.

Auditor's Responsibilities

During an external audit, responsibilities of the auditor include assessing the financial statements of the company, typically as of December 31, 2023, ensuring accuracy and compliance with Generally Accepted Accounting Principles (GAAP). The auditor must obtain sufficient evidence to provide a reasonable assurance that the financial statements are free from material misstatement. Methods such as substantive testing and analytical procedures will be utilized. Additionally, the auditor is responsible for communicating any identified deficiencies in internal controls to the Audit Committee, established in 2021, and providing a comprehensive report summarizing findings, conclusions, and recommendations. Ethical standards, such as independence and objectivity, guide the auditor's conduct throughout the engagement. The auditor will also evaluate risks of fraud and implement appropriate measures to address identified risks within the scope of the audit.

Management's Responsibilities

Management holds the primary responsibility for ensuring accurate financial statements, compliance with relevant laws, and internal controls within the organization. This includes the preparation and fair presentation of financial reports in accordance with accounting principles such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Management must evaluate risks and implement effective internal control systems to mitigate those risks, ensuring operations are efficient and reliable. Furthermore, management is responsible for providing external auditors with access to necessary financial records, supporting documentation, and other relevant information, facilitating a comprehensive audit process. Proper communication and cooperation with auditors are essential for achieving a successful and transparent audit outcome.

Timing and Deliverables

The external auditor engagement involves a well-defined timeline and clear deliverables to ensure transparency and accountability. The audit is scheduled to commence on March 15, 2024, covering the financial year ending December 31, 2023, followed by initial planning meetings held with the audit committee at the corporate headquarters in New York City. Preliminary fieldwork will take place from April 1 to April 15, allowing auditors to evaluate financial controls and gather necessary documentation. The final audit report is expected to be delivered by May 15, 2024, detailing findings, recommendations, and financial statement opinions. Timely communication is essential throughout the engagement, especially during the progress updates scheduled biweekly, ensuring alignment with regulatory requirements set forth by the Financial Accounting Standards Board (FASB). Crucial to the process are deliverables, including the management letter and agreed-upon procedures report, which enhance the entity's financial reporting integrity.

Fee Structure and Payment Terms

An external auditor engagement fee structure typically includes several components such as hourly rates, fixed fees for specific services, and potential additional costs for travel or specialized tasks. For example, the hourly rate for audit seniors may range from $150 to $300, depending on their experience level and the complexity of the audit, while junior staff may charge between $75 and $150. Fixed fees could be established for routine audits, often varying between $5,000 and $50,000 based on company size and industry. Payment terms usually stipulate a retainer fee upfront, often 25% of the total estimated cost, with the remainder due in installments. Expenses for travel can include transportation, accommodation, and meals, typically billed at actual costs or at a predetermined daily rate. Invoices are generally issued monthly, requiring payment within 30 days of receipt to maintain good standing. These structured processes ensure transparency and clarity regarding financial expectations between the auditor and the client organization.

Comments