If you've ever wondered about the intricate world of inventory valuation, you're not alone! Many businesses grapple with how to accurately assess the value of their inventory, and it can significantly impact financial statements and decision-making. From understanding the various methods to determining which one best suits your needs, there's a lot to unpack. So, if you're ready to dive deeper into inventory valuation and learn how it can benefit your business, keep reading!

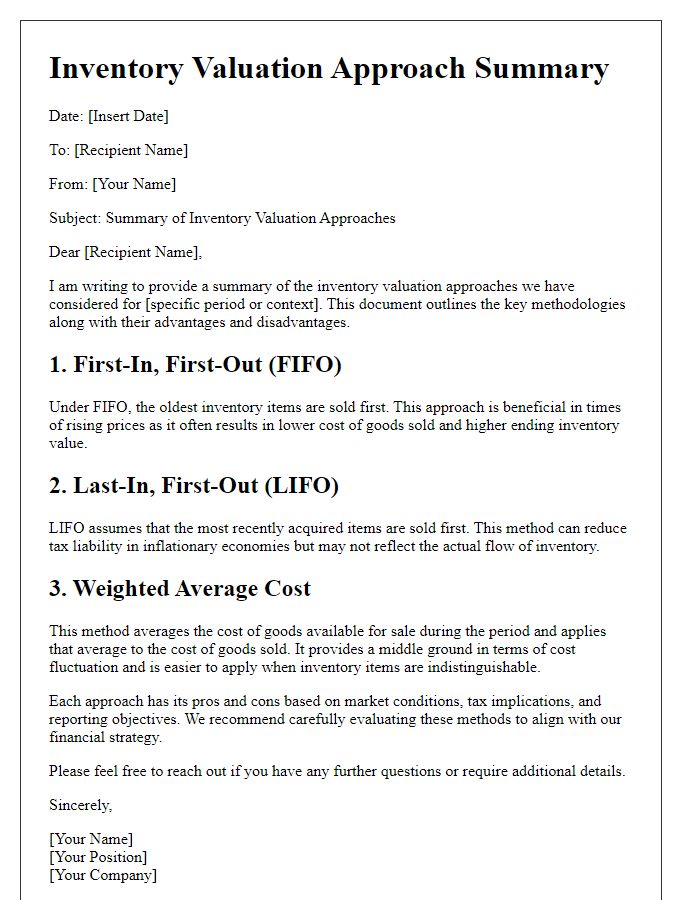

Inventory Valuation Method (e.g. FIFO, LIFO, Weighted Average)

In inventory management, the method of valuation plays a critical role in determining the cost of goods sold (COGS) and ending inventory on financial statements. FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, which can be particularly advantageous during periods of inflation, as it results in lower COGS and higher profits. LIFO (Last-In, First-Out) operates under the premise that the most recently acquired items are sold first, potentially leading to tax advantages in inflationary environments but can result in lower ending inventory valuations on the balance sheet. The Weighted Average method calculates an average cost for inventory items, providing a median approach that smooths out fluctuations in purchase prices over time. Each method impacts financial metrics, tax obligations, and inventory turnover ratios, influencing business decisions and stakeholder perceptions significantly. Understanding these nuances is crucial for accurate financial reporting and strategic planning.

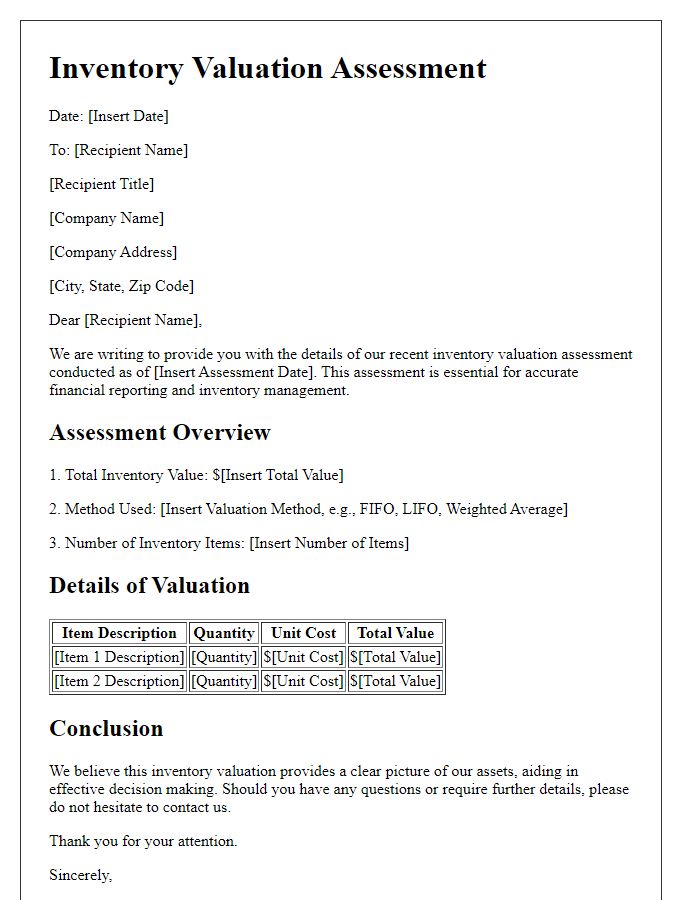

Impact on Financial Statements

Inventory valuation methods, such as FIFO (First In, First Out) and LIFO (Last In, First Out), significantly influence the financial statements of a company, including the balance sheet and income statement. FIFO assumes that the oldest inventory items are sold first, which can result in lower cost of goods sold (COGS) during periods of rising prices, thus increasing net income and impacting taxable income. In contrast, LIFO accounts for the newest inventory first, often leading to higher COGS, reduced taxable income, and ultimately lower net income in inflationary environments. The choice between these methods can affect inventory levels reported on the balance sheet, with FIFO typically yielding a higher ending inventory value compared to LIFO. Changes in inventory valuation also impact cash flow, as higher profits under FIFO can lead to increased tax liabilities. Overall, the selected inventory valuation method directly affects a company's profitability, financial ratios, and operational insights.

Market Conditions and Trends

Market conditions greatly influence inventory valuation. Economic indicators such as inflation rates (currently around 3.6% in November 2023) impact purchasing power and consequently the cost of goods sold. Industry trends (like increased online sales, which rose by 17.1% in 2023 compared to the previous year) also dictate demand fluctuations. Geographic regions with supply chain disruptions, such as ports in Los Angeles and Long Beach, affect lead times and affect valuation accuracy. Seasonal variations (like holiday shopping peaks in December) necessitate adjustments in stock levels and valuation methods. Understanding these factors is essential for accurate inventory assessment, ensuring compliance with accounting standards such as GAAP and IFRS.

Compliance with Accounting Standards

Inventory valuation plays a crucial role in financial reporting, ensuring compliance with accounting standards such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Accurate valuation methods like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) directly impact the enterprise's balance sheet and income statement, influencing financial ratios like the current ratio and gross margin. Adhering to the lower of cost or market rule ensures that inventory is reported at a value reflective of current market conditions, thus safeguarding against inventory write-downs that could misrepresent financial health. Regular audits and documentation support compliance, providing transparency and mitigating risks associated with financial misstatements. Proper attention to regulatory updates and interpretations is essential for maintaining adherence to evolving standards.

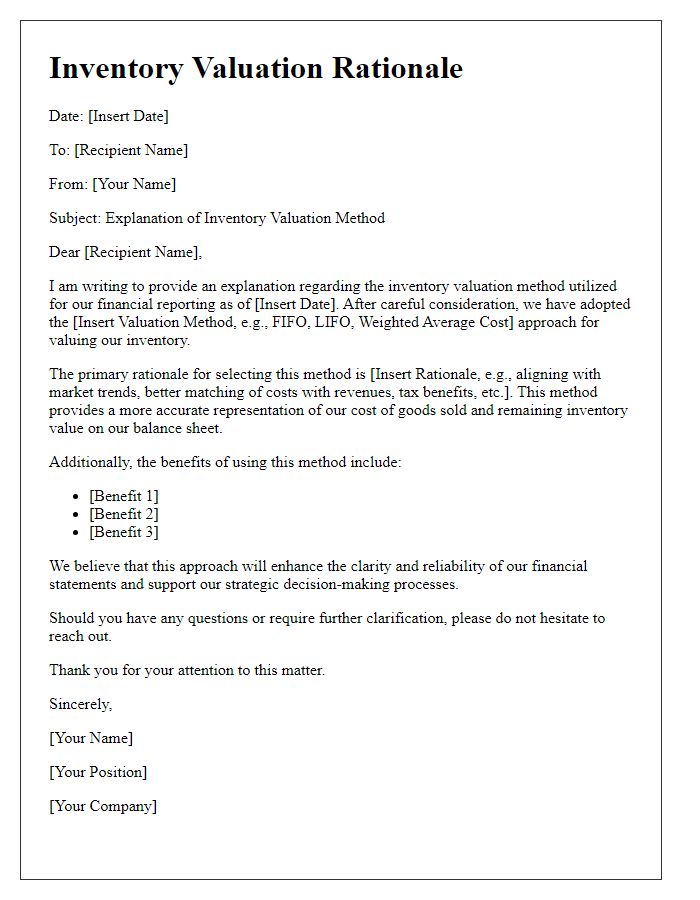

Justification of Valuation Changes

Inventory valuation changes can significantly impact financial statements and overall business analysis. The cost method (such as FIFO--First In, First Out, or LIFO--Last In, First Out) determines the assignment of costs associated with inventory items, influencing reported profits. For instance, in sectors like retail or manufacturing, fluctuations in market demand (like the recent surge in e-commerce due to the COVID-19 pandemic) may necessitate reevaluating inventory costs. Factors such as raw material price volatility, storage costs, and waste percentages also contribute to this evaluation. Accurate inventory valuation, adhering to GAAP or IFRS standards, is crucial for stakeholders to understand the company's financial health and performance metrics. Regular audits and inventory assessments help justify these valuation changes, ensuring compliance and transparency.

Comments