Preparing for a tax audit can feel overwhelming, but having a solid checklist can make the process smoother and more manageable. In this article, we'll walk you through essential steps to ensure you have all your documents organized and ready for review. From gathering financial records to understanding critical dates, we've got you covered every step of the way. So, let's dive in and empower yourself with the knowledge to navigate your tax audit seamlessly!

Income Documentation

Preparing for a tax audit requires meticulous organization of income documentation. Key documents include W-2 forms from employers, detailing annual earnings, 1099 forms for independent contractors and freelancers, which report non-employee compensation, and K-1 forms from partnerships or S corporations that summarize income, deductions, and credits. Bank statements, especially for any interest income, should be collected, reflecting deposits and interest earned. Additionally, records of other income sources, such as rental properties or investments, contribute to an accurate representation of personal finances. Pay stubs should also be retained, providing proof of income for the year, and any income from side businesses must be documented, including receipts and invoices. Organizing these documents in chronological order or by source can help streamline the audit process, ensuring compliance with IRS requirements.

Expense Records

Comprehensive expense records are crucial for tax audit preparation, especially for small businesses and self-employed individuals. Accurate documentation such as receipts, invoices, and bank statements should be meticulously organized, ideally in categorized folders (e.g., travel, supplies, meals) for easy access. The records should cover a minimum of three years to comply with IRS guidelines. Each expense should include key details, such as the date (month/day/year), amount, vendor name, and business purpose. Digital tools or accounting software can streamline this process by allowing easy tracking and archiving. Aggregated expense totals should align with revenue reports to ensure consistency, as discrepancies may trigger further scrutiny during the audit process.

Previous Tax Returns

Previous tax returns, essential documents for tax audit preparation, typically include forms such as 1040 (Individual Income Tax Return) and applicable Schedules (A, C, D). These historical returns, covering the last three to five years, serve as a reference point for income reported and deductions claimed. Important details to scrutinize include reported income sources (wages, dividends, interest), as well as itemized deductions or business expenses. Supporting documents like W-2 forms from employers or 1099 forms for freelance work, which report total income received, should also be gathered to ensure accuracy and compliance. Organizing these returns provides a comprehensive view of financial history, aiding in clarifying discrepancies during an audit.

Asset Verification

Asset verification is a critical step in tax audit preparation, focusing on the assessment of physical and financial assets. Valuation of real estate, such as commercial properties located in metropolitan areas, requires updated appraisals to confirm market value. Inventory counts must align with accounting records, ensuring discrepancies are investigated, especially for high-value items. Documentation, including invoices and purchase agreements for assets totaling over $10,000, must be organized for easy access. Depreciation schedules should reflect accurate asset values, adhering to IRS guidelines to avoid penalties. Additionally, reviewing fixed assets like machinery and vehicles at manufacturing sites can mitigate risks of tax disputes by ensuring proper recording of asset conditions and lifecycle.

Correspondence with Tax Authorities

Preparing for a tax audit requires careful attention to correspondence with tax authorities, including the Internal Revenue Service (IRS) in the United States. It's essential to gather all relevant communication, such as letters (Form 2848 for Power of Attorney), notices regarding audit dates, and requests for documents. Ensure that you have copies of tax returns for the last three to five years, as well as supporting documentation like W-2 forms, 1099 statements, and receipts for deductions. Organize all correspondence in chronological order to present a clear timeline of interactions. Note any specific points raised by the tax authorities that need addressing, such as discrepancies in reported income or claimed deductions. This not only enhances transparency but also facilitates a smoother audit process.

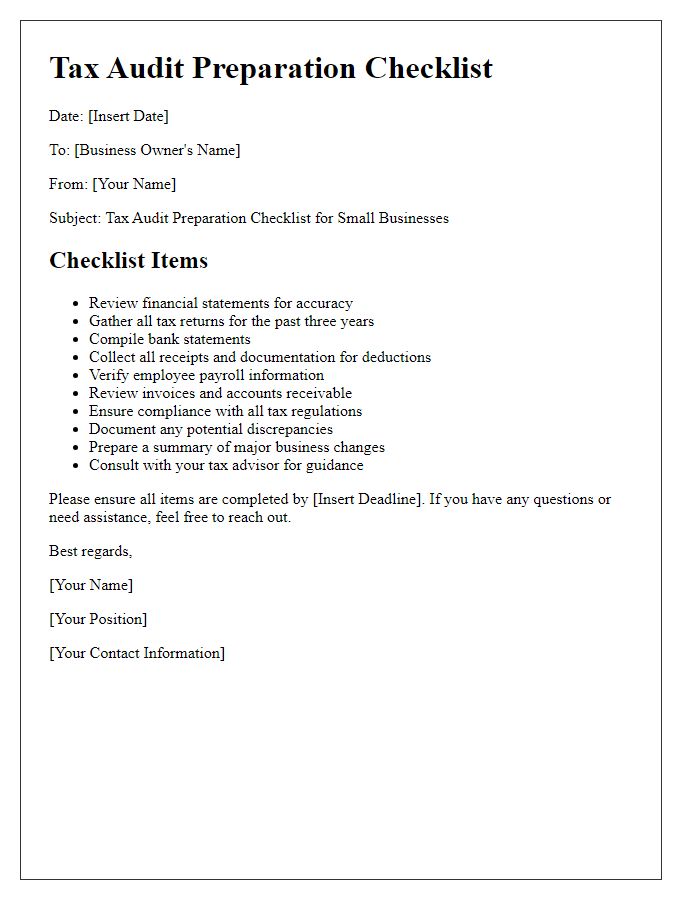

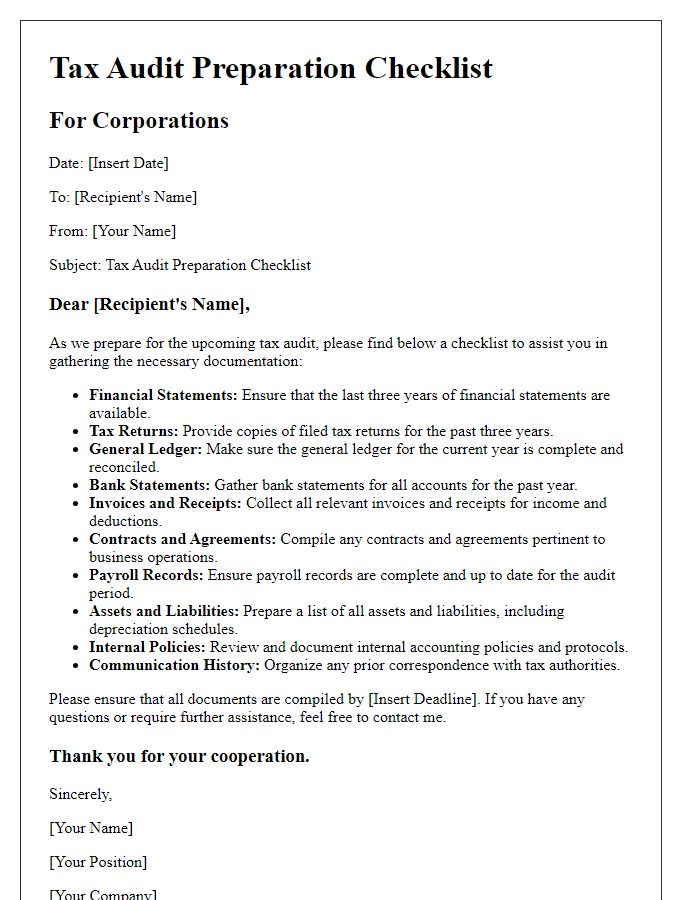

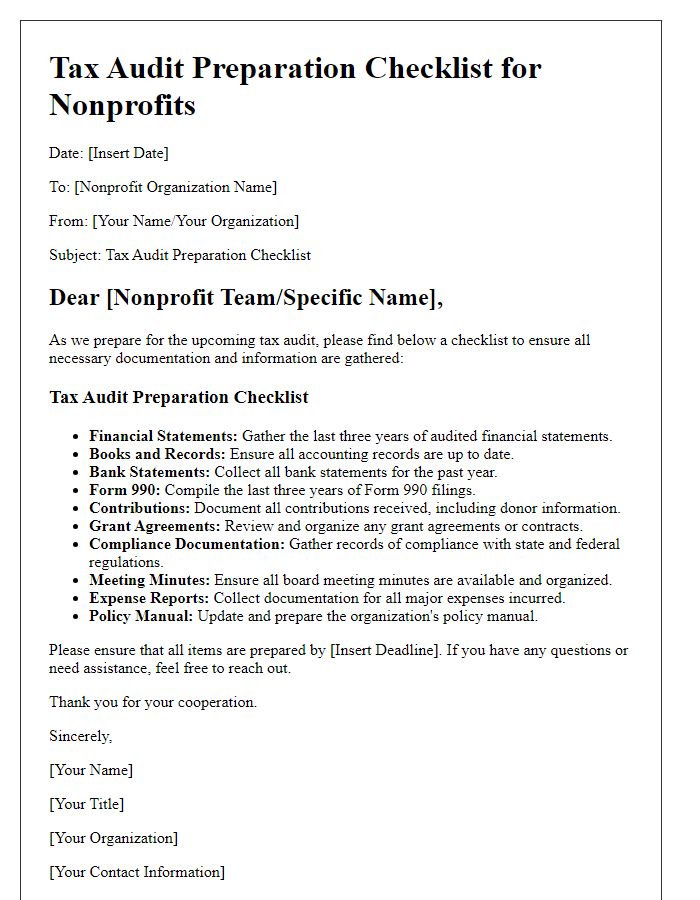

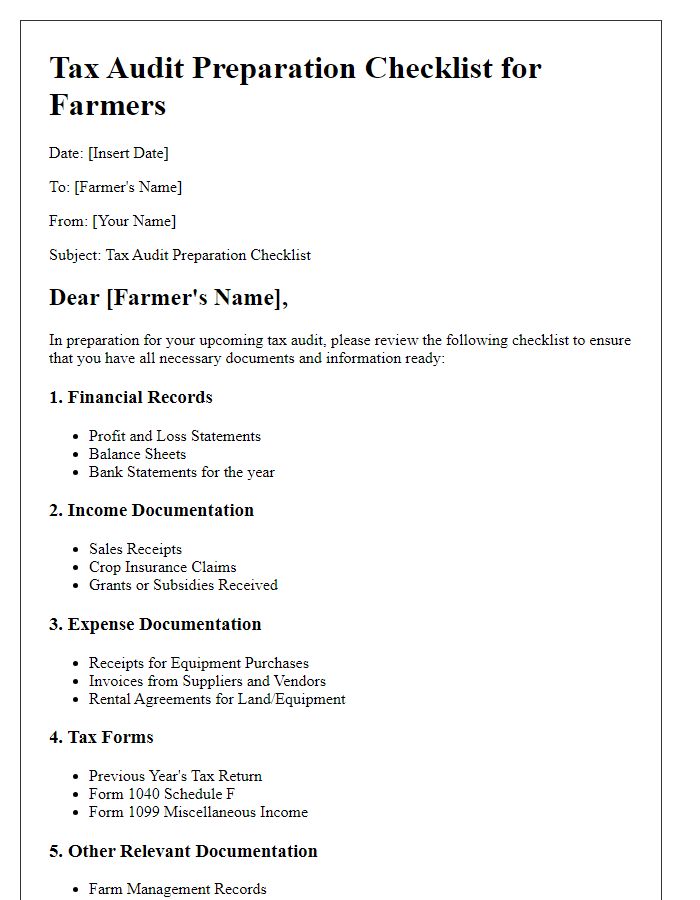

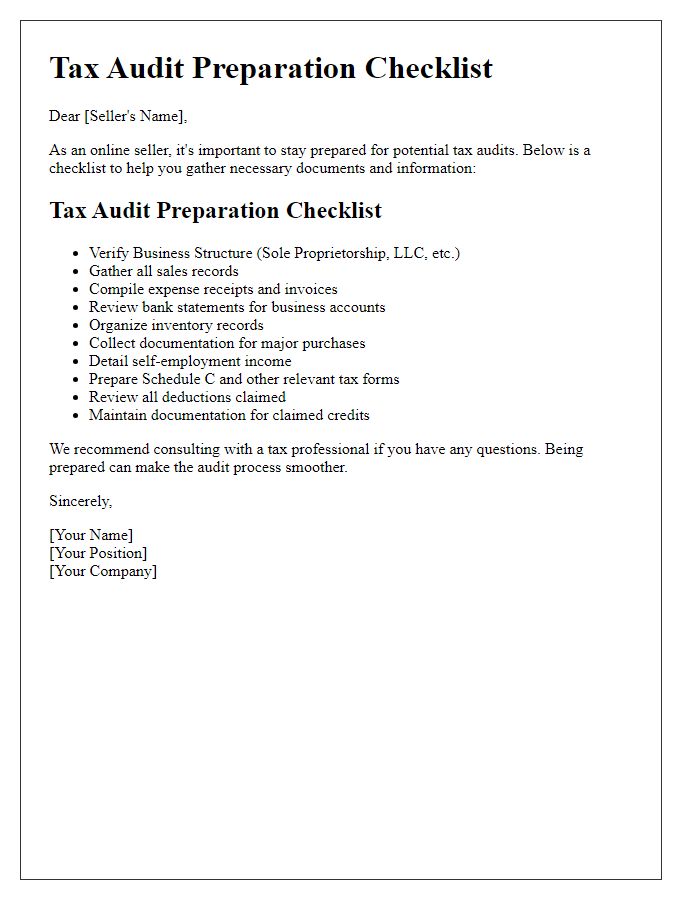

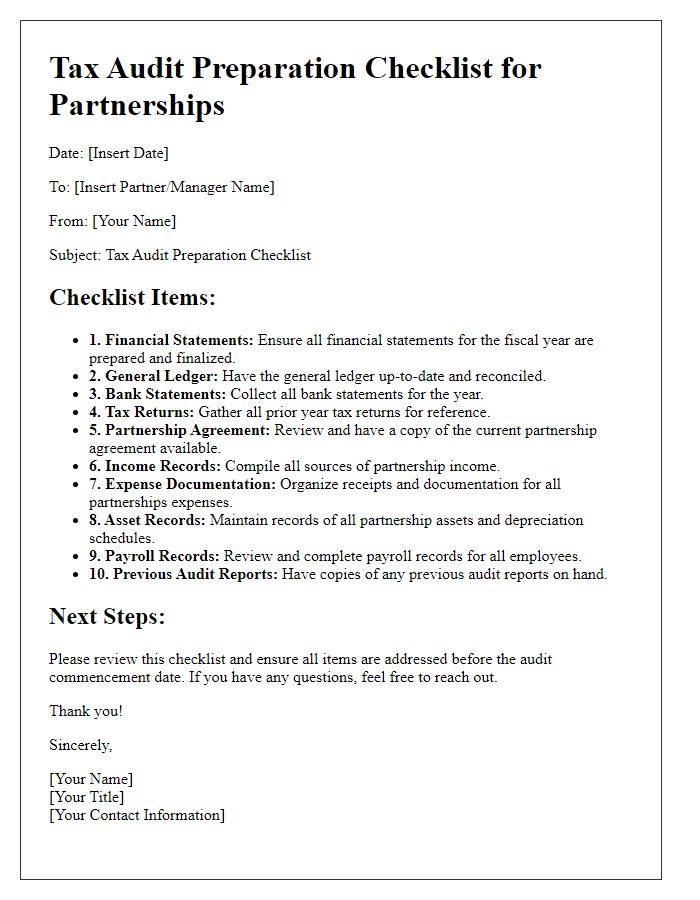

Letter Template For Tax Audit Preparation Checklist Samples

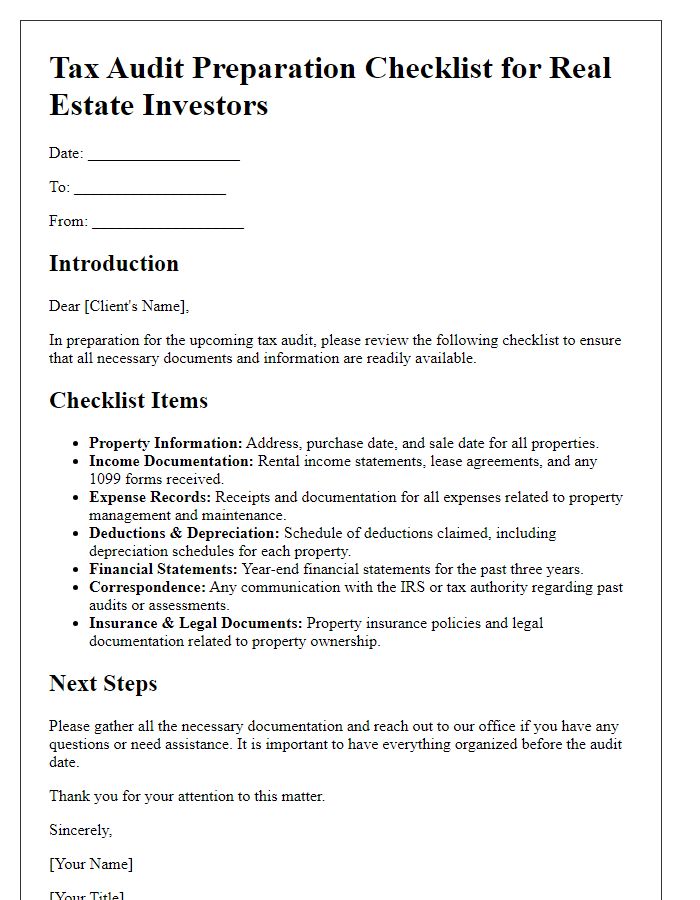

Letter template of Tax Audit Preparation Checklist for Real Estate Investors

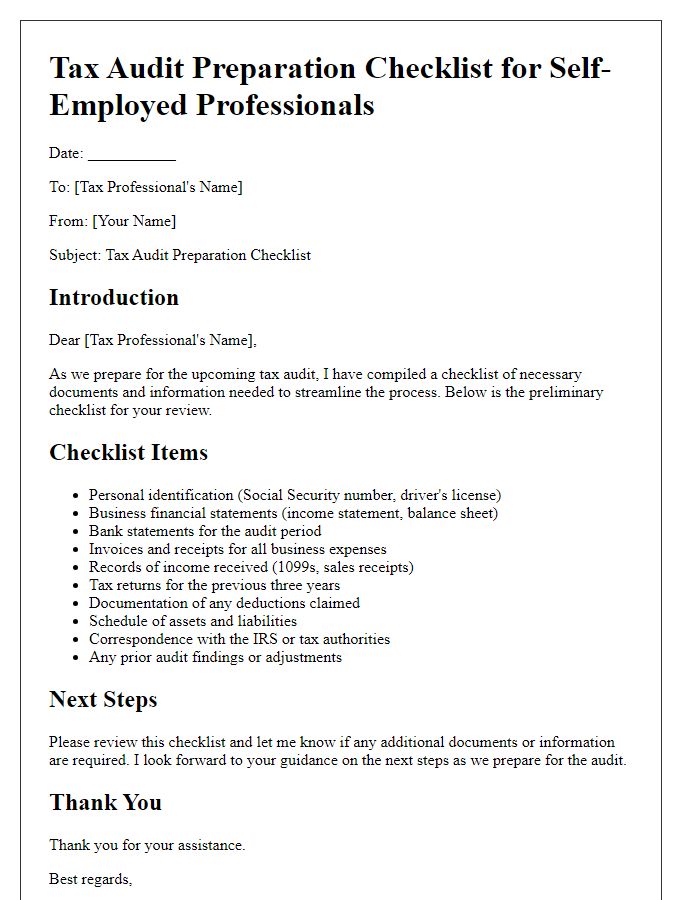

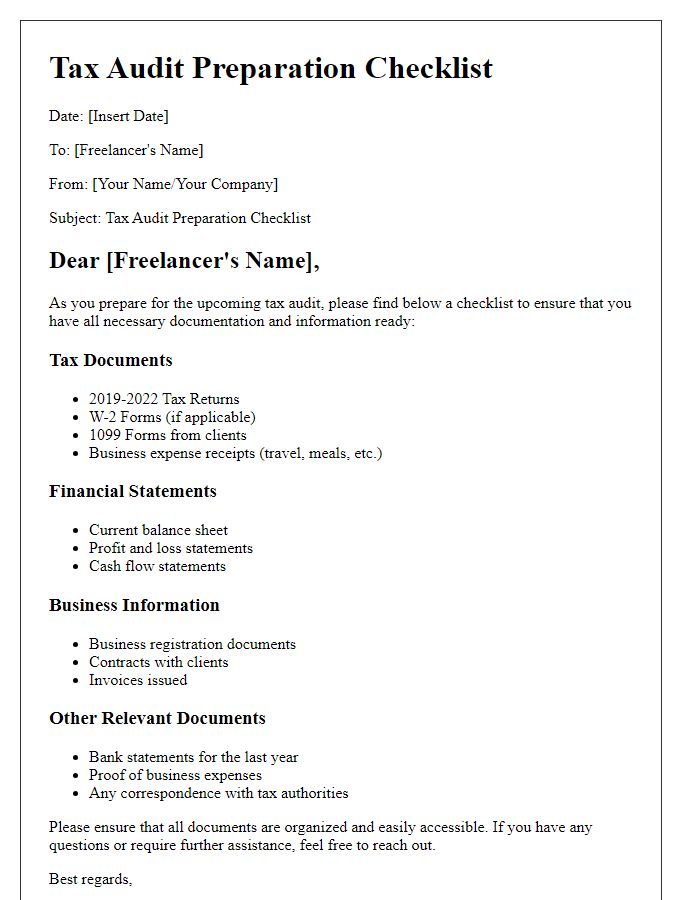

Letter template of Tax Audit Preparation Checklist for Self-Employed Professionals

Comments