Hey there! We've all experienced that moment of panic when we spot an accounting error, right? It can feel overwhelming to tackle the situation, but addressing mistakes promptly and clearly can make all the difference. In this article, we'll walk you through a simple yet effective letter template for rectifying accounting errors, ensuring you convey your message professionally. Ready to get started? Let's dive in!

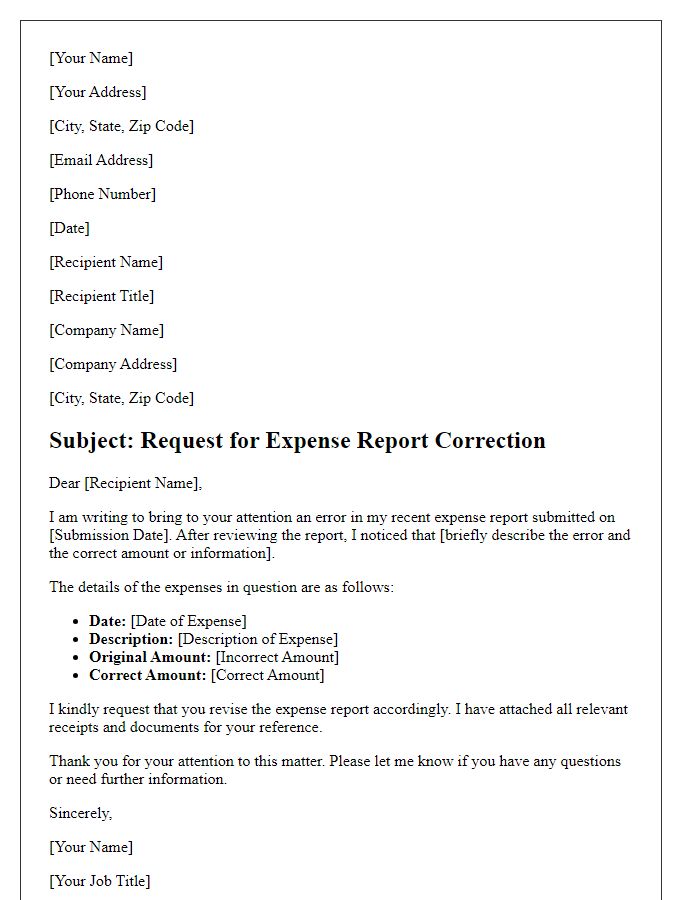

Clear Identification of Error

In financial accounting, accurate records are crucial for maintaining organizational integrity and regulatory compliance. An accounting error, such as a misposted journal entry, can lead to substantial discrepancies in financial statements. For instance, if a $10,000 transaction is mistakenly recorded as an expense instead of an asset, it results in a misrepresentation of profit margins and the company's overall financial health. Detailed documentation of the error, including date, affected accounts, and transaction number, is necessary for identifying the specific nature of the mistake. Rectification involves creating a correcting journal entry to amend the records, ensuring that future financial reports adhere to Generally Accepted Accounting Principles (GAAP) and provide an accurate reflection of the company's financial position.

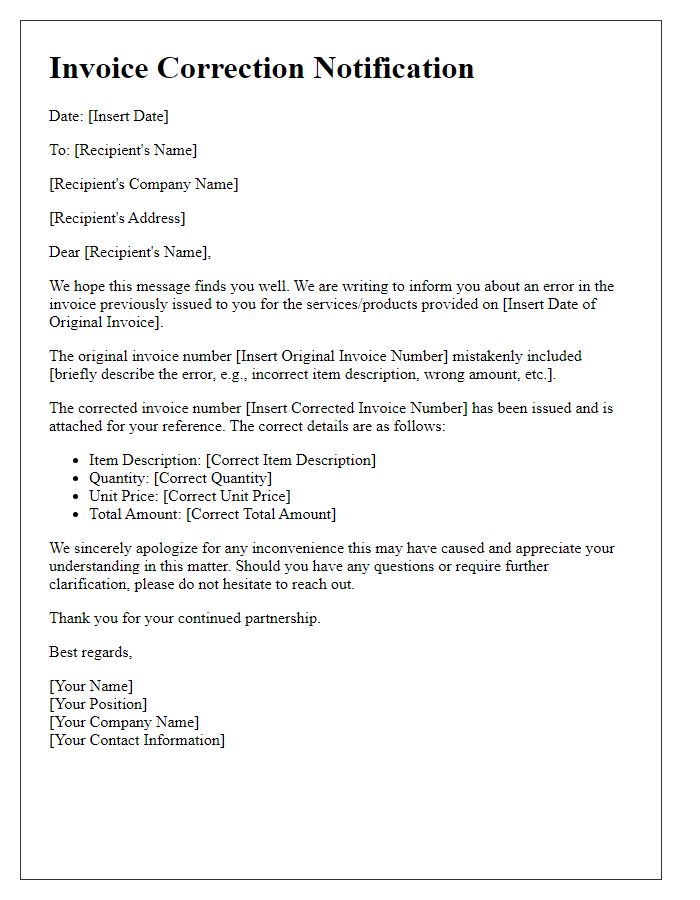

Concise Explanation of Correction

Accounting errors, such as miscalculations or incorrect data entries, often require prompt rectification to maintain accurate financial records. These mistakes can occur in various forms, including transposed numbers in accounts receivable, incorrect expense categorization in financial statements, or erroneous tax calculations impacting liabilities. For instance, a misreported revenue figure of $50,000 could lead to significant discrepancies in reported net income, potentially affecting stakeholder decisions. The correction process typically involves identifying the original error, documenting the adjustments with supporting evidence, and updating financial records in compliance with relevant accounting standards such as GAAP (Generally Accepted Accounting Principles). Properly addressing these errors ensures the integrity of financial reporting and preserves transparency in fiscal management.

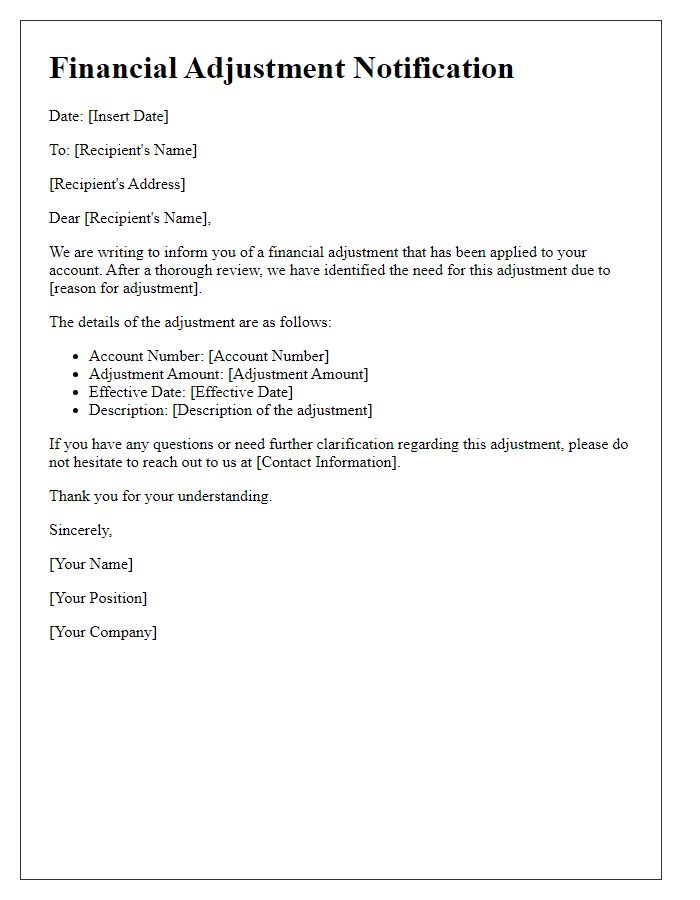

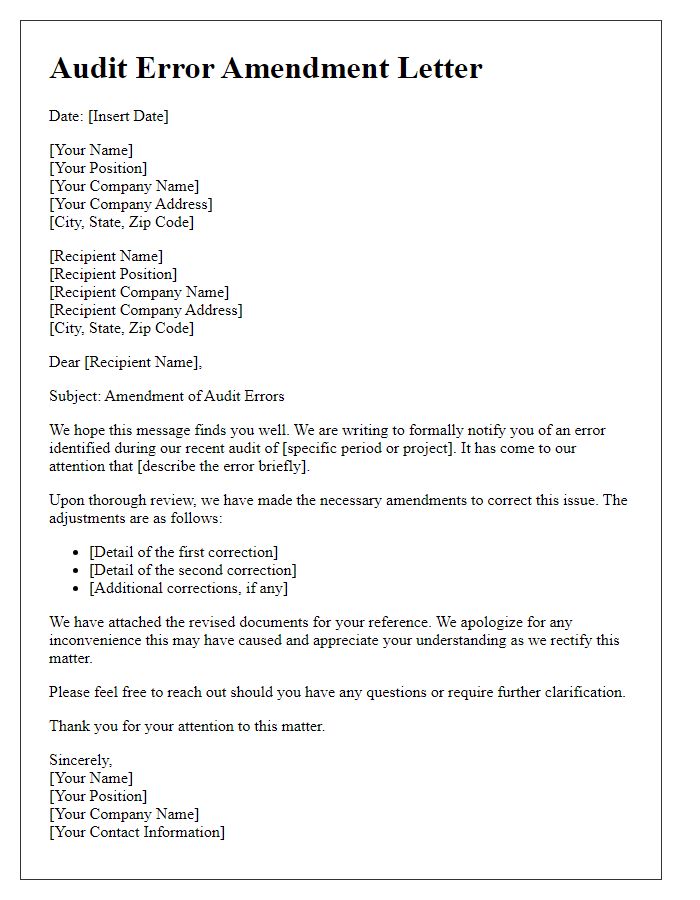

Reference to Supporting Documents

An accounting error rectification process requires thorough documentation to clarify discrepancies and ensure accurate financial reporting. Supporting documents, such as invoices, receipts, and bank statements, play a crucial role in identifying the nature of the mistake. For example, a mismatched invoice amount of $1,250 might be traced back to a clerical error in data entry, where a $1,520 entry mistakenly occurred. Additionally, previous financial statements, such as the January 2023 balance sheet, can provide context for the error's impact on overall financial health, revealing how it affects net income and equity. Proper referencing of these documents facilitates transparency and compliance with auditing standards, important for entities like the Financial Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS).

Timeframe for Resolution

Similarly to many businesses, accounting errors can disrupt financial reports and create discrepancies. A careful review of financial statements over the last fiscal quarter (January to March 2023) is essential for identifying any inaccuracies. Common errors may involve misallocated expenses or incorrect revenue recognition, potentially impacting profit margins and tax filings. The resolution timeframe varies depending on the complexity of the error, ranging from immediate correction (within three business days) to more comprehensive audits that may require several weeks for thorough investigation. Corrective actions may include journal entries, restatements of financials, or adjustments to future reports to align figures accurately. Documenting each step in the process ensures compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP).

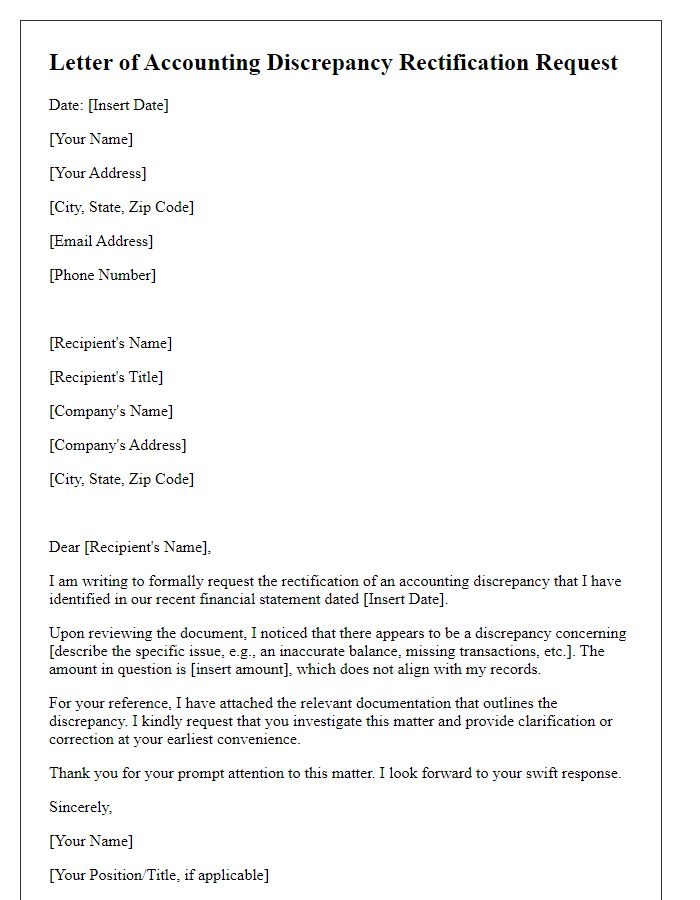

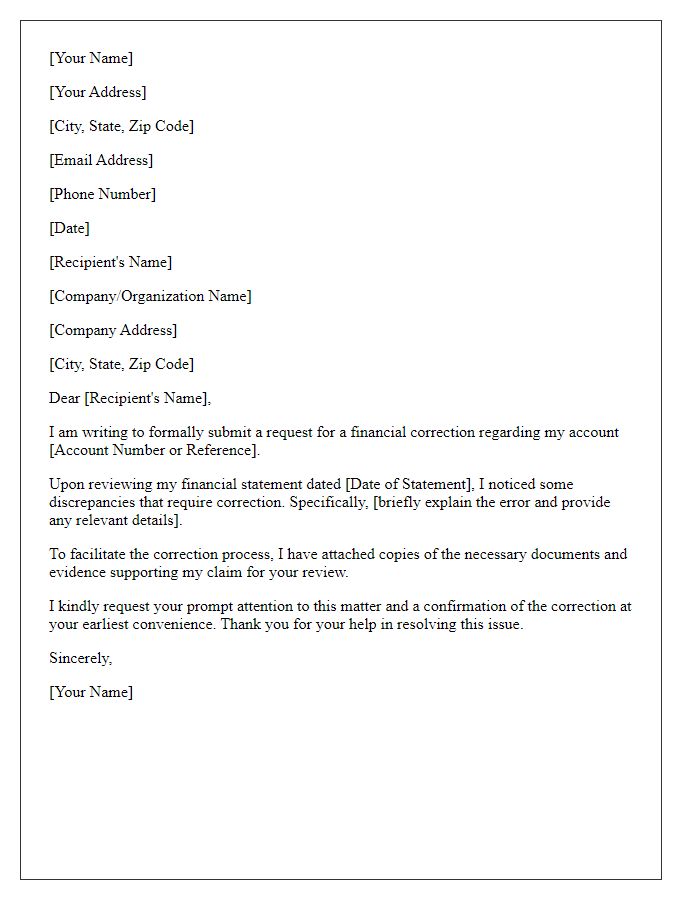

Contact Information for Further Queries

For effective resolution of accounting discrepancies, individuals are encouraged to utilize the contact information provided below. Reach out to the Accounting Department at XYZ Corporation, located at 123 Financial Ave, Suite 456, Metropolis, with inquiries regarding your account statement. The direct phone line is (123) 456-7890, available from 9 AM to 5 PM EST, Monday through Friday. Additionally, you can send emails to accounting@xyzcorp.com for a prompt response from our dedicated accounting team. Ensure to reference your account number for a streamlined inquiry process.

Comments