Hey there! Change can feel daunting, especially when it comes to financial policies that impact your day-to-day. We're committed to keeping you in the loop about any adjustments that affect your experience with us. Dive into the details of our recent financial policy changes to understand how they may benefit you and ensure transparency in our operations. Ready to learn more? Let's explore together!

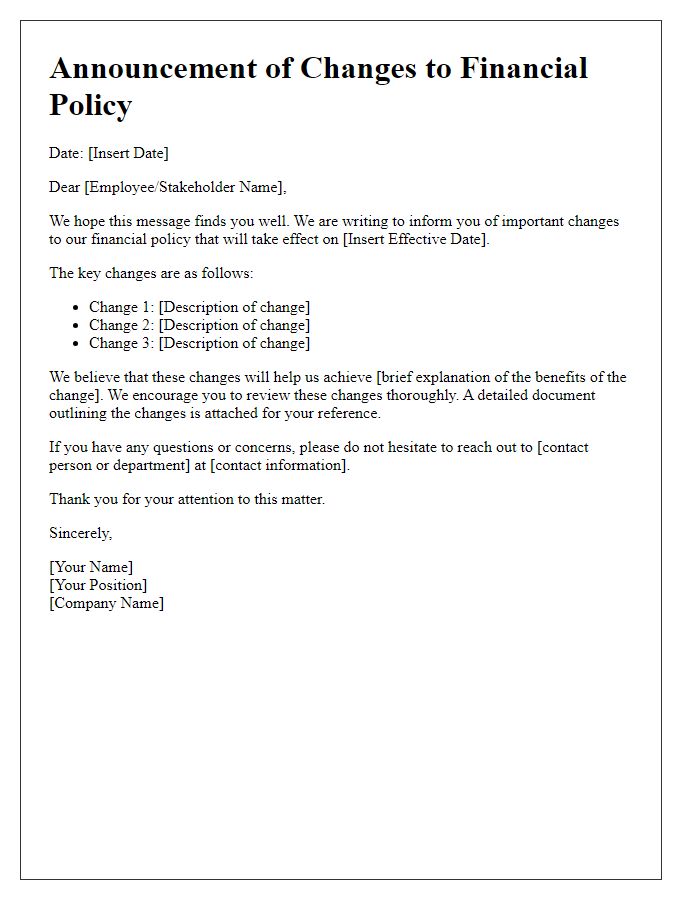

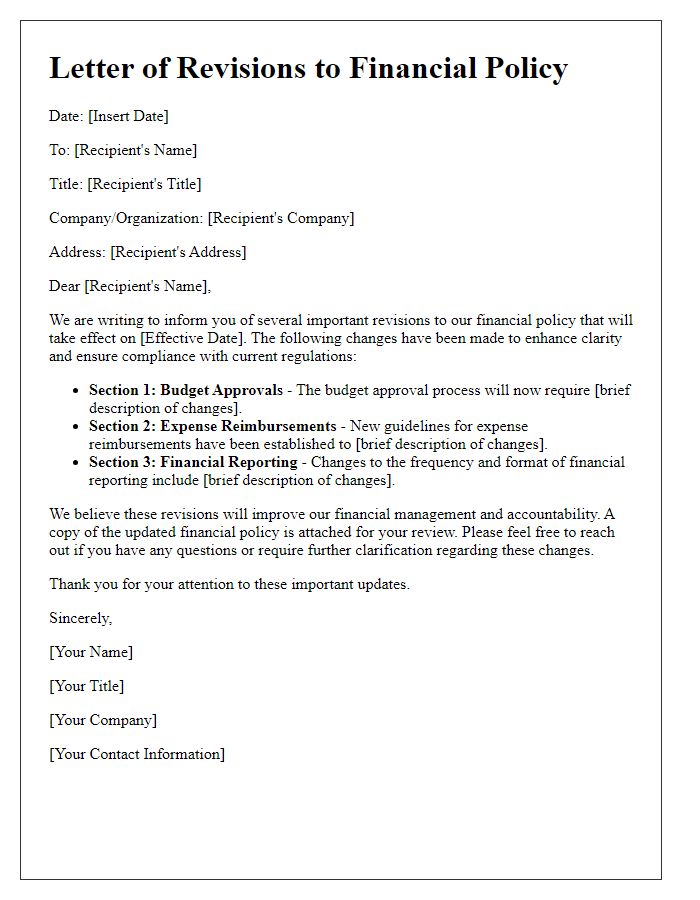

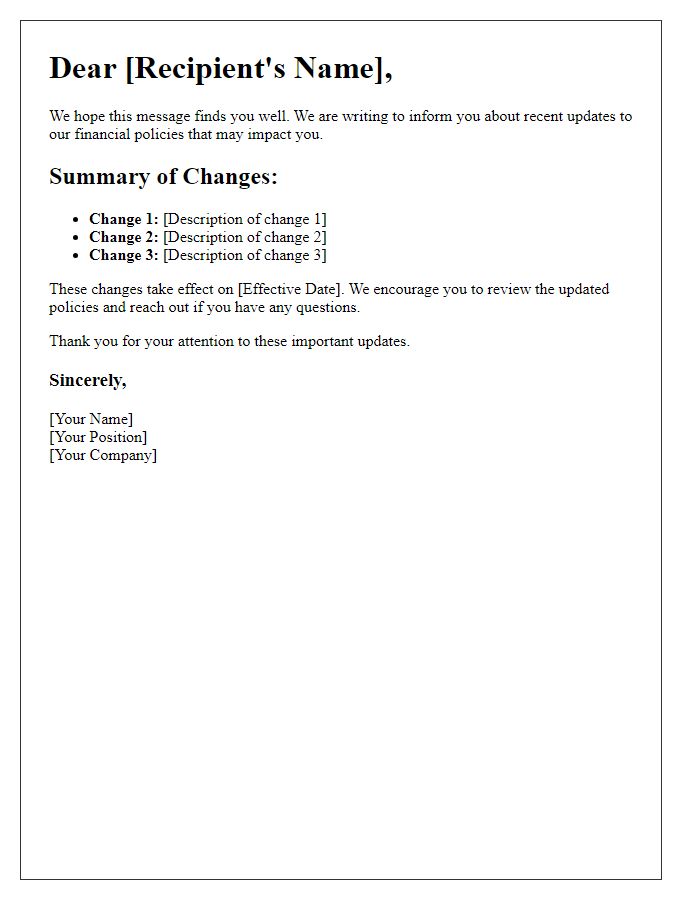

Clear subject line

A financial policy change notification requires careful attention to detail and clarity. Effective communication is essential to ensure all stakeholders understand the implications. A clear subject line, such as "Important Update: Changes to Financial Policy Effective [Date]," captures attention and provides context. This update may pertain to adjustments in budgeting processes, revisions in funding allocation strategies, or new compliance requirements under regulations such as the Sarbanes-Oxley Act (SOX). The notification should detail the reasons for the changes, highlight how they impact current operations, and outline the expected benefits moving forward. Providing a point of contact for questions ensures clarity and strengthens communication channels.

Concise introduction

Financial policy changes can significantly impact organizational operations and compliance. Effective communication regarding these changes is essential to ensure that all stakeholders understand the new regulations and procedures. The introduction should succinctly acknowledge the importance of the policy update, outline the effective date, and emphasize the need for compliance to maintain financial integrity and accountability within the organization.

Detailed explanation of policy change

Recent adjustments to the financial policy will enhance clarity and efficiency for stakeholders. The policy update, effective from January 1, 2024, aims to streamline expense reimbursements, specifically focusing on travel and operational costs. Stakeholders will now be required to submit detailed receipts, including dates and locations of transactions, to ensure compliance with new auditing standards mandated by the National Financial Oversight Board. Additionally, the annual budget review process will be shifted to a quarterly cycle, allowing for more frequent assessments of financial performance. These modifications reflect the organization's commitment to transparency and accountability, fostering a more resilient financial framework in a dynamic economic landscape.

Impact analysis

Financial policy changes can have significant effects on stakeholders, including employees, investors, and clients. Understanding the potential impact is crucial. For instance, a new investment strategy may influence asset allocation among mutual funds, potentially increasing returns by 15% based on historical performance data, while also altering risk exposure. Additionally, modifications to expense reporting protocols could streamline processes, reducing approval time by 25% and enhancing transparency. Important financial metrics like profit margins and operational costs may shift, compelling a review of cash flow forecasts and budget allocations. Regulatory compliance must also be monitored closely to avoid penalties, particularly with changes in tax law effective in January 2024. Such changes necessitate detailed communication strategies to ensure all parties are informed and prepared for adjustments.

Contact information for inquiries

The financial policy change notification outlines significant updates impacting account holders and stakeholders. Enclosed details include the effective date of changes, specific alterations in interest rates, fees, and eligibility criteria for loans, critical for customers of the XYZ Financial Institution, a well-established organization operating since 1992. For inquiries regarding these updates, account holders can reach the customer service team via the provided contact number, (555) 123-4567, or email at support@xyzfinancial.com. In addition, a dedicated online portal offers comprehensive resources and FAQs to assist customers in understanding the changes. Furthermore, the upcoming informational webinar scheduled for November 15, 2023, will provide additional clarity and an opportunity for direct questions.

Comments