Are you tired of the endless back-and-forth when it comes to reconciling your bank statements? Writing a letter for a bank reconciliation statement doesn't have to be a daunting task. With a clear template in hand, you can streamline the process and ensure all your financial records align perfectly. Let's dive into the essential components of an effective letter, and you might find just what you need to make your reconciliation a breeze!

Subject Line: Clear and specific purpose.

A bank reconciliation statement is a financial document that ensures the accuracy of an organization's financial records by comparing its bank account statements against its internal records. This process is essential for identifying discrepancies on a month-to-month basis. The reconciliation involves a detailed review of transactions, such as deposits, withdrawals, fees, and interest credited, which are recorded in the bank statement from institutions like Chase or Bank of America. An effective reconciliation process can prevent issues like overlooking uncashed checks, which may impact cash flow decisions. Additionally, understanding the timing differences, often seen in transactions that appear on bank statements but not in the cash book, is crucial for accurate financial reporting. Regular bank reconciliation not only maintains accurate financial records but also aids in fraud detection and assures the organization's financial integrity.

Company Information: Name, address, and contact details.

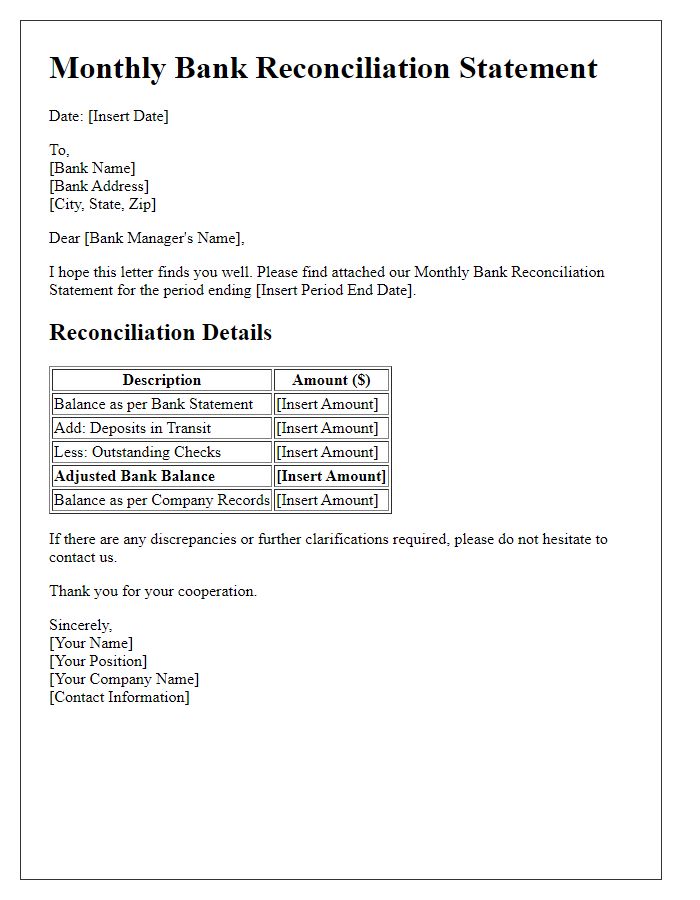

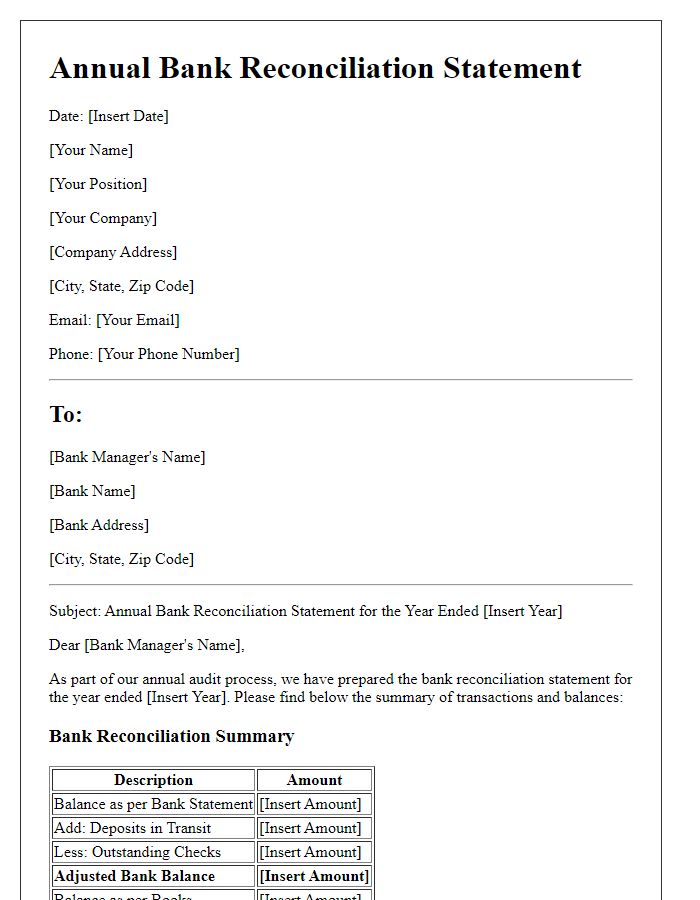

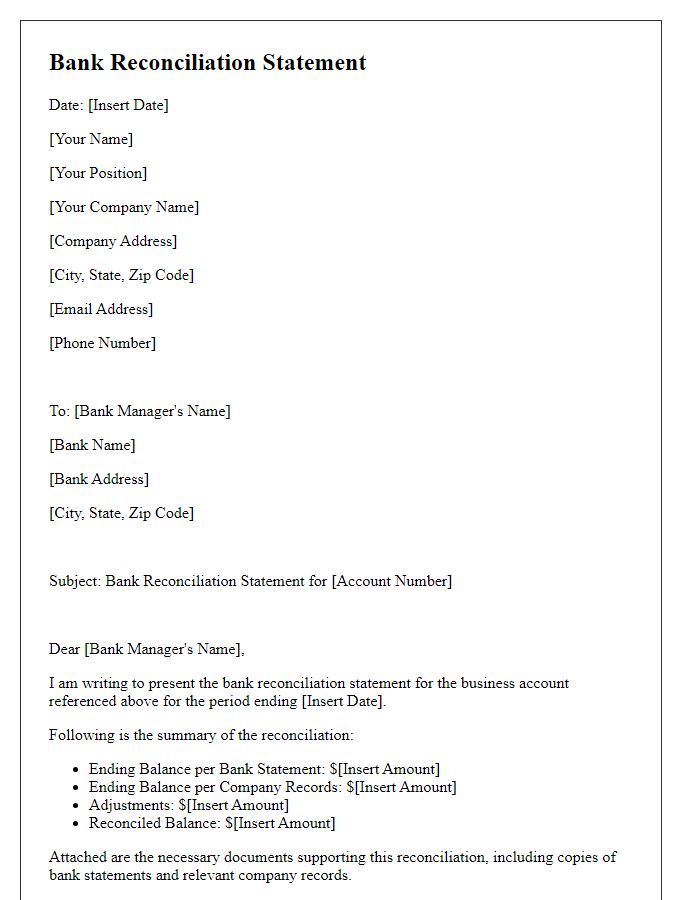

The bank reconciliation statement is essential for financial accuracy. Company XYZ, located at 123 Business Lane, Cityville, State, ZIP Code, can be contacted at (123) 456-7890 or email at info@companyxyz.com. This document reconciles internal transaction records with external bank statements, ensuring that the cash balance recorded in the company's accounts matches the balance reported by the bank. Discrepancies can arise from outstanding checks, deposits in transit, or bank charges, which need thorough examination. A comprehensive bank reconciliation process, typically conducted monthly, promotes financial integrity and facilitates effective cash flow management within the organization.

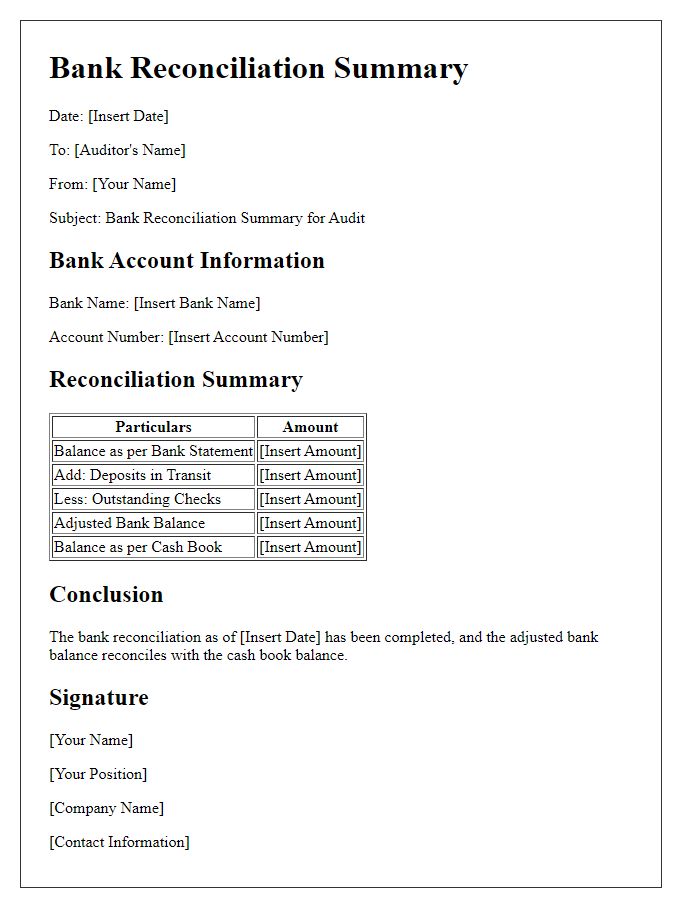

Statement Date: Clarify the period of reconciliation.

A bank reconciliation statement serves to align the bank statement with the financial records of a business, ensuring accuracy in accounting. The statement date specifies the exact period under review, often encompassing a monthly timeframe, such as from January 1 to January 31, 2023. This allows for a detailed comparison between the bank's records and the company's financial transactions during that month. Discrepancies, including outstanding checks, deposits in transit, or bank fees, can be identified and addressed. The reconciliation process is crucial for maintaining accurate financial records, facilitating cash flow management, and ensuring compliance with accounting standards.

List of Discrepancies: Detailed, itemized, and categorized entries.

A bank reconciliation statement serves to identify discrepancies between the general ledger (your financial records) and the bank statement. Common discrepancies may include outstanding checks, which are issued checks not yet cleared by the bank, deposit in transit, which refers to deposits made but not yet recorded by the bank, and bank fees that may be deducted without prior notice. Additionally, errors in recording transactions, such as transposed numbers or missed entries, should be itemized and categorized to clarify the nature of each discrepancy. The statement may also highlight unauthorized transactions that need further investigation. Each entry within the reconciliation should include the amount, date, and a brief description for clear identification and resolution.

Closing Statement: Summary and request for resolution or confirmation.

The bank reconciliation statement is a crucial financial document reflecting the accuracy of financial records against bank statements. This statement typically comprises details such as the company's cash balance according to its internal records, which may amount to $50,000, compared to the bank's recorded balance of $48,750 as of September 30, 2023, highlighting discrepancies of $1,250. Key components include outstanding checks, like Check #102 for $300, and pending deposits, such as a $2,000 deposit made on September 29, 2023, yet not processed by the bank. The summary serves as a request for resolution concerning the differences found, emphasizing the need for confirmation of transactions and alignment of financial records to ensure accuracy in the company's financial statements.

Comments