Are you feeling overwhelmed by the complexities of tax relief eligibility? You're not aloneâmany individuals are unsure about their options and how to navigate the application process. In this article, we'll break down the essential steps to determine if you qualify for tax relief and provide helpful tips for submitting your inquiry. So, let's dive in and explore how you can take control of your tax situation!

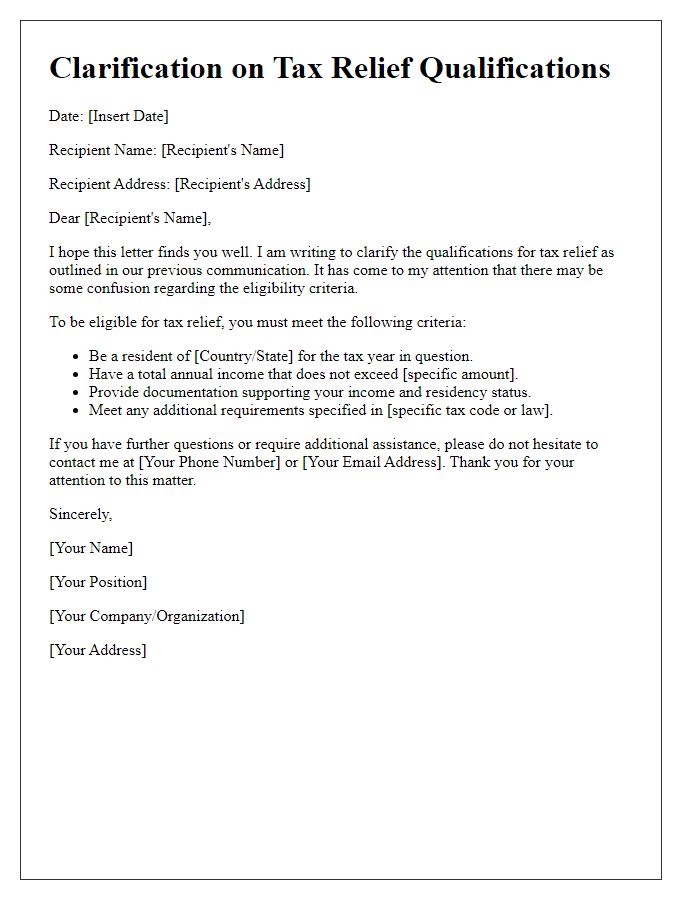

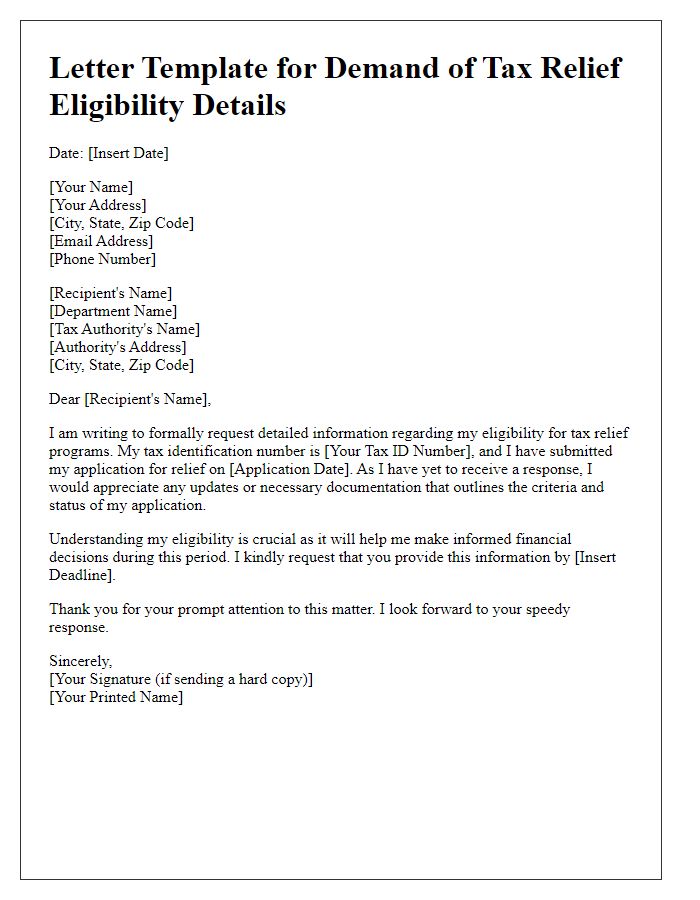

Clear subject line

Tax Relief Eligibility Inquiry - Request for Information

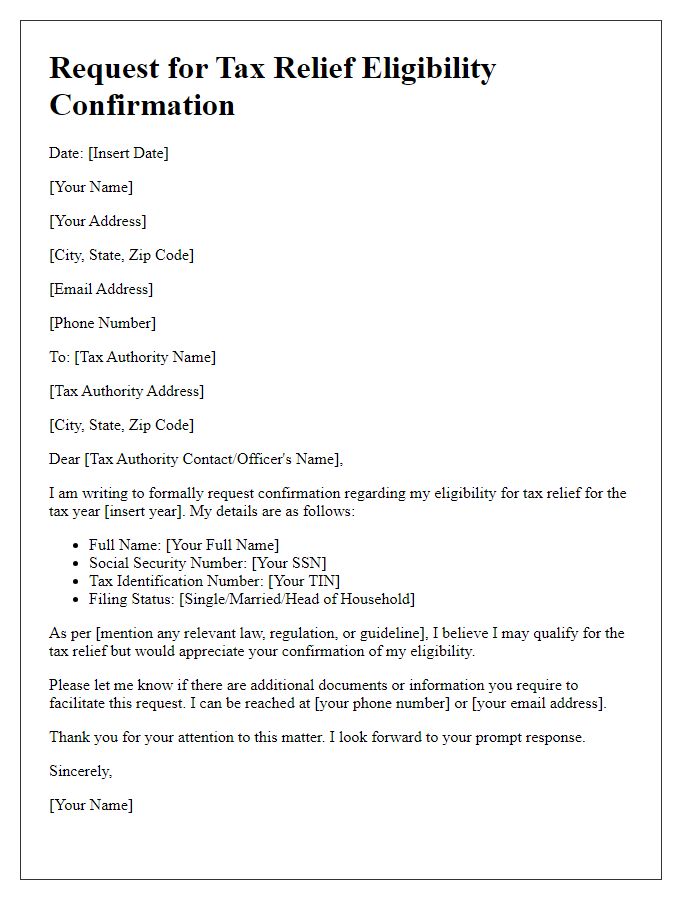

Personal identification details

Inquiries regarding tax relief eligibility often require personal identification details for verification purposes. Key identifiers include full name document (matching legal ID), Social Security Number (typically nine digits), current residential address (street, city, state, zip code), and date of birth (mm/dd/yyyy format). Additional relevant information may include filing status (single, married filing jointly, etc.) and tax year (e.g., 2022) in question. Documentation such as tax returns or W-2 forms can provide supporting evidence for income verification. Collecting this information is critical for expediting the review process by tax authorities.

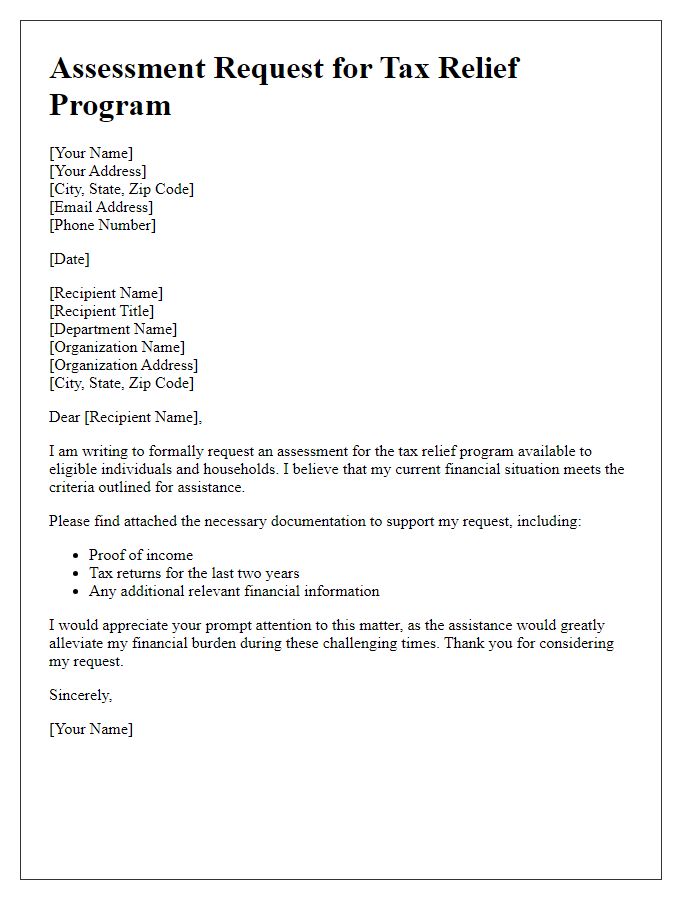

Description of financial situation

Individuals facing financial hardship may seek tax relief eligibility. Many experience reduced income due to unforeseen circumstances like medical emergencies, job loss, or family crises. For example, a single parent in a metropolitan area may struggle to maintain a stable income, leading to difficulties in meeting tax obligations. Households with dependents often encounter additional financial pressures such as childcare costs, housing expenses, and rising utility bills. Organizations, like the Internal Revenue Service (IRS) in the United States, offer programs that provide financial relief for those who meet specific income thresholds, helping alleviate the burden of unpaid taxes. Documentation of income fluctuations, expenses, and any other relevant financial details can strengthen a relief request.

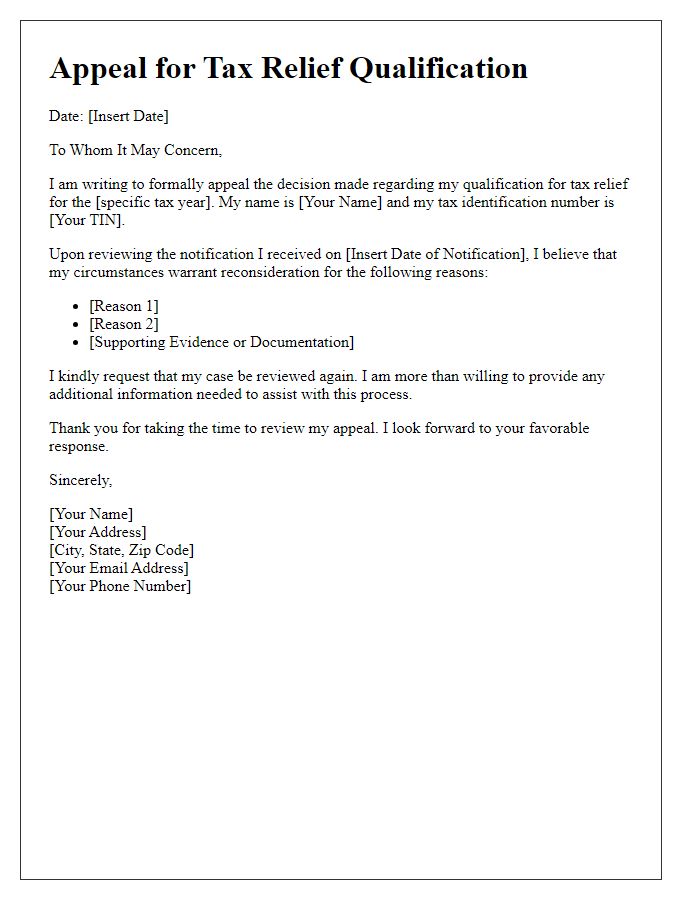

Specific relief request

Tax relief eligibility inquiries often pertain to specific programs, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC). These programs are designed to reduce tax burdens for qualifying individuals and families, often focusing on low to moderate-income earners. In the United States, the EITC can provide a credit of up to $6,728 based on income levels and number of qualifying children, while the CTC may offer up to $2,000 per child under 17, subject to income phase-outs. Applicants must provide detailed financial information, including adjusted gross income (AGI), to determine eligibility for the relief requested. The Internal Revenue Service (IRS) outline specific criteria, including residency and filing status, which must be met for approval. Understanding these nuances can greatly impact one's financial situation during tax season.

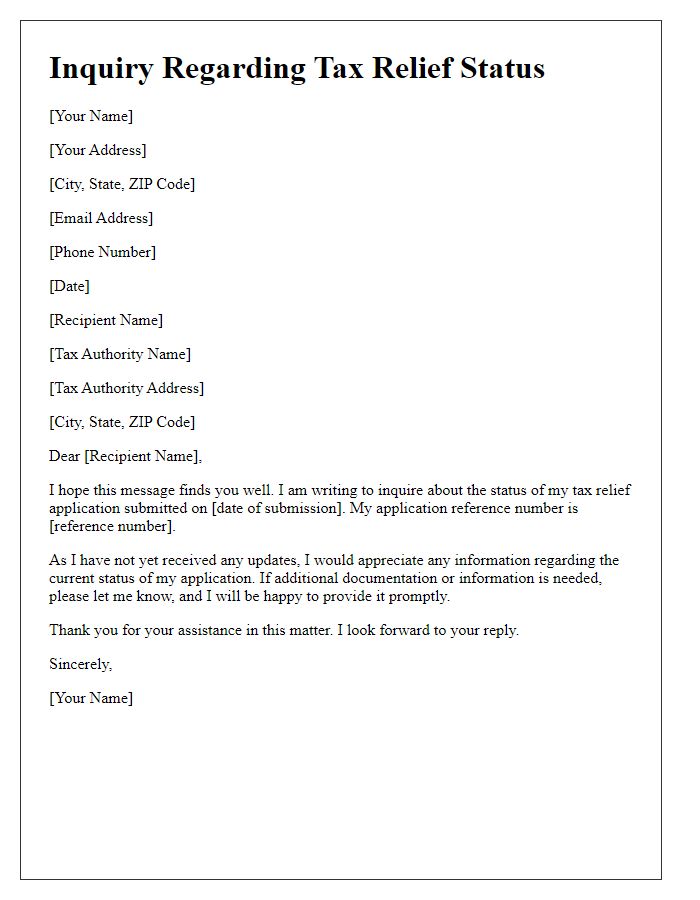

Contact information for response

Tax relief eligibility inquiries require precise contact information for a response. Essential details include full name, which identifies the claimant. Address is necessary for locating records, including city, state, and zip code for accurate correspondence. Phone number provides an alternative communication channel, ensuring quick resolution of questions. Email address is essential for digital correspondence, allowing timely replies and documentation exchanges. Including preferred contact method enhances efficiency in the communication process, ensuring the tax agency can reach the claimant effectively.

Comments