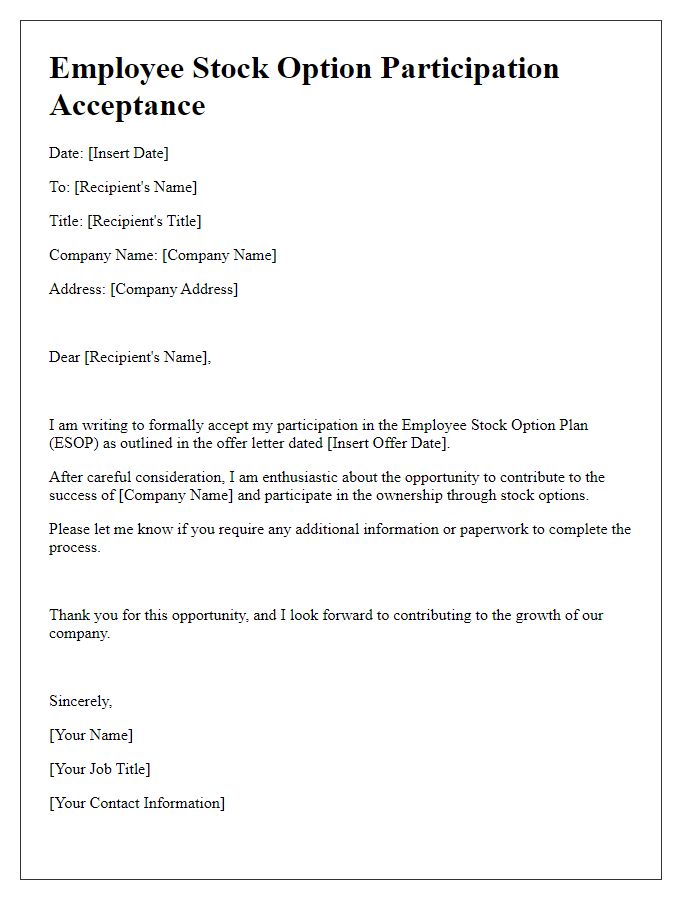

Are you looking to enhance your company's appeal and reward your employees in a meaningful way? An Employee Stock Option Plan (ESOP) is an effective strategy that not only fosters loyalty but also aligns your team's success with the company's growth. From understanding the benefits to implementing a tailored plan, it's essential to grasp the nuances of ESOPs and how they can transform company culture. So, if you're curious about how to create a thriving workplace through employee ownership, keep reading!

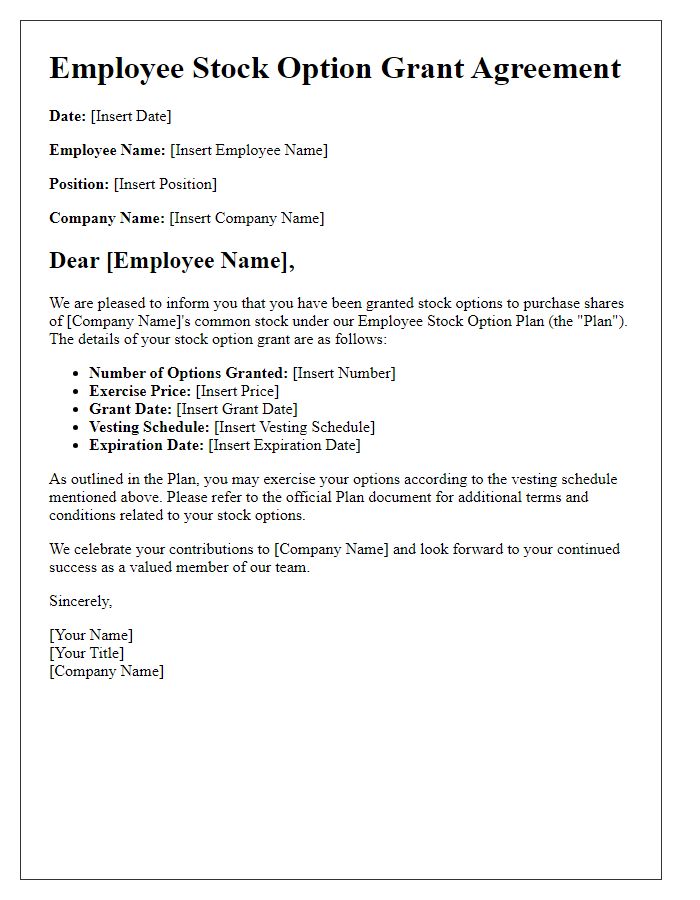

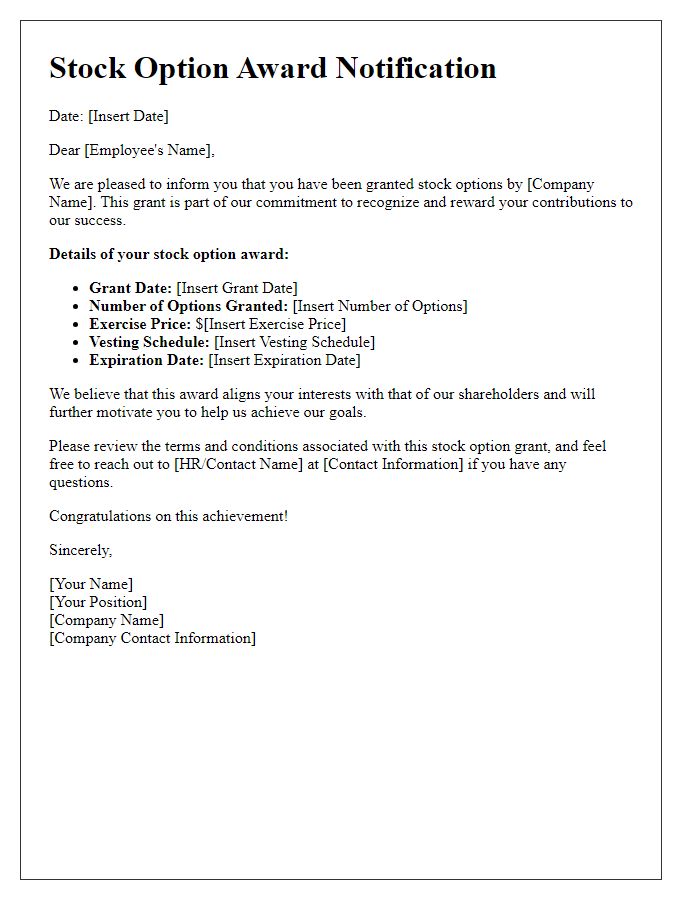

Clear outline of terms and conditions

Employee stock option plans (ESOPs) provide employees with the opportunity to purchase company shares at a predetermined price, often referred to as the exercise price. These plans typically include key terms such as eligibility criteria, which may specify full-time employees who have completed a minimum employment period (often one year). Vesting schedules dictate the timeline over which employees earn the right to exercise their options, commonly extending over four years with a one-year cliff. The exercise period outlines how long employees have to purchase shares after they vest, typically up to ten years from the grant date. Tax implications are crucial, as employees may incur taxes at both the time of option exercise and sale of shares. The plan may also define termination conditions, addressing whether options remain valid upon employee resignation or termination. Lastly, the company may reserve the right to modify or terminate the plan but must ensure that existing grants remain protected under the original terms.

Vesting schedule details

The employee stock option plan (ESOP) provides an opportunity for eligible employees to acquire shares of the company, enhancing motivation and aligning interests between employees and shareholders. The vesting schedule establishes when employees can exercise their options to purchase stocks. Typically, the vesting period is structured over four years, with a one-year cliff, meaning that employees must work at least one year before any options become available. Following the cliff, options may vest monthly or annually, depending on the specific terms outlined in the plan. For example, if an employee is granted 1,200 options, 300 options may vest at the end of the first year, and then an additional 75 options may vest monthly thereafter. This staggered approach encourages long-term commitment and retention, ultimately benefiting the company's growth and stability.

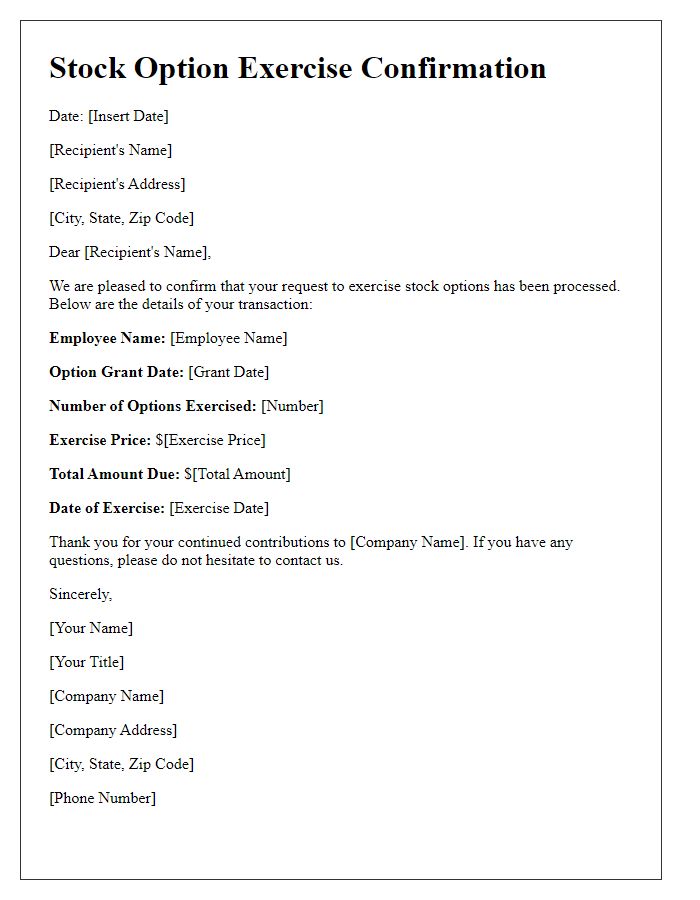

Exercise price and method

The employee stock option plan (ESOP) features a predefined exercise price of $15 per share, established to align with market conditions as of the plan's initiation date, June 1, 2022. Employees can exercise their options via a cash payment directly to the company or through a cashless exercise method, which involves selling a portion of the acquired shares to cover the exercise price, thereby minimizing their upfront cash outlay. This plan encourages employee investment in the company's future performance, fostering a sense of ownership and shared success within the organization. Additionally, stock options carry an expiration date of 10 years from the grant date, allowing employees ample time to assess market performance before making their decision.

Tax implications and responsibilities

Employee stock option plans (ESOPs) provide unique opportunities for employees to acquire company shares, typically at predetermined prices. Tax implications can vary based on the jurisdiction and specific plan structure. In the United States, for instance, employees may face ordinary income tax on the difference between the exercise price and fair market value at the time of exercise, potentially pushing them into a higher tax bracket. Additionally, capital gains tax is applicable on shares sold after holding them for over a year, benefiting from lower rates. Responsibilities include understanding the specific terms of the ESOP, adhering to exercise timelines, and maintaining accurate records for tax reporting purposes. Employees should consult with a tax professional to navigate individual circumstances and ensure compliance with federal and state tax regulations.

Expiration and termination clauses

The employee stock option plan (ESOP) outlines specific expiration and termination clauses integral to its execution. Options granted under the ESOP typically expire 10 years from the grant date, ensuring a defined period for exercise. In events such as employee termination, options may be affected according to the type of separation; for example, employees who resign voluntarily may have only 90 days to exercise their vested options, while those terminated for cause could forfeit their unexercised options immediately. Additionally, in cases of retirement or disability, different provisions may apply, allowing extended exercise periods to accommodate the circumstances of the individual. Understanding these clauses ensures employees are aware of their rights and obligations concerning their stock options.

Comments