Are you looking to understand how to effectively report your apartment rental income? Navigating the world of rental income can be complex, but with the right guidance, it can be a breeze. We'll break down the essentials you need to know, from tracking your income to understanding tax implications, to ensure you're fully prepared for tax season. So grab a cup of coffee and let's dive into the details together!

Tenant Information

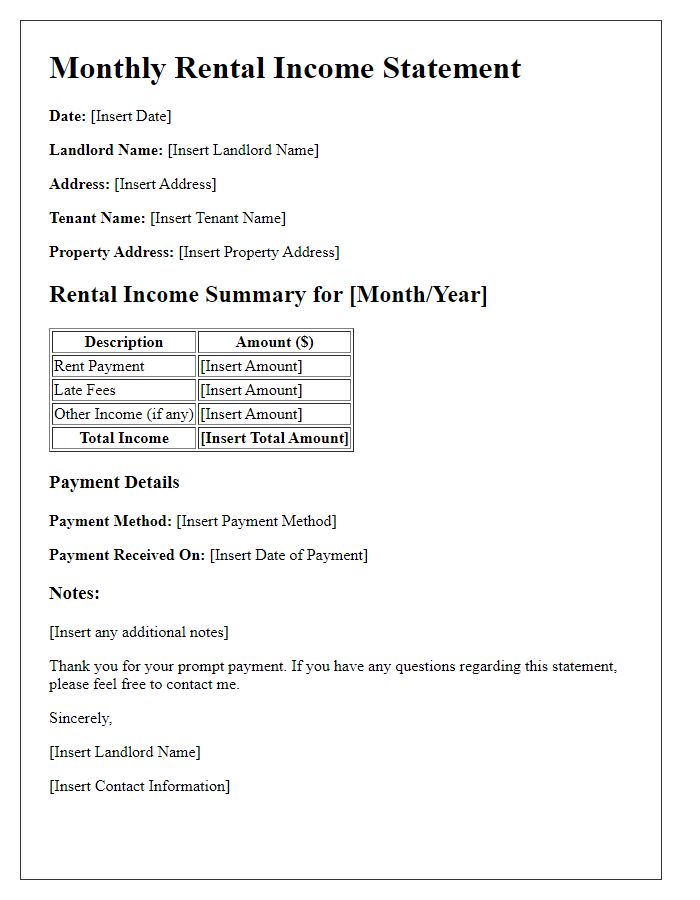

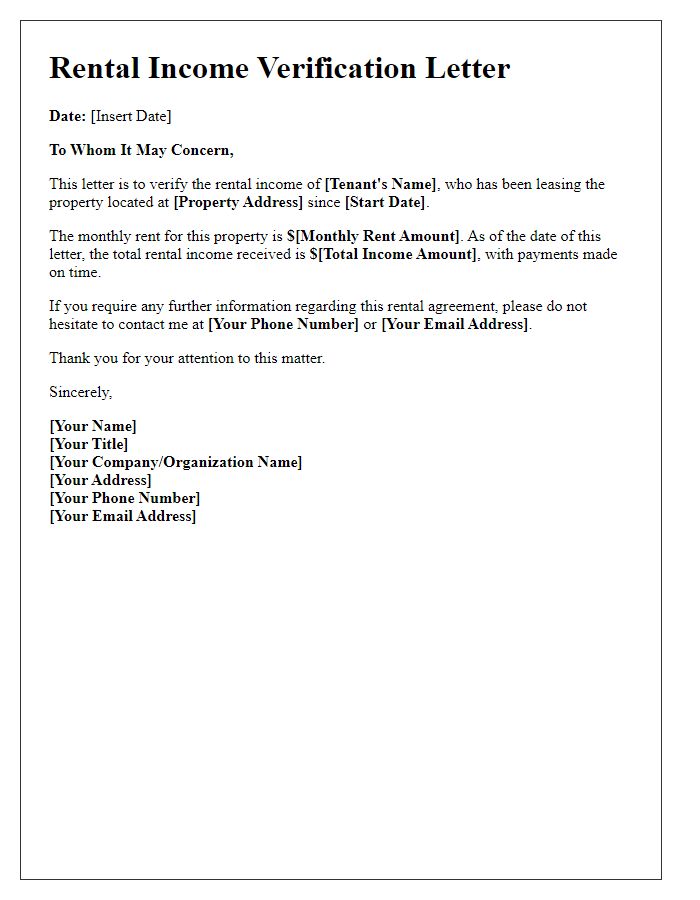

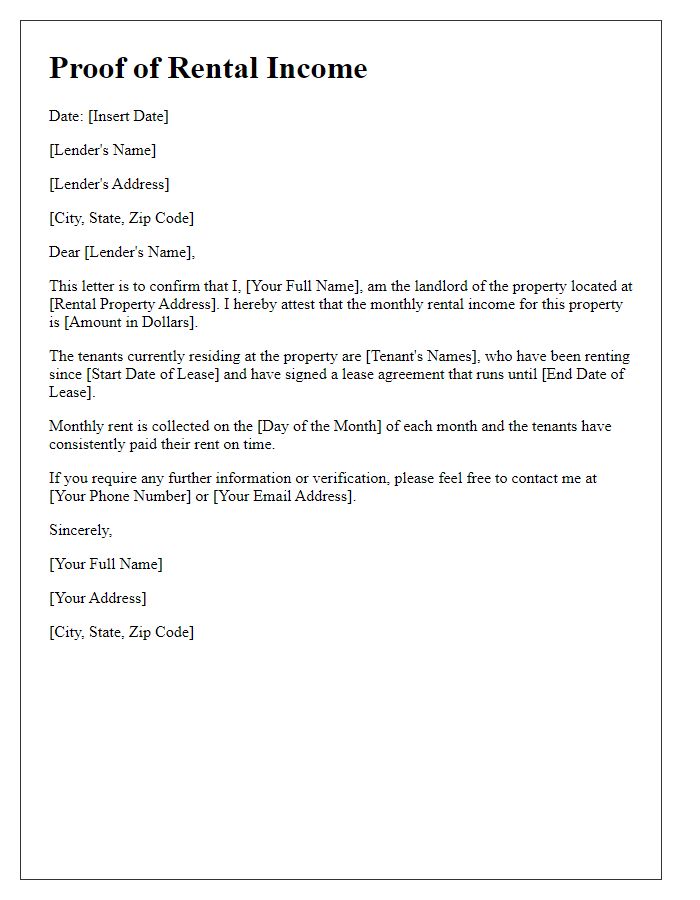

Tenant information plays a crucial role in apartment rental income reporting. Essential details include tenant names (e.g., John Smith, Emily Johnson), lease start and end dates (e.g., January 1, 2023, to December 31, 2023), monthly rent amounts (e.g., $1,500), payment history (e.g., timely, late payments), and any additional fees (e.g., pet fees of $200). Accurate documentation of tenant contact information (e.g., email and phone number) ensures proper communication. It is also vital to track the security deposit amount (e.g., $1,500) and the conditions under which it may be withheld at the end of the lease. Maintaining organized records of tenant information aids in financial analysis and tax reporting, ensuring compliance with local rental laws in places like California or New York.

Rental Property Address

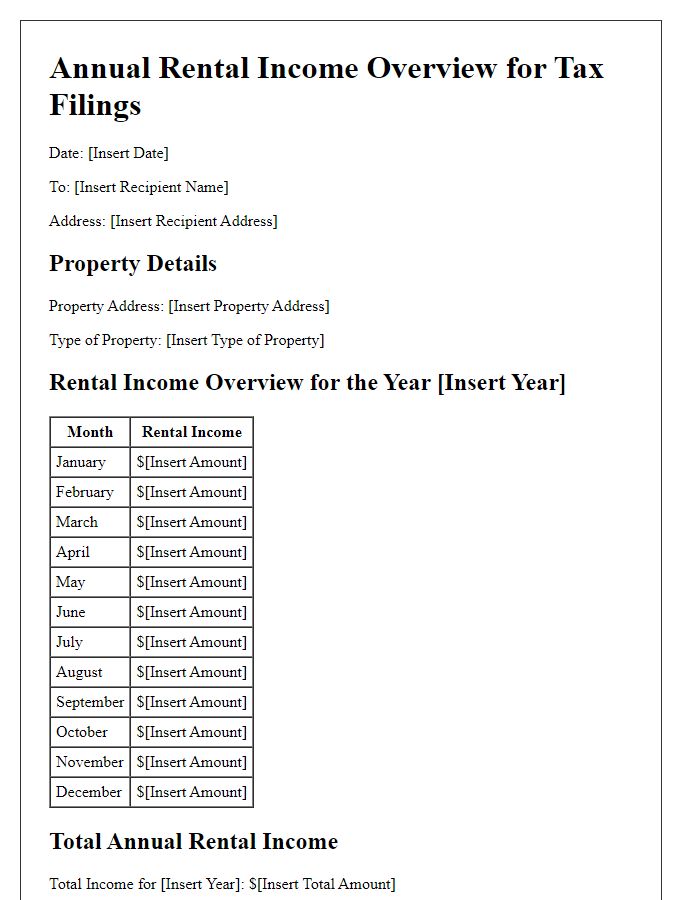

The address of the rental property, such as 1234 Elm Street, Springfield, serves as the location where the rental income is generated. This property may attract tenants due to nearby amenities, such as parks, schools, and shopping centers, which contribute to its desirability. Additionally, local market trends, including rental rates and vacancy rates, impact the financial performance of the property. Accurate documentation of rental income is crucial for tax reporting, ensuring compliance with local regulations established by the Internal Revenue Service (IRS) or appropriate governing bodies. Regular annual income assessments provide a clear picture of the profitability of this investment.

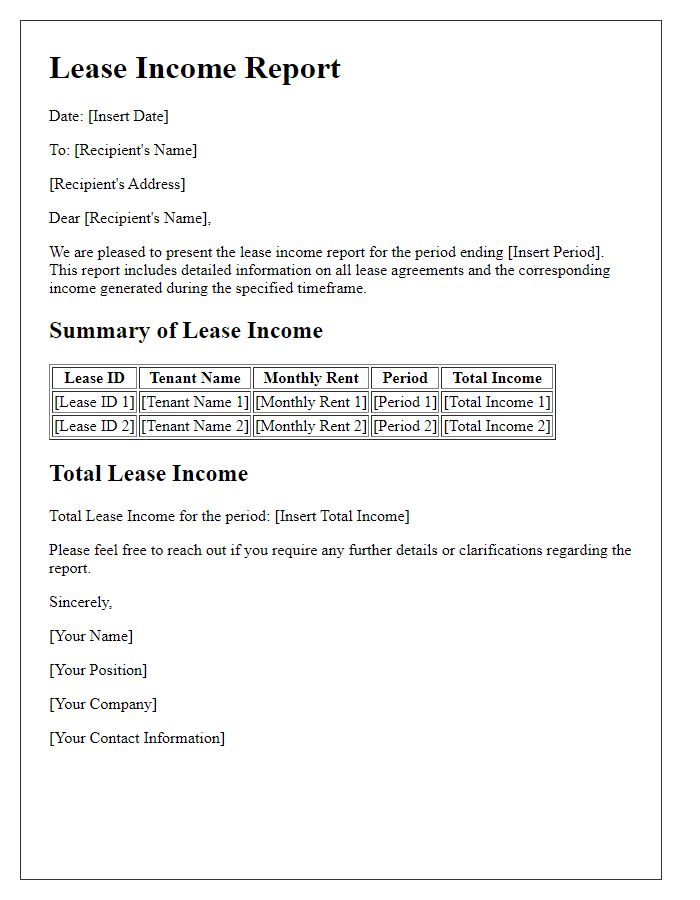

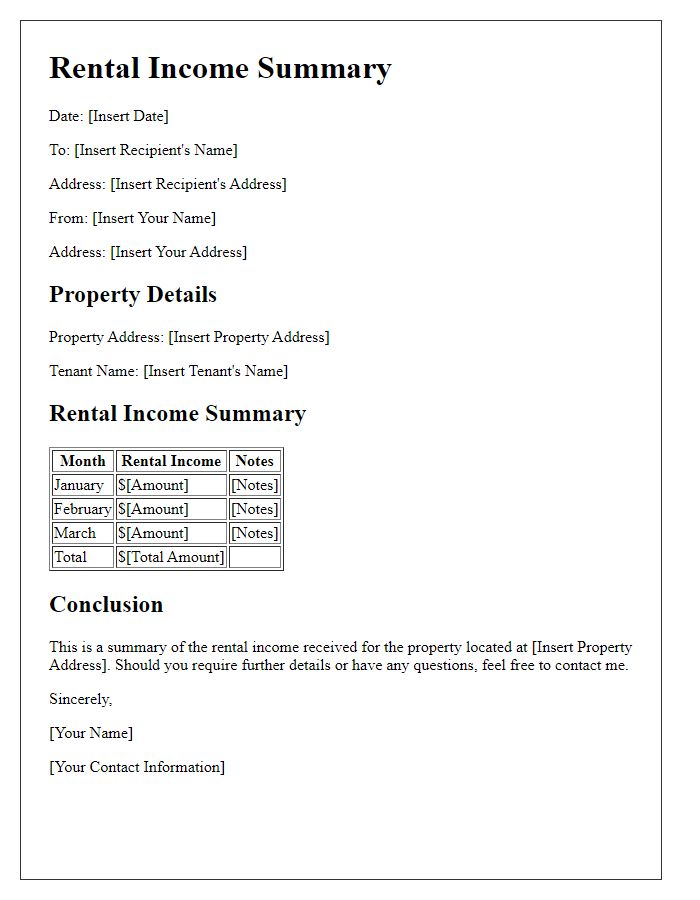

Rental Income Details

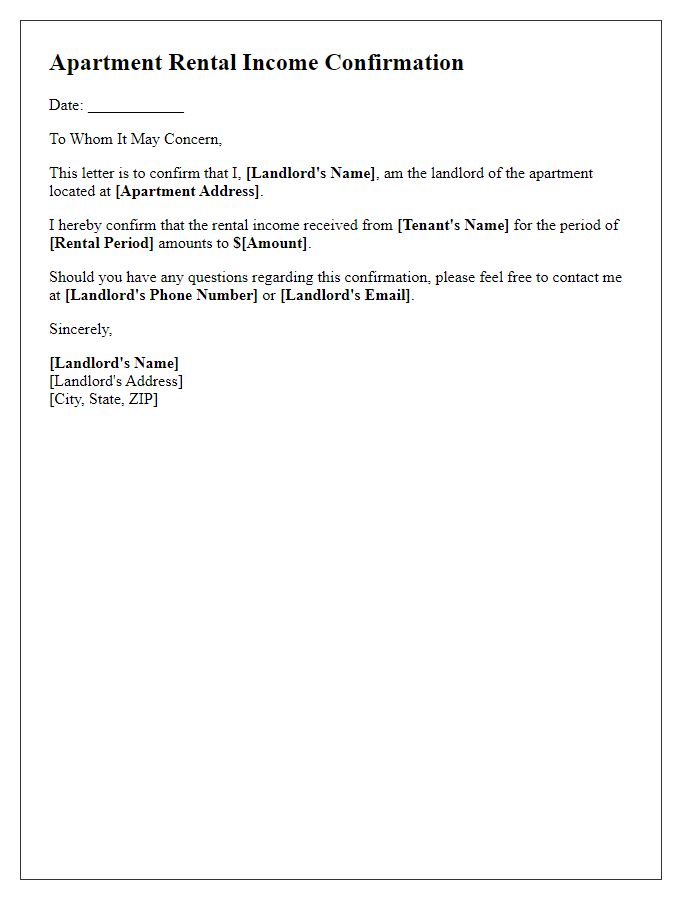

Rental income plays a vital role in real estate investments, providing financial returns through properties such as apartments, townhouses, or single-family homes. Specific details about rental income, including the monthly rent amount, lease start and end dates, and the identity of tenants, are crucial for accurate financial reporting. For example, a two-bedroom apartment located in Denver, Colorado, may have a rental income of $2,000 per month under a one-year lease agreement with the tenant set to renew in June 2024. Additionally, maintaining records of rental payments, late fees, and any expenses associated with property maintenance is essential for precise profit and loss assessments. Compliance with local tax regulations regarding rental income reporting, such as those outlined by the IRS, ensures adherence to legal requirements while maximizing potential tax deductions for property-related expenses.

Expense Deductions

When renting property in the United States, landlords can deduct various expenses related to managing and maintaining their rental units. Common deductible expenses include property management fees, which may account for 10-15% of gross rental income, repairs and maintenance costs, including plumbing or electrical work that can range from $100 to several thousand dollars depending on the severity, property insurance premiums, often between $500 to $2,000 annually, and mortgage interest payments, which can constitute a significant portion of monthly expenses based on the principal loan amount. Depreciation also offers tax relief; for residential properties, the IRS allows a standardized deduction over 27.5 years. Utilities paid by landlords, such as water or electricity, contribute to total expenses as well. Keeping detailed records of these expenses is crucial for accurate reporting and maximizing tax benefits.

Signature and Date

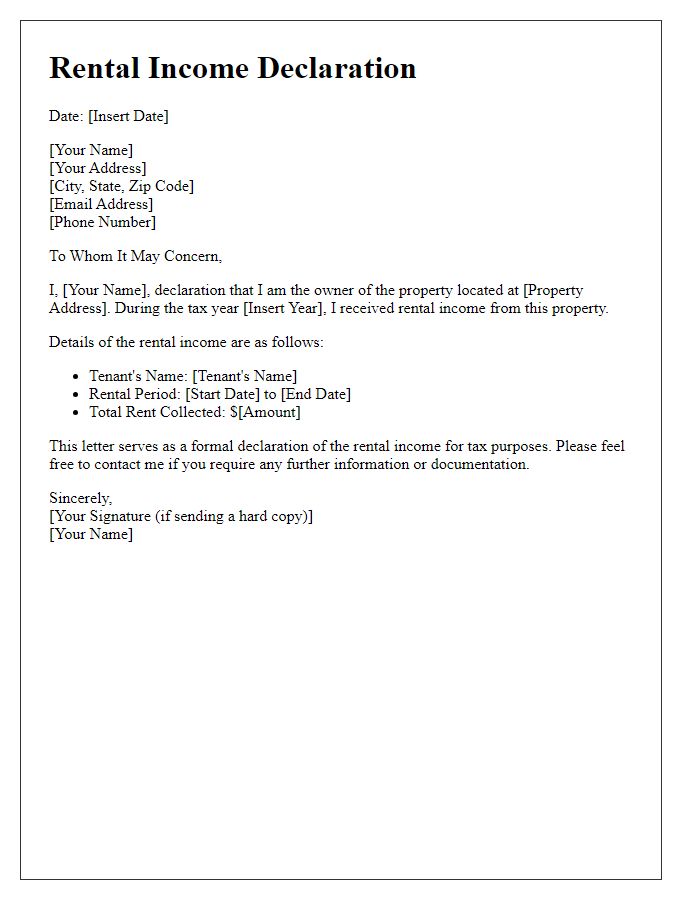

Apartment rental income reporting plays a crucial role in financial documentation for property owners. Rental income, defined as the monthly cash flow received from tenants occupying residential units, must be accurately recorded for tax purposes. In cities like New York (where average rental prices can exceed $3,000 per month), precise income reporting is essential to comply with IRS regulations and local housing laws. Contact information, such as the property owner's address (ensuring it matches official documents), along with the tenant's details, supports validation. Essential elements like the rental period (e.g., January to December 2023) and the total income received are integral, ensuring clarity. A signature line confirms the authenticity of the report, while the date underscores the timeliness of the submission, critical for financial audits or tax filings.

Letter Template For Apartment Rental Income Reporting Samples

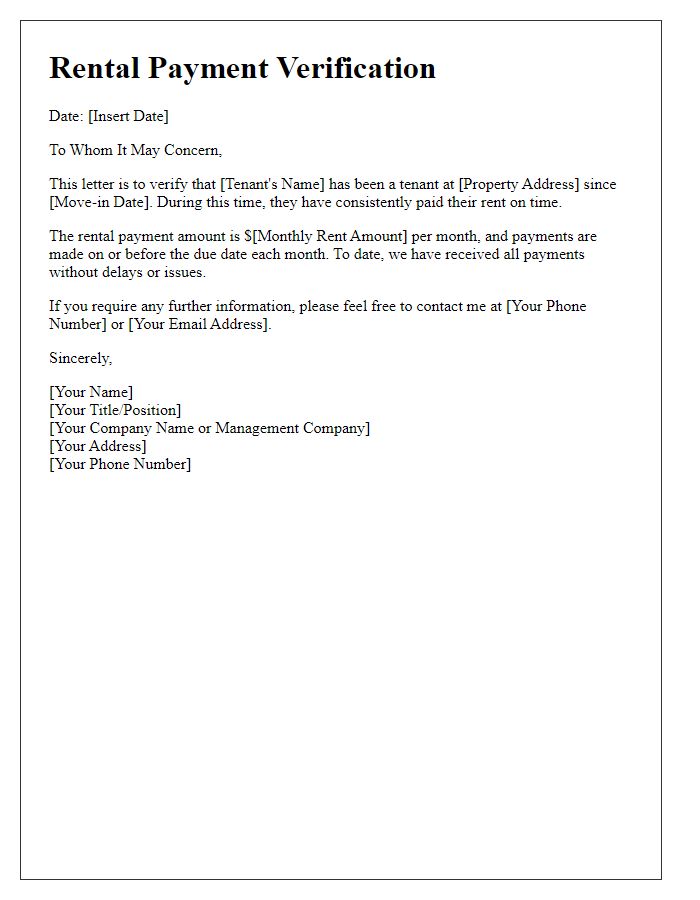

Letter template of rental payment verification for mortgage applications

Comments