When it comes to handling debt collection, effective communication is key. Crafting the right letter can make all the difference in encouraging prompt payment while maintaining a professional tone. In this article, we'll explore a simple template you can use to clearly outline your request and set the tone for a positive resolution. Ready to learn how to create an impactful debt collection letter? Let's dive in!

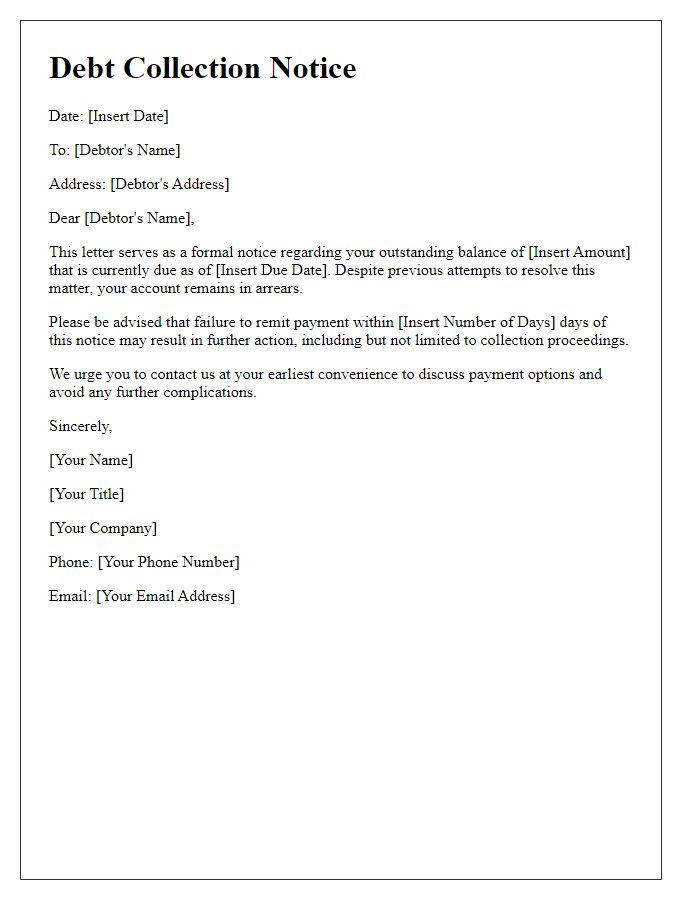

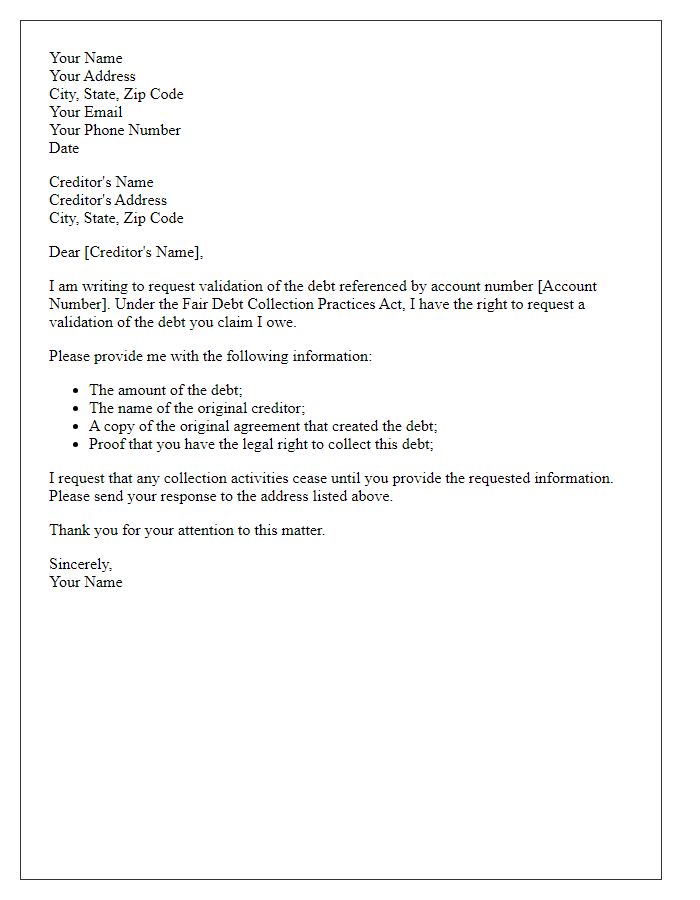

Creditor's Contact Information

Debt collection requests often include essential creditor information to ensure effective communication. Creditor's contact information typically comprises the full name of the creditor's company, mailing address (including street name, city, state, and ZIP code), phone number (with area code), and an email address. Additionally, including relevant identifying details, such as account numbers or reference numbers (unique identifiers assigned to the debt account), can help streamline the process. Providing the creditor's business hours can assist debtors in knowing the best times to contact for discussions regarding the outstanding debt. This information is crucial for both parties in navigating the resolution of the outstanding balance.

Debtor's Contact Details

The debtor's contact details should include essential information to facilitate effective communication and collection efforts. Include the full name of the debtor, which is critical for identification in legal processes. A valid mailing address, preferably the most recent residence, ensures that any correspondence reaches the debtor directly. Furthermore, a contact phone number is important for immediate outreach, ideally a mobile number for better accessibility. An email address can also enhance communication, allowing for quicker exchanges of information or documents. Information collected must comply with privacy regulations to ensure the confidentiality of the debtor's personal data.

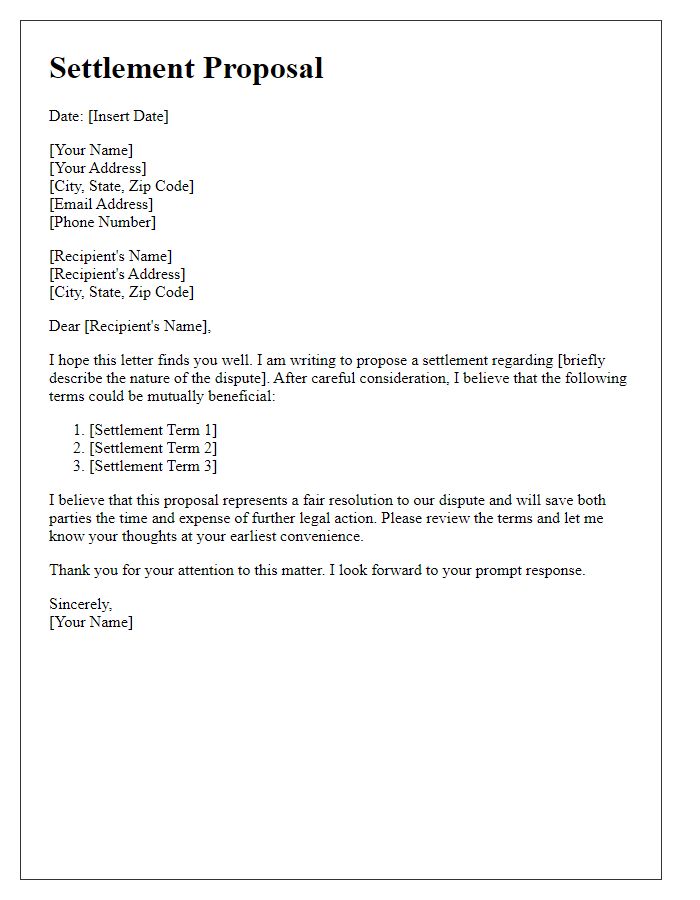

Outstanding Debt Amount and Due Date

Outstanding debts can severely impact an individual's financial stability and overall peace of mind. An unpaid debt amounting to $1,500, originally due on September 30, 2023, can lead to increased stress as it accrues interest. Late payment fees may escalate this figure further, complicating repayment efforts. Moreover, ongoing communication regarding this debt, typically with a collections agency or creditor, can negatively impact credit scores, creating barriers to future loans or credit access. Addressing this outstanding debt promptly can prevent potential legal actions or garnishments regarding wages, thereby preserving financial well-being.

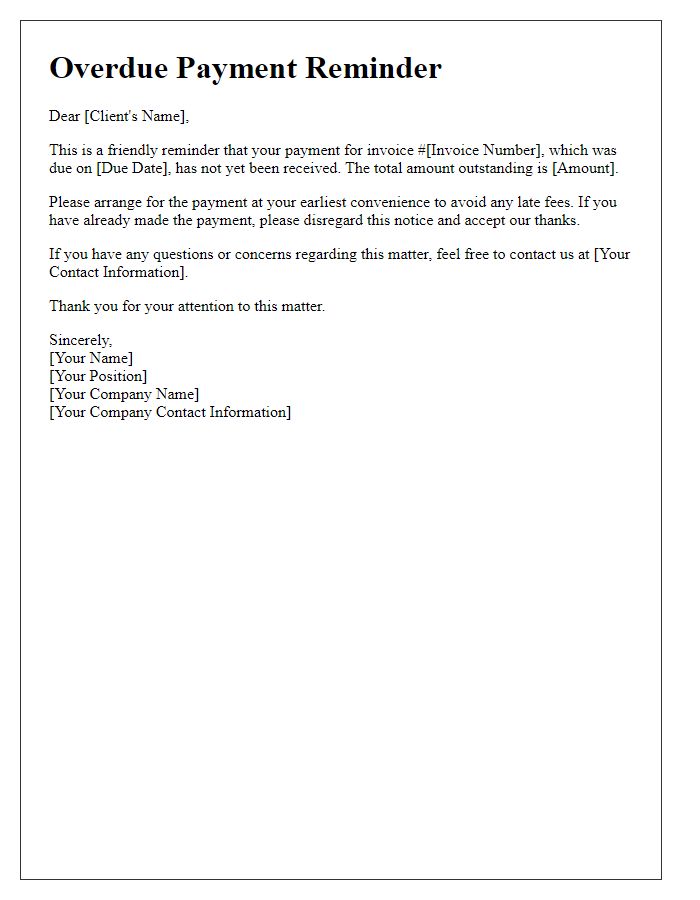

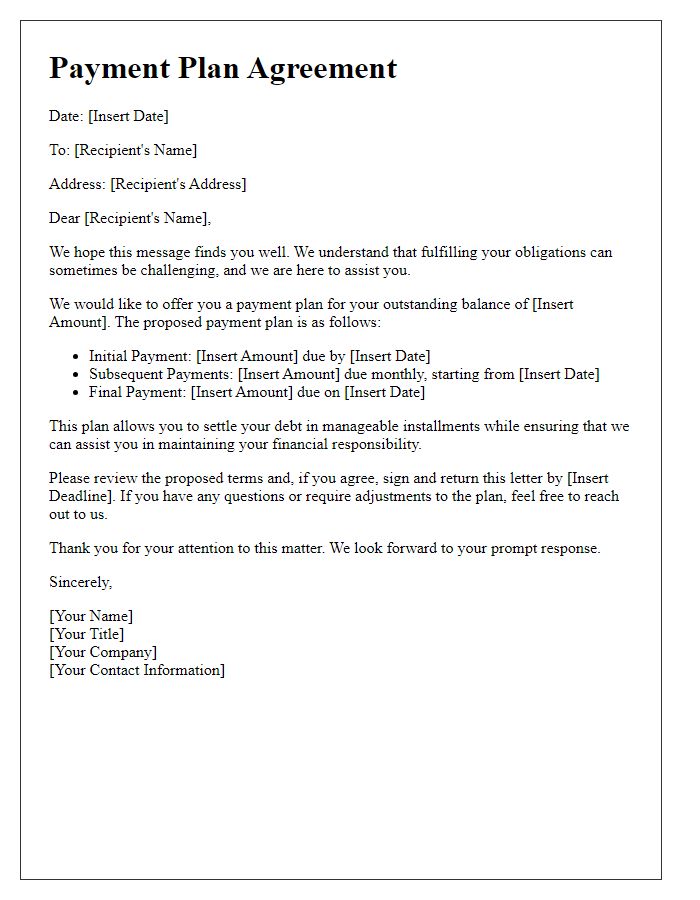

Payment Methods and Options

Businesses often require clear communication regarding payment methods and options when requesting debt collection. Acceptable payment methods typically include credit cards (Visa, MasterCard), bank transfers, and electronic payment platforms (PayPal, Venmo). A clear breakdown of options enhances customer understanding and promotes timely payment. Providing specific instructions regarding each payment method, including necessary account numbers and transaction limits, can facilitate smoother transactions. Deadlines for payment should also be established, often ranging from 30 to 60 days after the initial notice, ensuring recipients are aware of the urgency in settling their debts.

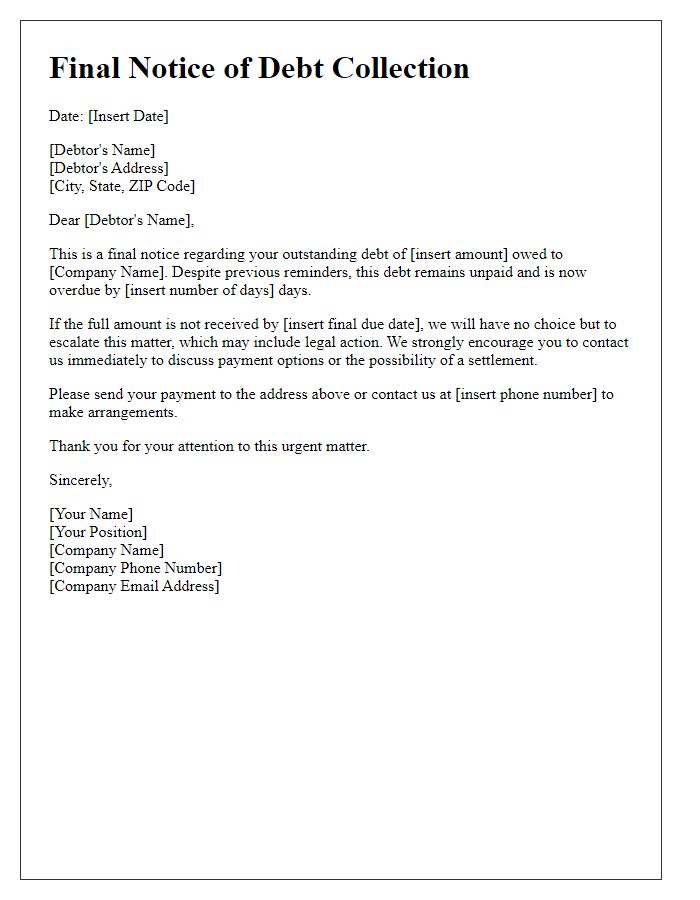

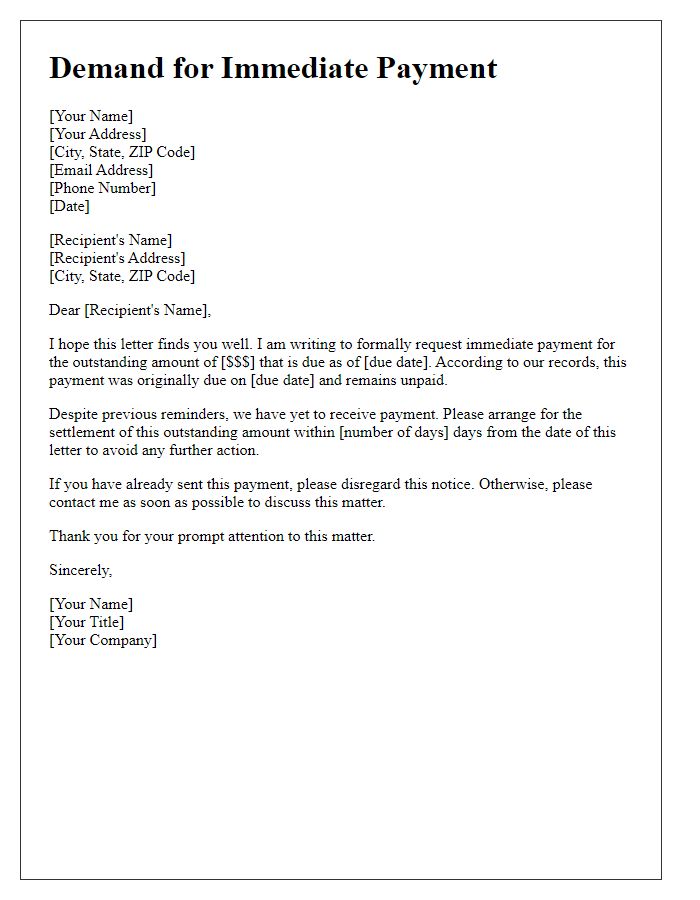

Consequences of Non-Payment and Legal Actions

Failure to fulfill debt obligations may lead to serious consequences for the debtor involved. Legal actions may initiate within 30 days of the missed payment deadline, potentially resulting in court summons or financial judgments. In certain jurisdictions, collection agencies may escalate recovery efforts, which can adversely impact credit scores significantly--often by 100 points or more. Furthermore, garnishment of wages may occur, whereby a portion of the debtor's earnings is withheld directly by the employer. Non-payment can also lead to additional fees and interest accrual, compounding the original debt amount and lengthening the repayment timeline. Legal counsel may be sought by creditors, increasing the financial burden on the debtor.

Comments