Are you curious about how municipal bonds can affect your tax situation? These investment tools not only provide reliable returns, but they also come with unique tax advantages that can benefit your portfolio. Understanding the nuances of municipal bond tax treatment is essential for maximizing your investment strategy and minimizing your tax burden. Dive into the details with us to discover how these bonds could be a game-changer for your financial planning!

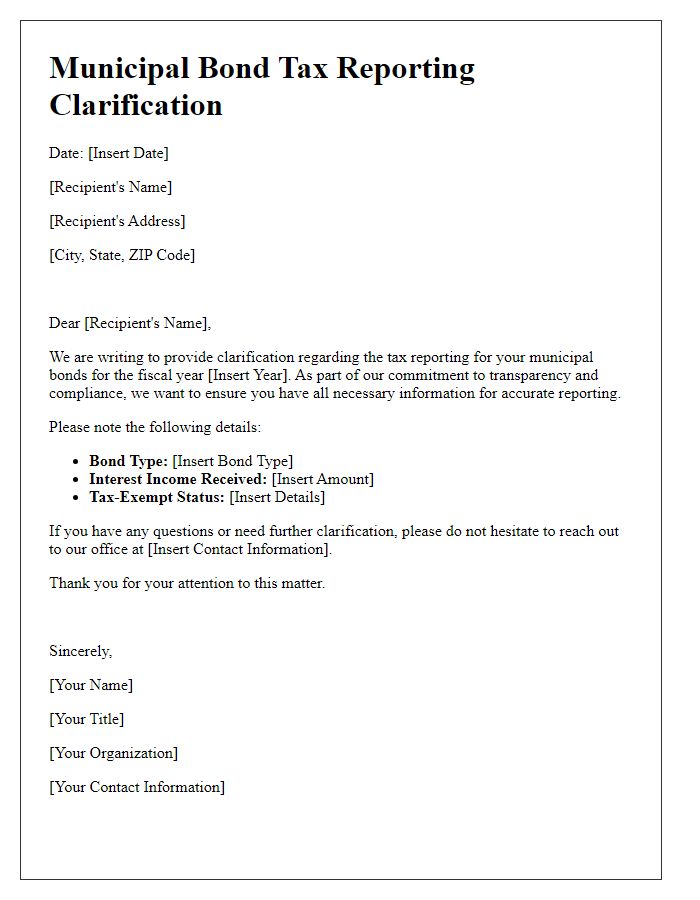

Jurisdiction-specific tax regulations

Municipal bonds, often referred to as tax-exempt bonds, can offer significant financial advantages in various jurisdictions. Local tax regulations, such as those established by the Internal Revenue Service (IRS) in the United States, can dictate specific tax treatments and exemptions. For instance, in New York City, residents can enjoy the dual benefit of state and local tax exemptions on interest income earned from municipal bonds issued within the state. Similarly, California's regulations may offer a marginal tax rate reduction for resident bondholders, particularly for bonds supporting local infrastructure projects. Notably, the treatment of these bonds can vary substantially between jurisdictions, impacting investment strategies and overall returns for individuals and institutional investors. Knowledge of local tax rules is essential for optimizing the benefits associated with these financial instruments and for effective portfolio management.

Types of municipal bonds (e.g., general obligation, revenue)

Municipal bonds serve as a vital financing tool for state and local governments, categorized primarily into general obligation bonds and revenue bonds. General obligation bonds derive their repayment from the issuing municipality's taxing power, often backed by property taxes, making them relatively secure investments. For instance, in 2020, municipalities in California issued approximately $12 billion in general obligation bonds to fund public projects. On the other hand, revenue bonds are repaid from a specific revenue stream, such as tolls from a highway or fees from a public utility, which usually makes them riskier than general obligation bonds. An example includes the issuance of revenue bonds to finance the construction of the new San Francisco Bay Bridge, linking Oakland and San Francisco, generating income through toll collection. Understanding the distinct characteristics and tax implications of these bond types is crucial for investors seeking favorable tax treatment, as interest from most municipal bonds is exempt from federal taxes and often from state taxes if held within the issuing state.

Tax-exemption qualifications

Municipal bonds provide tax-exempt status for investors, particularly under the Internal Revenue Code in the United States. These bonds, typically issued by states, cities, or counties, finance public projects like schools, highways, and infrastructure. Tax-exemption is contingent upon certain qualifications including compliance with regulations governing issuance and use of proceeds, like the 26 USC SS 103 requirements. Additionally, the proceeds from these bonds should be allocated solely for governmental purposes, which highlights their role in enhancing public welfare. Investors should be aware that tax-exempt interest may still have implications for alternative minimum tax (AMT) calculations, requiring careful financial planning.

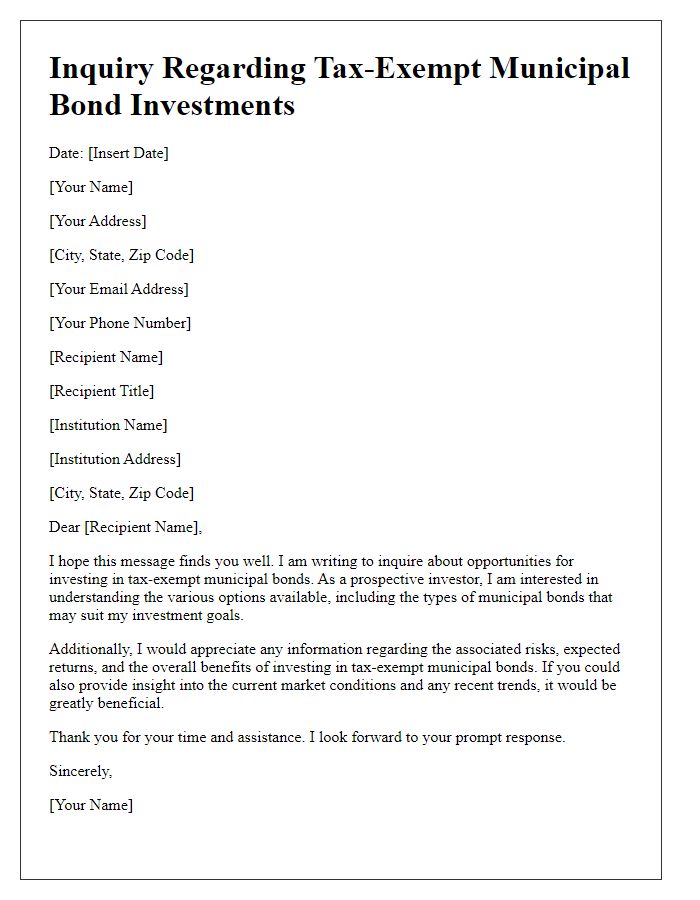

Reporting requirements for bondholders

Municipal bonds, often issued by state or local governments for public projects, generally provide tax-exempt interest income for bondholders. According to the Internal Revenue Service (IRS) guidelines, bondholders must report interest income from municipal bonds on Form 1040. The reported interest is exempt from federal income tax but may be subject to state taxes depending on residency. Specific reporting requirements stipulate that bondholders maintain accurate records of accrued interest and any capital gains or losses when bonds are sold. Certain municipalities may issue bonds with taxable interest, thus requiring bondholders to follow different reporting procedures. Additionally, the disclosure of premium amortization (decreasing bond cost over time for bonds purchased above par value) is essential for maintaining compliance with tax regulations. Understanding these reporting obligations helps bondholders avoid potential penalties while maximizing their tax advantages.

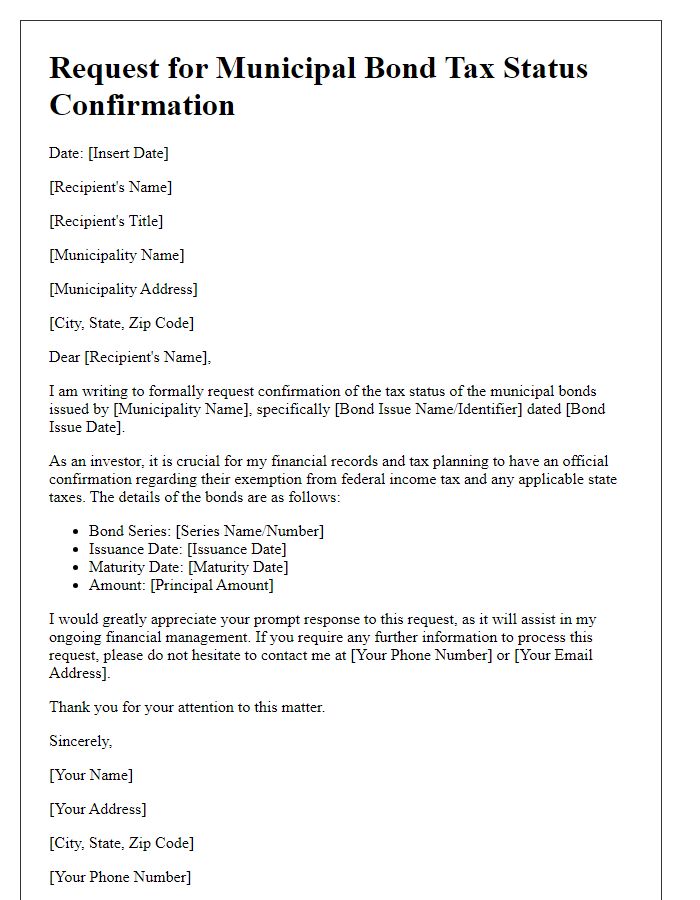

Compliance with IRS guidelines

Municipal bonds, issued by state or local governments in the United States, often receive favorable tax treatment under the Internal Revenue Service (IRS) guidelines, making them an attractive investment. Generally, the interest income from these bonds is exempt from federal income tax, providing a financial benefit to investors seeking tax-efficient strategies. Some municipal bonds may even be exempt from state and local taxes, depending on the investor's residence and the bond's issuing authority, such as California or New York municipalities. Compliance with IRS regulations is crucial for investors to maintain these tax advantages, requiring accurate reporting of interest income on tax returns. It is essential to consult the IRS Publication 550, which outlines the tax treatment of investment income, including specific rules on reporting municipal bond interest and potential alternative minimum tax implications.

Comments