Are you feeling overwhelmed by the complexities of capital gains tax calculations? You're not aloneâmany people find this topic confusing, but it's essential for effective financial planning. In this article, we'll break down the key components of capital gains and how to accurately calculate what you owe. So, if you're ready to simplify this process and boost your financial knowledge, keep reading!

Asset description

The asset description of the residential property located at 123 Maple Avenue, Springfield, purchased on January 15, 2015, for $250,000, resulted in significant capital gains upon sale. The property, featuring a three-bedroom layout and a spacious garden, was sold on June 30, 2023, for $450,000. Renovations completed in 2020, totaling $50,000, improved market value. The capital gains tax calculation involves deducting the purchase price and improvements (totaling $300,000) from the sale price, leading to a taxable capital gain of $150,000. This transaction falls under federal capital gains tax regulations, effective with assessment periods ending on December 31, 2023.

Acquisition date and cost

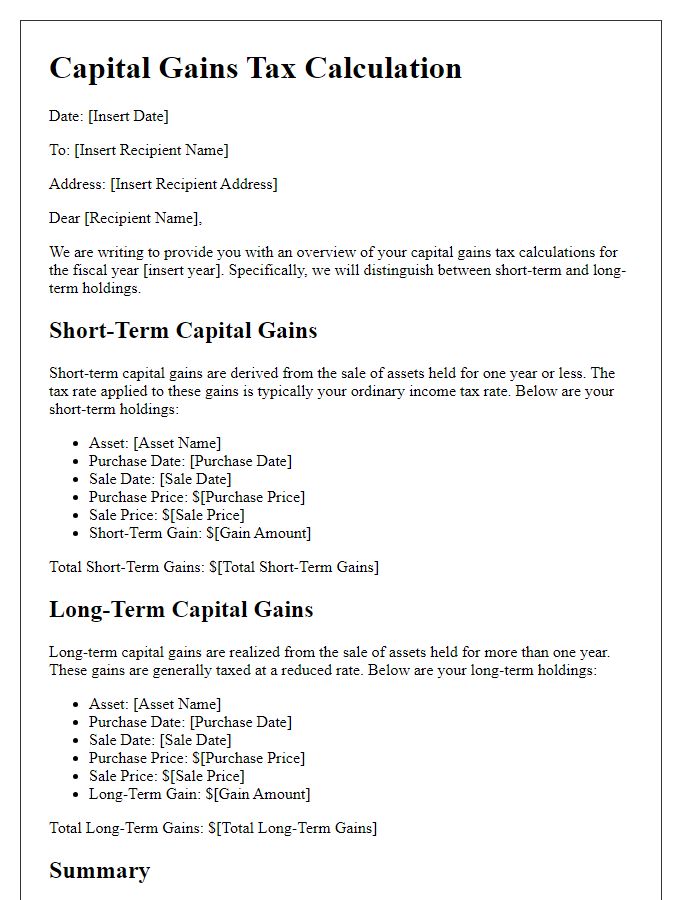

For capital gains tax calculation, the acquisition date signifies when an asset, such as real estate or stocks, was purchased. The acquisition cost encompasses the total amount spent to acquire the asset, including purchase price, associated fees, and taxes. Proper documentation of both the acquisition date and cost is essential, as it determines the holding period for capital gains tax implications. For example, assets held for over one year typically qualify for long-term capital gains rates, which are generally lower compared to short-term rates applicable to assets held for less than a year. Accurate reporting of these details ensures compliance with tax regulations, allowing for potential deductions related to expenses incurred during acquisition.

Disposal date and proceeds

The disposal of assets, such as real estate or stocks, is subject to capital gains tax calculations. The disposal date, which marks the transaction completion, is critical for determining the holding period of the asset, influencing the applicable tax rate. Proceeds from the sale include the total amount received, comprising cash, property value, or other forms of compensation. For instance, if a property located in Los Angeles, California sells for $500,000 on June 15, 2023, understanding the net capital gain requires subtracting the initial purchase price and associated costs, affecting the overall tax liability. Accurate record-keeping of both dates and amounts is essential for compliance with IRS regulations.

Applicable exemptions and reliefs

Capital gains tax calculations for property transactions require a thorough understanding of various applicable exemptions and reliefs. Principal residence exemption allows homeowners to exclude gains from the sale of their primary residence, which has been owned and lived in for at least two of the past five years. Entrepreneurs' relief can reduce the tax rate on qualifying business assets to 10%, provided specific conditions are met, including the ownership of the business for a minimum of two years. Investors should also consider the annual exempt amount, which allows individuals to realize a certain amount of capital gains tax-free each tax year (for example, PS12,300 for the fiscal year 2021-2022 in the UK). Certain capital losses can also offset gains, minimizing overall tax liability.

Calculated taxable gain

Capital gains tax calculation involves determining the taxable gain from the sale of assets such as real estate or stocks. The taxable gain is calculated by subtracting the asset's original purchase price (known as the basis) from the sale proceeds. For example, if an individual sells a property in New York City for $500,000 after purchasing it for $300,000, the taxable gain would amount to $200,000. Additionally, any improvements made to the asset, such as renovations worth $50,000, can adjust the basis upward, potentially lowering the overall tax liability. Understanding the applicable tax rates, which can vary based on income levels and holding periods, is crucial for accurate calculations. Furthermore, important events such as changes in tax laws or specific deadlines for reporting gains can significantly impact the final tax owed.

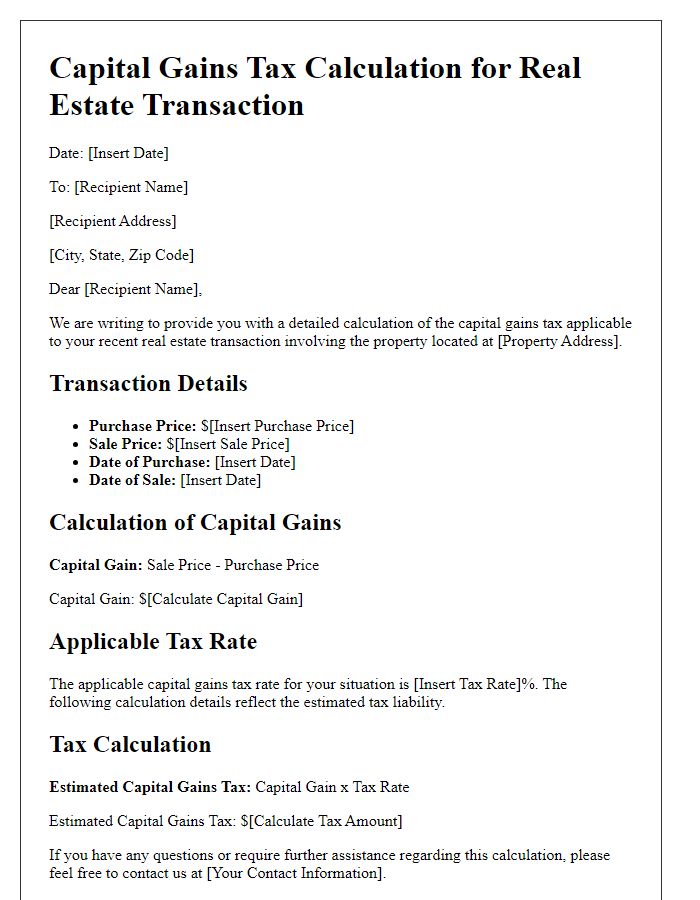

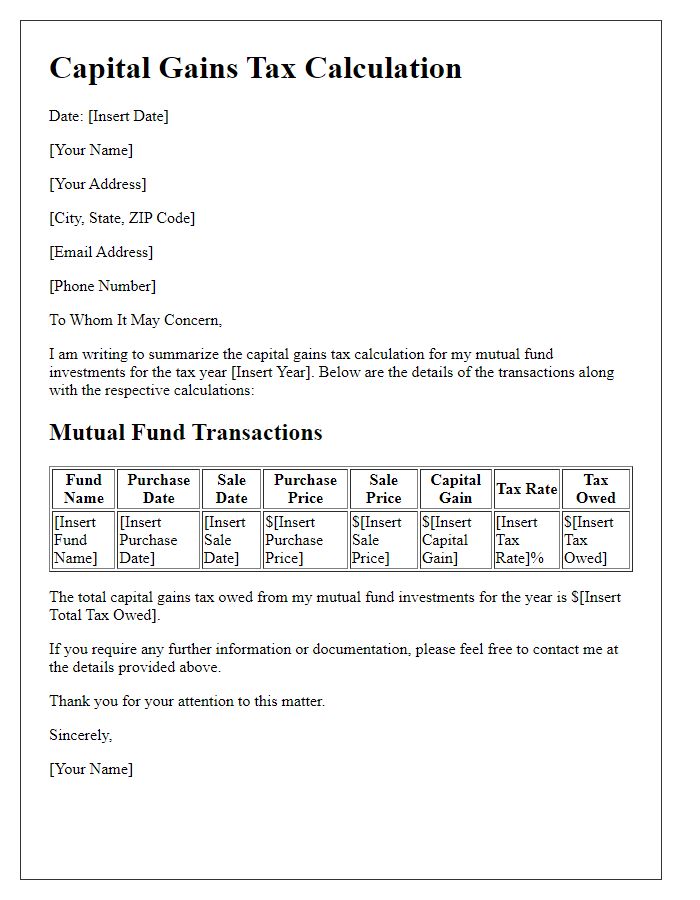

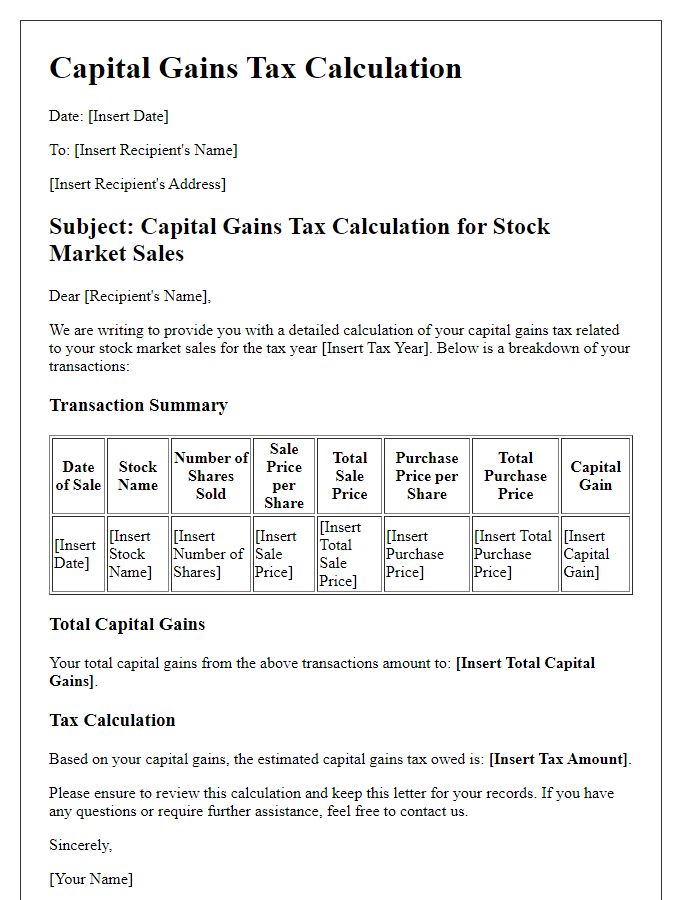

Letter Template For Capital Gains Tax Calculation Samples

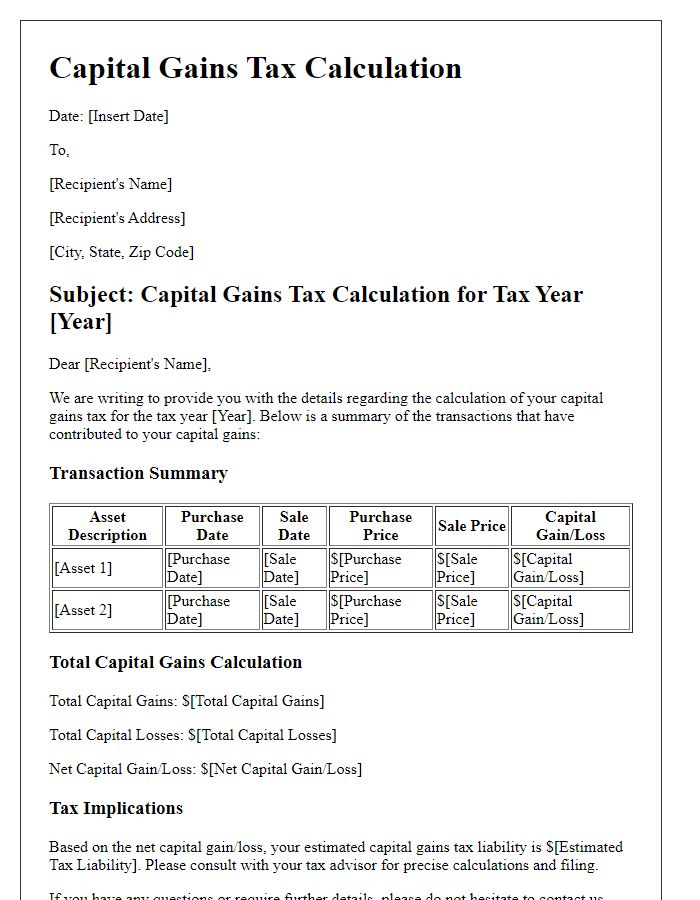

Letter template of capital gains tax calculation for real estate transactions.

Letter template of capital gains tax calculation for mutual fund investments.

Letter template of capital gains tax calculation for stock market sales.

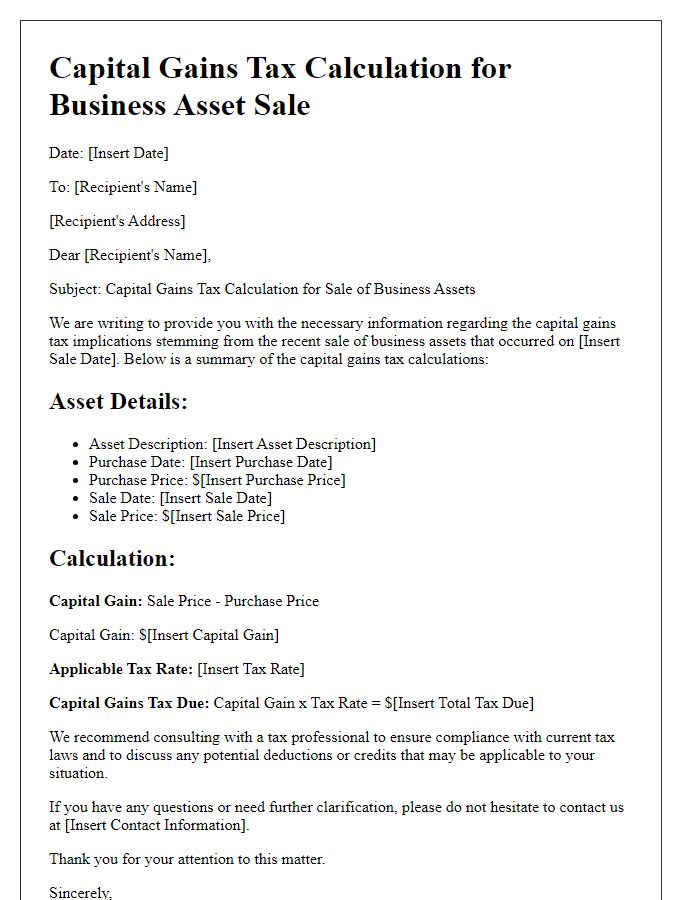

Letter template of capital gains tax calculation for business asset sales.

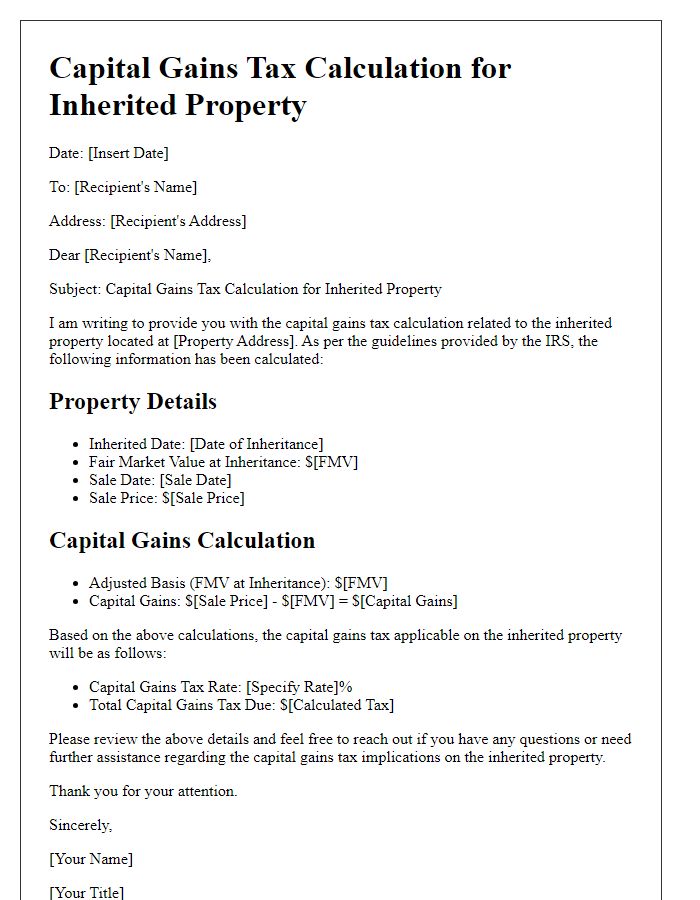

Letter template of capital gains tax calculation for inherited property.

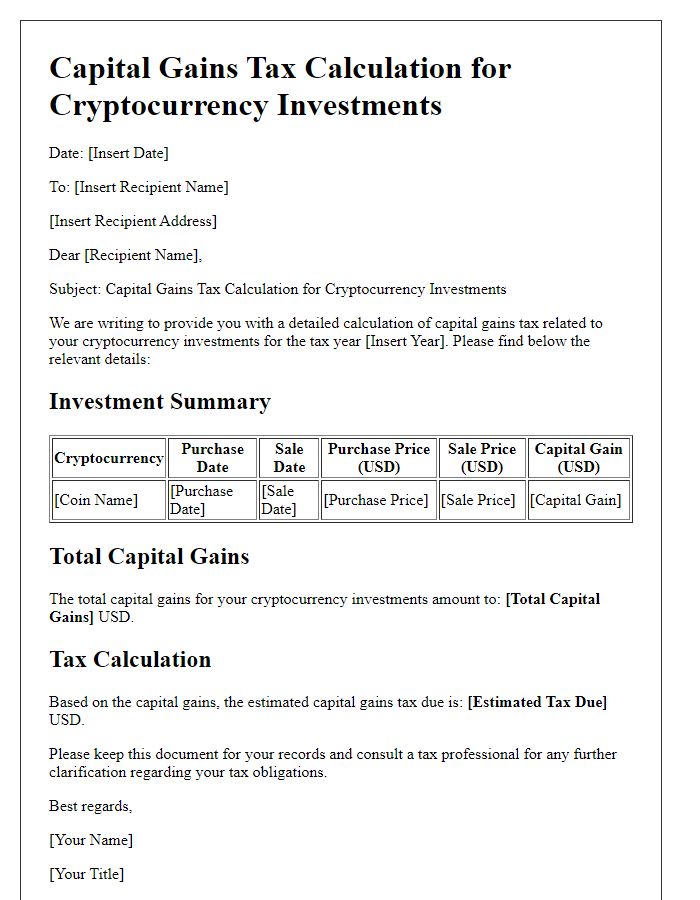

Letter template of capital gains tax calculation for cryptocurrency investments.

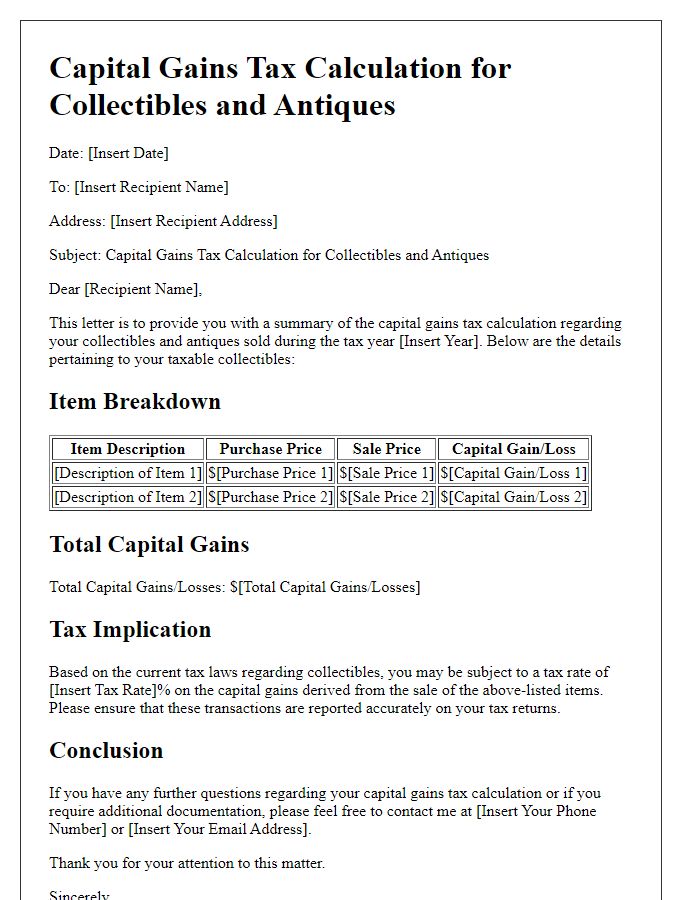

Letter template of capital gains tax calculation for collectibles and antiques.

Letter template of capital gains tax calculation for retirement account withdrawals.

Comments