Are you ready to dive into the intricate world of financial performance? This article unveils key insights and strategic recommendations tailored for senior management, ensuring you're well-equipped to make informed decisions. From analyzing financial trends to identifying opportunities for growth, we'll cover it all in a clear and accessible manner. So, come along and explore how our latest findings can empower your leadership; you won't want to miss what's next!

Executive Summary

The Executive Summary provides a concise overview of the company's financial performance for Q3 2023, highlighting key metrics such as revenue growth (15% increase year-over-year) and net profit margins (up to 25%). Significant events during this quarter include the successful launch of the new product line in North America and the strategic partnership established with a European market leader, enhancing market presence. Cost management initiatives led to a reduction in operational expenses by 10% while maintaining staff efficiency. The upcoming fiscal projections indicate sustained growth, driven by anticipated contributions from digital transformation initiatives and an expanding customer base, particularly within the Asia-Pacific region, where market demand has increased substantially.

Financial Performance Overview

The financial performance overview for Q3 2023 reveals a significant increase in revenue, reaching $2 million, driven primarily by a 15% rise in product sales within the technology sector. Key markets such as North America and Europe contributed substantially, with North America alone generating $1.2 million in sales, marking a 20% growth compared to Q2 2023. Operating expenses, however, saw an uptick of 10%, primarily due to increased marketing initiatives and personnel costs, totaling $800,000. Net profit for the quarter stands at $700,000, reflecting a margin of 35%. Cash flow from operations remains strong at $1 million, allowing for strategic investments in research and development of new product lines scheduled for launch in Q1 2024. Overall, the financial health of the organization indicates a positive trajectory, with key performance indicators surpassing previous forecasts.

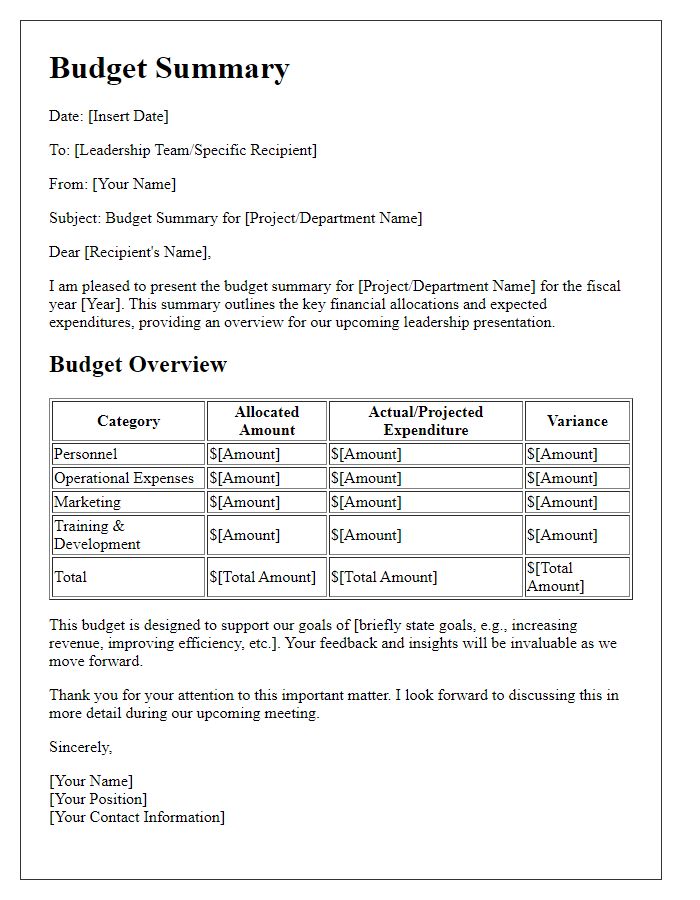

Key Financial Metrics

A financial briefing for senior management highlights essential metrics such as revenue, profit margins, and cash flow. Revenue growth, measured as a percentage increase from the previous quarter, provides insight into market performance. Profit margins, including gross and net margins expressed as percentages, reveal operational efficiency and cost management. Cash flow analysis, focusing on operating cash flow in relation to liabilities, indicates liquidity and the company's ability to meet short-term obligations. Key Performance Indicators (KPIs), such as Return on Investment (ROI) percentages and Earnings Before Interest and Taxes (EBIT), can also guide strategic decisions and resource allocation. Additionally, comparing these metrics across different regions--North America, Europe, and Asia-Pacific--enables management to identify trends and make informed business choices.

Strategic Initiatives Impact

Strategic initiatives impact organizations significantly, shaping future performance and direction. In 2023, companies like Apple and Amazon reported substantial shifts due to their investments in sustainability, digital transformation, and employee engagement. For instance, Apple's commitment to becoming carbon neutral by 2030 has influenced supply chain management and consumer loyalty, positioning the brand as an environmental leader. Similarly, Amazon's enhancement of its logistics infrastructure has improved delivery times, greatly impacting customer satisfaction. Key metrics such as Net Promoter Score (NPS) and Return on Investment (ROI) provide quantifiable insights into the effectiveness of these initiatives, informing senior management on resource allocation and operational adjustments. Additionally, consistent communication with stakeholders through quarterly briefings ensures alignment on strategic goals and ongoing challenges, ultimately driving organizational success.

Future Financial Projections

Future financial projections serve as a vital compass for organizational strategy and resource allocation. Analysts typically utilize historical data trends, economic forecasts, and market analysis to estimate anticipated revenue growth and potential cost fluctuations over the next three to five years. Key metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net profit margins provide insight into operational efficiency and profitability. External factors, including interest rates, inflation rates (projected at 2-3% annually), and consumer spending patterns are crucial in predicting changes in revenue streams. Upcoming events such as product launches or expansions into markets like Southeast Asia can significantly impact financial outlooks. Establishing realistic financial targets enhances stakeholder confidence and drives decision-making processes within the organization.

Comments