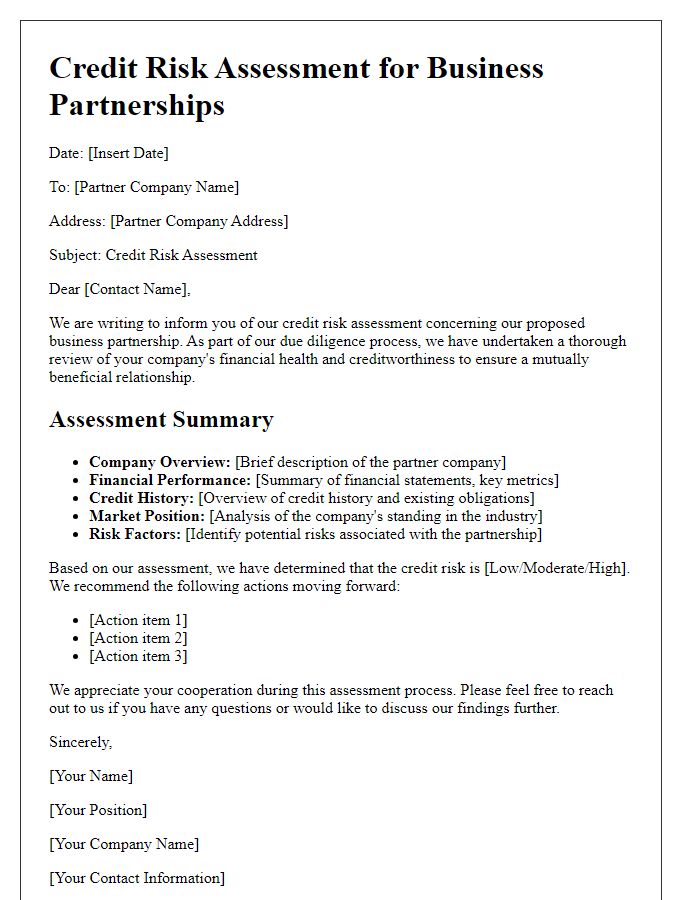

Are you looking to navigate the complexities of credit risk assessment with confidence? Understanding the nuances of evaluating creditworthiness is essential for both lenders and borrowers alike. In this article, we'll simplify the credit risk assessment process and provide you with practical tips to enhance your decision-making. So, pull up a chair and join us as we dive deeper into the world of credit assessment!

Applicant's financial health evaluation

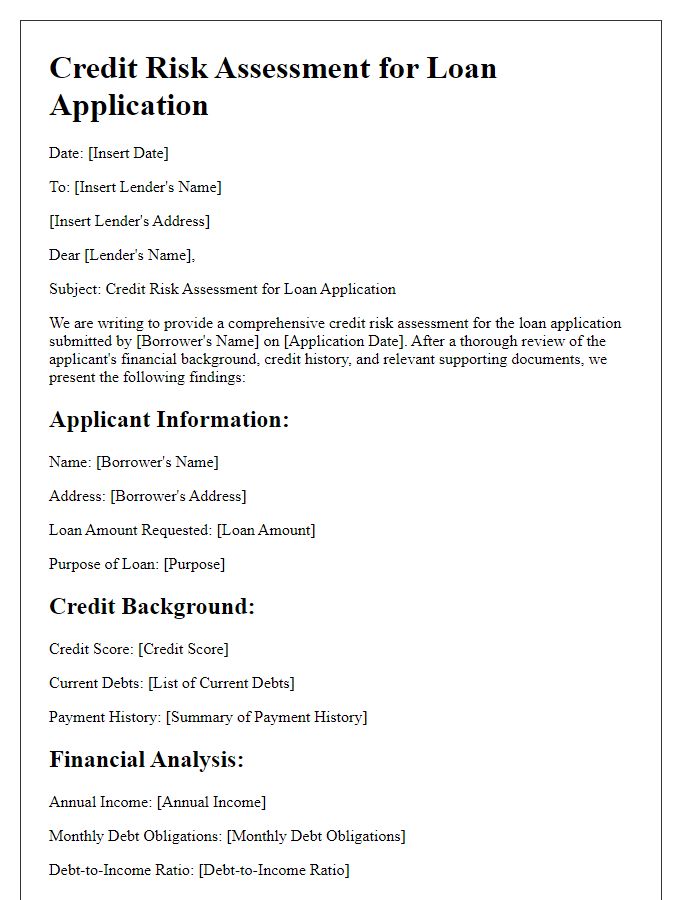

The financial health evaluation of an applicant involves analyzing various critical indicators such as credit score, income stability, debt-to-income ratio, and historical payment behavior. A credit score, typically ranging from 300 to 850, serves as a primary measure of creditworthiness, with scores above 700 generally considered favorable for loan applications. Income stability is assessed through employment verification, preferably showing at least two years of consistent income, indicating reliability in repayment. The debt-to-income ratio, calculated by dividing monthly debt payments by gross monthly income, ideally remains below 36%, signaling manageable debt levels. Additionally, reviewing the applicant's historical payment behavior through credit reports, which can reveal patterns of late payments and defaults, provides insight into their overall financial responsibility. Such comprehensive evaluations contribute to informed decisions regarding credit risk and lending approvals.

Income and debt analysis

In credit risk assessment, a thorough income and debt analysis is crucial for evaluating an individual's financial health and repayment capacity. Income sources may include salaries, bonuses, rental income, or investment returns, with a focus on steady and verifiable earnings, ideally exceeding the average income for similar roles in the region. Debt liabilities encompass mortgages, personal loans, credit card debt, and student loans, which should be clearly detailed to assess the debt-to-income ratio (DTI). A DTI ratio below 36% is generally seen as favorable, indicating a healthy balance between income and financial obligations. External factors, such as employment stability in industries like technology or healthcare, influence risk profiles, alongside credit scores derived from credit reports, reflecting payment histories and outstanding debts with agencies like FICO or VantageScore. Consideration of these elements ensures a robust analysis for determining the likelihood of default.

Credit history and credit score

Credit history plays a crucial role in determining an individual's creditworthiness, with credit scores ranging from 300 to 850 reflecting financial behavior. Factors such as payment history, outstanding debts, and length of credit accounts significantly influence this score. A high score, typically above 700, indicates timely payments and responsible credit use, whereas a lower score suggests potential risk, requiring closer scrutiny for loans or credit applications. Lenders often analyze credit reports from major agencies, including Experian, TransUnion, and Equifax, to assess an applicant's financial responsibility. Understanding these elements is vital for both lenders evaluating risk and individuals seeking to improve their financial profiles.

Asset and collateral assessment

Credit risk assessment involves a comprehensive evaluation of assets and collateral to determine the creditworthiness of an individual or an entity. Key assets such as real estate (commercial or residential properties) must be appraised accurately, as their market value directly influences the lending decision. Collateral types like vehicles, machinery, and financial instruments (stocks, bonds) should also be analyzed for liquidity and depreciation rates. Important metrics include loan-to-value ratios, with higher ratios indicating increased risk. Furthermore, the quality of collateral is assessed through condition reports or title ownership verification in property deals. Economic factors, such as regional market trends in real estate, play a vital role in asset valuation. Strong collateral can mitigate risk, leading to better loan terms and lower interest rates for borrowers.

Economic and industry conditions

Economic and industry conditions significantly influence credit risk assessments. Key indicators such as unemployment rates (11.1% in 2020 during the pandemic) and GDP growth (contracting by 3.4% in the same year) provide insights into economic health. Industry-specific factors such as consumer demand fluctuations (which dropped by 30% in various sectors) and regulatory changes (like the Dodd-Frank Act provisions on lending in the U.S.) can amplify credit risks for borrowers. Additionally, macroeconomic trends (like inflation rates increasing to 5.4% in mid-2021) can affect debt servicing capacity and payment behaviors across sectors. Understanding these conditions is crucial in evaluating a borrower's creditworthiness within their respective industries.

Comments