Are you considering making adjustments to your pension plan contributions? It's a smart move that can significantly impact your financial future. With the right strategy, you can ensure that your retirement savings align with your current goals and lifestyle changes. Dive in as we explore how to navigate these adjustments and set yourself up for a secure and comfortable retirement!

Personal and Plan Information

A pension plan contribution change can significantly impact an individual's financial future. These contributions, typically made under government-regulated plans like 401(k) in the United States, allow employees to save for retirement while benefiting from tax advantages. Accurate record-keeping of personal details, such as Social Security numbers and employment information, alongside plan specifics like the employer's matching policy and contribution limits set by the Internal Revenue Service (IRS), is essential for maximizing retirement savings. Changes may result from life events, such as marriage or job loss, necessitating a review of contribution levels. Regular adjustments, influenced by changes in income or legislation (like the Secure Act of 2019, which raised the age for required minimum distributions), ensure individuals stay on track toward a secure retirement.

Detailed Contribution Change Request

The pension plan contribution adjustment process is essential for ensuring adequate retirement savings for employees, particularly in structured plans offered by organizations like 401(k) or defined benefit plans. Businesses can implement adjustments annually or bi-annually, allowing employees to modify their contribution rates based on financial circumstances or retirement goals. Each employee must submit a formal request form detailing their desired percentage change, with specific attention to the maximum legal limits set by the Internal Revenue Service (IRS). For instance, 401(k) plans have a contribution cap, which was $19,500 for individuals under 50 years in 2021, with a catch-up provision allowing an additional $6,500 for those aged 50 and older. Once approved by human resources departments, changes are typically effective the following payroll cycle, helping employees align their contributions with their financial aspirations while benefiting from employer matching contributions, which can significantly enhance retirement savings.

Effective Date of Change

Changes to pension plan contributions can significantly impact both employer and employee financial planning. Effective from January 1, 2024, adjustments in contribution percentages will be implemented, affecting all participating employees across various departments. Employers must communicate the specific percentage changes, detailing how they will influence individual retirement savings. Additionally, contributions from salary deductions will reflect these changes in upcoming payroll cycles, ensuring employees are fully informed of their new retirement contributions. Proper documentation and frequent updates are essential to facilitate a smooth transition for all parties involved.

Authorization and Signature

A pension plan contribution change typically requires clear authorization and a signature to ensure compliance and proper processing. When submitting a request, clearly state the desired changes in contribution amounts or percentages, referencing any applicable policy numbers or employee identification numbers. Signature authorization is crucial, as it validates the request, preventing unauthorized adjustments. Often, organizations may require that the signature match the one on file to confirm identity. Additionally, maintaining a copy of the signed authorization for personal records can be beneficial for future reference or potential disputes regarding contribution adjustments.

Contact Information for Follow-up

Pension plan contribution changes can significantly impact retirement savings, especially for employees in companies like XYZ Corp. The annual contribution limit for 401(k) plans, established by the IRS, is typically $19,500, with an additional catch-up contribution limit of $6,500 for individuals aged 50 and over. Employees must submit their changes to the HR department at XYZ Corp by the end of the current calendar year, ensuring adequate adjustments for the upcoming fiscal year. Contact information, essential for follow-up, typically includes a dedicated HR email like hr@xyzcorp.com and phone number 555-123-4567. These details facilitate effective communication about pension adjustments and compliance with federal regulations.

Letter Template For Pension Plan Contribution Changes Samples

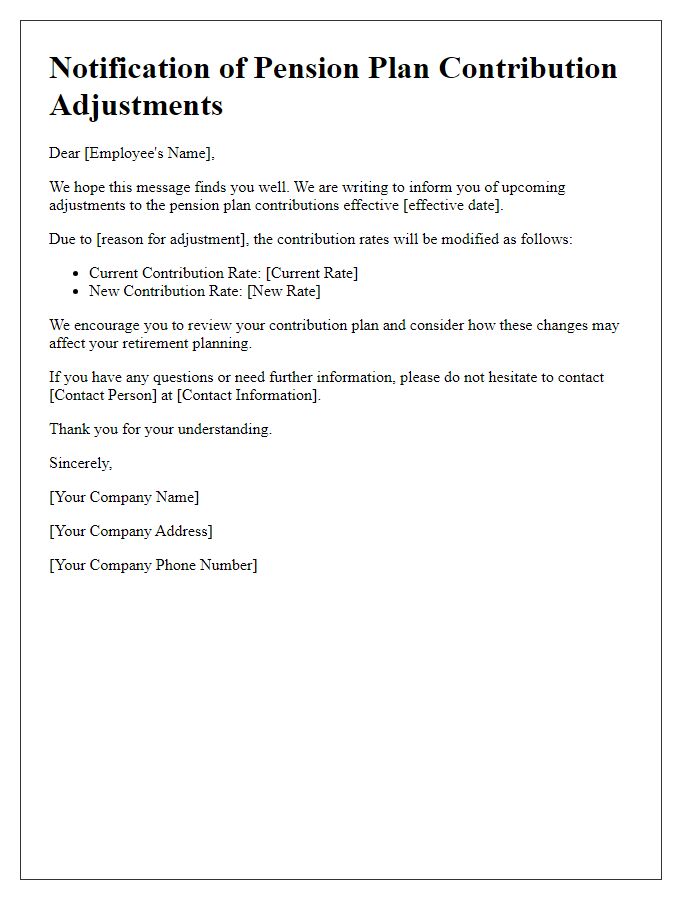

Letter template of notification for pension plan contribution adjustments

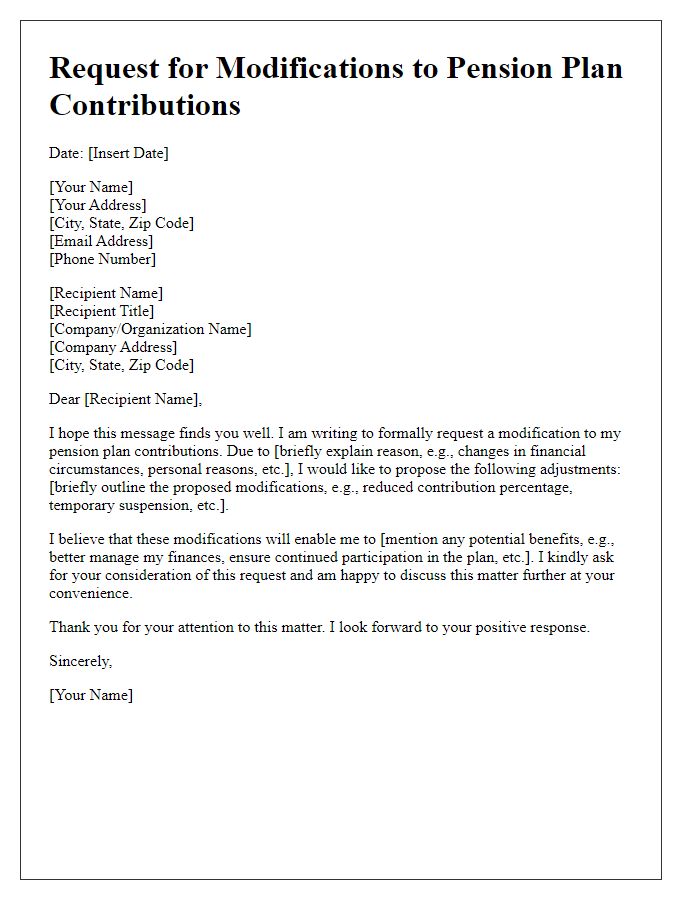

Letter template of request for modifications to pension plan contributions

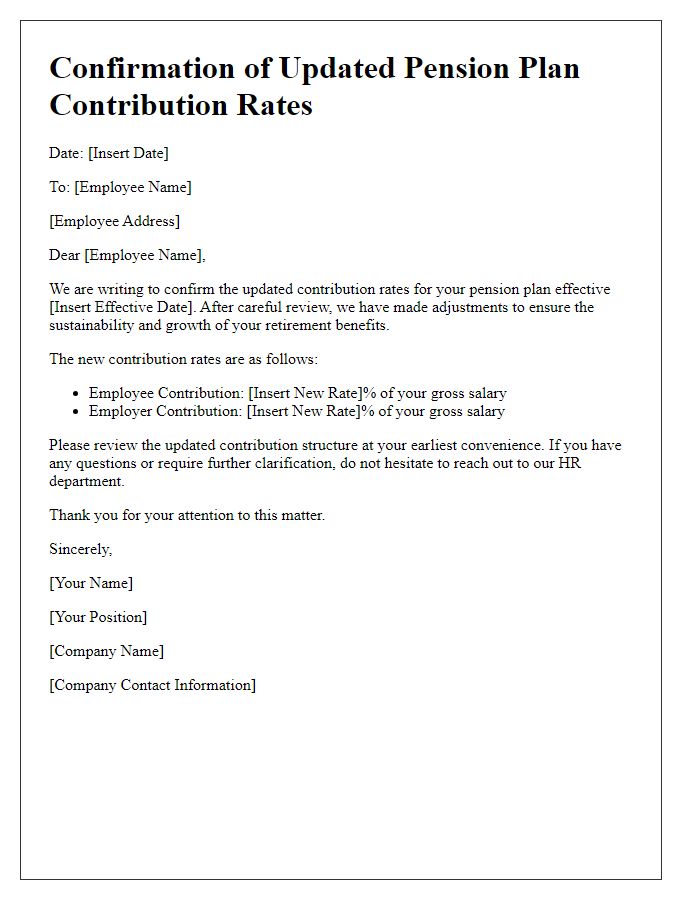

Letter template of confirmation for updated pension plan contribution rates

Letter template of reminder for upcoming pension plan contribution alterations

Letter template of approval for revised pension plan contribution amounts

Comments