Are you feeling overwhelmed by unexpected tax penalties? You're not alone; many taxpayers find themselves caught off guard by financial surprises that can create stress. Fortunately, there's a possibility for relief through a tax penalty waiver request, a process that allows you to plead your case for leniency. Dive in to discover how to navigate this procedure and increase your chances of a successful outcome!

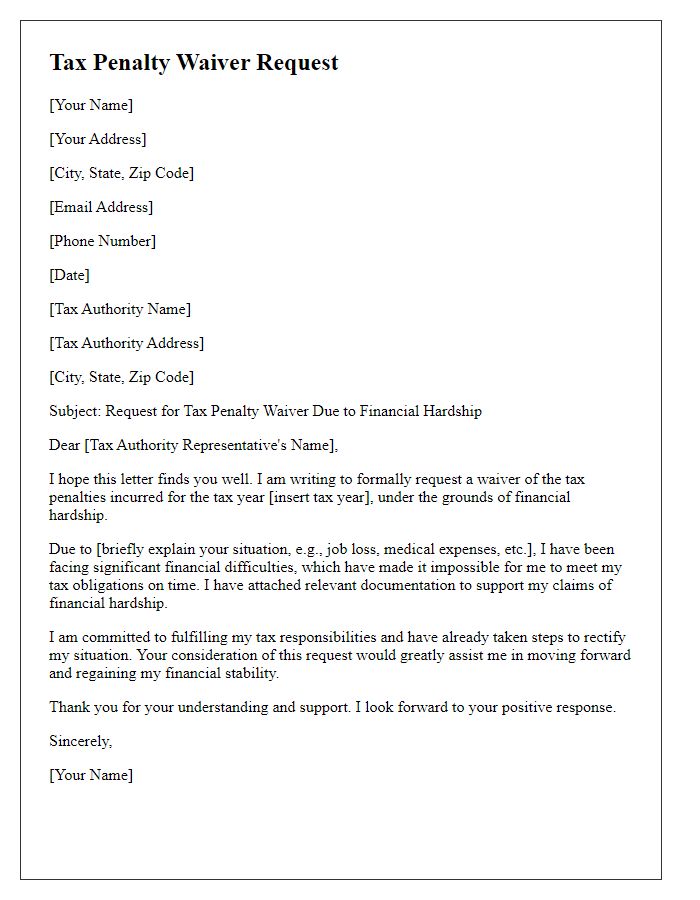

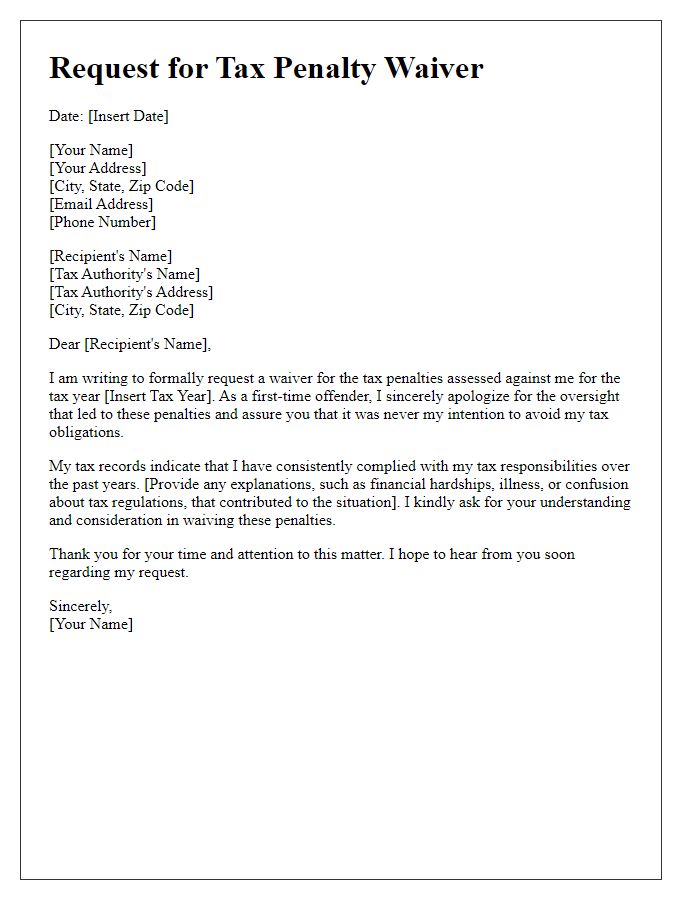

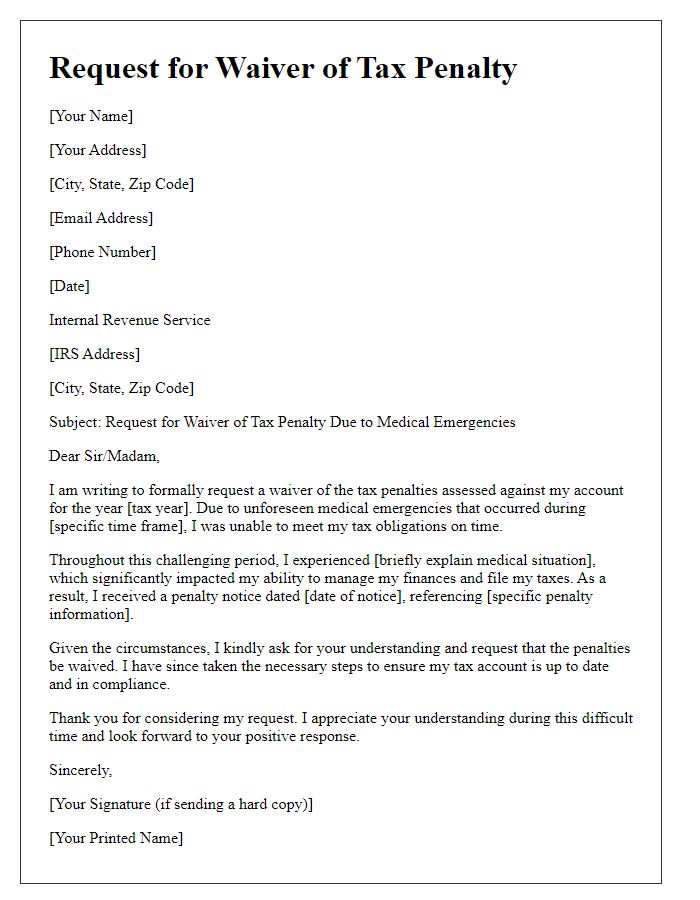

Clear and concise subject line.

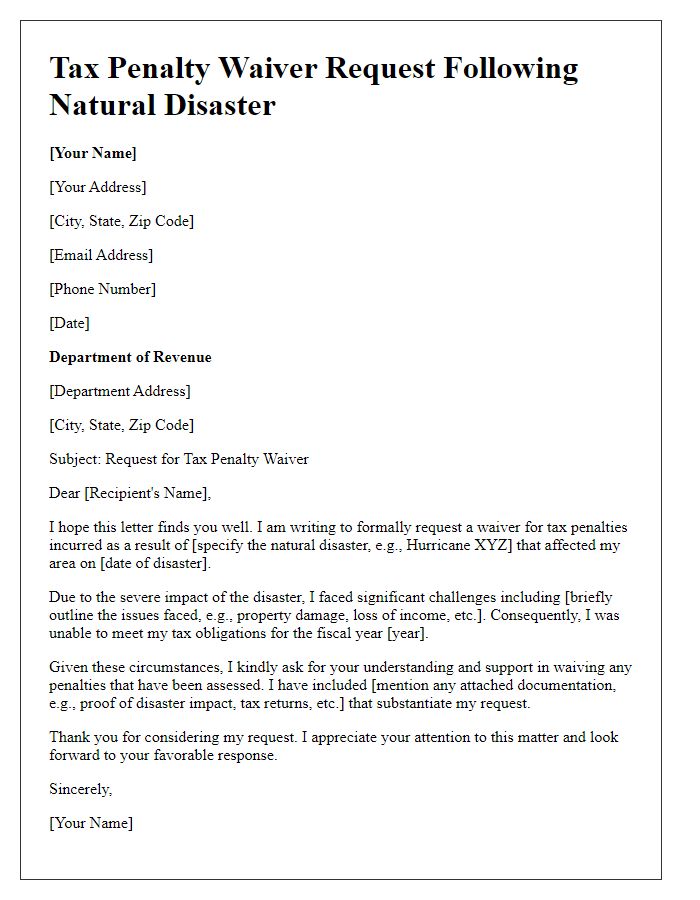

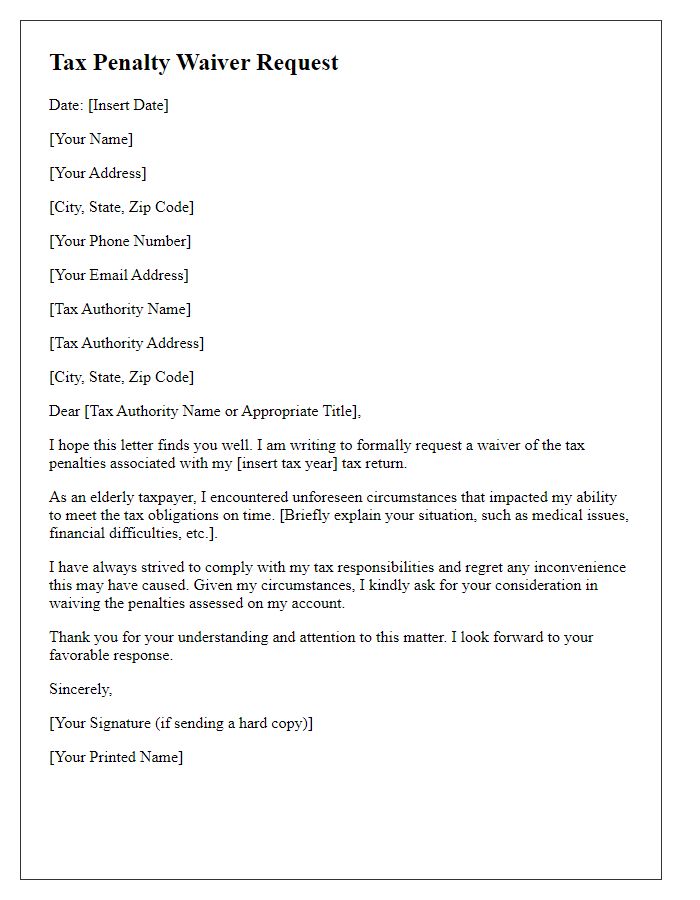

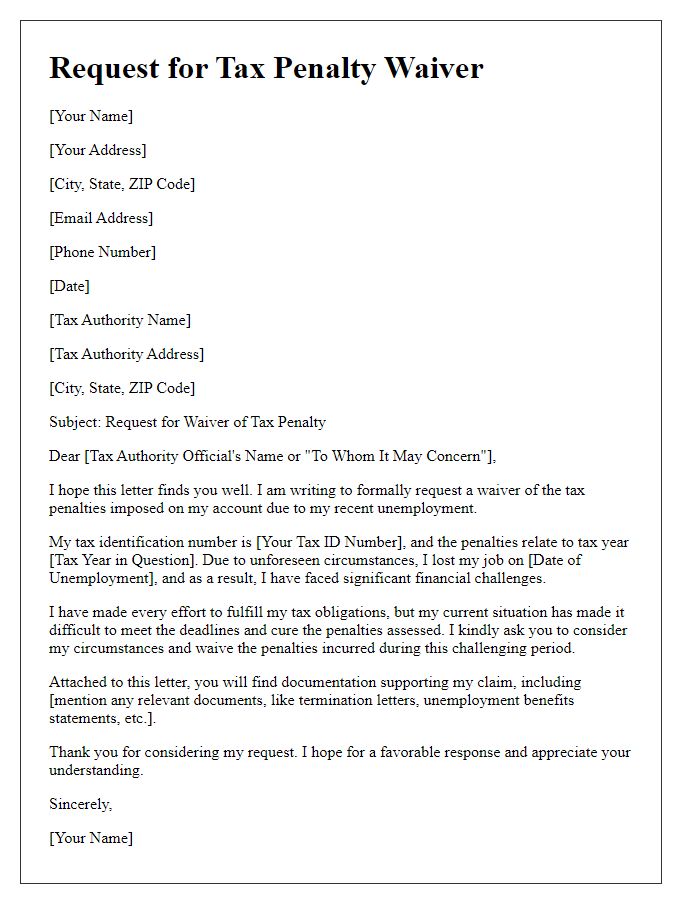

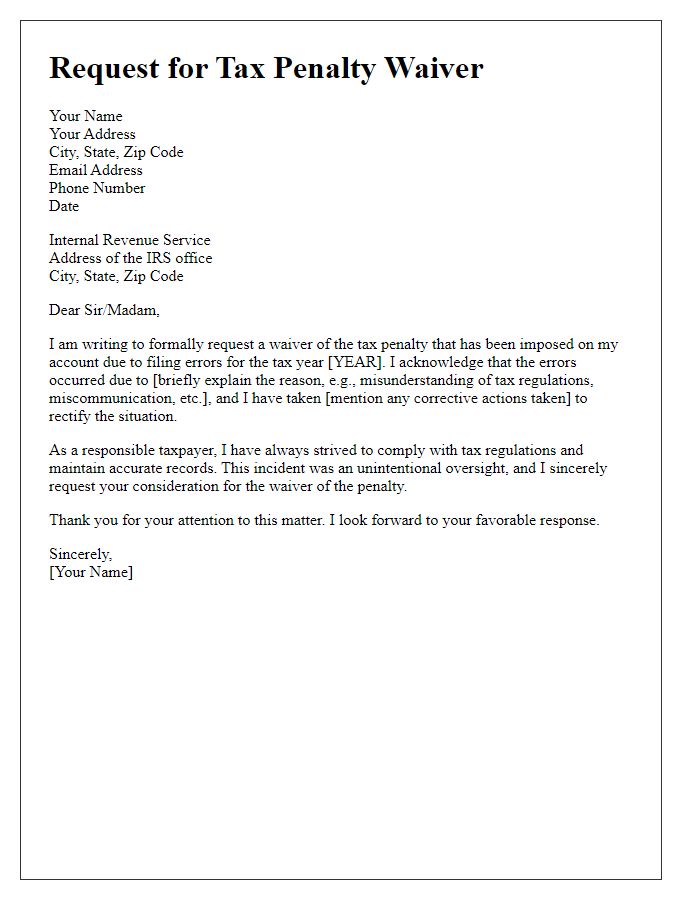

A tax penalty waiver request outlines a formal approach to seek relief from penalties imposed by the Internal Revenue Service (IRS). The subject line should state the purpose directly, such as "Request for Waiver of Tax Penalty for Tax Year 2022." In this context, taxpayers need to provide their personal information, like Social Security number and tax identification number, and detail the circumstances leading to the penalty, such as missed deadlines due to illness or natural disasters like Hurricane Ida in 2021. The request should emphasize compliance history, acknowledging past obligations and showing good faith. Timely submission of necessary documentation, including IRS notices and supporting evidence, is essential for a stronger case.

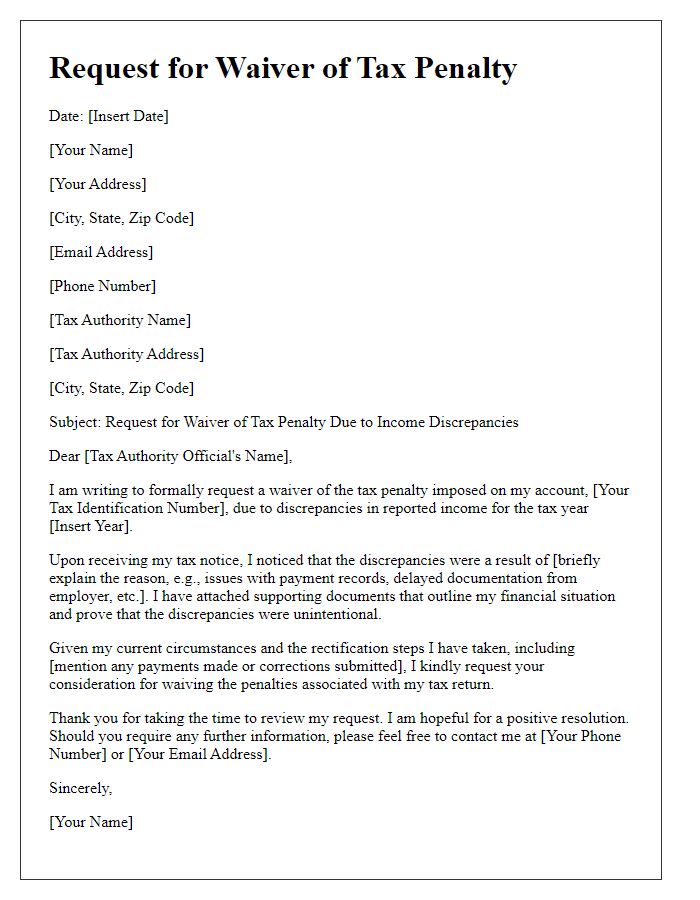

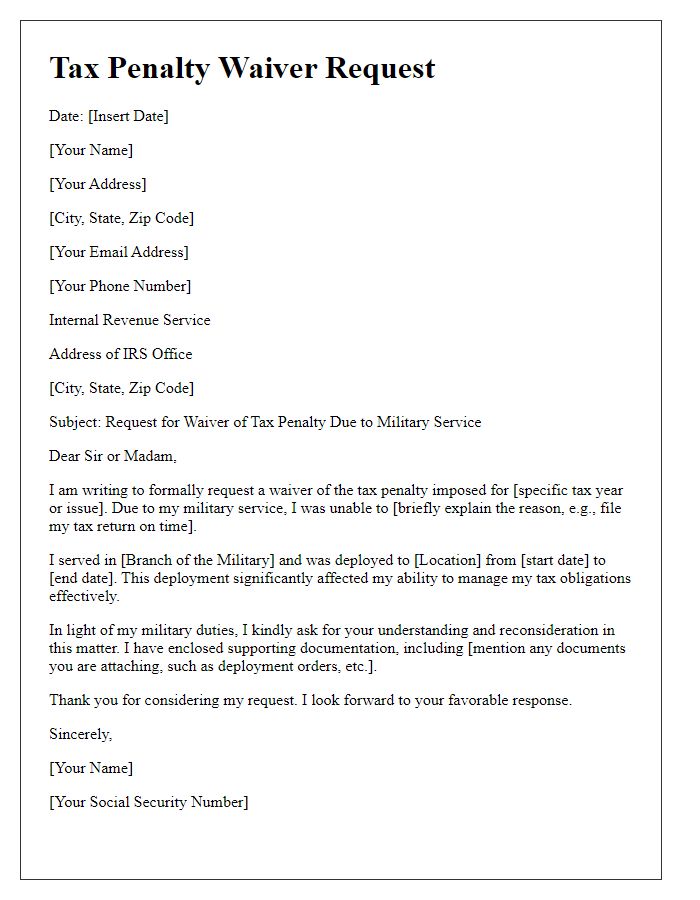

Personal identification and account details.

Submitting a tax penalty waiver request requires specific personal identification and account details to facilitate the review process by tax authorities. Essential information includes full name, taxpayer identification number (for example, Social Security Number or Employer Identification Number), mailing address (including city, state, and zip code), and contact information (like phone number and email address). Tax account number, representing the unique identifier assigned to the individual's tax records, and the tax period under consideration for the penalty (typically indicated as the year or quarter) must also be provided. A clear explanation of circumstances prompting the waiver request, such as unforeseen personal events or reasonable cause, strengthens the case for reconsideration of penalties imposed.

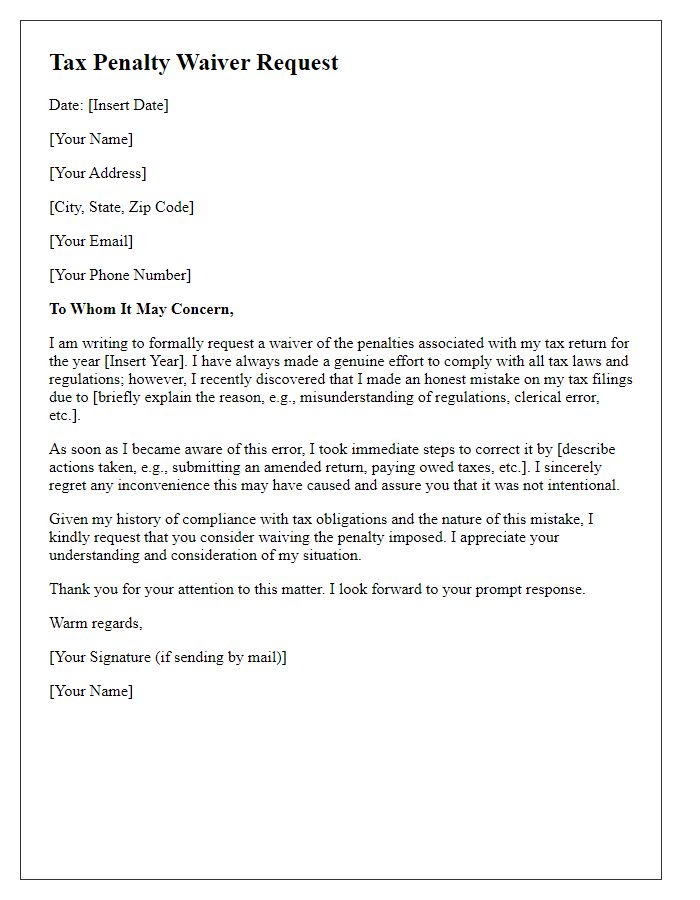

Explanation of circumstances leading to penalty.

A tax penalty waiver request stems from various circumstances that can affect an individual's ability to comply with tax regulations. For instance, unforeseen medical emergencies, such as hospitalization for major surgery, can incapacitate individuals and hinder their tax filing. Specific events, like natural disasters (e.g., hurricanes or floods) that impact local communities, can disrupt financial records, making timely submissions challenging. Additionally, complications arising from sudden job loss or prolonged unemployment may lead to missed deadlines due to financial instability. It is crucial to provide documentation, such as medical bills, news reports of natural disasters, or unemployment notices, to substantiate the claims and demonstrate good faith efforts in meeting tax obligations. These factors collectively shape the narrative for requesting a penalty waiver.

Request and justification for waiver.

Tax penalties can result from late payments or filings, negatively impacting financial stability. A tax penalty waiver request often involves citing specific circumstances, such as natural disasters, medical emergencies, or administrative errors, that led to the situation. Gather supporting documents, like medical records or disaster relief statements, to substantiate claims. Communicate clearly, referencing relevant tax years and penalty amounts, and outline previous compliance history to demonstrate a good-faith effort to fulfill tax obligations. Submit the request to the appropriate tax authority, such as the Internal Revenue Service (IRS) in the United States, ensuring adherence to any prescribed timelines and formats for the request.

Contact information for follow-up.

Tax penalty waivers often require clear communication of personal details (such as full name, address, phone number) to ensure accurate processing. The Internal Revenue Service (IRS) typically requires taxpayers to provide their Social Security Number (SSN) or Employer Identification Number (EIN) for identification. Small businesses and individual taxpayers alike need to specify the tax period in question, providing the exact tax year and any relevant forms (such as 1040 or 1120) to clarify the penalty concern. Documentation supporting the reason for the waiver request, such as unexpected medical expenses or natural disaster events, should accompany the communication for consideration. Prompt follow-up communication is essential to ensure the waiver request is being processed efficiently.

Comments