Are you looking to navigate the intricate world of real estate tax incentives? Understanding the nuances can be a game-changer when it comes to maximizing your benefits. In this article, we'll break down the essential details you need to know regarding tax incentives in real estate, making it easier for you to enhance your property investments. So, let's dive in and explore the opportunities awaiting you!

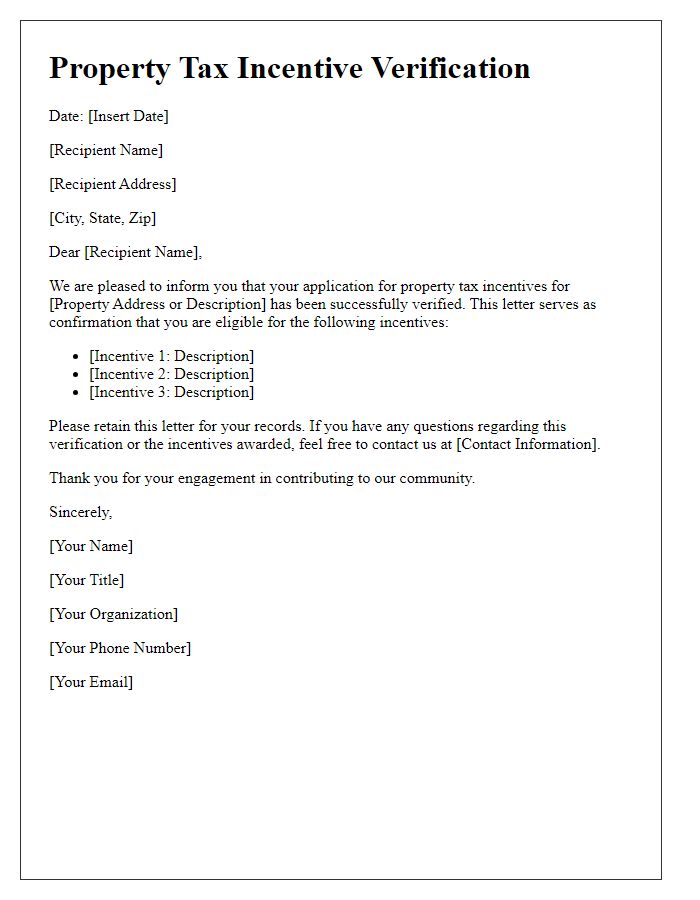

Property Identification

In a city like San Francisco, property identification numbers (PINs) play a crucial role in real estate tax incentive programs. Each PIN, a unique series of digits assigned to a specific property, is essential for tracking assessments and tax obligations. For instance, properties located in revitalization areas may qualify for significant tax breaks, sometimes exceeding 15% reduction in assessed value for five years. Local laws stipulate that property owners must submit documentation, including the PIN, to confirm eligibility for these incentives. These tax incentives aim to boost economic growth, encouraging development in underutilized neighborhoods. Properly understanding and managing the property identification process allows owners to maximize their tax benefits in a competitive market.

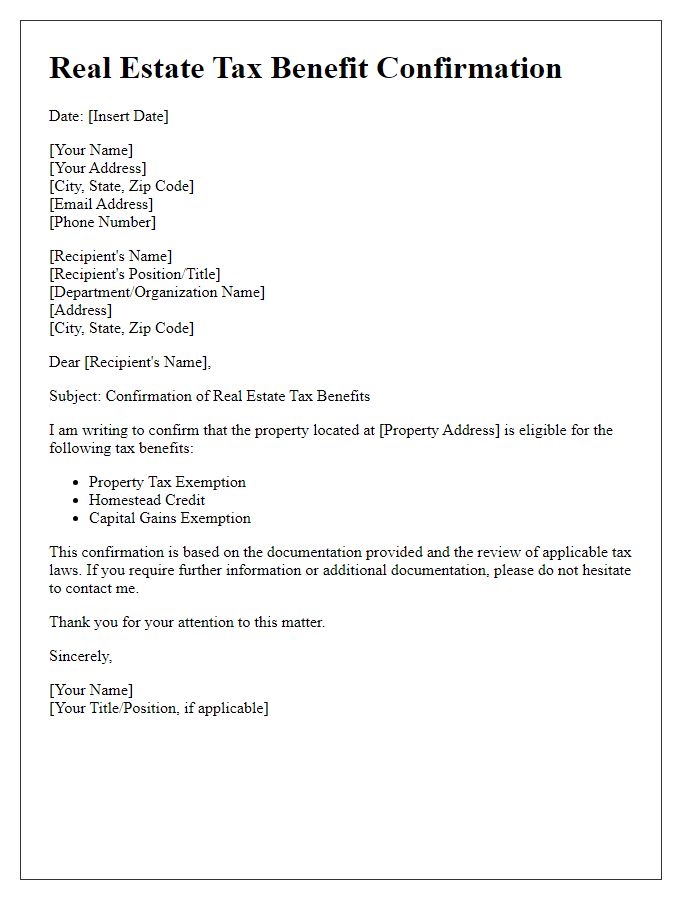

Tax Incentive Details

Real estate tax incentive programs, such as the property tax abatement (often designed for long-term residential or commercial properties), can significantly benefit property owners in cities like New York City. These tax incentives typically offer reductions in property tax assessments for a period of time, sometimes ranging from five to fifteen years, depending on the specific program requirements. Properties located in designated revitalization zones may qualify for additional incentives, such as exemptions or rebates linked to job creation or energy efficiency upgrades. Stakeholders, including property developers and local government agencies, play crucial roles in the application process, ensuring compliance with local laws, and optimizing the potential benefits of these tax relief programs for economic growth and urban development.

Legal Compliance Information

Real estate tax incentives can significantly impact property owners' financial obligations, particularly in urban areas such as San Francisco or New York City, where property values are substantial. The confirmation of eligibility for these incentives often hinges on legal compliance, ensuring that properties meet specific criteria established by local government entities. For instance, property owners must provide documentation demonstrating compliance with zoning laws and building codes, which vary widely across jurisdictions. Legal frameworks such as the Tax Cuts and Jobs Act of 2017 can also influence the availability of these incentives, as changes to tax legislation may introduce new benefits or requirements. Furthermore, timely submission of necessary applications and adherence to deadlines imposed by local tax authorities play crucial roles in securing these incentives, potentially offering substantial reductions in taxable income for qualified properties.

Contact Information

Real estate tax incentives are programs designed to encourage property development and investment. These incentives, often in the form of tax abatements or credits, can significantly reduce the financial burden on property owners and developers looking to invest in areas undergoing revitalization, such as downtown districts in cities like Detroit or New Orleans. In many jurisdictions, these incentives may require property owners to meet specific criteria, such as maintaining a higher standard of living space or preserving historical elements of the property. Local government agencies, in coordination with state tax authorities, typically oversee the application and approval processes. Understanding the nuances of these incentives can lead to considerable tax savings, stimulating community growth and boosting local economies.

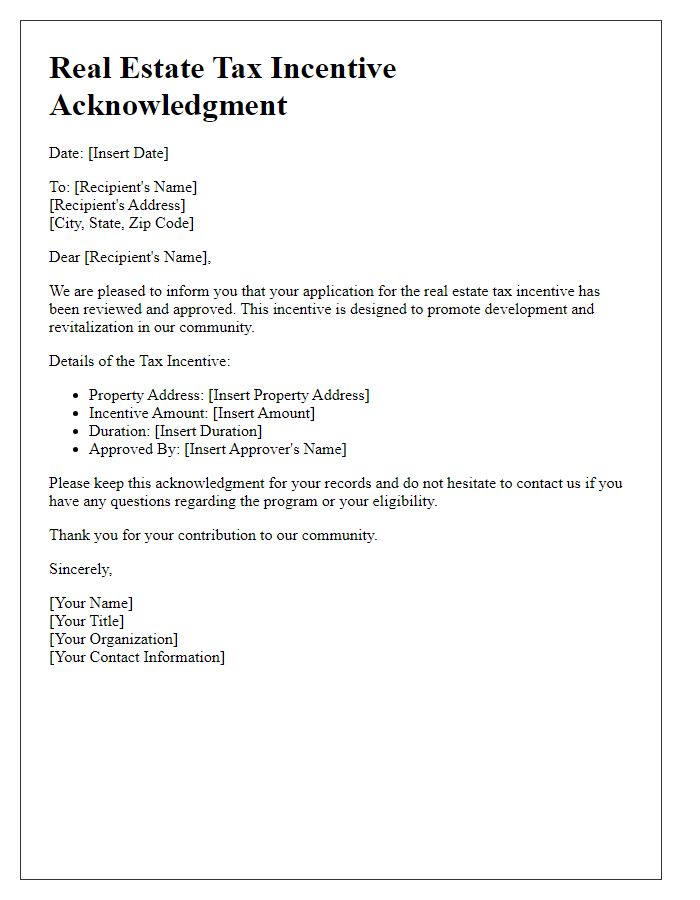

Authorized Signature

The real estate tax incentive confirmation for property owners includes an official document stating eligibility for tax benefits, such as the 10-year tax abatement offered by various local governments like New York City. The confirmation letter must include relevant information such as property address (e.g., 123 Main St, New York, NY) and details regarding the assessed value, tax reduction percentage (commonly ranging between 50% to 100%), and duration of the incentive (number of years benefits apply). Authorized signatures from both the tax authorities and the property owner validate the agreement, ensuring compliance with local tax codes and regulations. Additional notes on application deadlines and required documentation may also enhance the clarity of the confirmation.

Comments