When it comes to resolving a tax dispute, having the right communication tools at your disposal is essential. A well-crafted letter can set the tone for negotiations and clarify your intentions, creating a solid foundation for constructive dialogue. In this article, we'll explore effective letter templates that can guide you through the process, ensuring you articulate your concerns with confidence and clarity. Join us as we dive deeper into the intricacies of tax dispute resolution lettersâyour path to a smoother resolution starts here!

Clear subject line

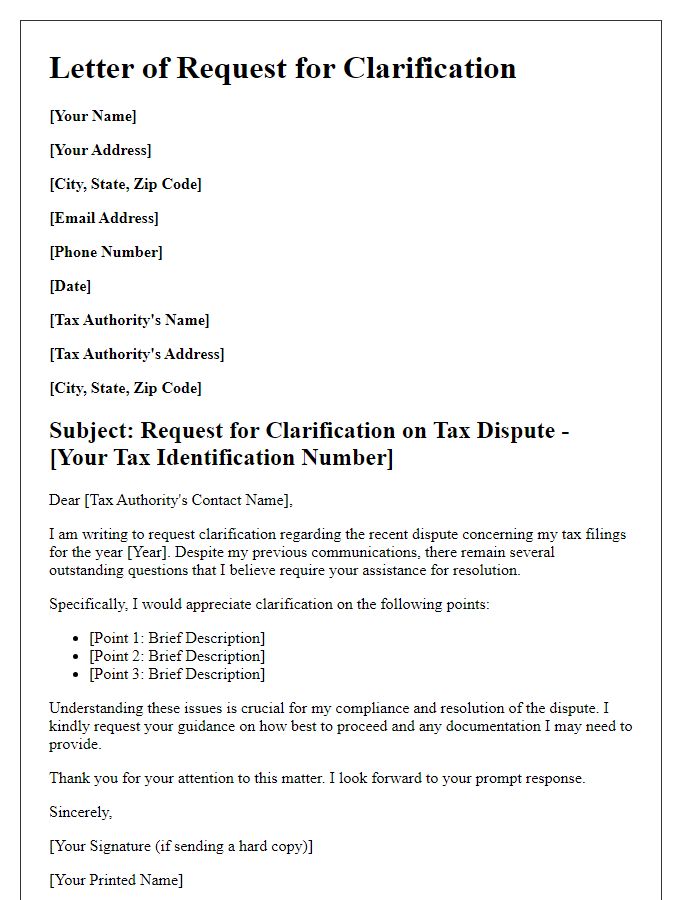

A clear subject line can significantly enhance the effectiveness of communication regarding tax dispute resolution. Example: "Tax Dispute Resolution Request: [Insert Tax Year/Reference Number]". This concise subject line helps the recipient immediately identify the purpose of the email, allowing for efficient processing. Including specific details such as the tax year or reference number can ensure that the communication is associated with the correct case, streamlining any necessary follow-up action. Furthermore, clarity in the subject increases the likelihood of prompt responses from tax authorities or financial advisors involved in the dispute resolution process.

Accurate taxpayer identification

Accurate taxpayer identification is essential in tax dispute resolution processes. The Internal Revenue Service (IRS) utilizes Taxpayer Identification Numbers (TINs) to effectively manage taxpayers' accounts and ensure accurate record-keeping. Cases of incorrect identification can lead to significant complications, including improper tax assessments, delayed refunds, and even penalties. For instance, a 2021 IRS report indicated that approximately 37 million taxpayers faced issues due to mismatched TINs, highlighting the importance of accurate data. Ensuring that names, Social Security Numbers (SSNs), and other relevant identifiers align correctly with IRS databases is crucial for efficient dispute resolution. Proper identification facilitates communication, aids in the correct application of tax laws, and streamlines the overall resolution process.

Precise details of dispute

A tax dispute can arise from discrepancies in reported income, deductions, or credits, often involving agencies like the Internal Revenue Service (IRS) in the United States or local tax authorities. Common disputes include unreported income, which may involve figures exceeding $10,000, or disallowed deductions related to business expenses that aim to reduce taxable income. Additionally, failure to file documentation by established deadlines, such as April 15 for individual taxpayers, can escalate into disputes, often leading to penalties. Tax filers might also encounter disagreements regarding tax credits, like the Earned Income Tax Credit, which requires strict income thresholds (typically less than $57,000 for eligibility) to qualify. Clear documentation, such as copies of filed returns, W-2 forms, and receipts for claimed deductions, is crucial when presenting cases for resolution with tax authorities. Regularly updates from the tax agency, which may issue notices or correspondence via certified mail, add layers of complexity to the dispute resolution process.

Relevant tax regulations and codes

Tax dispute resolution often involves navigating complex regulations and statutory frameworks. The Internal Revenue Code (IRC), primarily Title 26 of the U.S. Code, outlines numerous provisions such as Section 6015, which addresses innocent spouse relief, and Section 7430, detailing the conditions for the award of attorney fees. Additionally, each state, like California with its Revenue and Taxation Code, presents unique criteria for tax disputes, influencing local jurisdictions and procedures. Understanding the Taxpayer Bill of Rights (TBOR) is essential, as it protects taxpayers' rights during the dispute process, ensuring fair treatment and transparency. Engaging with these regulations is crucial for effective resolution strategies.

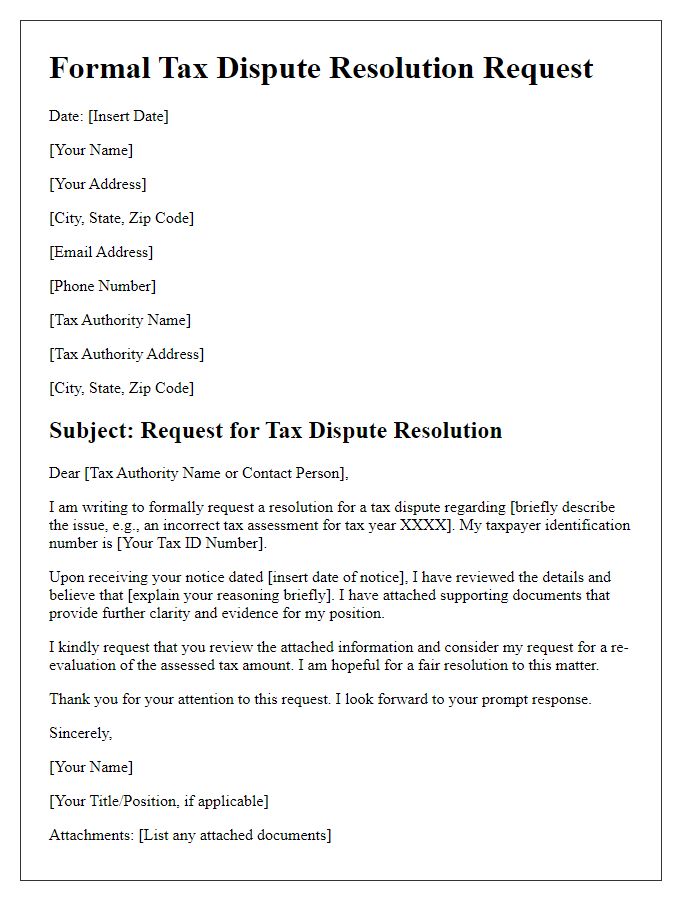

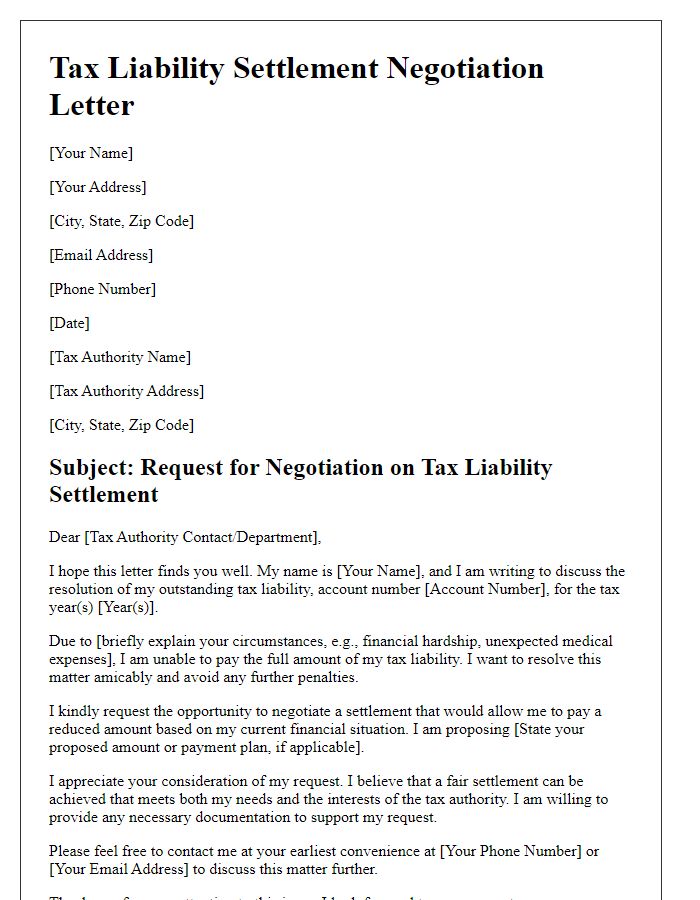

Proposed resolution or action plan

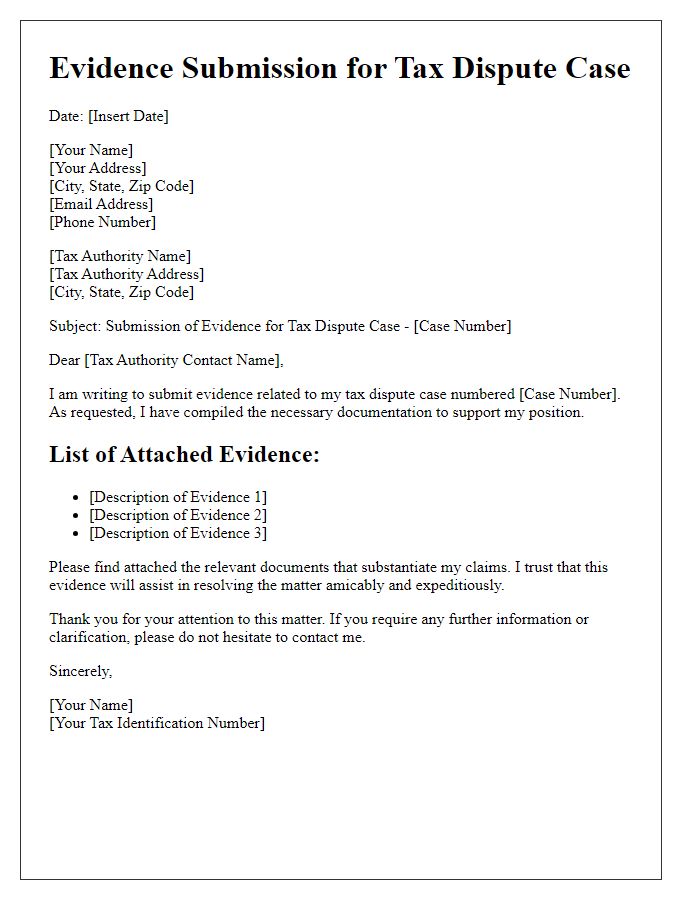

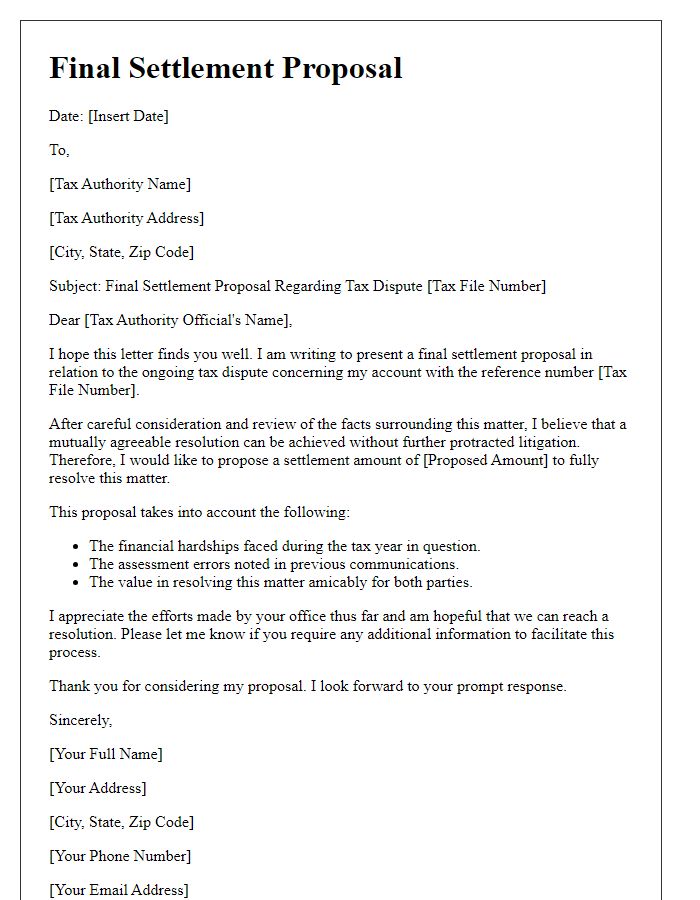

Tax disputes can arise from various circumstances, including discrepancies in income reported to the Internal Revenue Service (IRS), misinterpretation of tax laws, or challenges regarding deductions. A proposed resolution or action plan typically involves presenting documentation that substantiates claims, such as W-2 forms (which detail wages and taxes withheld) or 1099 forms (which report income from self-employment or other gigs). Engaging qualified tax professionals or attorneys can lead to a thorough examination of relevant tax regulations applicable to the specific case. Additionally, establishing open communication with the tax authority, like the IRS, may facilitate a more favorable outcome, potentially through negotiation or settlement options, including Offers in Compromise, which could lower tax liabilities based on financial hardship. It's crucial to adhere to deadlines set forth by tax authorities to avoid penalties or further complications in the resolution process.

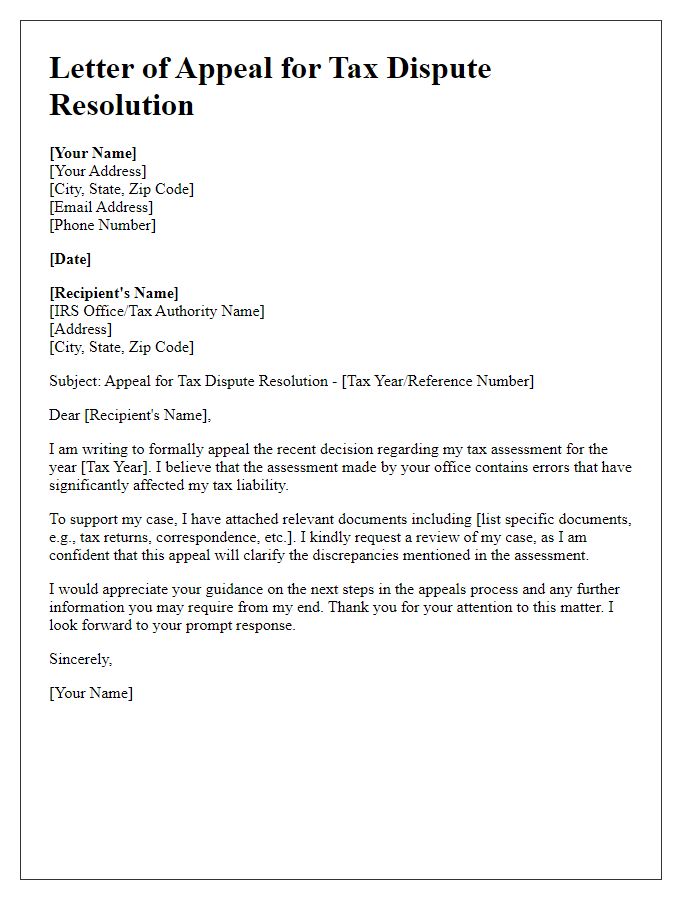

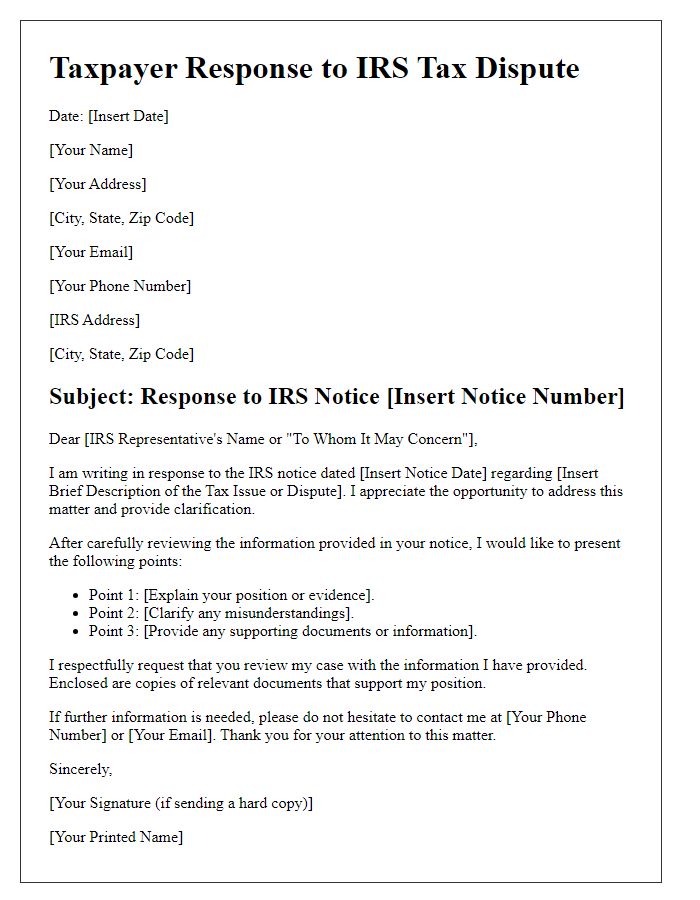

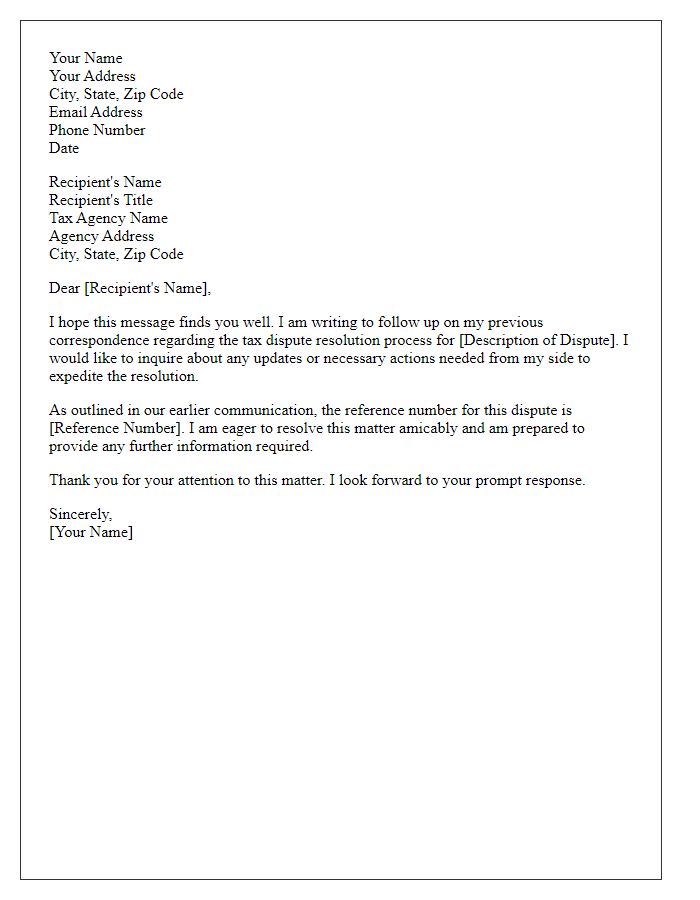

Letter Template For Tax Dispute Resolution Communication Samples

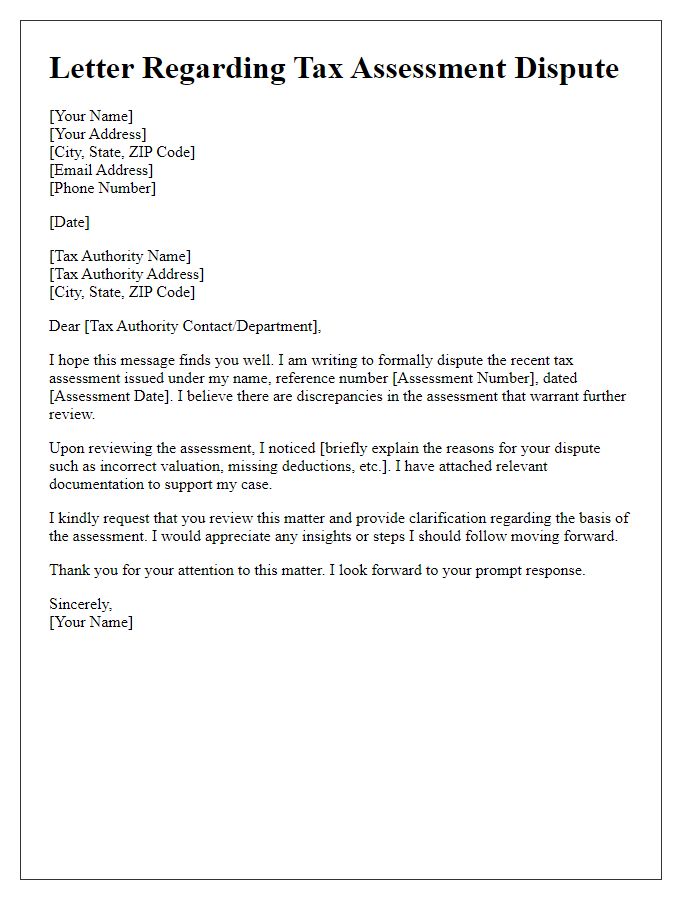

Letter template of initial communication regarding tax assessment dispute

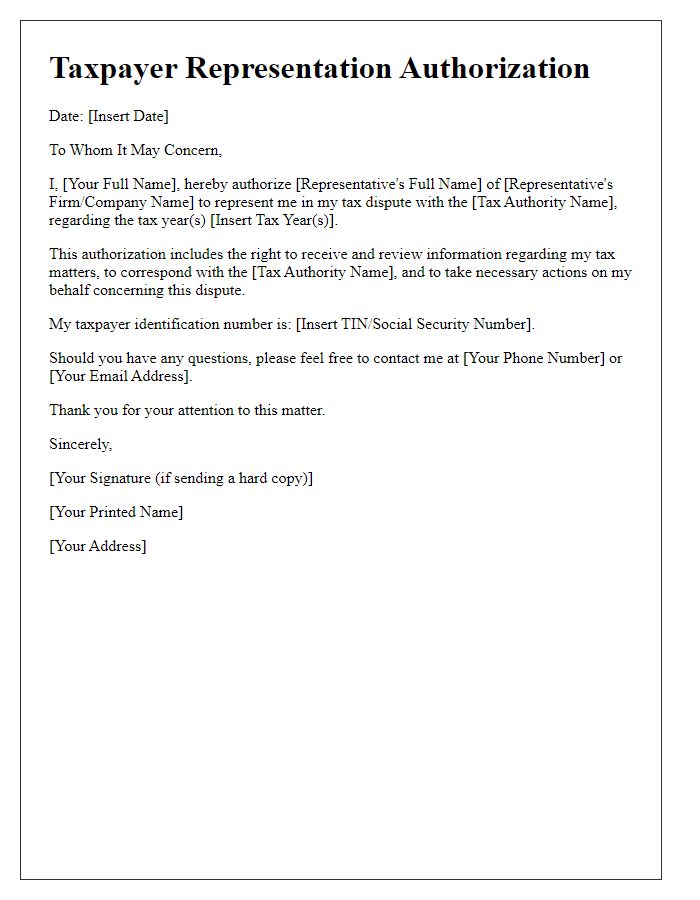

Letter template of taxpayer representation authorization for tax dispute

Comments