Are you a freelance artist wondering how to navigate the complex world of taxes and discover potential benefits? As an independent creator, it's crucial to understand what deductions you may be eligible for, such as materials, home office expenses, and even travel costs associated with your work. Understanding these details can help you maximize your income and ensure you're not leaving money on the table. Join me as we dive deeper into the tax benefits for freelance artists and explore how you can take full advantage of them!

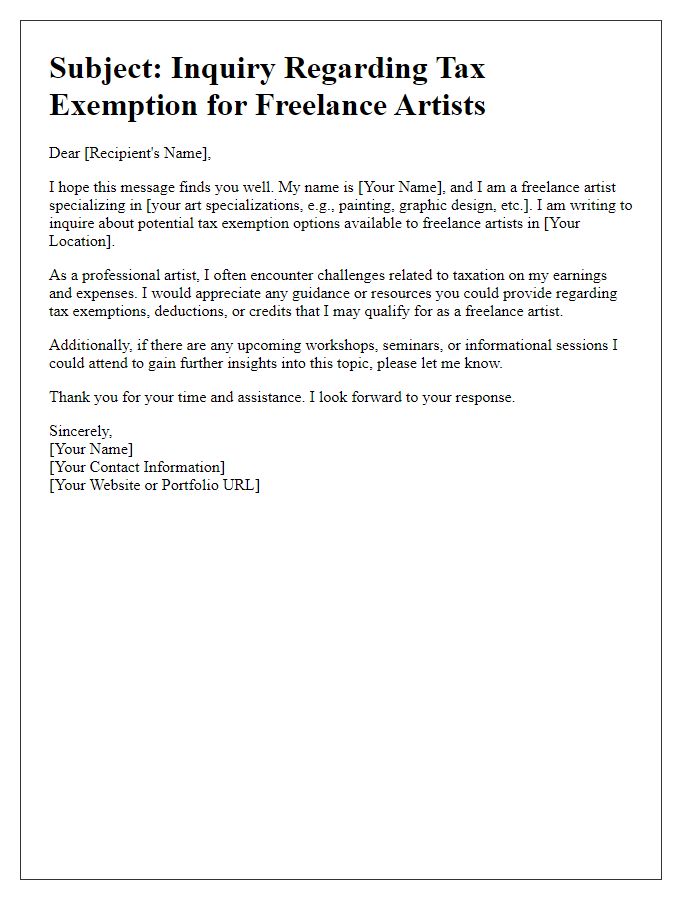

Understanding of local tax regulations.

Freelance artists operating within various jurisdictions often encounter complex local tax regulations that significantly impact their financial management and tax benefits. Local tax codes (varying by state or municipality) may offer specific deductions for business expenses, including art supplies, studio rentals, and promotional costs. Additionally, some regions provide tax credits aimed at supporting creative sectors, which can enhance an artist's overall income. In certain cases, local governments may implement tax incentives for artists who participate in community arts programs or public exhibitions, fostering cultural development. Familiarity with these regulations can help freelance artists optimize their financial strategies, ensuring compliance while maximizing available benefits.

Awareness of tax deductions and credits specific to artists.

Freelance artists, like photographers, painters, and musicians, can benefit significantly from understanding tax deductions and credits available to them. Expenses related to studio space (average cost of $250 per month), art supplies, and professional development courses can be deducted, reducing taxable income. Additionally, costs incurred while promoting artwork (such as website fees, which can average around $100 annually) may also be claimed. Artists often qualify for credits related to self-employment taxes due to income generated through their creative pursuits. Awareness of these deductions and credits (totaling potentially thousands in savings) ensures artists maximize financial benefits and remain compliant with IRS regulations regarding reporting income from various gigs or sales.

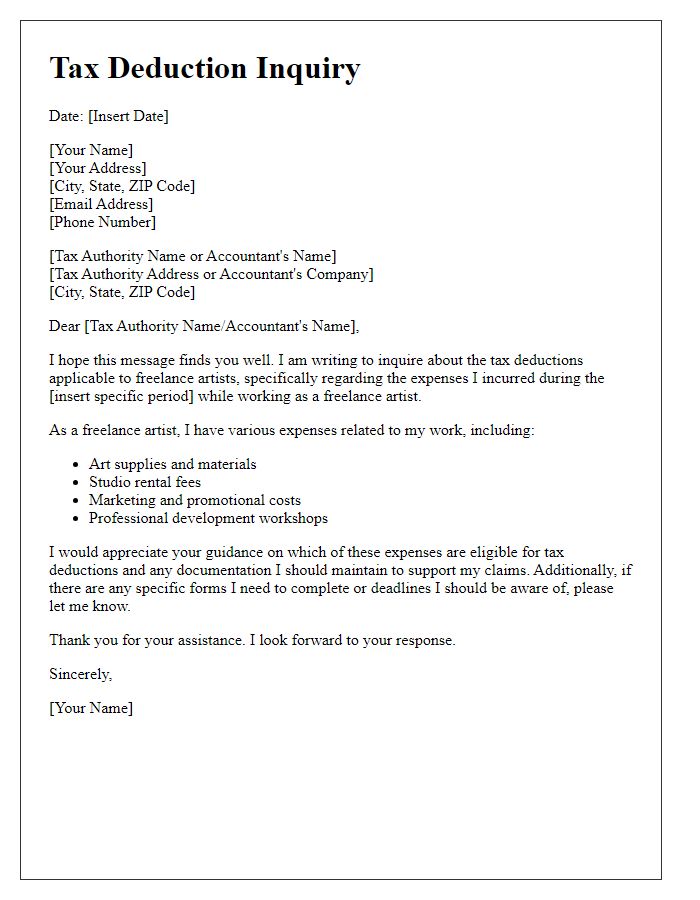

Proper documentation and record-keeping.

Freelance artists must maintain proper documentation and meticulous record-keeping for tax benefits. Accurate records of income, such as invoices totaling $30,000, alongside expenses like art supplies costing $2,000, are essential for deductions. Categories for expenses include studio rent (e.g., $1,200 monthly), marketing costs (web hosting fees of approximately $300 annually), and professional development (workshops averaging $500 each). Organizing receipts and bank statements can streamline the file process during tax season. Software like QuickBooks or spreadsheets can assist in tracking finances efficiently. Understanding tax laws, including permissible deductions and benefits, ensures compliance and maximizes financial advantages for artists.

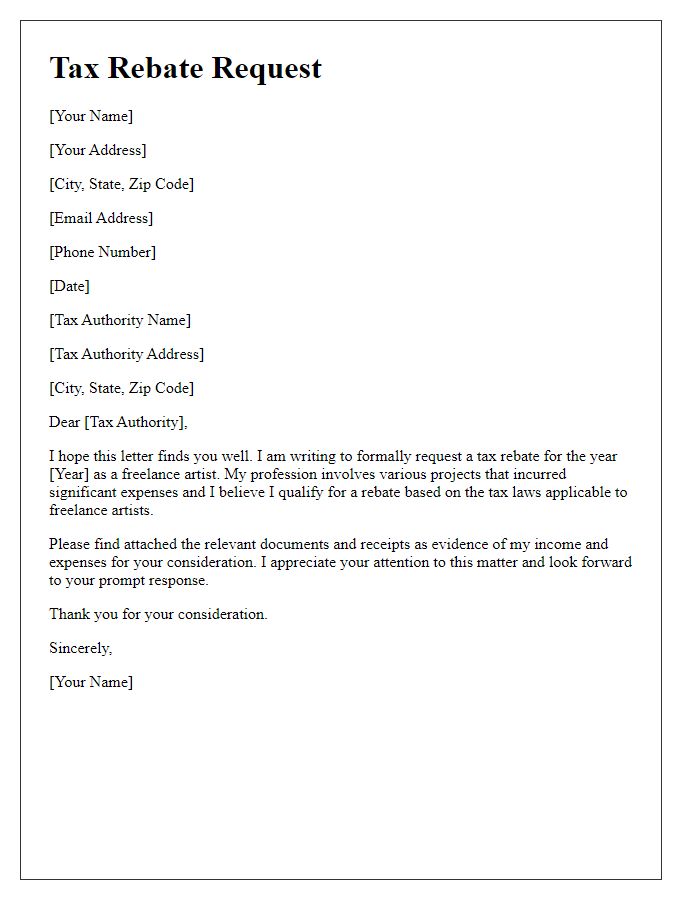

Consultation with a tax professional or advisor.

Freelance artists often navigate unique tax considerations that can affect their financial outcomes. Seeking consultation with a tax professional can illuminate important aspects such as deductible business expenses, including art supplies and studio rent, potentially amounting to thousands of dollars depending on individual circumstances. Knowledge of specific tax benefits available to artists, like the Qualified Performing Artist deduction, can prove immensely valuable, particularly for those generating income through performances or sales at venues like galleries or local markets. Additionally, understanding how to accurately report income from various sources, such as commissions or digital sales, can minimize potential tax liabilities while ensuring compliance with Internal Revenue Service regulations. Engaging with a tax advisor specializing in the creative industry can provide tailored guidance on navigating these complex tax scenarios effectively, ensuring artists retain more of their hard-earned income.

Networking with other freelance artists for shared insights.

Freelance artists often benefit from a variety of tax deductions that can significantly reduce their taxable income. Staying connected with other freelancers, especially in creative hubs such as Brooklyn, New York, can provide valuable insights into eligible expenses, like art supplies, studio rentals, and marketing costs. Networking events and online communities often share tips on navigating tax regulations, such as the IRS guidelines on self-employment tax, which can affect those earning over $400 annually. Additionally, shared experiences on filing can reveal less commonly known benefits like the Qualified Business Income deduction, potentially allowing artists to deduct up to 20% of their income. Engaging with local artists' cooperatives or workshops can also yield practical strategies for organizing financial records, ultimately fostering a supportive environment that encourages compliance and maximizes tax benefits.

Comments