Navigating the landscape of franchise tax return requirements can feel overwhelming, but it doesn't have to be! Understanding what documents and information you need is crucial for staying compliant and avoiding unnecessary penalties. Whether you're a seasoned business owner or just starting your entrepreneurial journey, the right guidance can simplify the process significantly. So, let's dive in and explore what you need to know to get your franchise tax return rightâread more to find out!

Business Information Accuracy

Accurate business information is crucial for franchise tax return compliance in the United States, especially for entities operating in Texas. Essential details include the business name, which must match legal documents precisely, the federal Employer Identification Number (EIN), and the correct North American Industry Classification System (NAICS) code that reflects the primary business activity. Additionally, the registered agent's name and physical address are necessary for legal correspondence. Failing to ensure the accuracy of this information can lead to penalties, inability to obtain necessary licenses, and issues with maintaining good standing with the Texas Secretary of State. Regularly updating business records, especially after significant changes such as mergers, relocations, or ownership transfers, ensures alignment with state requirements and minimizes the risk of non-compliance.

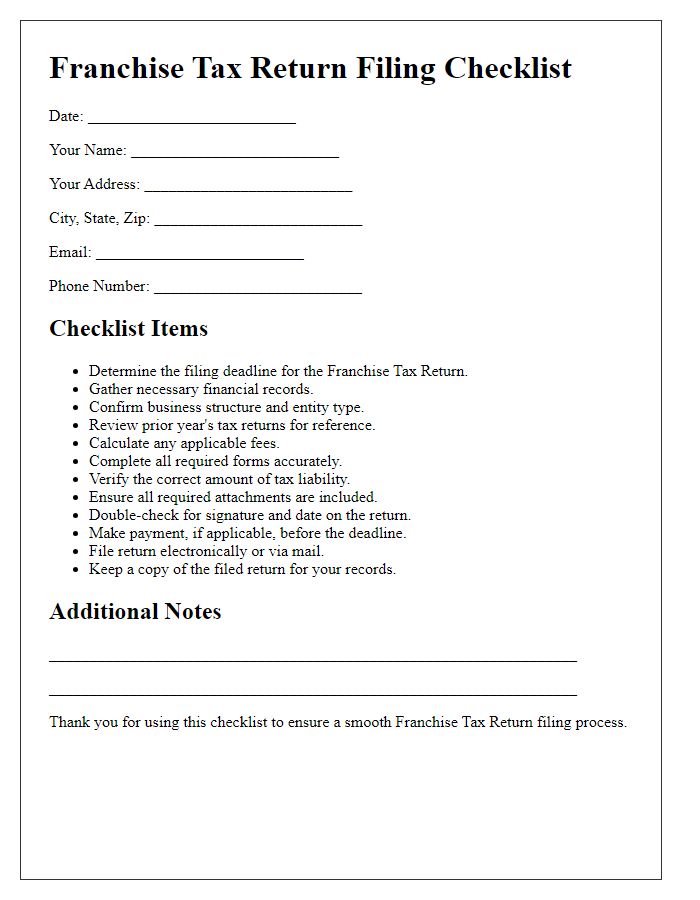

Revenue Reporting Compliance

Franchise tax return requirements are critical for businesses operating within jurisdictions like Texas, which mandates annual reports from corporations and limited liability companies (LLCs). Each entity must accurately report revenue figures, including gross receipts which can vary depending on the specific business activity. Failure to comply with these revenue reporting standards may lead to penalties, including fines up to $1,000 or more, depending on the severity and duration of the non-compliance. Additionally, the franchise tax applies to both domestic and foreign entities engaged in business within the state, necessitating a thorough understanding of the state's threshold revenue criteria, which can fluctuate annually (currently set at $1,230,000 for 2023). Timely submissions are essential, with typical deadlines falling on May 15 or next business day if it applies, ensuring avoidance of interest on unpaid taxes. Accurate reporting not only fulfills legal obligations but also aids in maintaining good standing and enabling access to business opportunities.

Timely Submission Deadlines

Franchise tax return requirements in the United States involve specific deadlines that vary by state. For example, Texas mandates the filing of franchise tax returns by May 15 each year. Delaware typically operates on a June 1 deadline. Late submissions can incur penalties, ranging from a flat fee of $50 (in Illinois) to 25% of the owed taxes (in California). Companies must also be aware of the necessity of submitting an annual report alongside franchise tax returns in several states, including New York and Pennsylvania. Additionally, keeping track of estimated franchise tax payments, which may be due quarterly, is crucial for compliance and avoiding interest or further penalties.

Applicable Deductions and Exemptions

Franchise tax return requirements in the United States often include specific deductions and exemptions that businesses can leverage to minimize their taxable income. Eligible entities, such as limited liability companies (LLCs) and corporations, must navigate state regulations (varying by state, including Texas and California) to identify applicable deductions. Common deductions include cost of goods sold (COGS), employee wages, and certain business expenses that are necessary for operation, like rent and utilities. Exemptions may apply to specific industries, such as non-profit organizations or businesses under a revenue threshold, thereby reducing their tax liability significantly. Keeping detailed records of all qualifying deductions and exemptions is essential for compliance and to ensure accurate reporting during tax season.

State-specific Filing Guidelines

Franchise tax return requirements vary significantly across different states, often influenced by state-specific regulations. For instance, California mandates annual franchise tax payments of a minimum of $800 for corporations doing business within the state and requires filing the California Form 100 each year by the 15th day of the 3rd month after the close of the taxable year. In Texas, the franchise tax is based on the revenue amount, with businesses owing taxes if their revenue exceeds $1,230,000. Filing is done using the Texas Franchise Tax Report, due by May 15 annually. Furthermore, Delaware emphasizes maintaining a registered agent in the state and requires an annual tax fee of $300 alongside the Delaware Franchise Tax, submission deadline being June 1 each year. Each state's specific regulations, fees, and forms necessitate thorough research and compliance for successful franchise operation.

Comments