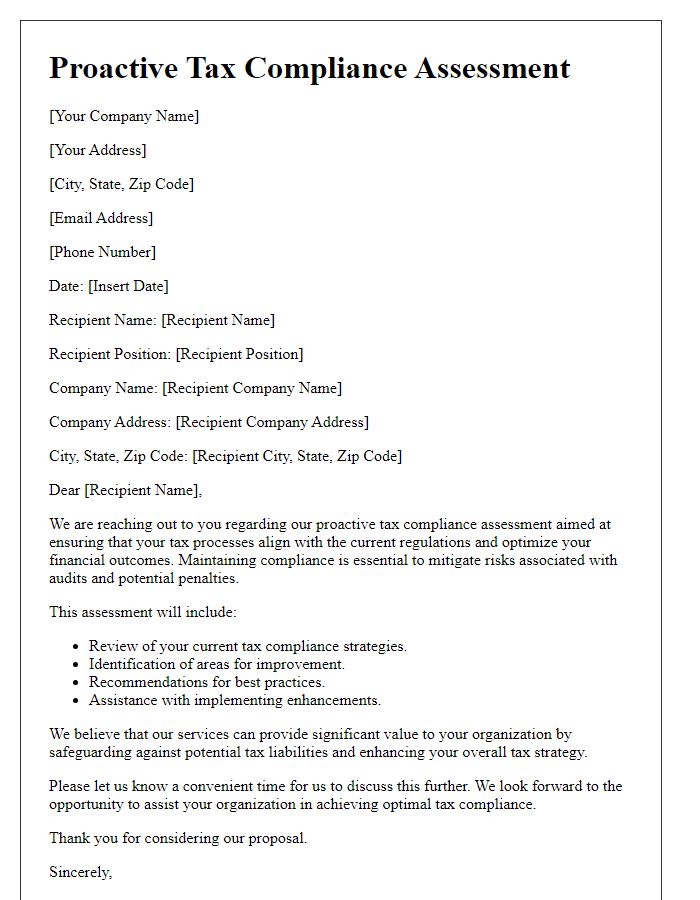

Are you looking to ensure your tax compliance is up to par? A proactive tax compliance review can be a game changer for both individuals and businesses alike, helping to identify potential issues before they become costly problems. In this article, we'll explore the importance of staying ahead of tax obligations and how a thorough review can safeguard your financial health. So, let's dive in and uncover the benefits of a proactive approach to tax compliance!

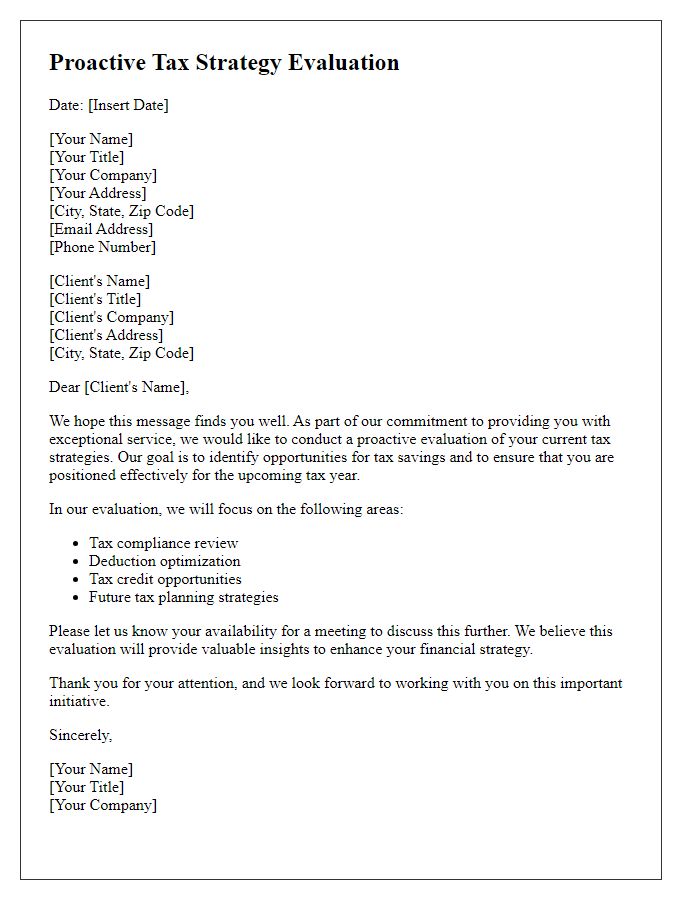

Clarity and Conciseness

Proactive tax compliance reviews enhance clarity and conciseness in financial reporting. Regular assessments, typically conducted annually, ensure alignment with evolving tax regulations, minimizing risks of penalties or audits. Utilizing software solutions, such as SAP or Oracle, facilitates real-time tracking of tax liabilities and credits. Engaging tax professionals, such as certified public accountants (CPAs), provides expert insights into complex tax laws, including the Internal Revenue Code in the United States. Documenting tax positions accurately enhances transparency, while clear communication with stakeholders, such as investors or board members, ensures understanding of compliance status and obligations. Overall, a structured review process establishes a robust framework for maintaining tax compliance and optimizing financial performance.

Compliance Requirements

Proactive tax compliance reviews involve meticulous examination of applicable regulations and requirements that govern tax obligations across various jurisdictions. Understanding the Internal Revenue Service (IRS) guidelines ensures businesses adhere to laws, minimizing risks associated with penalties and audits. Compliance includes accurate reporting of revenues, documentation of expenses, and timely filing of tax returns, such as Form 1040 for individuals or Form 1120 for corporations. In addition, organizations must stay updated on state-specific tax codes, like California's Proposition 13 for property taxes, which can significantly affect financial standing. Engaging professional tax advisors enhances knowledge of nuances in tax regulations, providing insights into potential deductions and credits, ultimately promoting sustainable compliance practices.

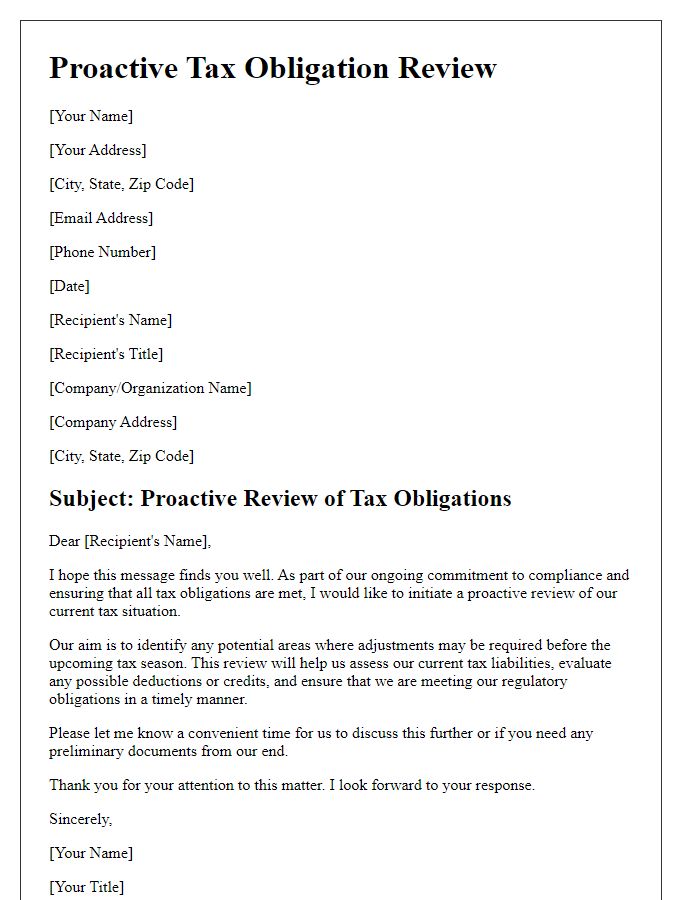

Deadlines and Timeframes

Proactive tax compliance reviews play a crucial role in ensuring adherence to regulations and optimizing financial health for businesses. Significant deadlines include April 15 for individual federal tax returns (Form 1040) and March 15 for S Corporation (Form 1120S) filings. Transparency with state deadlines is essential, as each state may have unique regulations, such as California's requirement for Form 540 by April 15. Timeframes for estimated tax payments also vary; typically, they are due quarterly, with key dates falling on April 15, June 15, September 15, and January 15 of the following year. Regular reviews throughout the fiscal year, ideally quarterly, help identify discrepancies or opportunities, fostering proactive adjustments before year-end. This approach not only mitigates risks of audits but also enhances strategic financial planning.

Contact Information

Proactive tax compliance reviews enable businesses to identify and rectify potential tax liabilities before they lead to penalties. Significant factors include jurisdictions (e.g., state and federal regulations in the United States), deadlines (such as April 15 for individual tax returns), and documentation requirements (like W-2 and 1099 forms). Specific tax codes (e.g., Internal Revenue Code Section 162 relating to business expenses) can impact deductions. In addition, understanding tax credits (such as those for renewable energy) can enhance a firm's financial position. Regular reviews help ensure adherence to compliance standards while optimizing tax strategies.

Personalized Engagement

A proactive tax compliance review ensures adherence to regulatory requirements and minimizes risks in financial reporting. This process involves a thorough examination of tax returns for corporations, partnerships, and sole proprietorships, including federal and state jurisdictions. By analyzing financial documents such as balance sheets, income statements, and supporting schedules, tax advisors identify discrepancies and potential areas of non-compliance. Personalized engagement with stakeholders, including CFOs and tax directors, fosters discussions around strategic tax planning, regulatory updates, and risk mitigation strategies. Additionally, utilizing tax software and digital tools enhances accuracy and efficiency in data analysis, further streamlining the review process. Regular training and updates on evolving tax laws are essential to maintain compliance standards.

Comments