Hey there! If you've recently received a notification about an adjusted tax liability, you might be feeling a mix of confusion and concern. It's important to understand what this means for you and how it can impact your finances moving forward. But don't worry, we're here to break things down and help you navigate this situation with ease. Let's dive deeper into what steps you can take and what options are available to you!

Personal Information Section

The Personal Information Section of an adjusted tax liability notification typically includes crucial details such as the taxpayer's full name, Social Security Number (SSN), address (including city, state, and ZIP code), and contact information (like a phone number or email address). This section should be clearly labeled to ensure easy identification and include any relevant identification numbers assigned by the tax authority (e.g., taxpayer identification number). These details create a direct link between the taxpayer and the adjusting agency, ensuring that the notification is accurately associated with the correct individual and facilitating further communication regarding adjusted tax liabilities.

Explanation of Adjustment

An adjusted tax liability notification outlines changes in an individual's or entity's tax obligations due to various factors. The notification generally specifies the reason for the adjustment, such as discrepancies identified during audits, changes in reported income, or new tax laws enacted by governing bodies like the Internal Revenue Service (IRS) in the United States. It may also highlight specific taxable events or transactions, such as capital gains from the sale of property in 2023 or adjustments related to tax deductions claimed in previous filings. The notification includes revised figures, detailing the new total tax liability, which might reflect an increase or decrease and illustrates any penalties or interest accrued due to late payments. Additionally, important information regarding the appeals process or options for payment plans could be included to assist the recipient in addressing their new tax responsibilities effectively.

Revised Tax Liability Details

Revised tax liability notifications serve as important communications detailing changes in individuals' or businesses' tax obligations, often due to new assessments or adjustments by the Internal Revenue Service (IRS). These notifications may indicate different amounts owed, such as an increase or decrease from previously filed returns. Taxpayers should pay close attention to specific figures, such as the adjusted total, which can significantly impact their financial planning. Additionally, the notification might outline pertinent deadlines for payments or appeals, influencing timely compliance. Understanding the implications of these revisions is essential, as penalties or interest may accrue on unpaid balances if not addressed promptly, affecting overall tax liabilities and financial status.

Payment Instructions

Adjusted tax liabilities can impact financial planning for individuals or businesses. The notification process includes essential details to guide taxpayers effectively. Payment instructions typically outline due dates, which may range from 15 to 30 days after notification. Payment methods include electronic funds transfer (EFT), credit card, or check addressed to the Internal Revenue Service (IRS) regional office. Additionally, specific account numbers linked to tax identification numbers help streamline processing. Failure to adhere to these payment instructions may incur penalties or interest, which can accumulate based on the outstanding amount daily. Clear communication regarding these adjustments is critical to maintaining compliance with tax obligations.

Contact Information for Assistance

The adjusted tax liability notification informs taxpayers about changes to their tax obligations, often as a result of audits, adjustments in income, or changes in deductible expenses. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, may contact individuals directly via official letters. Relevant contact information includes phone numbers, email addresses, and office locations for assistance, typically found on the official website of the tax authority. For example, IRS assistance can be reached at 1-800-829-1040, providing taxpayers with access to knowledgeable representatives who can address questions regarding tax assessments or disputes.

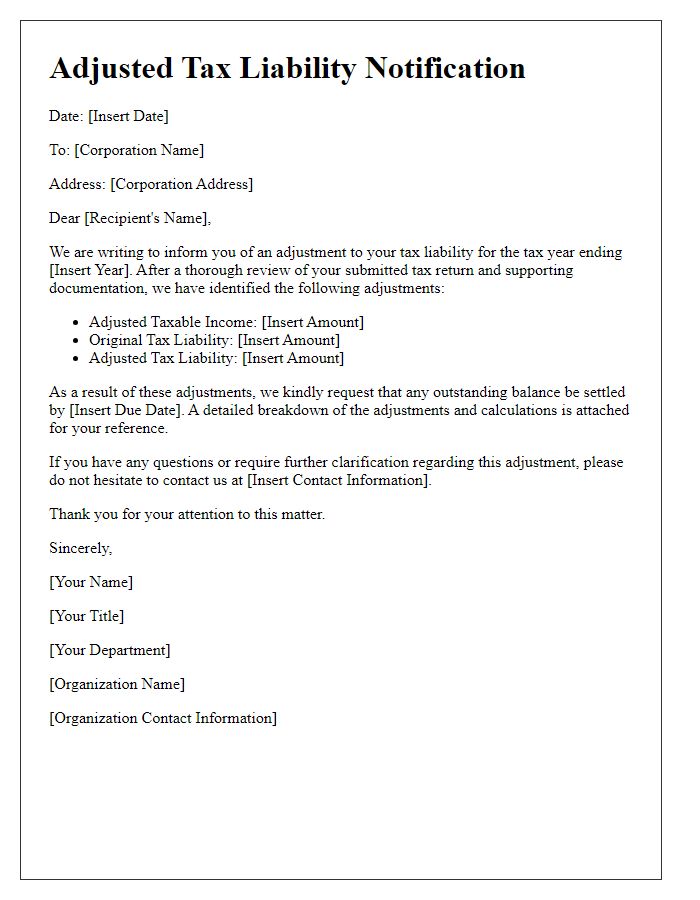

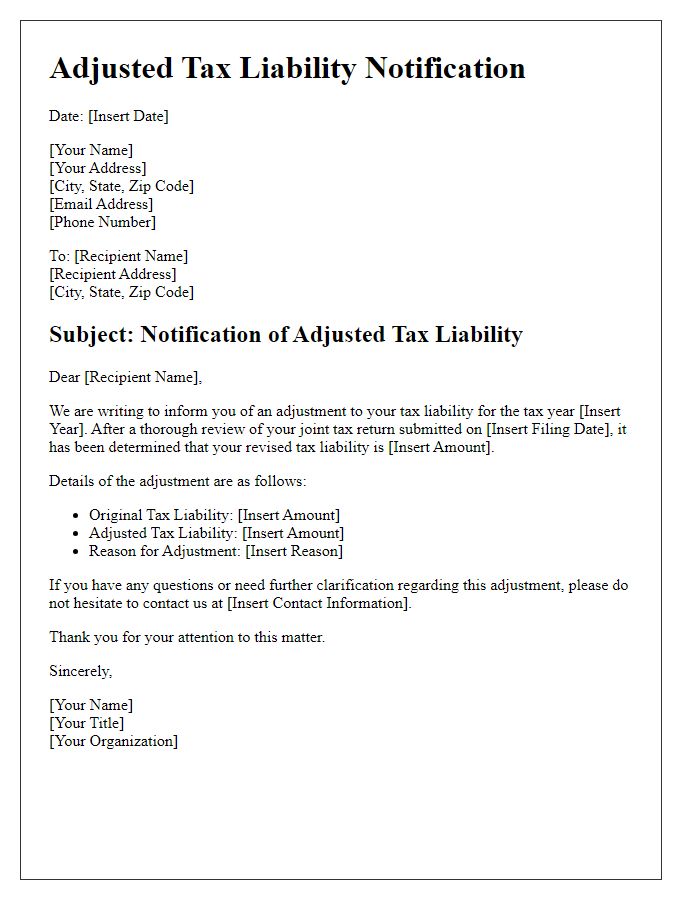

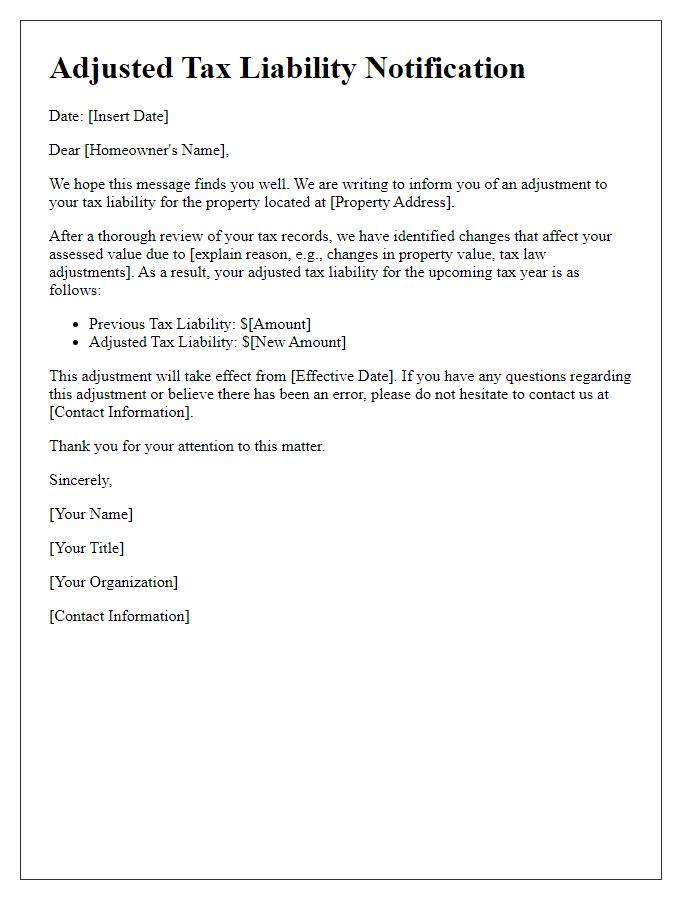

Letter Template For Adjusted Tax Liability Notification Samples

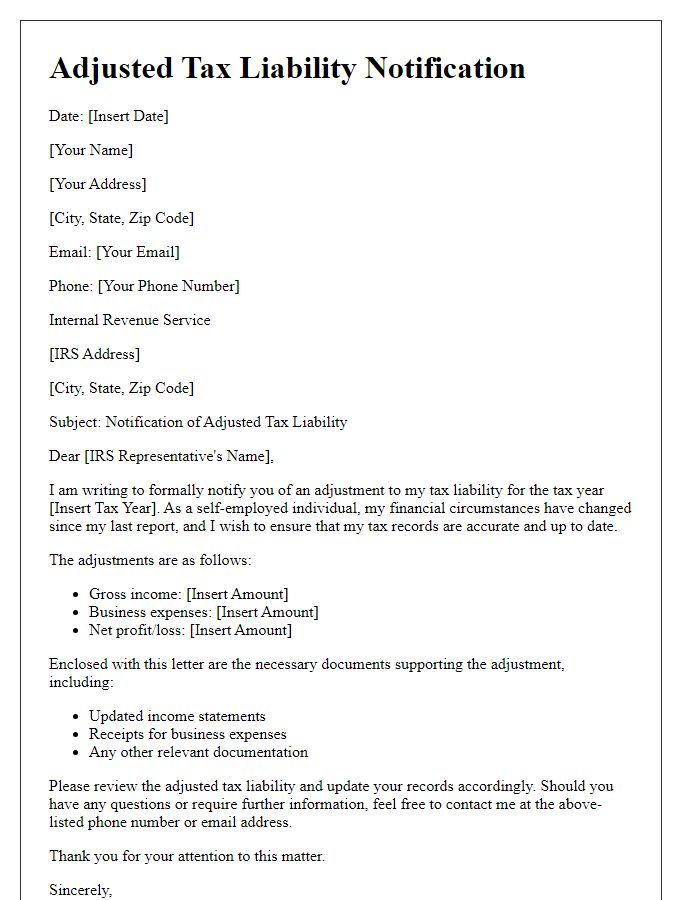

Letter template of adjusted tax liability for self-employed individuals.

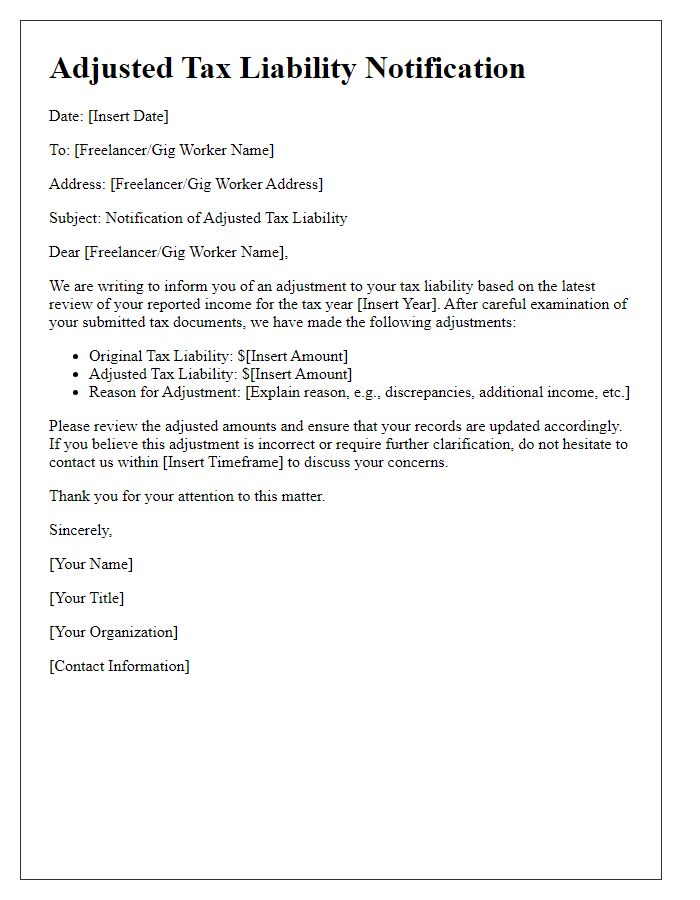

Letter template of adjusted tax liability for freelancers and gig workers.

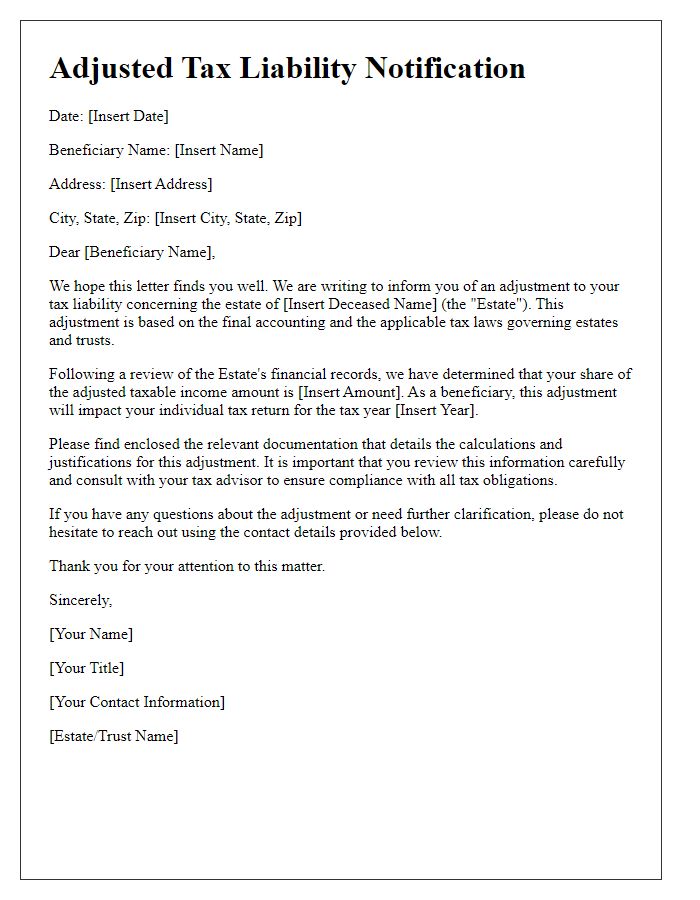

Letter template of adjusted tax liability for estate and trust beneficiaries.

Comments