Hey there! If you've ever found yourself puzzled by payroll tax reconciliation, you're not aloneâit's a common challenge for many businesses. This process plays a crucial role in ensuring your payroll records are accurate and compliant with tax regulations. In this article, we'll break down the essentials of payroll tax reconciliation, offering tips and best practices to make it a smoother experience. So, grab a cup of coffee and dive in to learn more about mastering your payroll tax reconciliation!

Clear subject line

Payroll tax reconciliation updates involve a comprehensive review of employee earnings, tax withholdings, and contributions, ensuring compliance with federal regulations set forth by the Internal Revenue Service (IRS). Each quarter, payroll departments analyze data from various sources, including W-2 forms, to confirm accuracy. Discrepancies may arise from underreported income or incorrect tax rates, potentially leading to penalties. Timely updates on reconciliations help organizations maintain financial health and assure employees that their tax obligations are met. Engaging in regular audits, particularly by using payroll processing software, can prevent issues and streamline the reconciliation process, promoting transparency and organization.

Concise summary of changes

Payroll tax reconciliation updates are critical for ensuring compliance with federal and state regulations. Recent adjustments include an increased federal withholding rate, now at 22% for supplemental wages exceeding $1 million. Changes in state tax rates, such as the recent update in California, now at 9.3% for individuals earning over $61,214. The Social Security wage base limit for 2023 has been raised to $160,200, impacting FICA contributions. Employers should also note the new filing deadlines for Forms 941, which have shifted to the 15th of the following month, ensuring timely submission to avoid penalties. Additionally, revisions have been made to certain deductions, such as the increase in dependent care benefits, now capped at $5,000 for employed individuals. It is essential for organizations to review these updates to maintain accuracy in payroll processing and tax compliance.

Adjusted payroll figures

Adjusted payroll figures play a crucial role in ensuring accurate payroll tax reconciliation for businesses. This process involves recalculating employee income tax withholdings and Social Security contributions based on updated payroll data, which may arise from corrections in reported hours or pay rates. Adjustments can lead to discrepancies when completing forms like the IRS Form 941 (Employer's Quarterly Federal Tax Return) or the annual Form W-2 (Wage and Tax Statement). Typically, adjustments should be documented carefully, as misreporting can result in penalties or fines from tax agencies. Furthermore, maintaining compliance with state-specific regulations (such as California's Employment Development Department requirements) is essential for avoiding legal issues. Regular communication with payroll service providers and accounting departments helps ensure that all adjustments are reflected accurately in financial statements, supporting fiscal accountability and transparency.

Tax compliance guidelines

In the realm of payroll tax reconciliation updates, adhering to tax compliance guidelines is crucial for organizations, particularly in the United States. The Internal Revenue Service (IRS) mandates that employers accurately report wage and tax information for employees, ensuring timely submission of forms such as Form 941 (Employer's QUARTERLY Federal Tax Return) and Form W-2 (Wage and Tax Statement). Accurate calculations of federal, state, and local taxes, which can vary significantly by jurisdiction (e.g., California's high state income tax rate influencing payroll deductions), are essential for avoiding penalties. Failure to comply can result in fines and increased scrutiny during audits, complicating financial operations. Implementing robust payroll systems and regular audits helps maintain adherence to IRS regulations, ensuring that employee compensation aligns with the established tax codes, thereby protecting the organization's financial integrity.

Contact for inquiries and assistance

Payroll tax reconciliation updates are crucial for maintaining compliance with federal and state tax regulations. Organizations often engage with tax professionals or the finance department to ensure accurate reporting and timely submissions. For inquiries regarding the reconciliation process, contact your company's payroll administrator for assistance. Providing necessary documentation such as W-2 forms, 1099s, and state withholding details can streamline this process. Engaging with local tax authorities ensures proper adherence to legislative changes impacting payroll taxation. Staying informed helps mitigate fines or penalties associated with tax discrepancies.

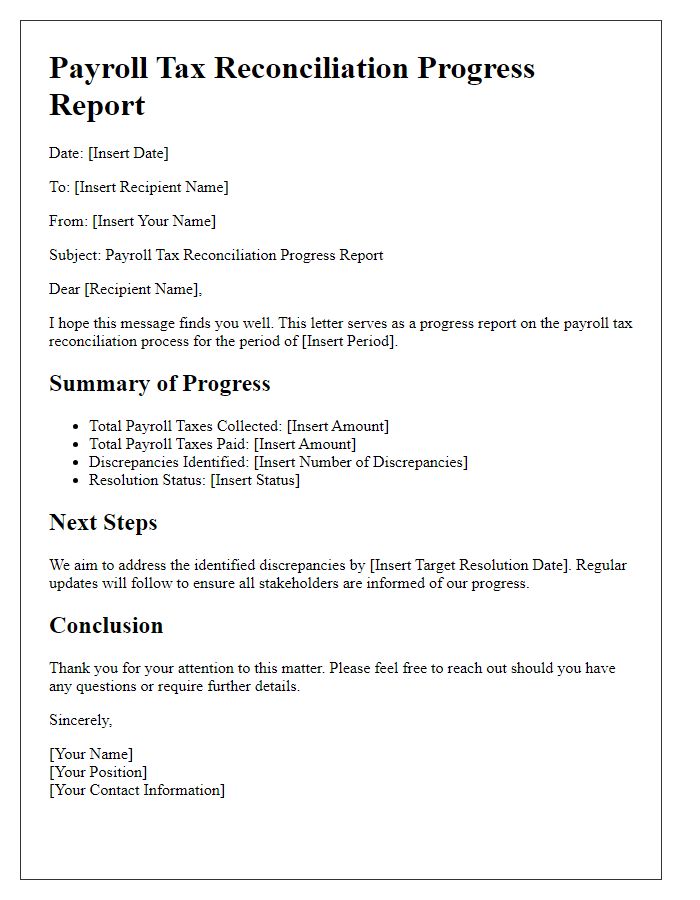

Letter Template For Payroll Tax Reconciliation Update Samples

Letter template of payroll tax reconciliation communication to stakeholders

Comments