Are you feeling overwhelmed by the complexities of personal tax exemptions? You're not alone; many individuals seek clarity and guidance on how to navigate the tax landscape for optimal savings. In this article, we'll break down the essential elements of crafting a compelling letter for your personal tax exemption request, ensuring you have all the tools you need to communicate effectively with the authorities. So, grab a cup of coffee and let's dive in to make your tax experience smootherâkeep reading!

Taxpayer Identification Information

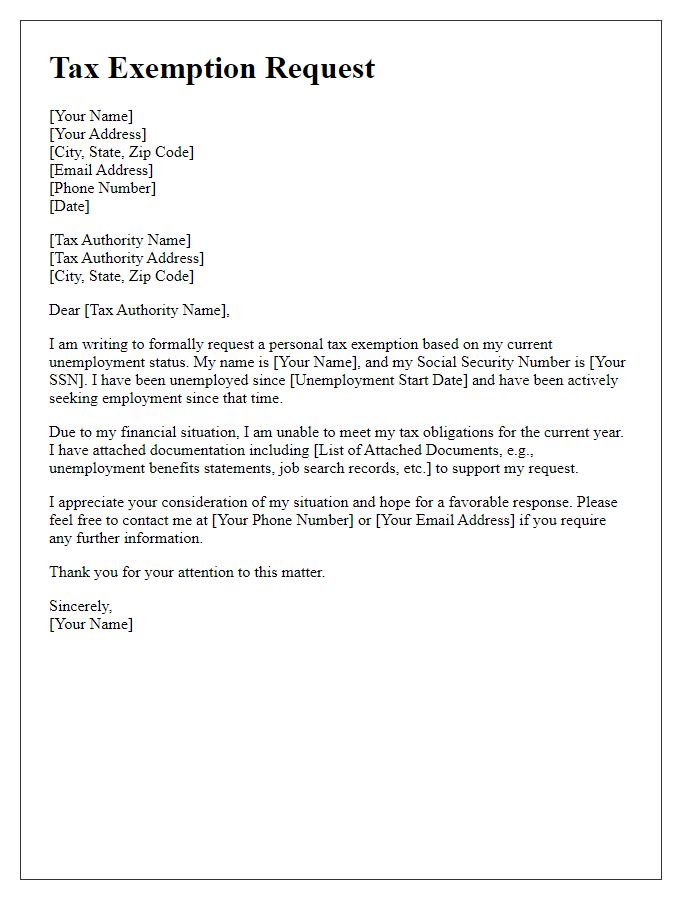

Individuals seeking personal tax exemption must provide detailed taxpayer identification information, including Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), essential for accurate tax processing by the Internal Revenue Service (IRS). The full name, as registered with the IRS, must be included, along with the current address detailing state and zip code, which establishes residency. Taxpayers often need to reference previous tax returns, including filing status such as single, married, or head of household, and any specific exemption categories applicable based on income or eligible dependents. Accurate and complete personal identification is crucial to expedite the approval process and ensure compliance with federal tax regulations.

Reason for Exemption Request

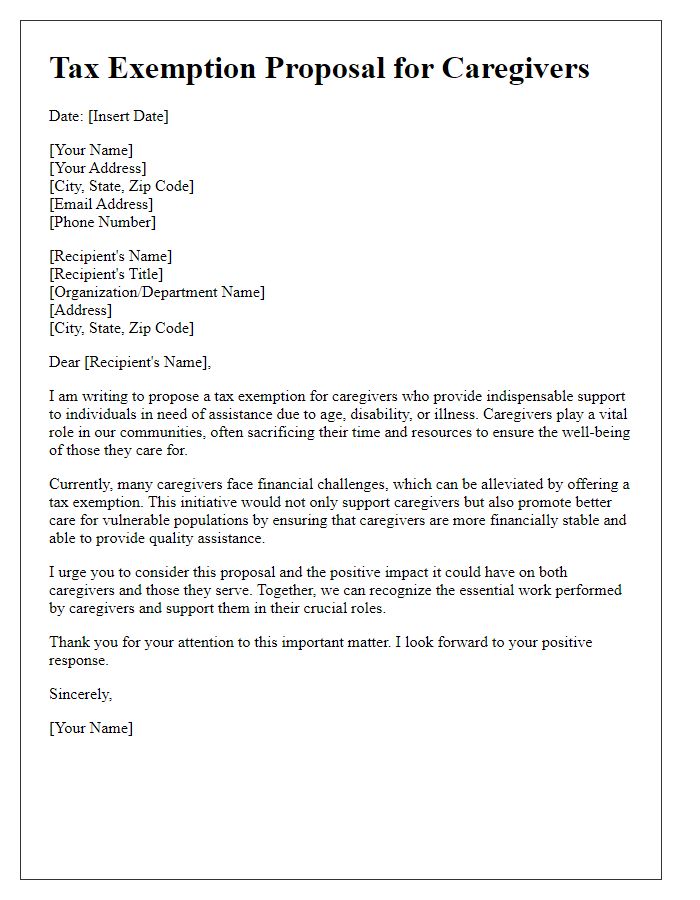

Personal tax exemption requests often arise due to unique circumstances affecting an individual's financial situation. Common reasons include permanent disability, which may prevent individuals from maintaining regular employment, or significant medical expenses that exceed a certain percentage of income, impacting disposable income. Loss of a primary source of income, such as job termination or business closures, can further justify the need for tax relief. Additionally, caregivers of dependents with special needs often face increased financial burdens. In some cases, individuals relocating to areas with higher living costs may also seek exemptions to alleviate financial strain. Each request must be accompanied by relevant documentation to support the claim and demonstrate the validity of the circumstances.

Relevant Tax Code or Regulation Citation

Tax exemption requests may reference specific regulations, such as Section 501(c)(3) of the Internal Revenue Code, which outlines qualifications for organizations seeking tax-exempt status in the United States. This section specifies the requirements that must be met, including the organization's purpose, operational limitations, and the prohibition against private benefit and political involvement. Compliance with these stipulations may enhance the likelihood of approval from the Internal Revenue Service (IRS), ensuring adherence to the legal framework governing tax-exempt entities. Proper citation of this regulation strengthens the argument for eligibility under the relevant tax code.

Supporting Documentation and Evidence

Supporting documentation and evidence are crucial for requesting personal tax exemptions, particularly for individuals seeking to navigate complex tax scenarios. Relevant tax forms, such as IRS Form 1040, must be completed meticulously to ensure accuracy. Documents like W-2 forms, which report annual income from employers, and 1099 forms, indicating income from freelance work or investments, serve as primary evidence. Additional support can include bank statements reflecting financial stability, receipts for deductible expenses, medical bills for medical exemptions, and proof of residency, such as utility bills. Personal identification, such as a driver's license or social security card, is essential to establish identity and eligibility. The submission of these documents to the appropriate tax authority, such as the Internal Revenue Service in the United States, is necessary for a thorough review process.

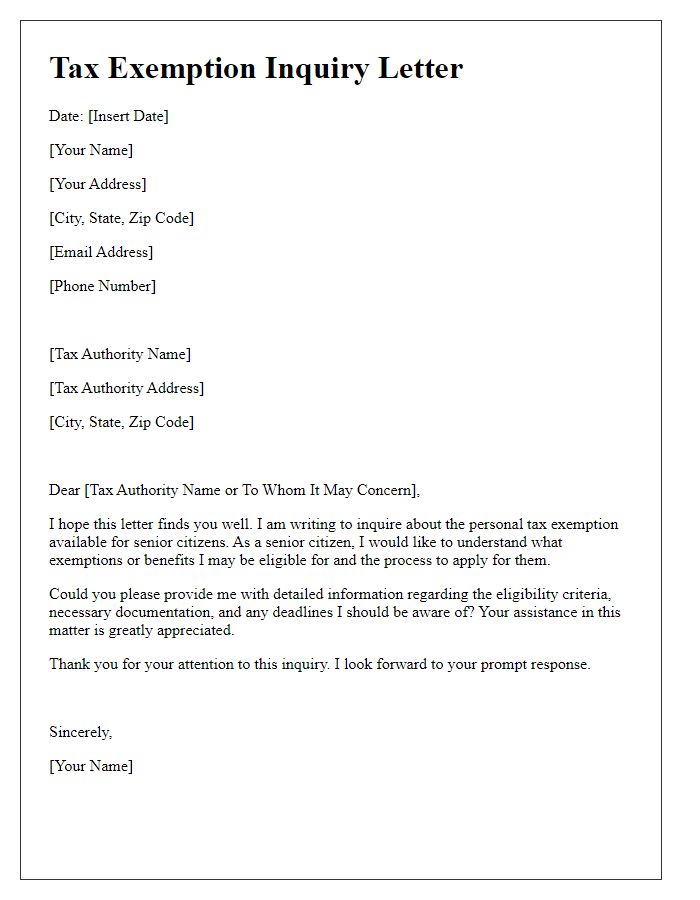

Contact Information for Follow-up

In submitting a personal tax exemption request, it is essential to provide comprehensive contact information for effective follow-up communication. Include your full name, such as John Doe, and residential address, detailing street name, city, state, and zip code, for verification purposes. Add your phone number, preferably a mobile line, like (123) 456-7890, to expedite real-time discussions regarding your request. Ensure to provide an email address, example john.doe@email.com, for official correspondence and documentation sharing. Incorporating a preferred method of communication can facilitate prompt responses from the tax authorities, improving the overall efficiency of the request process.

Letter Template For Personal Tax Exemption Request Samples

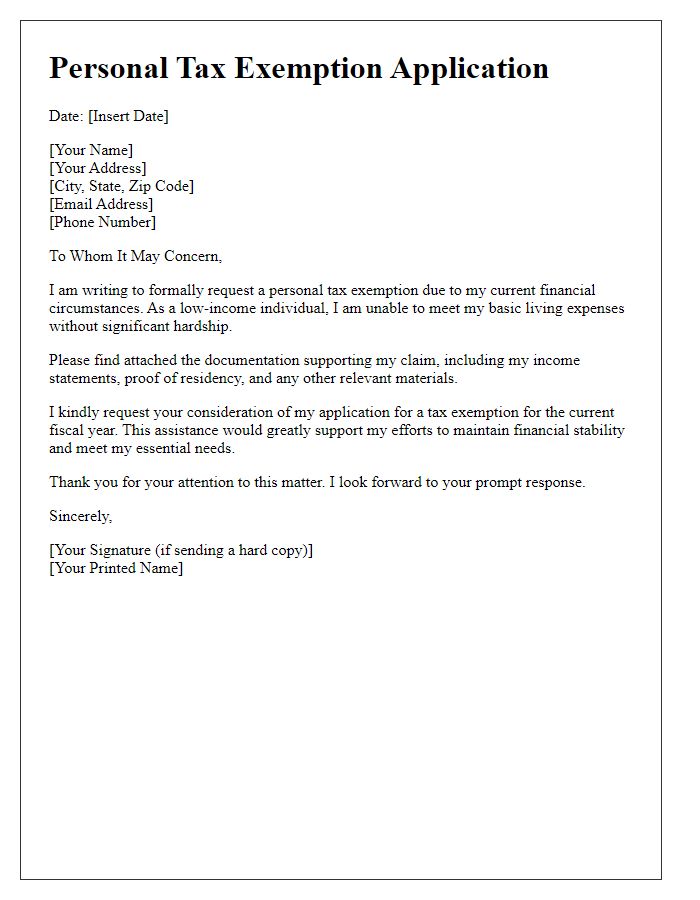

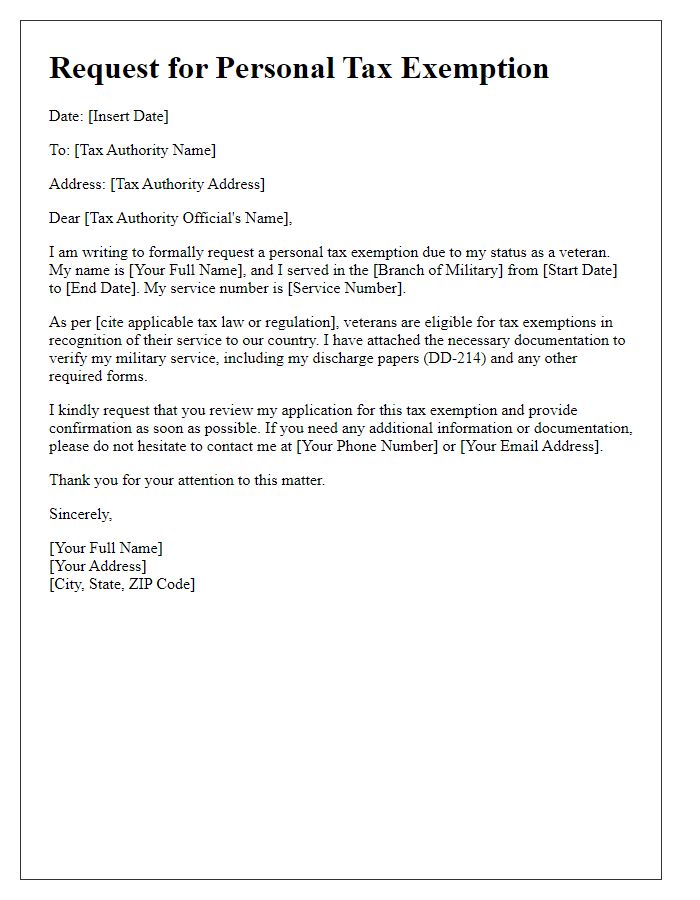

Letter template of personal tax exemption application for low-income individuals.

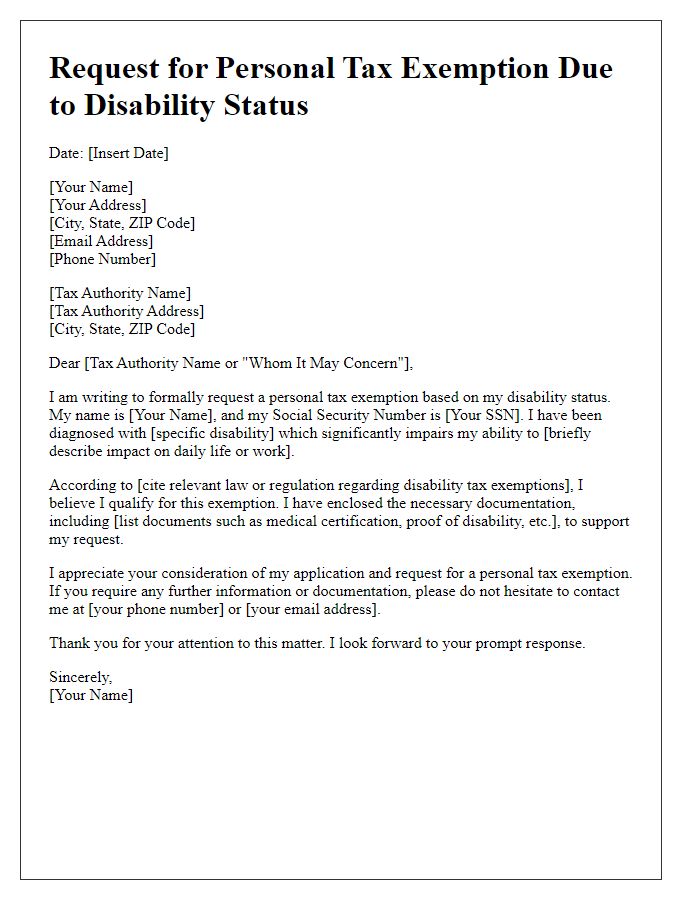

Letter template of personal tax exemption request due to disability status.

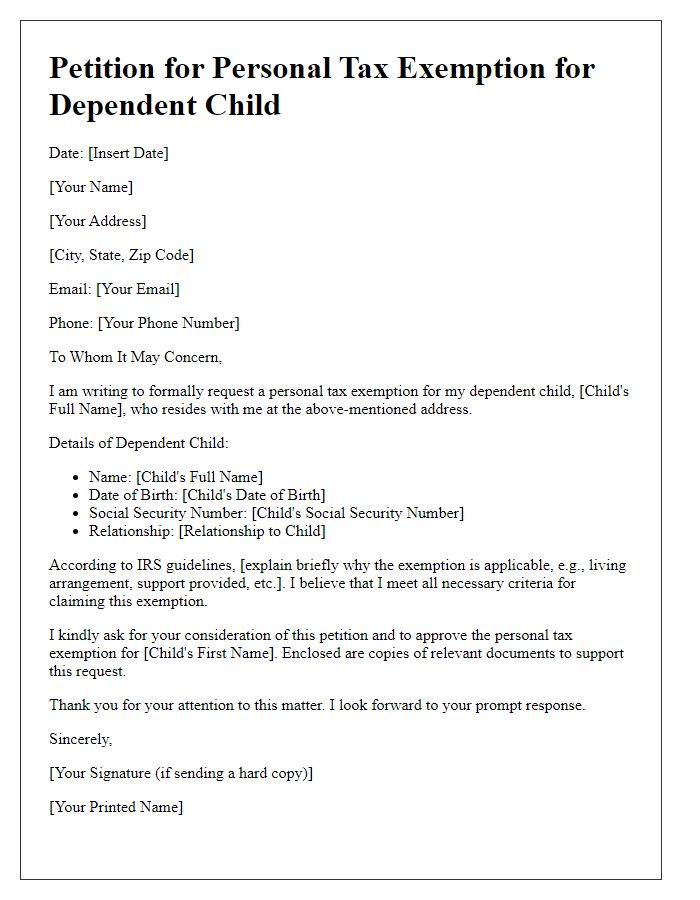

Letter template of personal tax exemption petition for a dependent child.

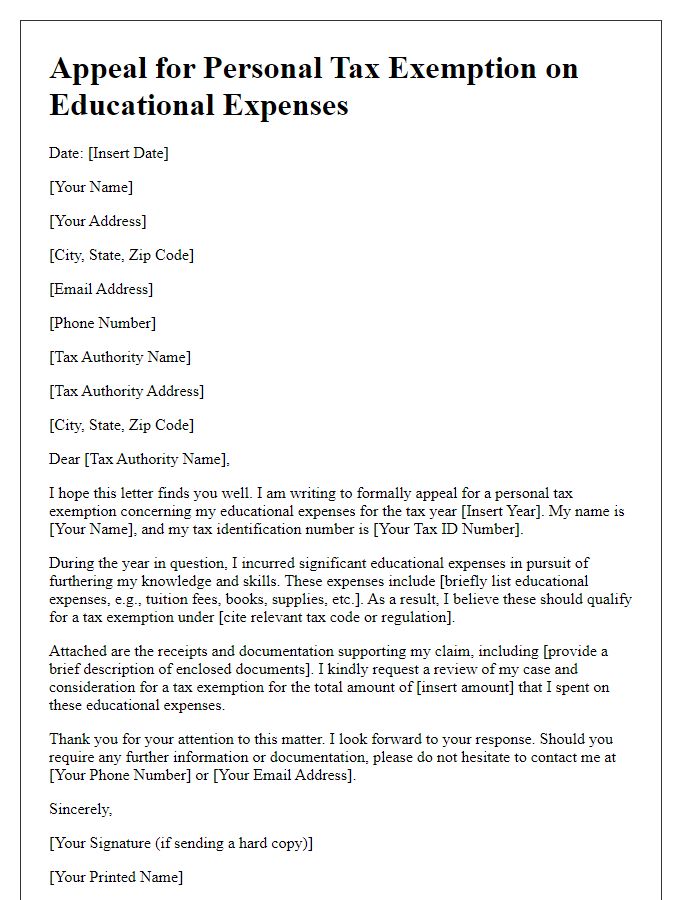

Letter template of personal tax exemption appeal for educational expenses.

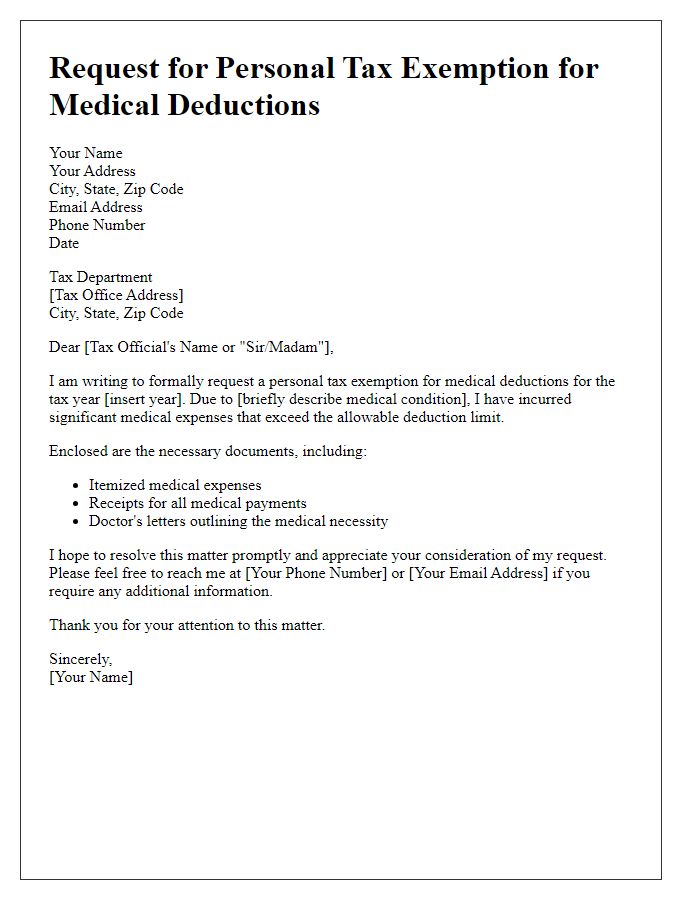

Letter template of personal tax exemption request for medical deductions.

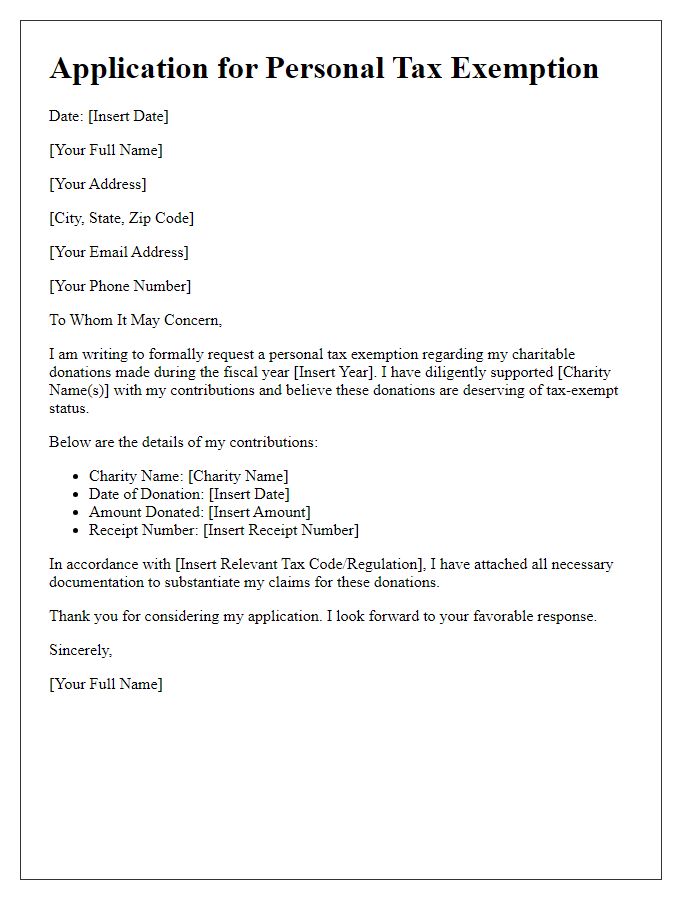

Letter template of personal tax exemption application for charitable donations.

Comments