Are you navigating the complexities of permanent establishment (PE) tax calculations? Understanding how to properly determine your tax obligations can be daunting, but it's crucial for ensuring compliance and minimizing risks. In this article, we'll explore essential strategies and insights that simplify the PE tax calculation process, tailoring them to your specific business needs. Join us as we delve deeper into this important topic and uncover valuable tips that can help streamline your approach!

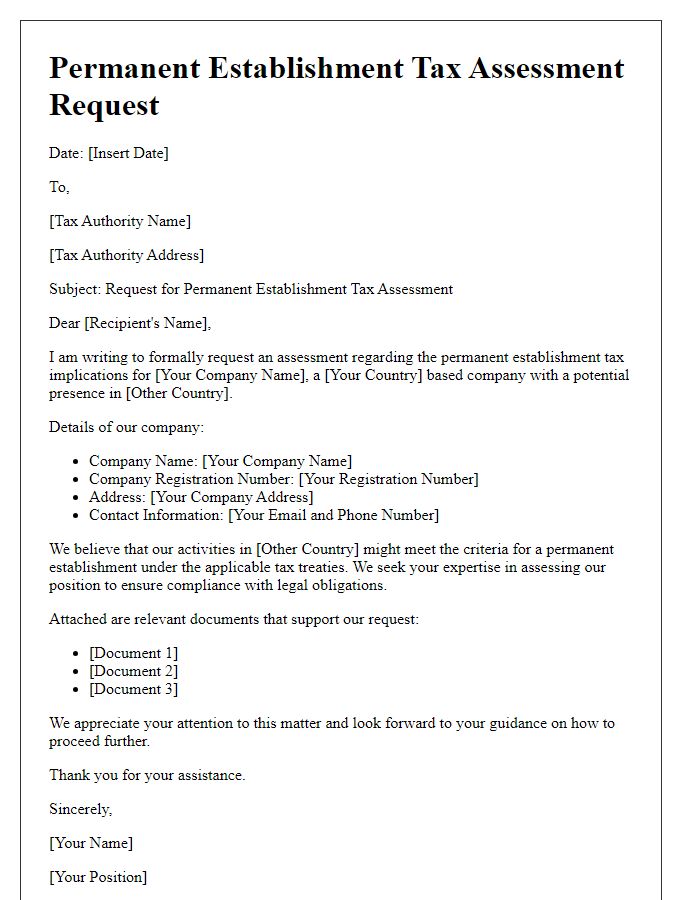

Legal Entity Identification

Permanent establishment (PE) tax calculations require precise identification of legal entities involved in international business activities. The Legal Entity Identifier (LEI), a unique identification code assigned to organizations engaging in financial transactions, plays a crucial role in ensuring accurate reporting and compliance with tax regulations across jurisdictions. Countries such as the United States, Germany, and Japan have varying criteria for determining a PE, emphasizing the need for thorough documentation. Factors influencing PE status include fixed places of business, representative agents, and the nature of business activities conducted. Entities must maintain up-to-date LEI information to facilitate seamless communication with tax authorities and reduce the risk of unexpected tax liabilities. Accurate PE calculations hinge on these identifiers, ensuring that organizations adhere to tax obligations while optimizing their tax strategies.

Nature of Business Operations

Permanent establishment tax calculations require a detailed understanding of business operations, particularly for corporations engaged in international trade. Tax guidelines specify that entities with a physical presence, such as offices or warehouses, in countries like Germany or Japan may be liable for local taxation. Nature of business operations includes factors like the duration of activities, types of goods traded, and services rendered. For instance, a company conducting construction projects (often long-term) in Brazil could trigger permanent establishment rules due to sustained business operations. Additionally, activities classified as auxiliary or preparatory, such as storage or display, may impact tax obligations differently across jurisdictions. Accurate documentation of business activities and locations is essential for compliance and determining tax liabilities.

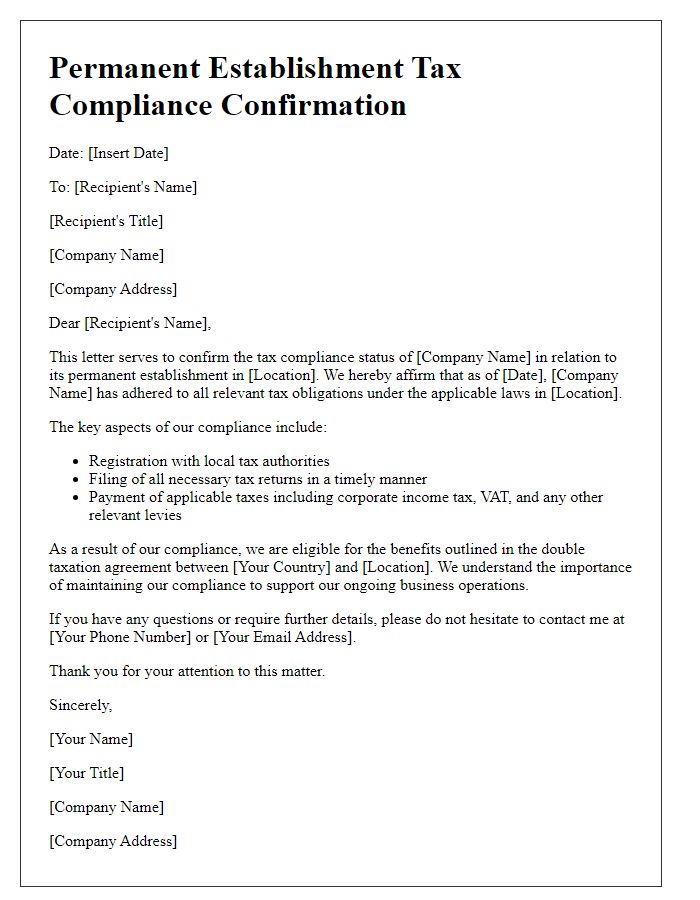

Allocation of Profit Attribution

Permanent establishment (PE) tax calculations involve allocating profit attribution to ensure compliance with international tax regulations. Jurisdictions define PE based on local laws and OECD guidelines, detailing criteria such as a fixed place of business or a dependent agent acting on behalf of a foreign enterprise. Various methodologies like the Comparable Uncontrolled Price (CUP) or the Profit Split Method may determine the allocation of profit among entities working in multiple locations. Relevant documents include financial statements, transfer pricing reports, and local country tax regulations, all crucial for accurate and transparent allocation. Furthermore, factors such as the nature of the business activities, local market conditions, and intercompany agreements influence profit attribution, helping secure appropriate taxation within established agreements across jurisdictions.

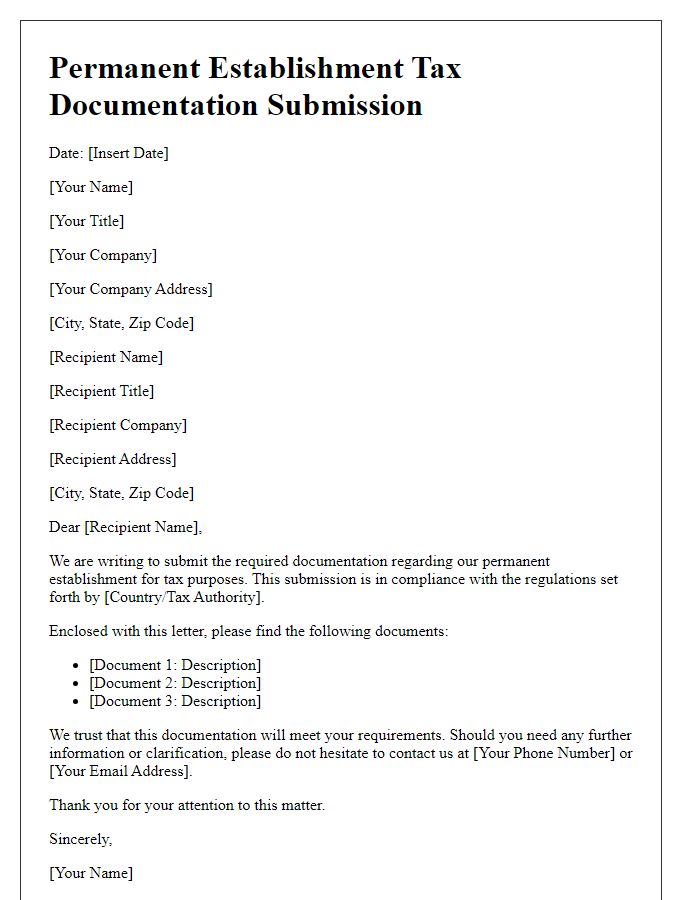

Transfer Pricing Compliance

Permanent establishment tax calculations play a critical role in transfer pricing compliance for multinational enterprises operating in various jurisdictions. Specifically, the OECD Transfer Pricing Guidelines provide a framework for determining the appropriate allocation of income and expenses attributed to a permanent establishment (PE) in locations such as Germany, Japan, or Brazil. Accurate calculations are essential to avoid double taxation and ensure compliance with local regulations. Elements for consideration include functional analysis, which evaluates the economic activities performed by the PE, and arm's length principle, which mandates that transactions between related entities reflect market conditions observed between unrelated entities. Documentation requirements, such as country-by-country reporting, further underscore the importance of maintaining precise records for audits by tax authorities, including the Internal Revenue Service in the United States or Her Majesty's Revenue and Customs in the United Kingdom. Failure to adhere to these regulations can result in significant penalties and reputational risks for companies.

Double Taxation Treaty Provisions

Permanent establishment (PE) tax calculations often involve complex considerations influenced by various Double Taxation Treaty (DTT) provisions. Countries like Germany and the United States may impose PE tax when a foreign business operates within their borders for an extended period, usually exceeding six months. Specific DTT articles define the scope of taxable income, operational activities, and allocation of profits. For example, Article 5 generally outlines the criteria for establishing a PE, while Article 7 details how profits attributed to the PE are computed, considering local regulations and international accounting standards. Additional provisions may address withholding tax rates on dividends and interest, ensuring that companies do not face excessive taxation. Thorough analysis of both domestic tax laws and international treaties is essential for accurate tax compliance and effective financial planning.

Comments