Are you looking to simplify your electronic tax record submission process? You've come to the right place! In this article, we'll walk you through a straightforward template that not only streamlines your submission but also ensures that you stay compliant with tax regulations. So grab a cup of coffee and let's dive into the details of crafting the perfect letter for your electronic tax recordsâread on to get started!

Clear Identification Details

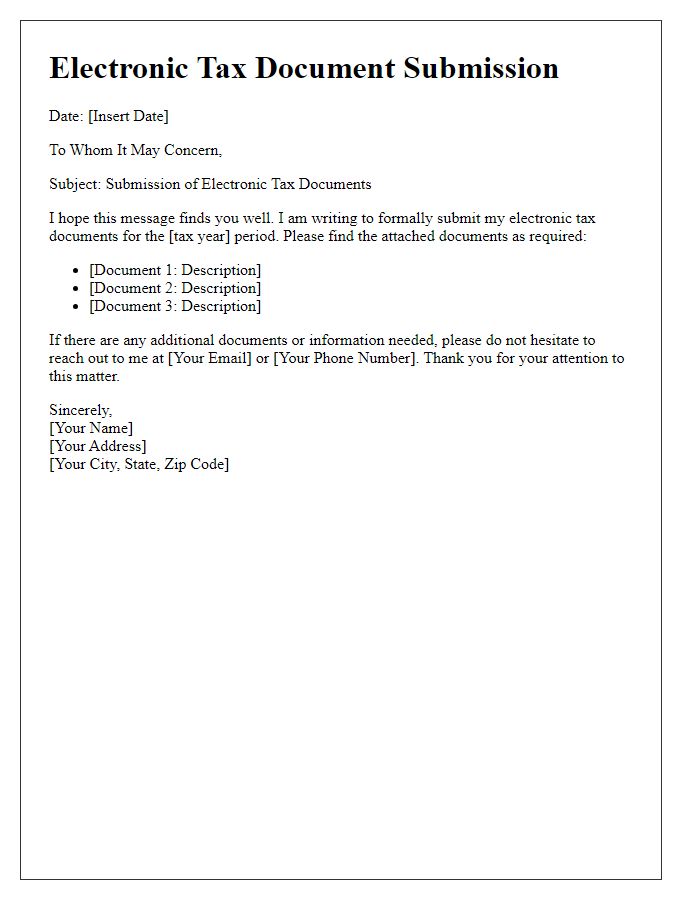

Electronic tax record submissions require clear identification details for processing accuracy. Taxpayer Identification Numbers (TIN), often nine digits, are critical for linking records to individuals or entities. Submission forms should include full legal names alongside corresponding business names when applicable, ensuring precise alignment with official records. Address details must be comprehensive, including street number, street name, city, state, and zip code, preventing misrouting during processing. Dates of tax years need clarity, typically represented in MM/DD/YYYY format, to delineate specific reporting periods. Additionally, contact information should encompass valid phone numbers, formatted to facilitate immediate communication if discrepancies arise during assessment. These details collectively ensure smooth navigation through the electronic tax filing process.

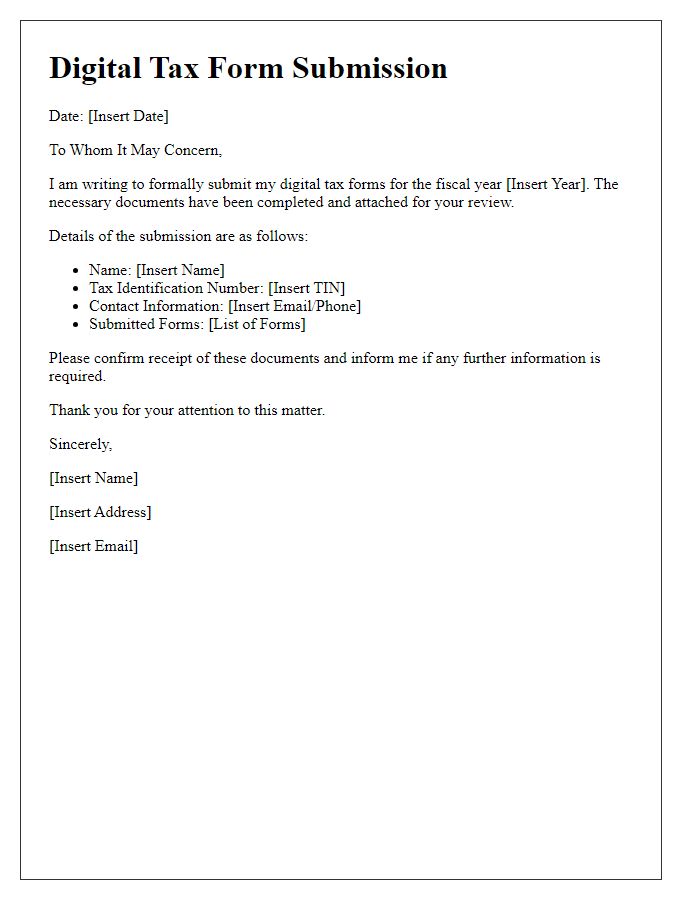

Precise Submission Instructions

Electronic tax record submission requires adherence to specific guidelines for accurate processing. Document types include W-2 forms, 1099 forms, and Schedule C (Profit or Loss from Business). Submission formats must be PDF or XML, ensuring clarity and compatibility with IRS systems. File size limits typically cap at 25 MB. The electronic filing system, accessible via the IRS website, mandates user authentication with an e-Filing PIN or prior year AGI (Adjusted Gross Income) for verification. Deadlines for submission generally fall on April 15th, with extensions available until October 15th, contingent upon prior approval. Failure to comply with these guidelines can result in delays or rejections of filed records.

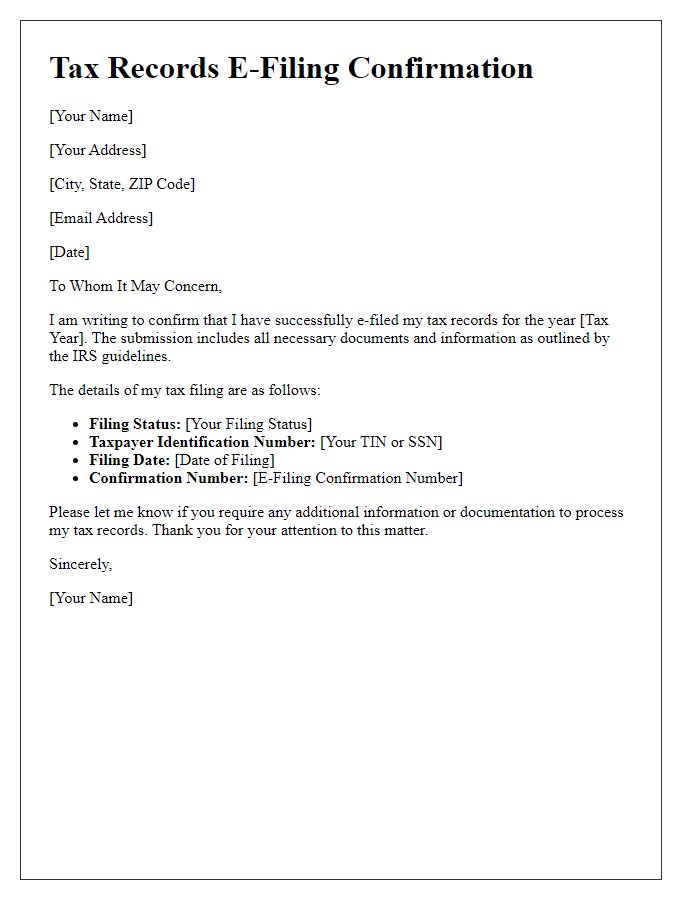

Compliance Reference Number

Electronic tax record submission involves a Compliance Reference Number (CRN), which is a unique identifier assigned to track tax filings. This number aids in organizing and managing compliance documentation effectively, ensuring all submitted records can be easily retrieved and verified by tax authorities, such as the Internal Revenue Service (IRS) in the United States. Accurate recording of the CRN is crucial to avoid delays in processing and potential fines. Additionally, maintaining a log of associated submission dates and any correspondences related to the submission can streamline future audits, providing a clear trail of compliance efforts in tax obligations for the fiscal year.

Contact Information for Queries

For electronic tax record submission, contact information is essential for addressing queries effectively. The Internal Revenue Service (IRS) provides a dedicated helpline at 1-800-829-1040, available Monday through Friday, from 7 AM to 7 PM local time, excluding holidays. Additionally, taxpayers can access the IRS website at www.irs.gov for comprehensive resources, including FAQs and guidelines regarding electronic submissions. For state tax inquiries, individual state revenue departments maintain specific contact numbers, typically listed on state websites, ensuring relevant assistance based on geographic location. Properly documenting contact information enhances clarity in communication and expedites resolution of tax-related issues.

Digital Signature and Authentication

Digital signature technology plays a crucial role in the electronic submission of tax records, providing both security and authenticity. A digital signature, which utilizes cryptographic algorithms (like RSA or DSA), ensures that the document remains unaltered during transmission and verifies the identity of the sender, meeting regulatory compliance standards set by governing bodies like the IRS in the United States. Authentication mechanisms, including two-factor authentication (2FA), add an extra layer of security, often requiring a unique verification code sent to a registered mobile device. This process safeguards sensitive financial information from unauthorized access, ensuring that tax records submitted electronically are both confidential and valid. Implementing these technologies is essential for businesses and individuals aiming to streamline their tax filing processes efficiently while maintaining compliance with evolving digital security regulations.

Comments