Hello there! If you've recently received news about changes to your local tax rate, you're not aloneâmany residents are feeling the impact of these adjustments. It's important to stay informed about how these changes might affect your pocketbook and the community at large. Understanding the reasons behind the tax rate modifications can help you navigate your finances more effectively. Curious to learn how these developments may influence you and your neighbors? Read on for more insights!

Subject line or header

Local Tax Rate Change Notification for 2023

Introduction and purpose

The local tax rate change notification serves as an essential communication tool to inform residents and businesses in [City/County Name] about the recent adjustments to the property tax rates. Effective from [Effective Date], the new tax rates will be [New Tax Rate Percentage], a modification from the previous rate of [Old Tax Rate Percentage]. This change aims to address community needs, fund local services, and support essential infrastructure projects such as road maintenance, public safety, and education initiatives. Residents can anticipate receiving detailed information regarding how these adjustments may impact their property tax bills, ensuring transparency and compliance with local tax regulations.

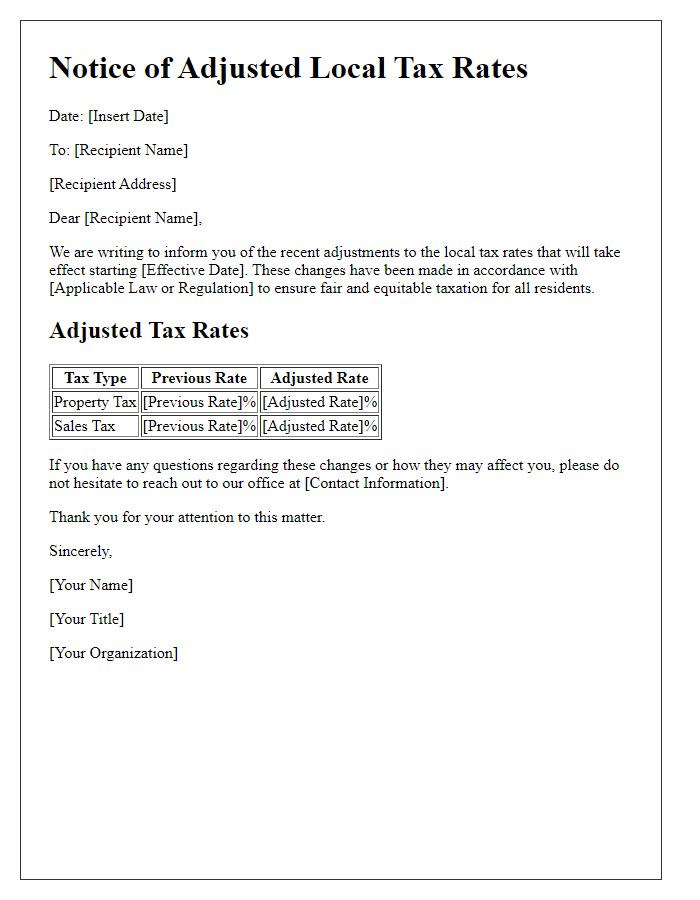

Details of the tax rate change

Local tax rate adjustments can significantly impact residents and businesses within municipal boundaries. For instance, the recent decision by the Springfield City Council to raise the property tax rate from 1.5% to 2% effective January 1, 2024, aims to generate additional revenue for essential services such as public safety, education, and infrastructure improvements. This change will apply to all properties within Springfield, affecting an estimated 10,000 households and approximately 500 commercial enterprises. The increase translates to an average annual payment rise of $200 for residential properties valued at $150,000. Furthermore, residents can expect updated tax assessments to be mailed by December 15, 2023, detailing the revised tax amounts and payment options. Public hearings will allow citizens to voice concerns about these changes on December 5 and December 12 in the City Hall Council Chambers.

Implementation date

Local tax rate changes can significantly impact residents' finances and local government revenue. Effective January 1, 2024, a new tax rate of 2.5% will be implemented for residents in Springfield, Ohio, impacting property taxes collected. This adjustment follows recent legislative changes aimed at addressing budget deficits while maintaining essential public services such as education and infrastructure development. Residents are encouraged to review updated assessments before the January deadline to understand the implications for their property taxes. Additionally, community engagement meetings will be held at the Springfield City Hall to provide more information and answer any questions about the new tax structure.

Contact information for inquiries

Local tax rate changes impact residents and businesses significantly, necessitating clear communication. For inquiries regarding adjustments to tax rates effective January 1, 2024, residents can contact the City Tax Office located at 123 Main Street, Springfield. The office is available Monday through Friday, from 9 AM to 5 PM, and can be reached at (555) 123-4567. Email inquiries can be directed to taxinfo@springfield.gov for prompt assistance. Essential updates regarding the tax rate changes, including percentage adjustments and relevant deadlines, will also be posted on the official city website, ensuring residents stay informed of their financial responsibilities.

Comments