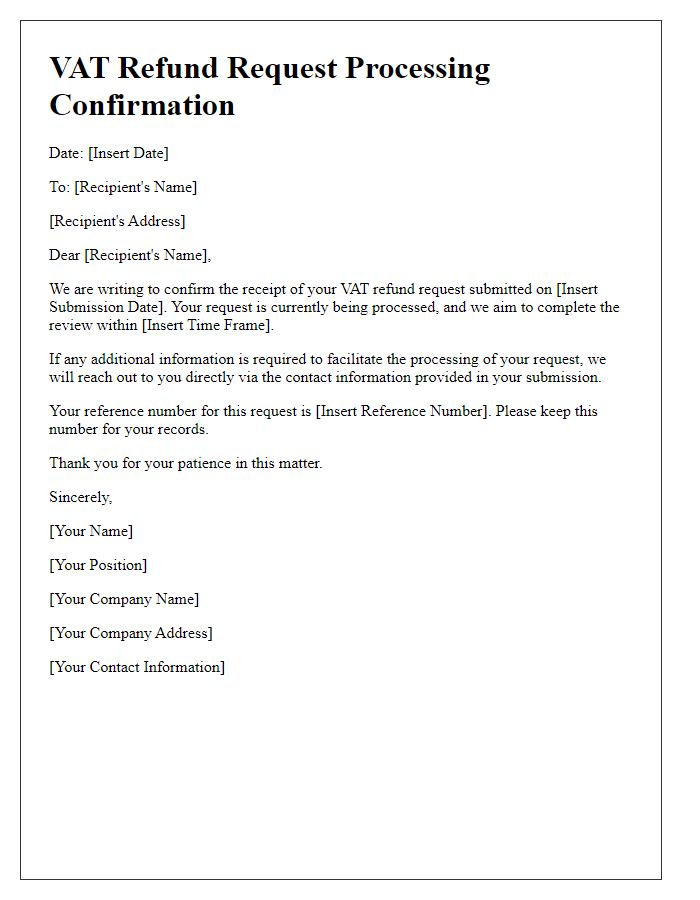

Are you ready to tackle your VAT refund request but unsure where to start? Navigating the world of tax refunds can be daunting, yet having a solid letter template can make the process smoother and more effective. In this article, we'll walk you through a simple yet comprehensive VAT refund request confirmation letter, ensuring you cover all the essential points while maintaining a professional tone. So, let's dive in and simplify your VAT refund journey!

Subject Line Optimization

Subject line optimization is vital for increasing email open rates and ensuring clear communication of intent. When crafting a subject line for a VAT refund request confirmation, it's important to include key elements such as the purpose of the email (VAT refund request), the status (confirmation), and possibly a reference number for tracking. A highly effective subject line could read: "Confirmation of VAT Refund Request - Ref: #123456789". This format not only informs the recipient about the nature of the email but also provides a specific reference, enhancing the chances of quick recognition and response. Additionally, including the date (e.g., "Confirmation of VAT Refund Request - Ref: #123456789 - Date: October 15, 2023") can further contextualize the correspondence, ensuring clarity in future communications.

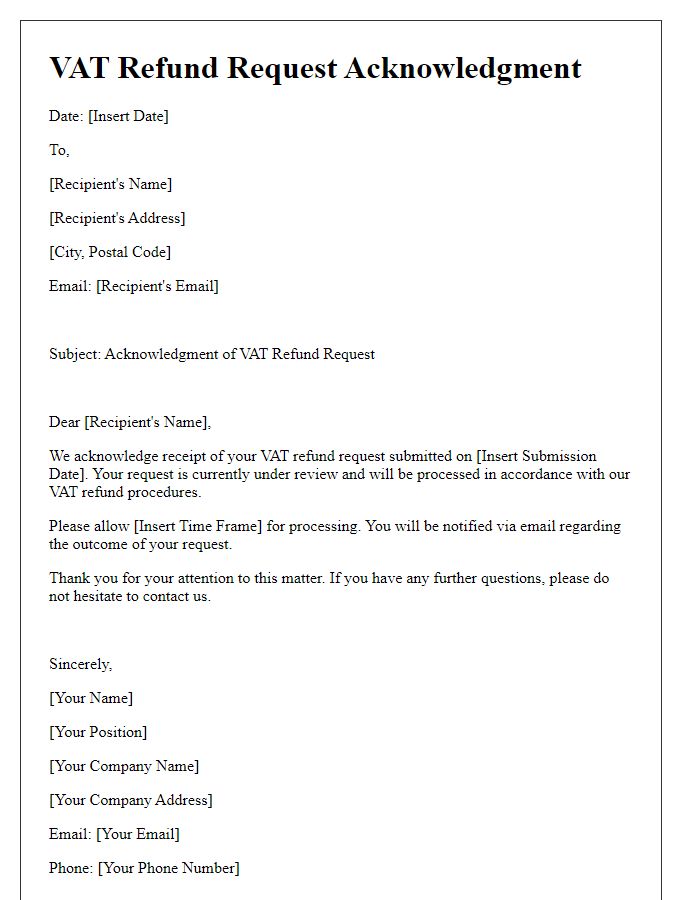

Clear Contact Information

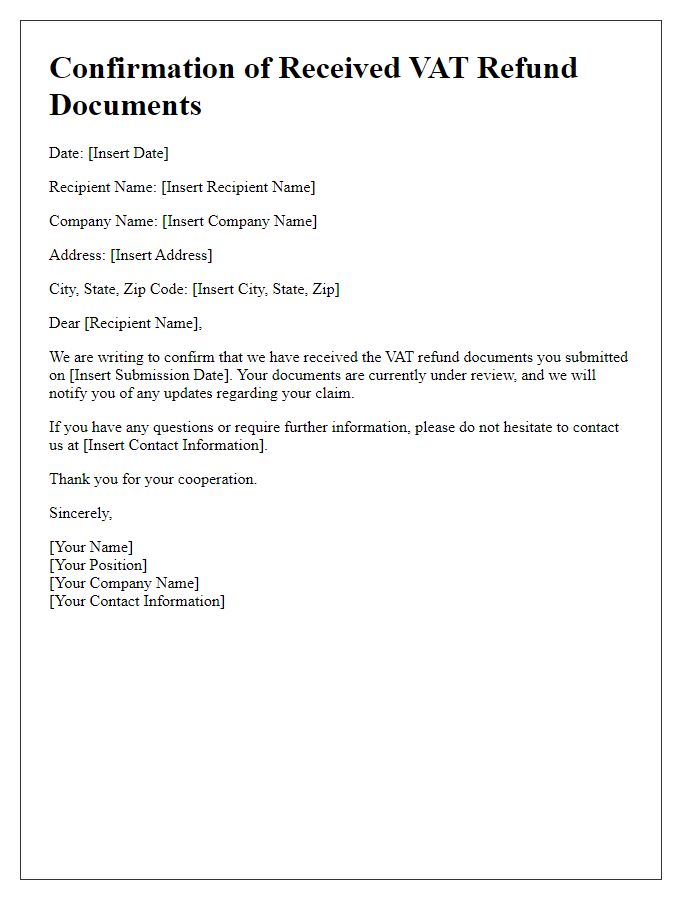

A VAT refund request confirmation requires clear contact information to ensure seamless communication between the applicant and the tax authority. Essential details include the applicant's full name, organization name, and valid mailing address including street address, city, and postal code for accurate processing. Additionally, a phone number (preferably a mobile number) should be provided for direct communication regarding the status of the refund request. An email address is also critical for electronic correspondence, ensuring that any updates or inquiries are received promptly. Providing clear contact information facilitates efficient resolution of any issues related to the VAT refund process, contributing to a smoother experience for all involved parties.

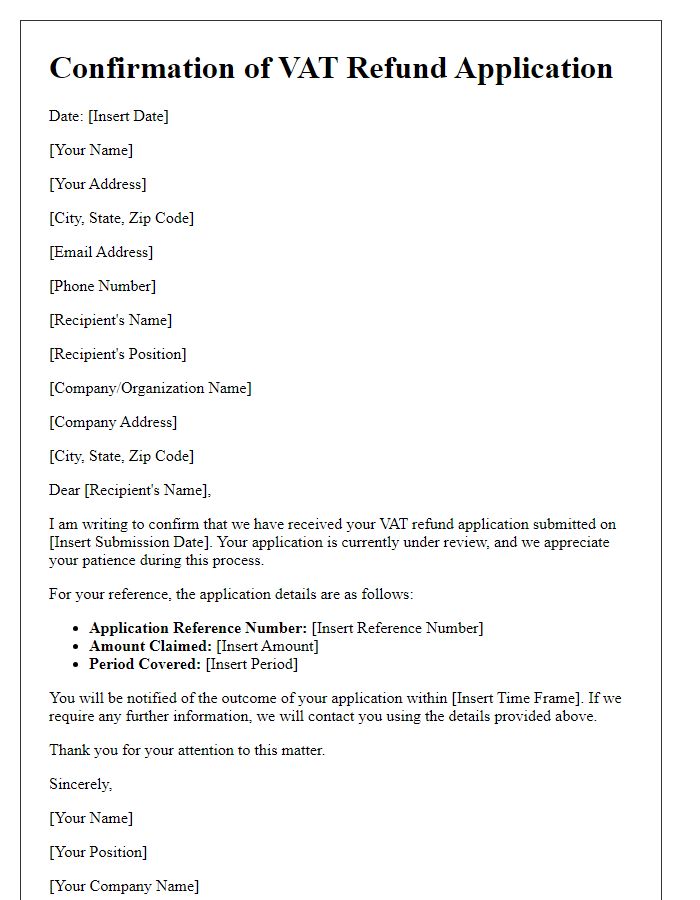

Reference to Original Request

The VAT refund process requires meticulous attention to detail in its documentation, particularly in an official communication addressing the initial request. The confirmation should reference the original request clearly, providing pertinent details such as the VAT registration number, original submission date, and the VAT period in question. Furthermore, it must include any identifying reference numbers associated with the original claim, which enhances traceability. This confirmation can be addressed to the relevant tax authority, ensuring compliance and expediting the refund process. Accurate record-keeping surrounding these dates and details is critical, as it not only aids in efficient processing but also mitigates potential delays related to inquiries or mismatches in documentation.

Detailed Refund Amount

A VAT refund request confirmation is essential for businesses engaged in international trade, particularly in the European Union, where VAT regulations are strict. The detailed refund amount can be significant, often reaching thousands of euros, depending on the volume of eligible purchases. The refund process typically involves meticulous record-keeping and submission of invoices, with some companies waiting several months for their refunds to be processed by tax authorities like HM Revenue and Customs (HMRC) in the United Kingdom or the Bundeszentralamt fur Steuern in Germany. Timely confirmation of the refund request is crucial, providing clarity on received documentation, the status of the claim, and any outstanding issues that need resolution.

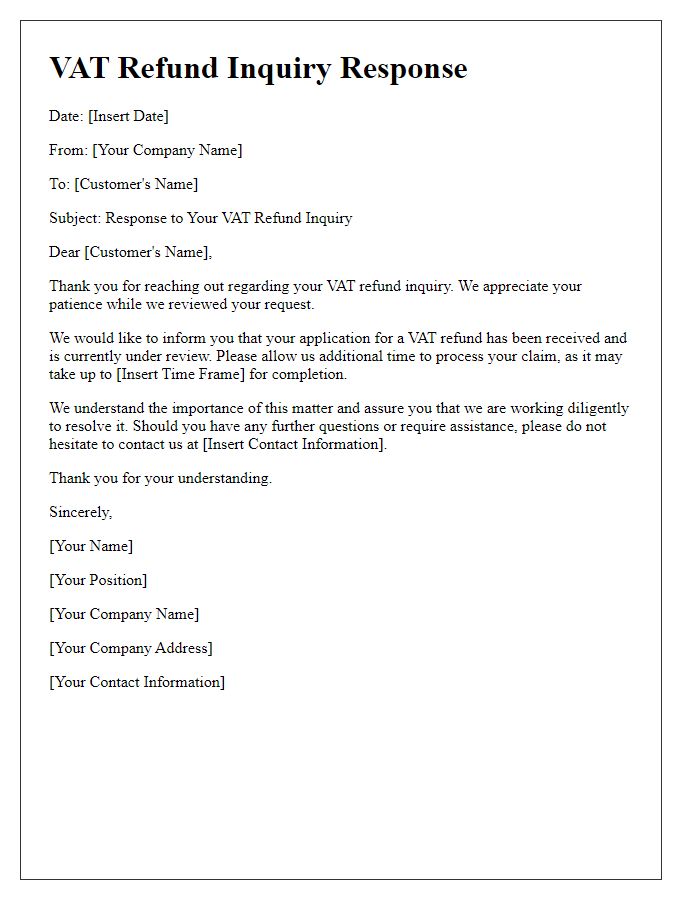

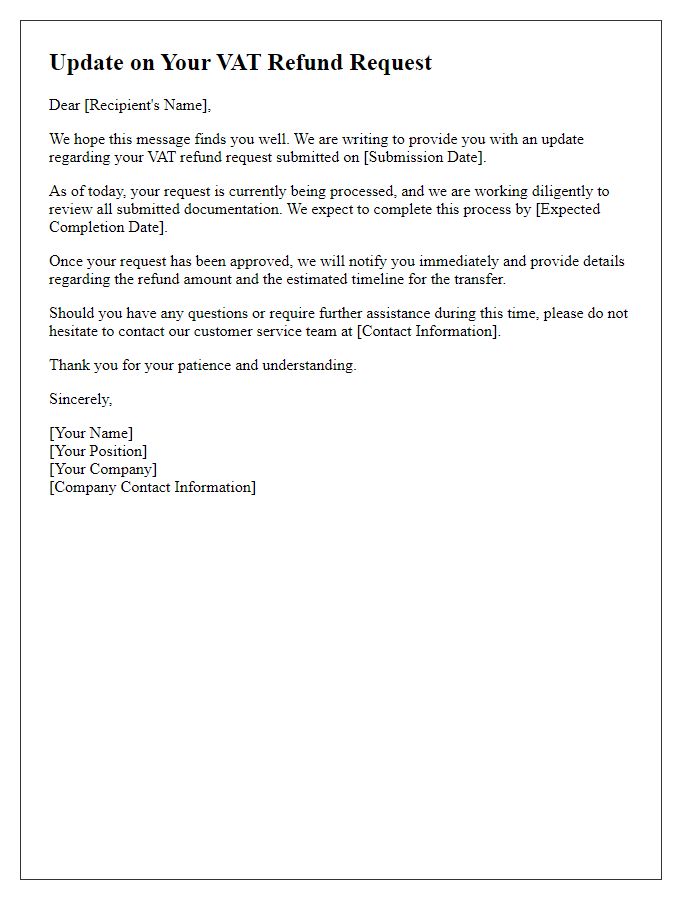

Processing Timeline

A VAT refund request confirmation indicates the initiation of the refund process, typically associated with value-added tax in transactions across the European Union, involving businesses and impacting financial records significantly. Processing timelines for VAT refunds can vary considerably, ranging from four to six weeks, depending on the complexity of the claim and the efficiency of the tax authority in the specific country, such as HM Revenue and Customs in the United Kingdom. Factors influencing the timeline include the completeness of documentation provided, the verification process, and any potential audits that may be conducted on the submitted claim. Efficient submission through online portals can expedite processing, reducing wait times associated with manual handling procedures.

Comments