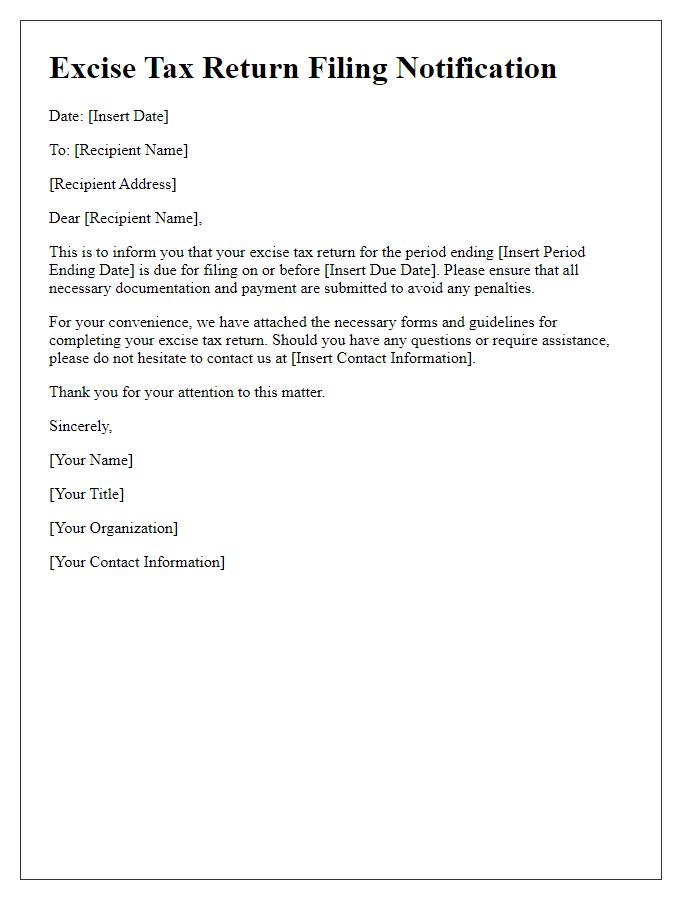

Are you feeling a bit overwhelmed by the excise tax return submission process? You're not aloneâmany individuals and businesses find navigating these forms challenging. In this article, we'll break down the essentials of creating an effective letter template for your excise tax return submission, ensuring you stay compliant and stress-free. So, if you're ready to simplify your excise tax return experience, keep reading to discover valuable insights!

Taxpayer Information

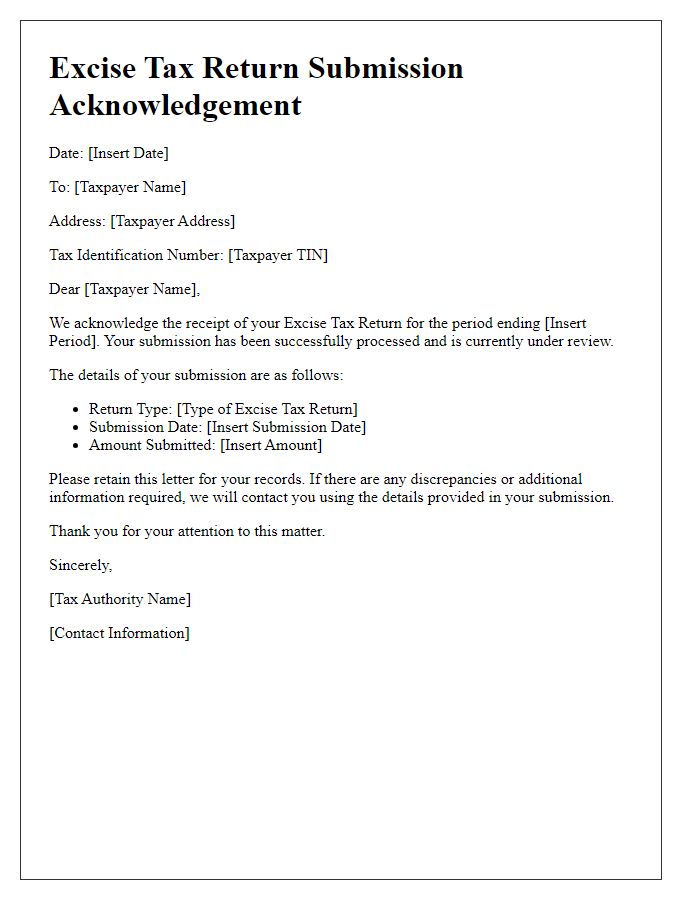

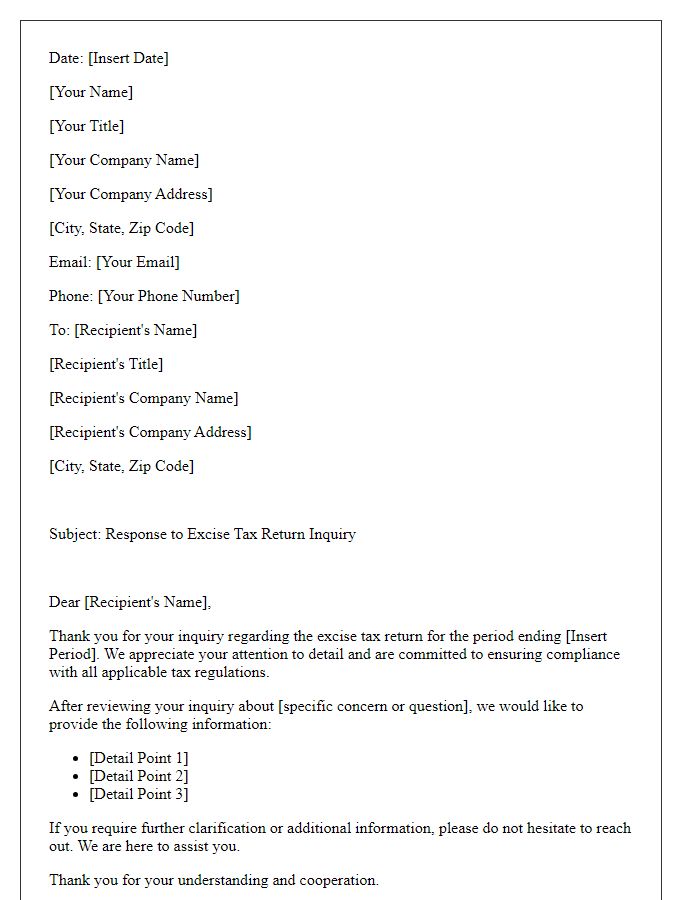

The excise tax return submission process requires precise Taxpayer Information to ensure compliance with federal regulations. Essential details include the Tax Identification Number (TIN), which uniquely identifies a business entity, alongside the legal name of the taxpayer as registered with the Internal Revenue Service (IRS). The business address should reflect the principal place of operation, including street number, city (e.g., Washington D.C.), state (e.g., California), and zip code (e.g., 90001). Additionally, contact information such as phone number and email address must be provided for any follow-up communications regarding the return. Accurate reporting of business type--whether a corporation, partnership, or sole proprietorship--plays a crucial role in the proper processing of tax obligations. These elements collectively contribute to a seamless filing process and adherence to tax responsibilities.

Filing Period

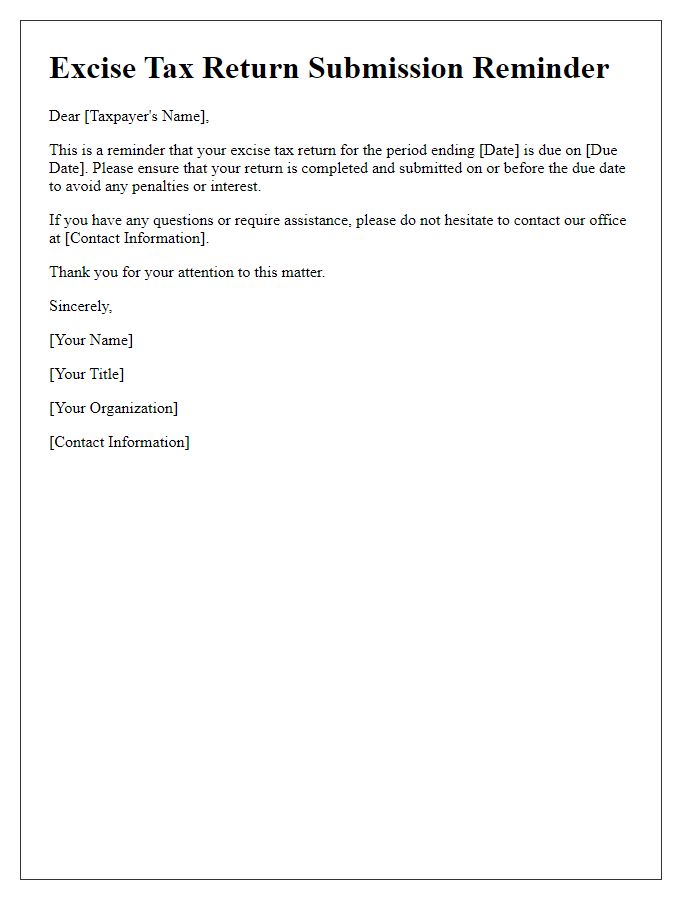

Excise tax returns represent the mandatory documentation that businesses submit to federal or state authorities, detailing the amount of excise tax owed for specific goods and services. The filing period, often monthly or quarterly, varies based on local regulations, such as the Internal Revenue Service (IRS) guidelines for alcohol, tobacco, and fuel products. Timely submission is critical to avoid penalties, which can escalate to significant amounts, sometimes exceeding 25% of the owed tax. For businesses operating in multiple states, jurisdictional differences in filing deadlines and applicable rates must be meticulously managed. Each submission must include accurate figures, supporting documents, and relevant identification numbers for compliance with the Tax Code.

Detailed Itemization

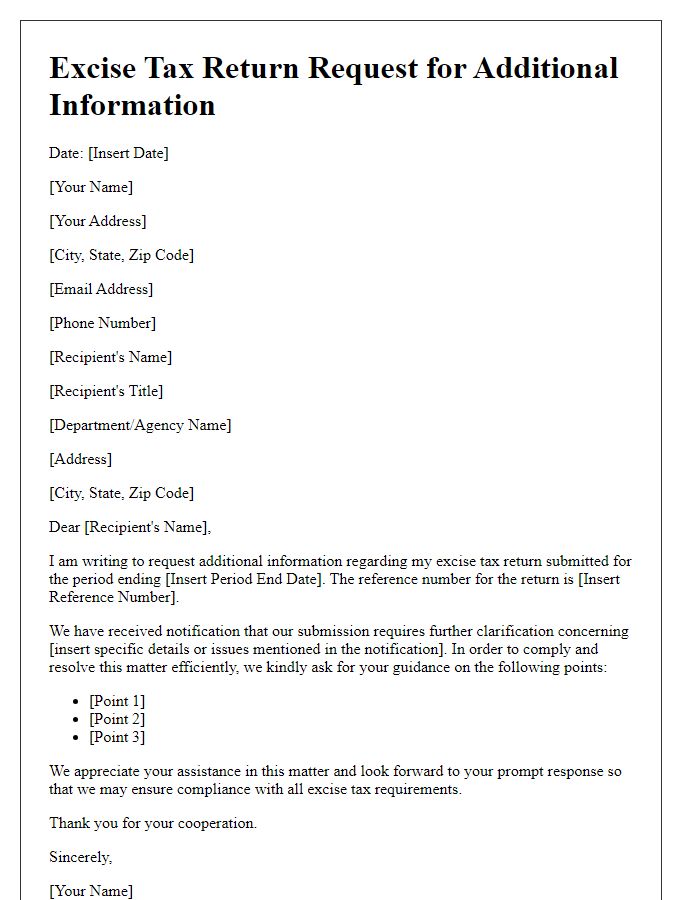

Excise tax return submissions require clear documentation of taxable goods, services, and associated costs. Detail itemization should include specific product names, quantities, and tax rates applicable, such as the Federal Excise Tax (FET) rate for gasoline at 18.4 cents per gallon. Reporting must encompass periods, typically quarterly, indicating the submission for Q1 2023 (January-March). Additionally, breakdowns for each line item should reference distinct categories, such as tobacco products, alcoholic beverages, and heavy vehicles, emphasizing compliance with IRS regulations. Ensuring accurate records facilitates smoother audits and minimizes potential penalties, crucial for businesses operating in regulated sectors.

Payment Instructions

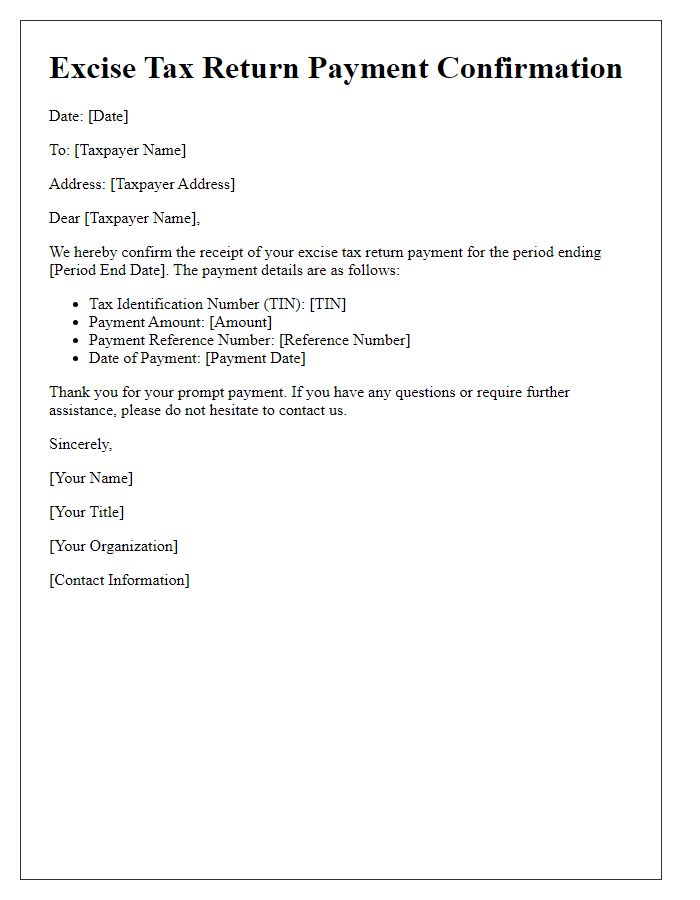

When submitting excise tax returns, accurate information and adherence to deadlines are crucial. Payments should be remitted to the designated state revenue department, often located in the capital city. The typical due date for excise taxes is the 15th day of the month following the reporting period. For electronic filing, utilize secure online portals provided by the revenue department to ensure timely processing. Include specific details such as taxpayer identification number (TIN), return period, and payment amount in your submission. Check acceptable payment methods including ACH debit, credit card, and e-check services to avoid delays. Ensure that you maintain copies of all submitted forms and payment confirmations for record-keeping purposes.

Contact Information

Accurate contact information is essential for effective communication during the excise tax return submission process. This typically includes the taxpayer's full name, registered business name (if applicable), physical address, email address, and phone number. For example, a sole proprietor may list their individual name followed by their business name, such as "John Smith - Smith's Bakery." The physical address must include the street number, street name, city, state, and zip code, ensuring it aligns with the information recorded with local tax authorities. Utilizing a professional email address, like info@smithsbakery.com, enhances credibility. Including a direct phone line, such as (555) 123-4567, facilitates swift responses to any inquiries or issues that arise during the review of the excise tax return, which is critical for compliance with tax regulations.

Comments