Navigating the ins and outs of multi-state tax liability can feel like a daunting task for many businesses, but it doesn't have to be. Understanding how to allocate your tax responsibilities across different states is crucial for compliance and avoiding costly penalties. With a clear strategy and the right information, you can effectively manage your tax obligations while maximizing your financial efficiency. Ready to dive deeper into the essentials of multi-state tax liability allocation? Let's explore further!

Accurate Income Sourcing

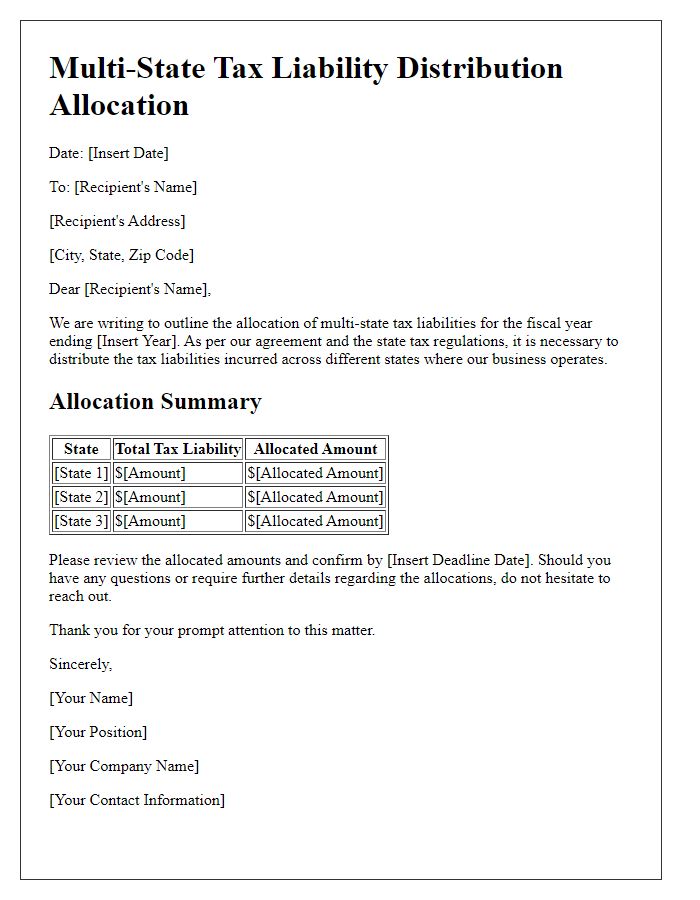

Multi-state tax liability allocation plays a critical role in accurate income sourcing for businesses operating across various jurisdictions in the United States. Different states, such as California, Texas, and New York, have unique tax regulations affecting how income is attributed and taxed. Properly documenting revenue streams, including sales figures, payroll expenses, and property values, is essential for compliance and optimal tax strategy. Each state employs specific allocation formulas, which may consider factors like the location of sales (market-based versus cost-of-performance) and employee presence. Businesses must stay vigilant about filing requirements and deadlines to avoid penalties while maximizing tax credits available in states such as Massachusetts or Illinois.

State-Specific Tax Rates

Multi-state tax liability allocation involves determining the proportion of income subject to taxation in each state where a business operates. Diverse state-specific tax rates, such as California's 8.84% corporate tax rate or New York's 6.5% general corporation tax, necessitate careful calculation to ensure compliance with local regulations. Each state, including Texas with no corporate income tax and Florida maintaining a 4.458% corporate tax rate, presents unique guidelines for income allocation, often influenced by factors such as sales, payroll, and property location. Businesses must meticulously document income sources and operational activities across states to accurately determine tax liability, ensuring adherence to the Multistate Tax Commission standards and minimizing exposure to audits or penalties.

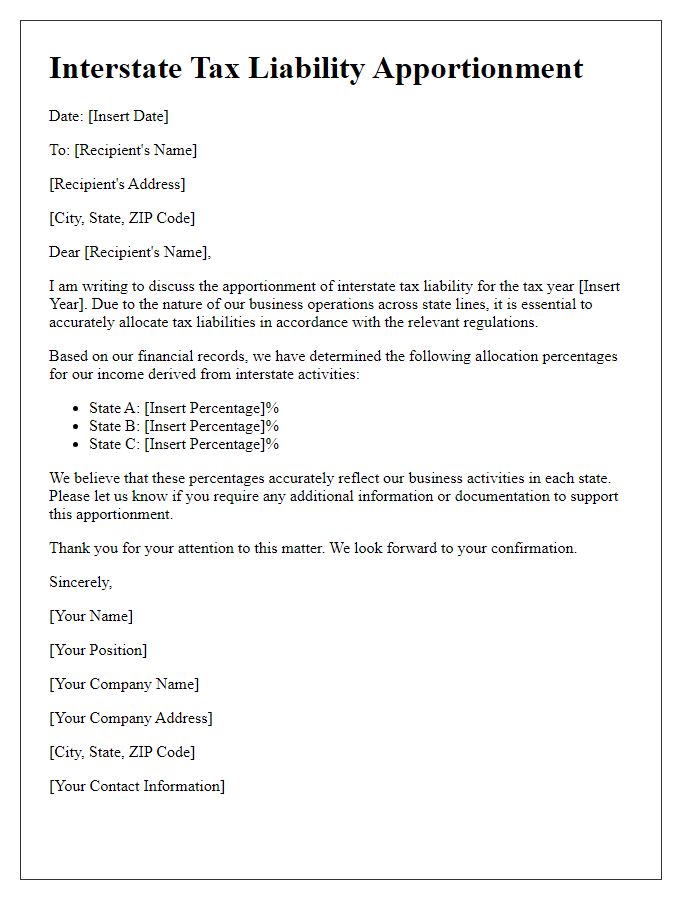

Apportionment Methods

Multi-state tax liability determines how businesses allocate income across different states for tax purposes. Various apportionment methods exist, including the three-factor formula which considers property, payroll, and sales to distribute income. States such as California and New York often utilize this method, emphasizing sales to reflect the distribution of economic activity. The market-based approach, applied in states like Illinois and Texas, focuses predominantly on sales within the state, while the cost of performance method, favored in some cases, considers where income-producing activities occur. Businesses must stay informed about each state's criteria to ensure compliance, as misallocation can result in penalties or increased audit scrutiny. Accurate documentation and detailed records play a critical role in supporting apportionment claims during audits.

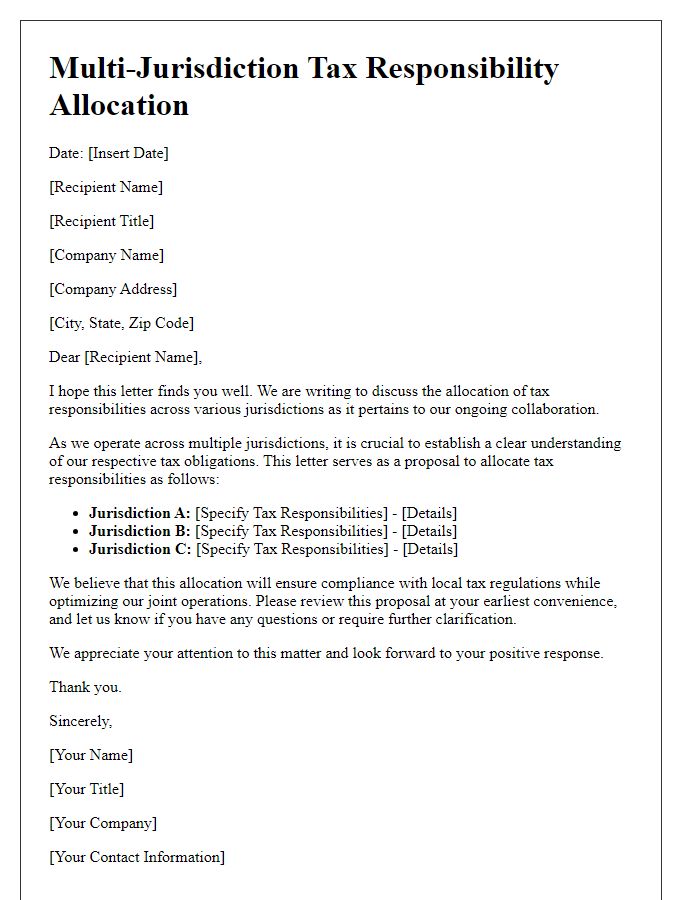

Nexus Rules and Compliance

Multi-state tax liability allocation involves complex regulations and compliance with various Nexus rules, which determine a business's tax obligations based on physical presence or economic connection. For instance, the Supreme Court's decision in South Dakota v. Wayfair (2018) broadened the scope of nexus, allowing states to impose sales tax on out-of-state sellers exceeding $100,000 in sales or 200 transactions annually. Businesses operating in multiple states, like California and Texas, must accurately allocate revenue based on apportionment formulas that consider factors such as property, payroll, and sales within state borders. Compliance requires a thorough understanding of state-specific regulations, including registration requirements, filings, and potential penalties for non-compliance. Regular audits and consultations with tax professionals can ensure adherence to these evolving guidelines, enabling organizations to mitigate risks associated with multi-state taxation.

Documentation and Record Keeping

Multi-state tax liability allocation requires meticulous documentation and record-keeping to ensure compliance with various state regulations. Taxpayers must maintain accurate financial records that capture income generated in each state, such as revenue streams from specific business activities or sales transactions. Relevant documents include state tax returns, W-2 forms (for employee earnings), 1099 forms (for freelance income), and supporting invoices. Each document should clearly indicate the location of the income-generating activity to facilitate accurate allocation. Maintaining organized files will streamline the audit process, and adherence to the uniform standards established by the Multistate Tax Commission can help mitigate risks associated with discrepancies in tax reporting.

Comments