In today's digital age, navigating the ins and outs of tax registration can feel daunting, especially with the evolving landscape of digital services. Whether you're a small business owner or a freelancer, understanding the requirements for digital services tax registration is crucial to ensure compliance and avoid penalties. This article aims to simplify the process, breaking down everything you need to know in a straightforward manner. So, grab a cup of coffee and join us as we dive into the essentials of digital services tax registration!

Company Information

Digital services tax registration requires detailed company information to ensure compliance with regulations. Legal entity name, such as XYZ Digital Solutions Inc., must be provided alongside the registered address located at 123 Tech Avenue, Suite 100, Silicon Valley, CA 94043. The unique business identification number (EIN) is essential for tax purposes. Additionally, key contacts, including the finance manager, Jane Doe, reachable at (555) 123-4567, need to be specified for any inquiries. Company revenue details, such as gross income reported at $1 million for the previous fiscal year, are also necessary for accurate tax calculation. This information forms the basis for registration and ensures adherence to local digital service tax laws.

Tax Identification Number

Digital services tax registration requires specific information for obtaining a Tax Identification Number (TIN). The registration process often involves providing details about the business entity, including the legal name, address (such as street, city, and postal code), and nature of the services offered (for example, e-commerce, digital advertising, or software services). Additionally, documentation may include proof of business operations, such as incorporation certificates or business licenses, along with identification verification for key stakeholders. Timeliness is crucial; many jurisdictions impose deadlines to comply with tax obligations, avoiding penalties that might arise from defaults. It is essential to check local regulations, such as the effective date of the tax law and completion timeline for submissions, to ensure full compliance and smooth registration.

Description of Digital Services

Digital services encompass a range of online offerings, including cloud computing solutions, software as a service (SaaS), digital advertising platforms, and e-commerce marketplaces. These services can include website hosting (allowing businesses to maintain an online presence), data storage solutions (enabling users to securely store information) and online learning platforms (providing educational resources remotely). Digital advertising (such as pay-per-click campaigns on platforms like Google and social media) plays a crucial role in business visibility. Furthermore, e-commerce solutions (like Shopify or Amazon) enable transactions between consumers and businesses globally, affecting various sectors, from retail to service industries.

Compliance Statement

Digital services tax registration requires a compliance statement to confirm adherence to regulations. This statement must include specific details such as the tax identification number (TIN) assigned by the local authority, relevant jurisdiction (e.g., European Union, United Kingdom), and a declaration of accurate revenue reporting from services provided across digital platforms, including e-commerce or digital advertising. The statement should explicitly mention adherence to deadlines established by tax authorities, outlining the submission of quarterly reports and annual returns detailing taxable activities. Moreover, it should affirm the understanding of penalties associated with non-compliance, such as potential fines or interest on unpaid taxes, ensuring full transparency in operations.

Contact Information

Digital services tax registration requires accurate and comprehensive contact information. Essential details include the registered business name (exactly as filed with tax authorities), business address (including city, state, and zip code), email address (for official correspondence), and phone number (business or contact cell). Additional information may involve a designated representative's contact details (name, title, and their direct phone number or email) to facilitate communication with tax agencies. Accuracy in this section is crucial for ensuring timely updates regarding any regulatory changes or compliance matters related to the digital services tax.

Letter Template For Digital Services Tax Registration Samples

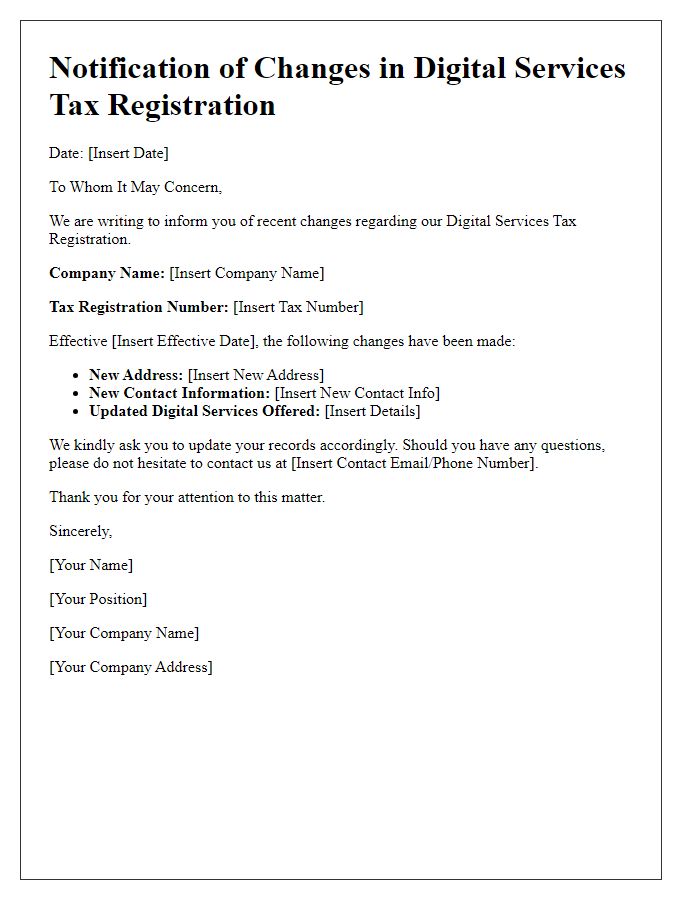

Letter template of notification for changes in digital services tax registration

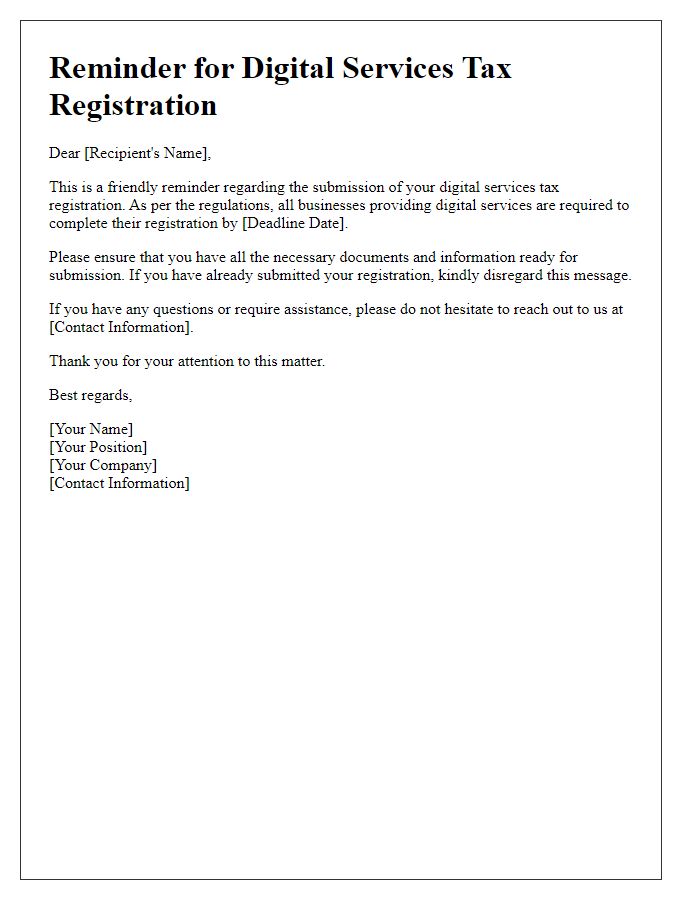

Letter template of reminder for digital services tax registration submission

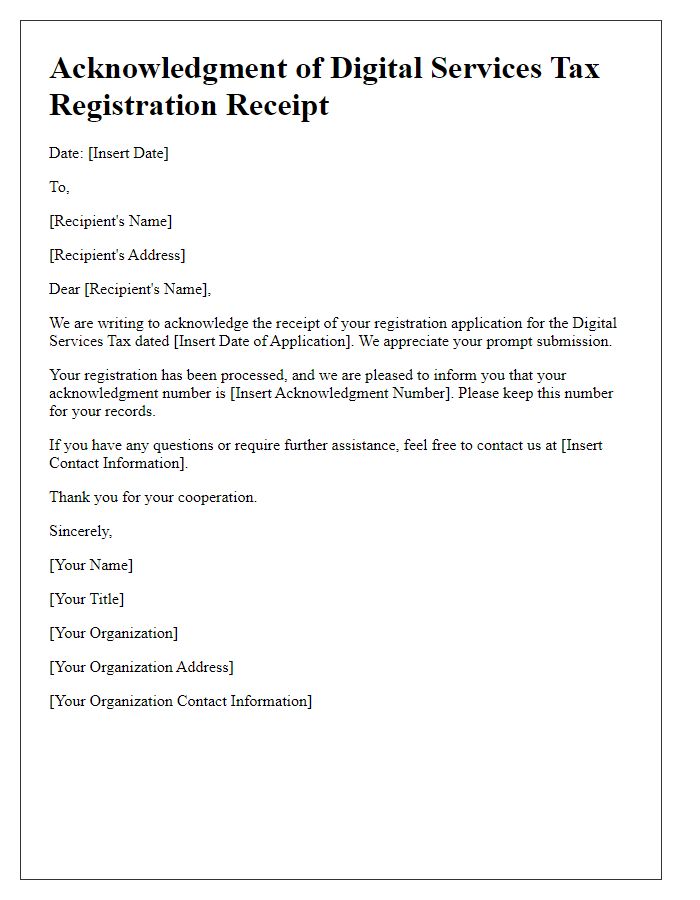

Letter template of acknowledgment for digital services tax registration receipt

Comments