Are you navigating the complexities of international tax treaties and wondering how to access potential benefits? You've come to the right place! Understanding the intricacies of these agreements can significantly impact your tax obligations and financial planning. Dive deeper with us as we explore essential tips and insights on maximizing your treaty benefitsâlet's get started!

Double Taxation Avoidance

An international tax treaty serves as a critical mechanism to mitigate the burden of double taxation on cross-border transactions and investments. Such treaties, negotiated between two countries, like the United States and Canada, outline provisions that allow residents of either nation to receive a tax credit or exemption on income earned abroad, ensuring that the same income is not taxed twice. Key elements often include reduced withholding tax rates on dividends, interest, and royalties, with specific rates typically set at around 15% or lower, depending on the type of income and stipulations in the treaty. Moreover, treaties provide clarity on residency determination, addressing complex situations where an individual or entity may be considered a resident in both countries. Obtaining benefits under such treaties often requires submission of documentation, like a certificate of residence, to the relevant tax authorities, thereby streamlining tax compliance and promoting international economic cooperation.

Residency Status Confirmation

Residency status confirmation serves as essential documentation for individuals seeking benefits under international tax treaties. This confirmation typically requires personal information such as the individual's name, country of residence, and tax identification number for verification purposes. For example, a resident of Canada claiming treaty benefits with the United States must provide evidence of Canadian residency status, as specified in Article 4 of the Canada-U.S. Tax Treaty established in 1980. The nature of the treaty benefits often includes reduced withholding rates on various income types such as dividends, royalties, and interest, as well as elimination of double taxation policies. Moreover, it is important to reference the relevant tax authority, such as the Canada Revenue Agency or the Internal Revenue Service, when submitting such documentation to ensure compliance and streamline the benefit application process.

Income Nature Classification

Tax treaty benefits serve to mitigate double taxation for international income, allowing for reduced withholding rates or exemptions on types of income such as dividends, interest, and royalties. Each tax treaty, such as the one between the United States and Luxembourg, specifies classifications for income types to determine eligibility. For instance, dividends, which represent a share of profits distributed to shareholders, may be subject to a reduced withholding tax rate of 5% instead of the standard 30% for non-resident taxpayers. Similarly, interest income, derived from loans or other financial instruments, can benefit from treaty provisions that lower withholding rates. Royalties, which encompass payments for the use of intellectual property, also often qualify for beneficial treatment under such treaties. Accurate classification of income nature is crucial when applying for treaty benefits to avoid potential audits and ensure compliance with local tax regulations.

Withholding Tax Reduction

International tax treaties, such as the Double Taxation Agreement (DTA) between the United States and Germany, provide mechanisms for withholding tax reduction on cross-border income. This agreement typically applies to various types of income, including dividends, interest, and royalties, offering favorable tax rates compared to domestic rates, often reducing withholding tax to 0-15% depending on specific conditions. The withholding tax reduction aims to prevent double taxation and encourage foreign investment. Eligible entities must submit relevant documentation, like Form W-8BEN or equivalent, to claim benefits effectively while complying with local regulations set forth by tax authorities. These treaties promote economic cooperation by ensuring tax efficiency and legal clarity for international transactions.

Treaty Article Reference

International tax treaties often provide benefits that minimize the risk of double taxation and promote cross-border commerce. For example, the United States has tax treaties with countries such as Germany and Japan, often referencing specific articles related to the withholding tax rates on dividends, interest, and royalties. Article 10 typically addresses dividends, allowing for reduced withholding rates, often reduced to 15% or lower depending on ownership thresholds. Article 11 focuses on interest, setting maximum withholding rates around 10%. Article 12 manages royalties, often specifying rates as low as 5%. Understanding these references enables tax professionals to optimize tax liabilities and ensure compliance when conducting international business activities.

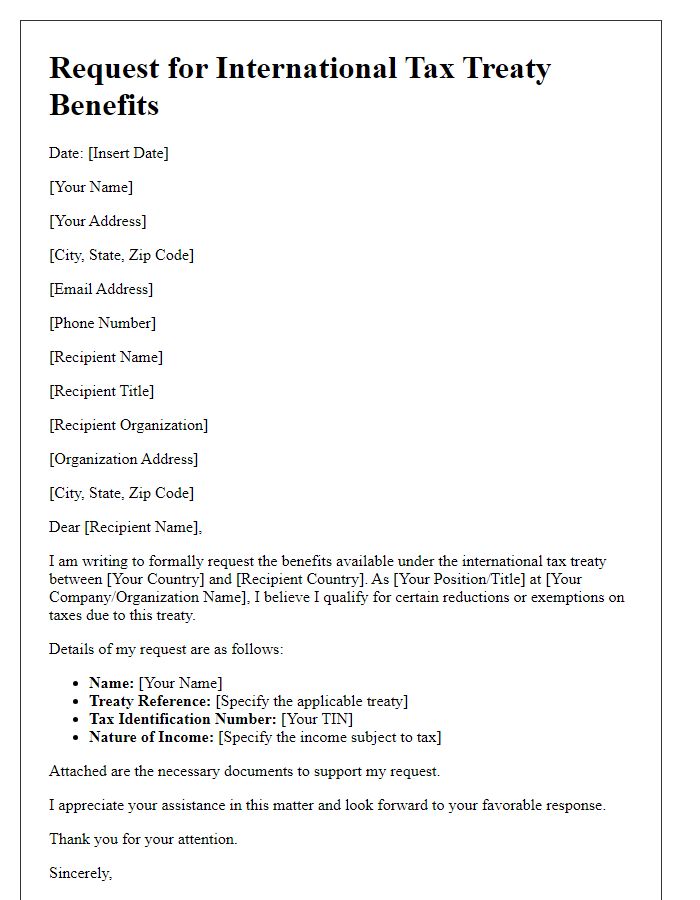

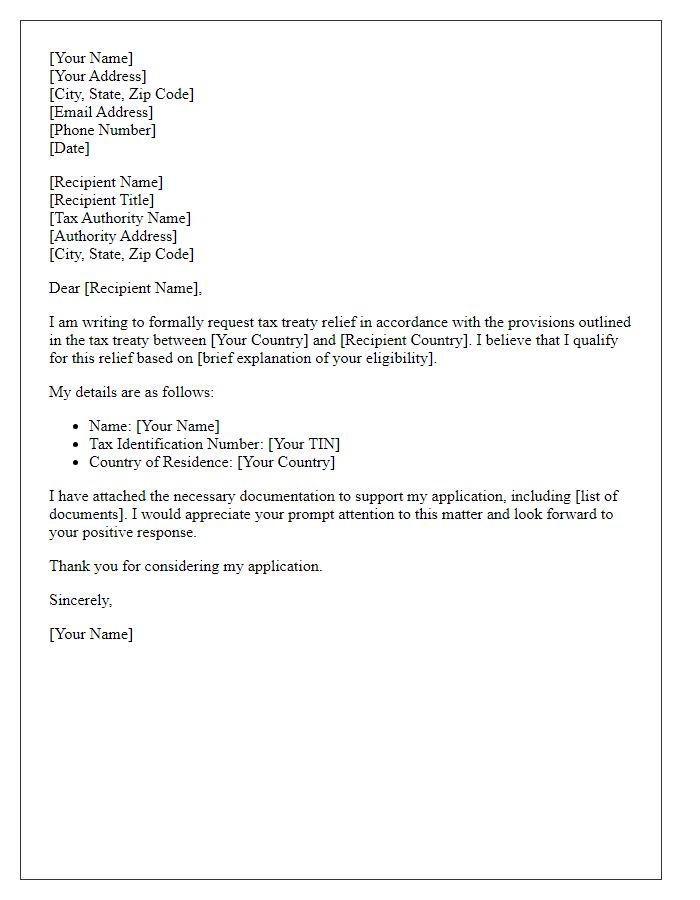

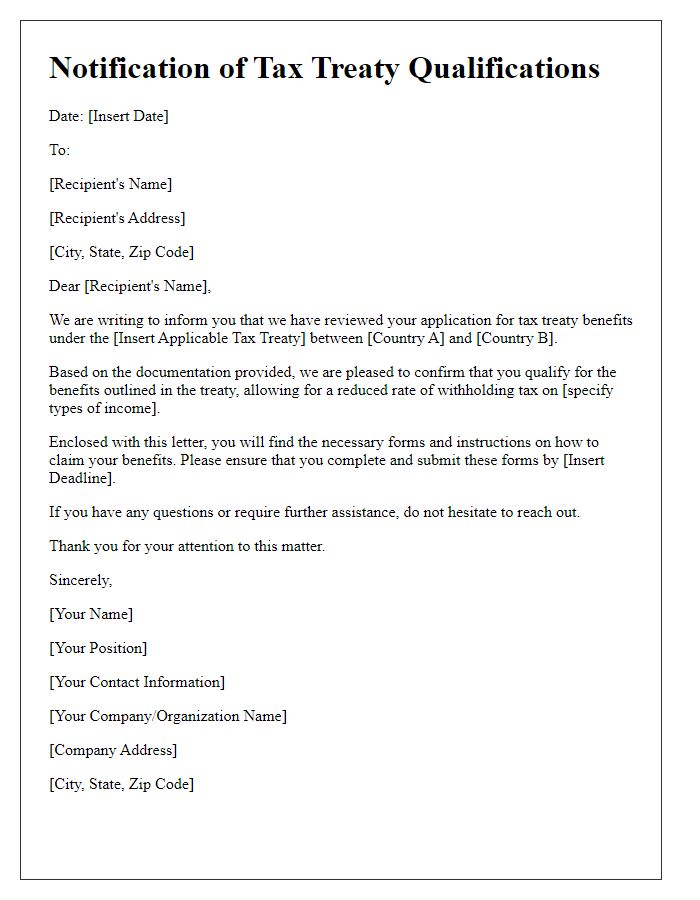

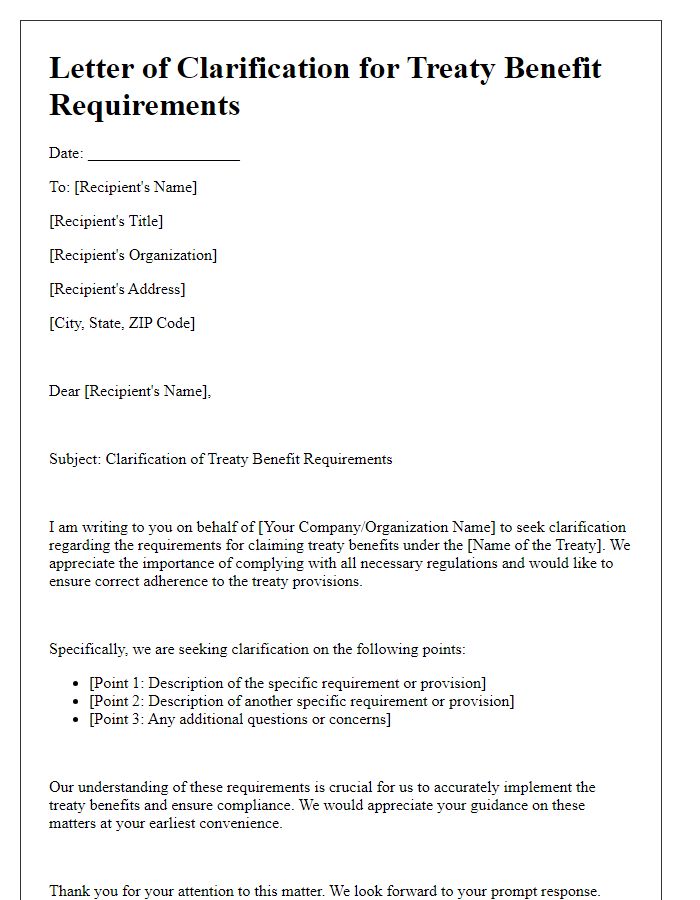

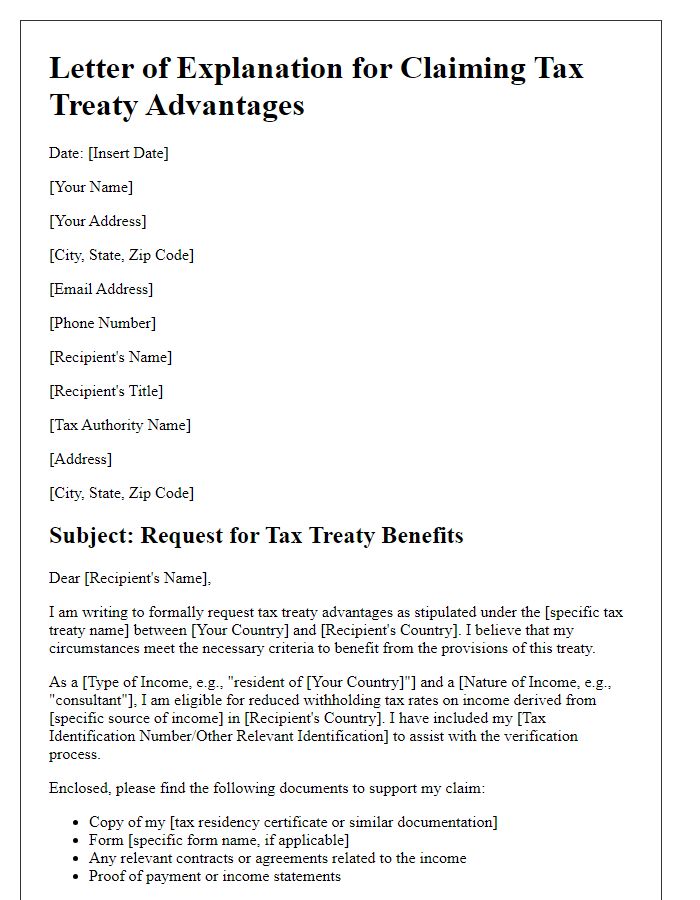

Letter Template For International Tax Treaty Benefits Samples

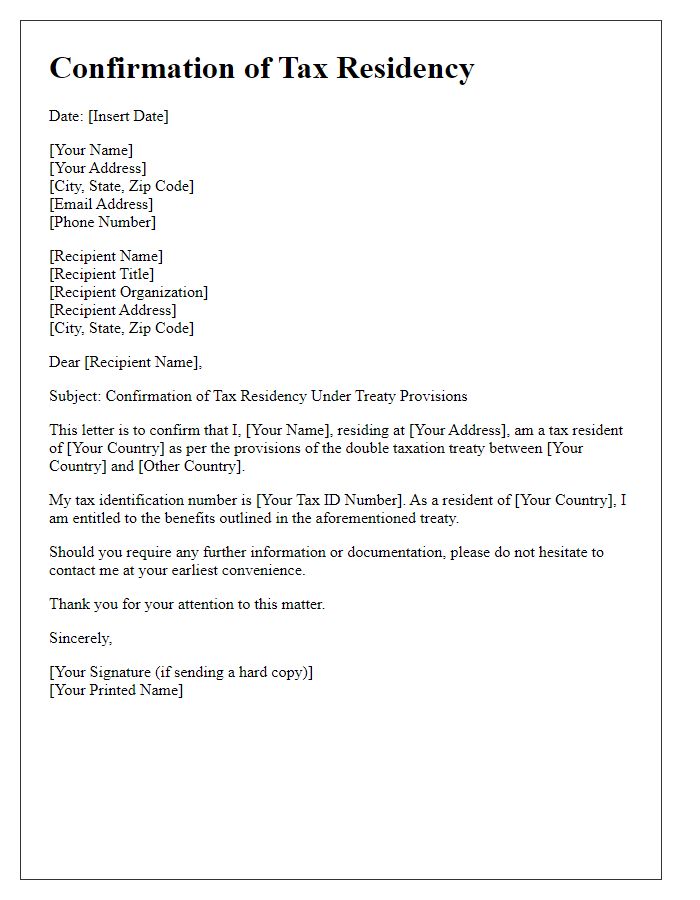

Letter template of confirmation for tax residency under treaty provisions

Comments