Are you feeling a bit confused about your tax residency status? You're not alone! Many people find themselves wondering how their residency affects their tax obligations, especially when dealing with international transactions or moving abroad. In this article, we'll break down everything you need to know and guide you through the process of making a tax residency status inquiry, so stick around for some helpful insights!

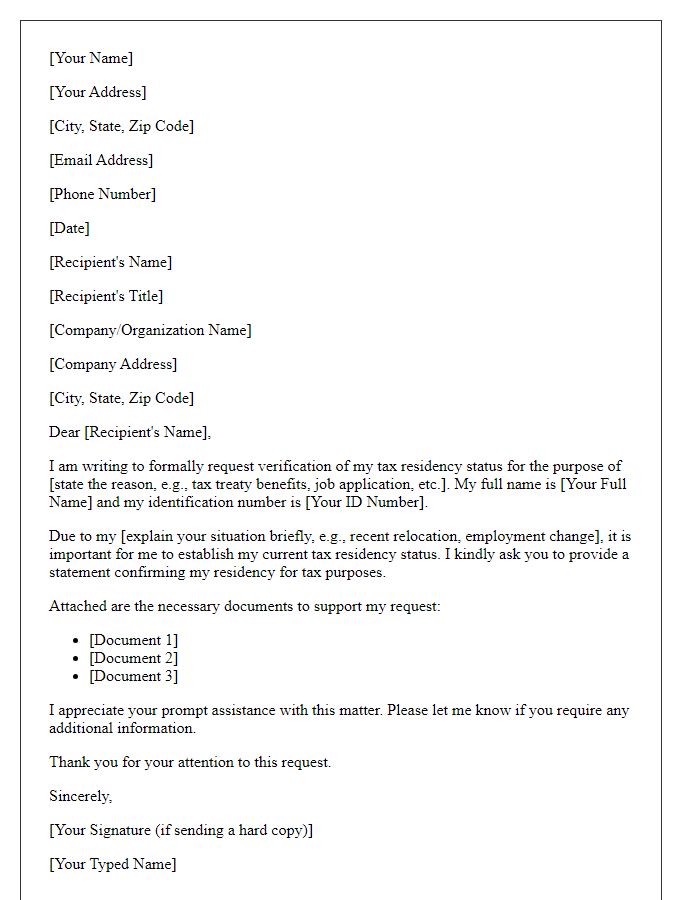

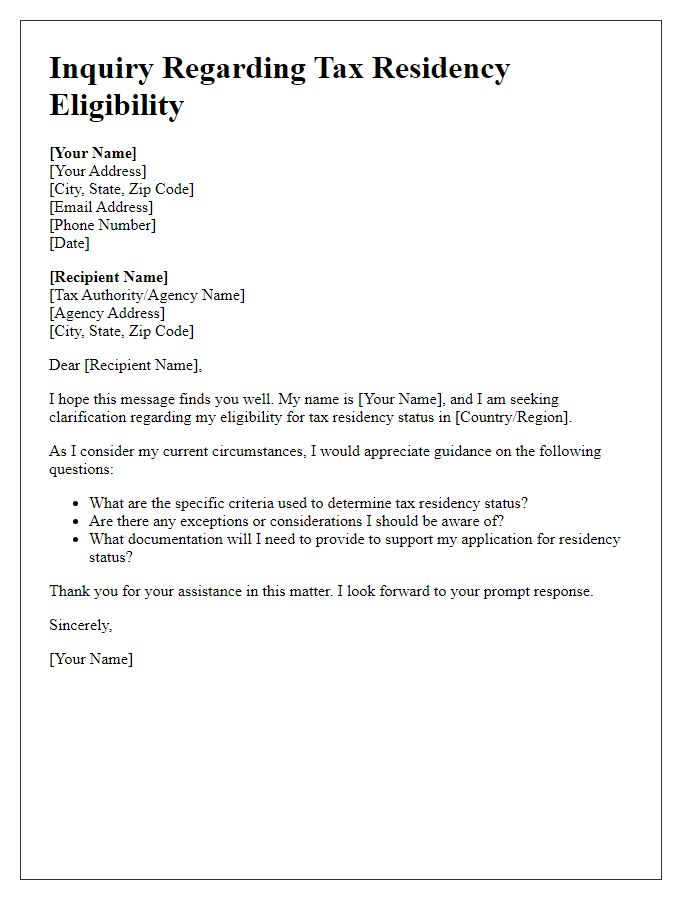

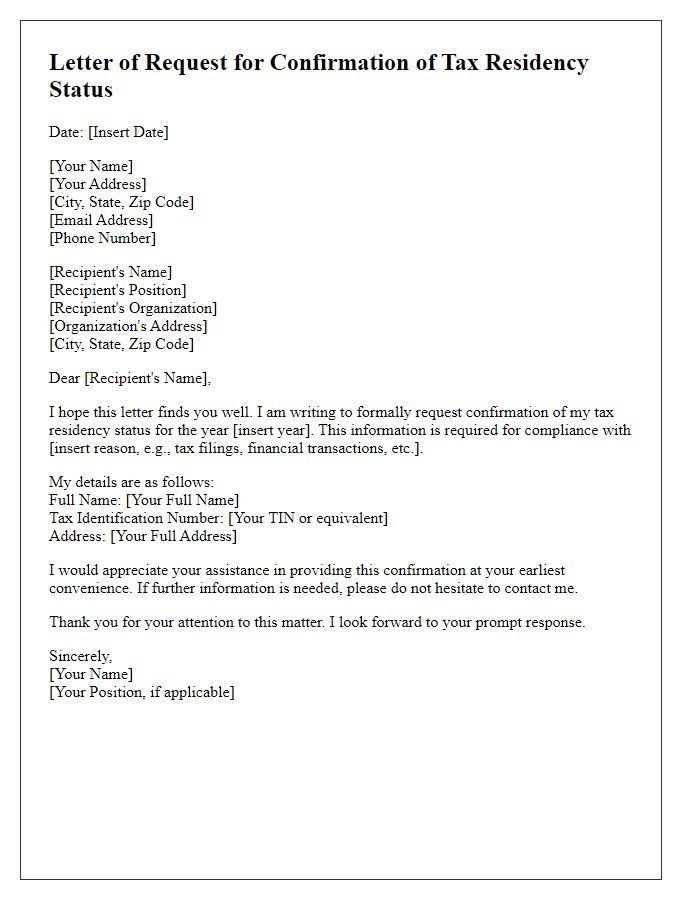

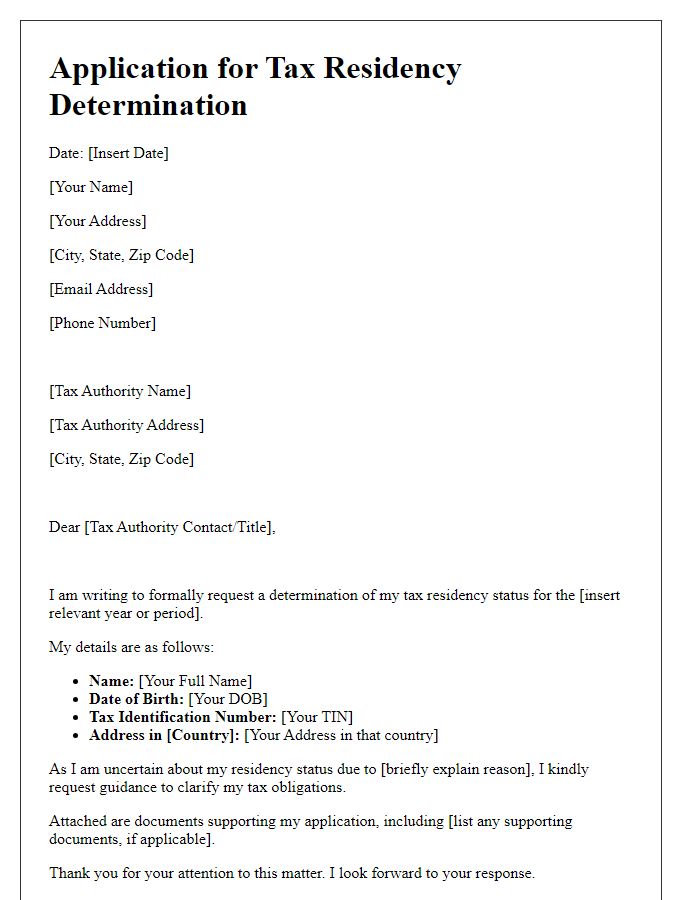

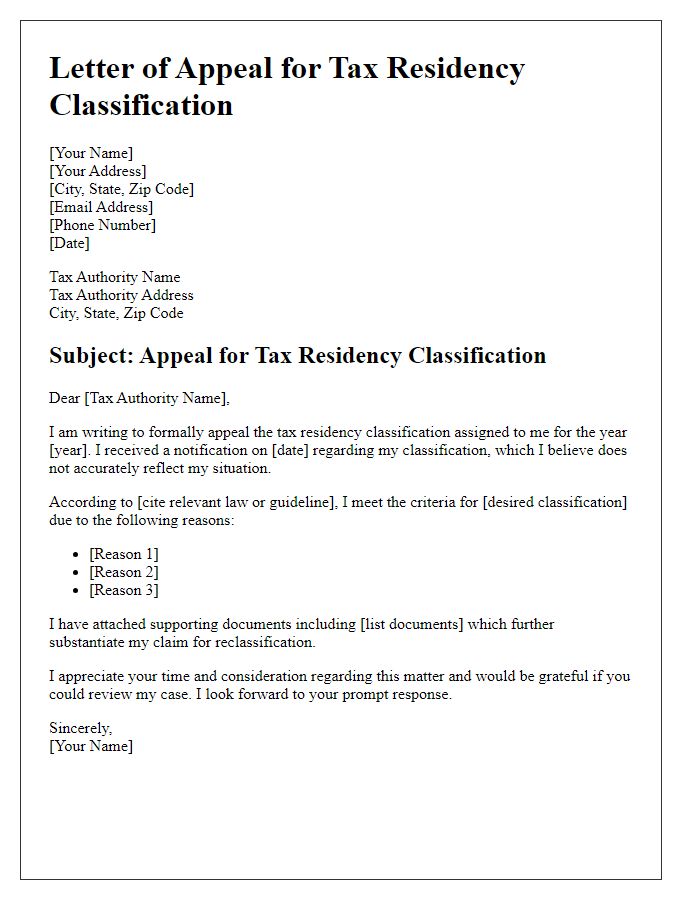

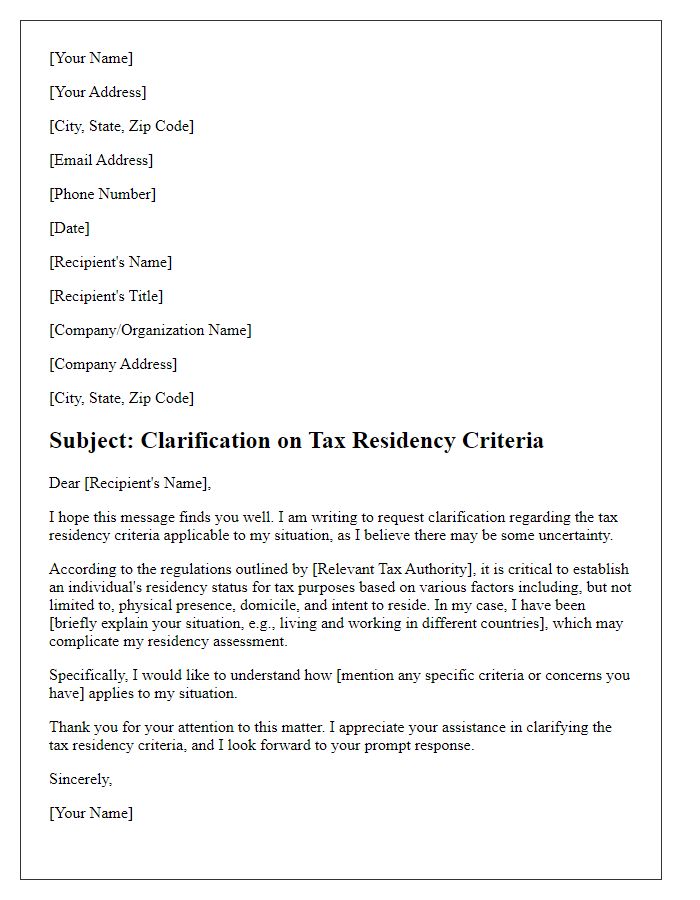

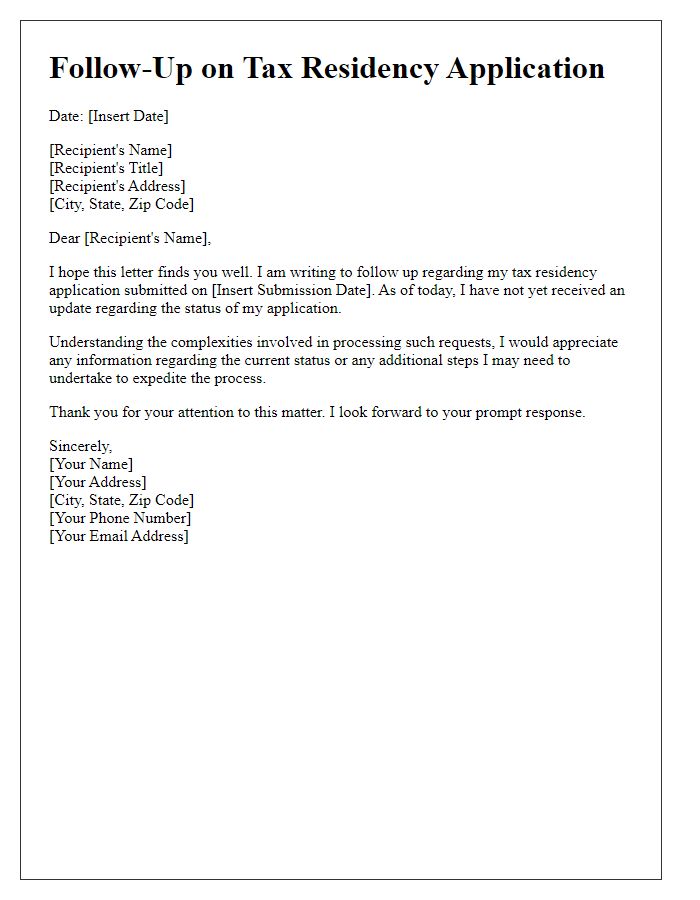

Header with sender and recipient details

Inquiries regarding tax residency status often involve complex regulations and specific legal frameworks. The process may vary depending on the governing jurisdiction. Tax residency typically hinges on criteria like days spent within a country (usually 183 days), permanent home location, and significant personal and economic ties to a state. Consulting official tax authority guidelines or legal professionals specializing in international taxation is often essential. Examine forms like tax residency certificates, required documentation, and deadlines relevant to the jurisdiction involved. Be aware of agreements like double taxation treaties that may impact residency determination and tax obligations.

Clear subject line specifying tax residency inquiry

The process for determining tax residency status varies significantly among countries, necessitating precise guidelines based on individual circumstances. Tax residency, defined by criteria such as physical presence and substantial connections, impacts tax obligations for individuals and entities. Some jurisdictions, like the United States, utilize the "substantial presence test," where individuals are considered tax residents after spending a minimum of 183 days in the country over a three-year period. Conversely, countries like the United Kingdom employ a "statutory residence test," evaluating residence based on multiple factors, including ties to the UK and the number of days spent in the country. Accurate assessment of tax residency is imperative for compliance with local tax laws and avoiding potential penalties. Inquiries regarding tax residency often require documentation, including travel logs, employment details, and residency permits, to clarify one's status.

Introduction highlighting purpose of the inquiry

Tax residency status plays a crucial role in determining tax obligations for individuals, especially for expatriates or those with international ties. Individuals may need clarification regarding their residency status for taxation to ensure compliance with governmental regulations. Differentiating between tax residents and non-residents can affect various aspects, including income tax rates, eligibility for deductions, and liability for reporting foreign income. Accurate information is essential for understanding the complexities of tax residency in jurisdictions such as the United States, United Kingdom, or other nations, particularly amid changing tax laws and policies.

Detailed request for tax residency confirmation or information

Tax residency status can significantly impact financial obligations and compliance requirements for individuals, particularly expatriates and international business owners. Key countries such as the United States, United Kingdom, and Germany have distinct criteria for determining residency, often based on physical presence, income sources, and legal domicile. For instance, the IRS utilizes the Substantial Presence Test, which involves days of physical presence over a three-year period. Additionally, tax treaties between countries can prevent double taxation but may require explicit residency verification. Understanding these regulations often necessitates formal inquiries, ensuring that documentation like the Certificate of Residency or relevant tax forms are accurately provided by tax authorities.

Contact information for follow-up or additional queries

Tax residency status inquiries require clarity and precision regarding individuals' tax obligations based on residence. Tax authorities, such as the Internal Revenue Service (IRS) in the United States or Her Majesty's Revenue and Customs (HMRC) in the United Kingdom, can provide information on residency rules. Providing contact information, including phone numbers and email addresses for your local tax office, facilitates follow-up questions. Include details such as office hours (typically 9 AM to 5 PM local time) and any reference numbers relevant to your inquiry to expedite the response process. This proactive approach ensures that individuals receive accurate guidance regarding their tax situation and compliance requirements.

Comments