Navigating the complexities of expatriate tax exemption can be daunting, but it doesn't have to be. Understanding the requirements for documentation is crucial for ensuring compliance and maximizing your benefits while living abroad. From gathering your income records to understanding residency rules, this process can be simplified with the right approach. So, if you're ready to unravel the ins and outs of expatriate tax exemption documentation, read on for more insights and tips!

Recipient's full name and contact information

Expatriates often seek tax exemption documentation to navigate international tax laws. Important details include the recipient's full name, which ensures proper identification, along with contact information, such as phone numbers and email addresses, allowing for effective communication. Documentation should also reference tax treaties, specifying countries involved, for clarity on eligibility. It's essential to include the expatriate's current residence, whether in cities like Dubai or Singapore, where tax advantages may be significant. Timely submission of this documentation can impact tax obligations, enhancing financial planning for expatriates.

Clear subject line indicating tax exemption purpose

Expatriate tax exemption documentation requires precision and clarity. Relevant tax authorities must receive forms correctly filled, such as the IRS Form 2555, which outlines foreign earned income exclusions. Specific dates, like the finalized tax year, are crucial. Include the expatriate's tax residency status, which signifies non-resident intent for tax purposes, and reflect key details such as overseas employment agreements. Supporting documentation, including a certificate of residency from the foreign country, is vital for successful tax exemption claims. Each detail, from income sources to dates of foreign tax payment, strengthens exemption validity against potential audits.

Detailed explanation of expatriate's circumstances

Expatriates often face unique tax circumstances due to their relocation and employment in foreign countries. Tax residency status significantly affects income tax obligations, with regulations differing considerably among nations. For instance, an expatriate residing in Singapore (known for its favorable tax regime) may find that their income from overseas sources is exempt from local taxation, provided they do not meet specific duration thresholds (more than 183 days within a calendar year). Additionally, tax treaties between countries, such as the one between the United States and the United Kingdom, can mitigate double taxation through credits or exemptions. Documentation supporting these circumstances generally includes employment contracts, residency permits, and evidence of tax paid to foreign authorities. Accurate record-keeping ensures compliance with local laws while minimizing tax liabilities for expatriates navigating international employment landscapes.

Reference to applicable tax laws or treaties

Expatriate tax exemption documentation requires reference to specific tax laws or treaties applicable in the host country. For instance, the US Internal Revenue Code Section 911 allows qualifying expatriates to exclude foreign earned income up to a certain threshold, which can significantly reduce taxable income. Additionally, bilateral tax treaties, such as the ones between the United States and Germany, help allocate taxing rights to avoid double taxation on income earned by expatriates. Ensuring compliance with these laws and treaties is imperative for maintaining valid tax exemption statuses and optimizing financial benefits for expatriates.

Supporting documents or evidence attachment list

Expatriate tax exemption documentation often requires detailed supporting documents to facilitate the approval process. Commonly needed items include a valid passport (specifying nationality and expiration date), proof of residency status (such as utility bills or lease agreements indicating address), employment contract (outlining terms of employment, salary details, and duration), and tax residency certificates from both home and host countries (demonstrating tax obligations). Additionally, income statements from the employer (showing gross income and withheld taxes) and any relevant tax returns from the expatriate's home country (helping to establish tax compliance) may be necessary. Health insurance documents (confirming adequate coverage while abroad) often complement this list, ensuring comprehensive evidence aligns with regulatory requirements. Each document plays a vital role in validating the expatriate's claim for tax exemption status.

Letter Template For Expatriate Tax Exemption Documentation Samples

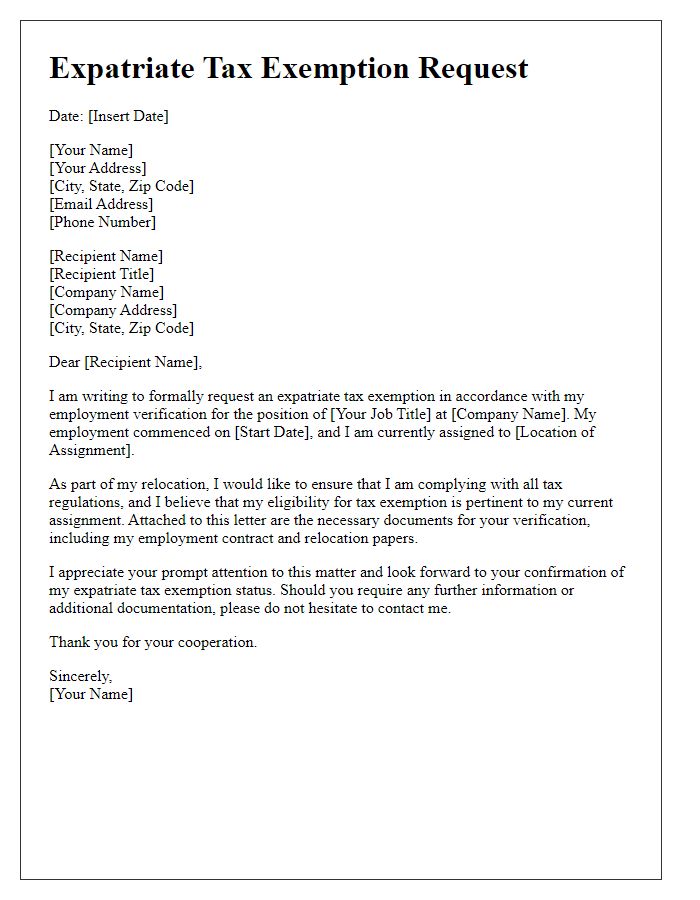

Letter template of expatriate tax exemption request for employment verification.

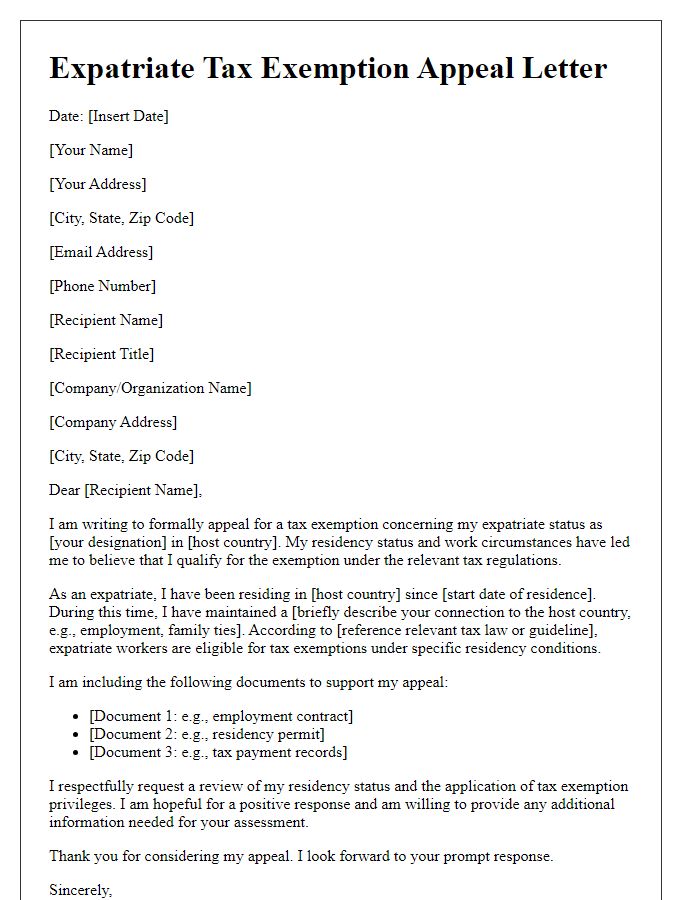

Letter template of expatriate tax exemption appeal for residency status.

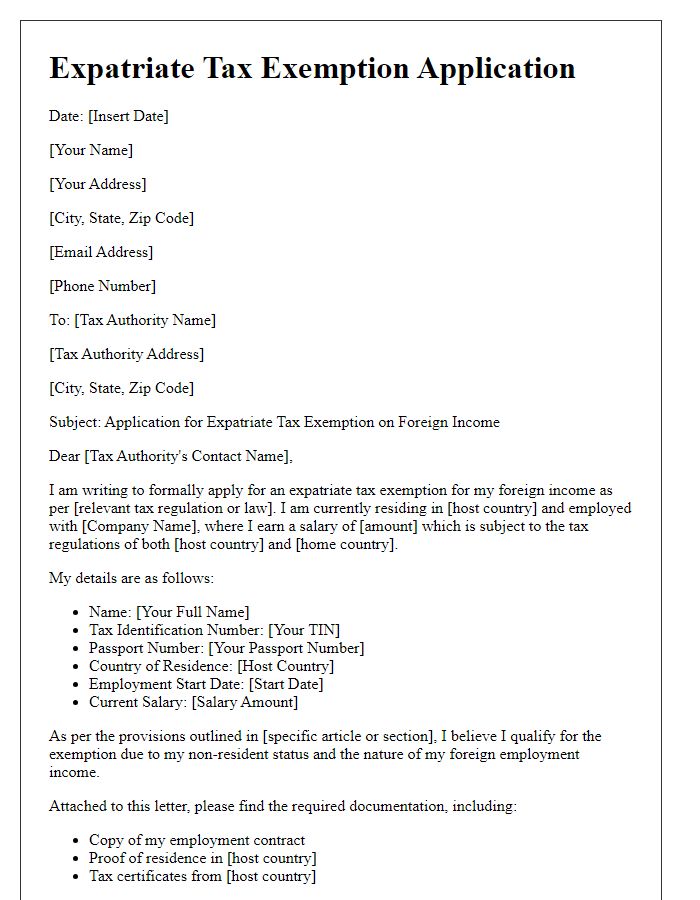

Letter template of expatriate tax exemption application for foreign income.

Letter template of expatriate tax exemption inquiry for benefit eligibility.

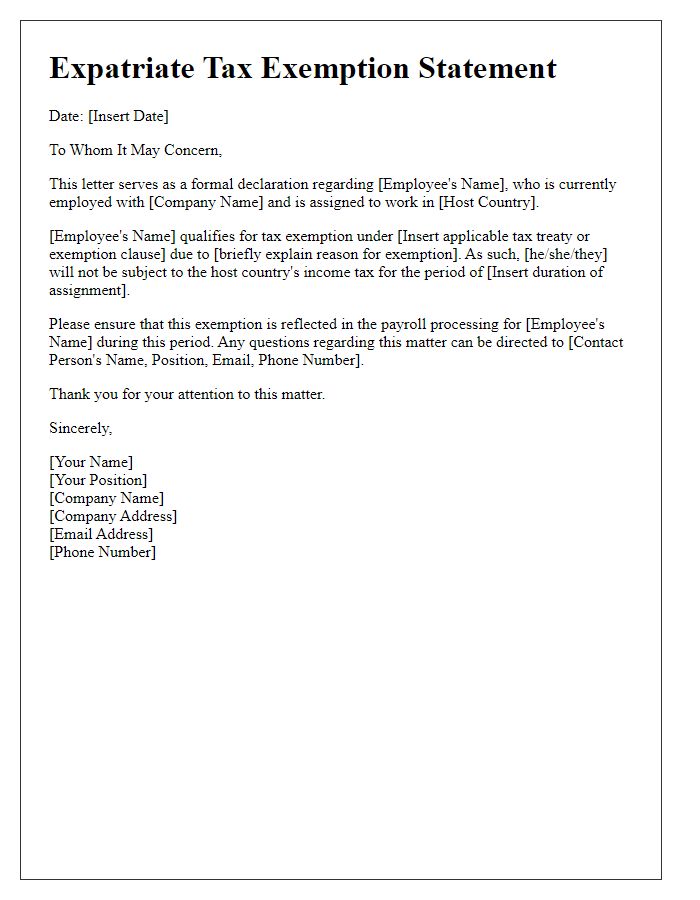

Letter template of expatriate tax exemption justification for tax authority.

Letter template of expatriate tax exemption provision for financial institutions.

Letter template of expatriate tax exemption declaration for local government.

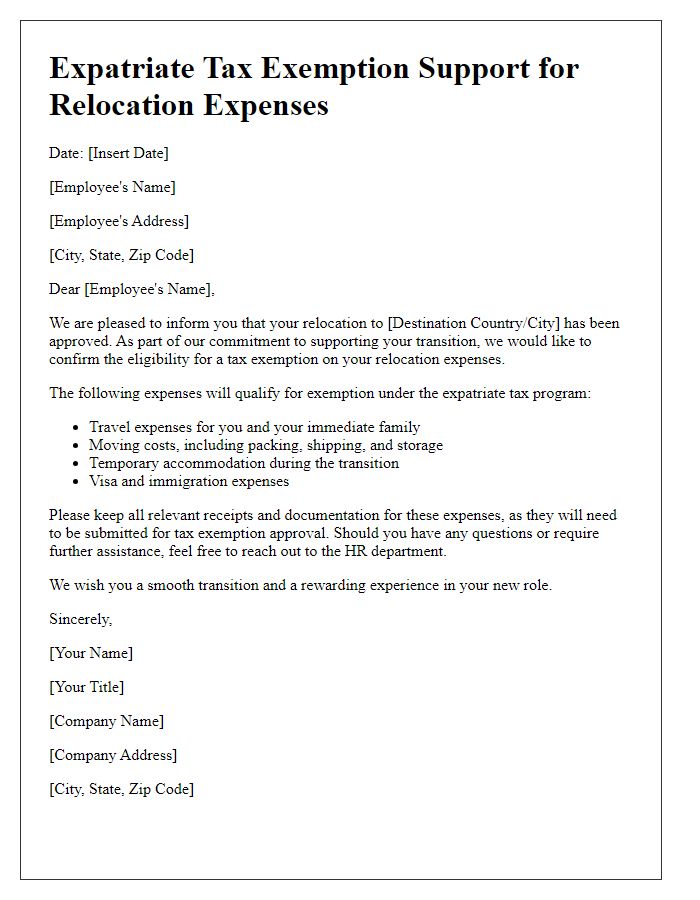

Letter template of expatriate tax exemption support for relocation expenses.

Comments